Fintech Innovation | Dec 5, 2023

Image: VCA, Succeeding with Super Apps, Chart

Image: VCA, Succeeding with Super Apps, ChartSuper Apps Are Redefining Convenience in the Digital Age

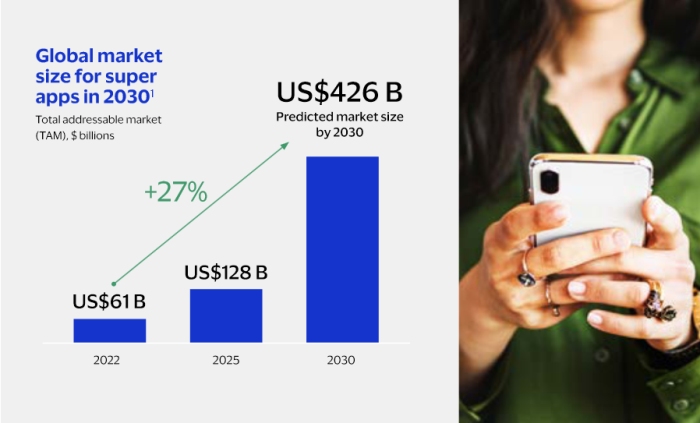

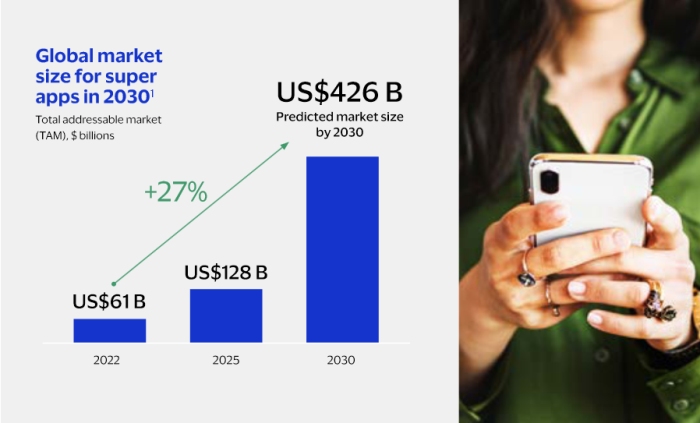

A super app is essentially a multi-utility mobile application offering a wide array of services, from financial transactions and e-commerce to social networking and entertainment. Such apps have transformed user experience by integrating various functionalities into a single, user-friendly platform, enabling easy and seamless access to a multitude of services. Visa Consulting & Analytics (VCA) published a recent report titled "Succeeding with Super Apps," highlighting its rapid global growth and key drivers.

See: Will Elon’s X Become A Fintech Super App in 2024?

The super app market, valued at over US$60 billion in 2022, is anticipated to grow at a staggering 27% annually, potentially reaching US$426 billion by 2030. This growth is propelled by super apps' ability to cater to diverse consumer needs efficiently within a single platform.

Growth Drivers

Key factors driving this phenomenal growth include:

- Younger generations, familiar and comfortable with digital technologies, show a preference for integrated digital platforms.

- A digital transition from traditional brick-and-mortar services to digital platforms has been observed globally, enhancing the appeal of super apps.

- The convenience of a single app handling multiple services is a welcome change from managing numerous individual applications.

- Companies are increasingly expanding their digital offerings, evolving into super apps.

- The popularity of digital platforms among peer groups and the attraction to popular marketplaces fuel the growth of super apps.

Regional Variations

The adoption and evolution of super apps show significant regional variations. The table below compares how super apps are being shaped by regional characteristics and how they are evolving to meet diverse consumer needs.

| Region | Description | Example | Details |

|---|---|---|---|

| Asia Pacific | Dominated by mobile usage and favorable demographics, this region sees super apps integrating extensively into daily life. | Started as a messaging app but has evolved into an all-in-one platform, offering services ranging from social media and mobile payments to ride-hailing and bookings. | |

| Central Europe, Middle East, and Africa | Driven by smartphone adoption and a vibrant, dynamic market, super apps are rapidly growing. | Careem | Began as a ride-hailing service but has expanded into a super app, providing services like food delivery, payments, and logistics. |

| Europe and UK | A fragmented regulatory landscape and strict data privacy laws have shaped the growth of local super app players. | Revolut | Initially launched as a fintech startup offering banking services, Revolut has expanded its scope significantly, including currency exchange, stock trading, and insurance services. |

| Latin America | Focuses on financial inclusion and convenience, with super apps evolving from delivery service platforms and marketplaces. | Rappi | Started as a delivery service and has transformed into a super app, offering a wide range of services including grocery delivery, financial services, and travel bookings. |

| North America | Presents a challenging environment for super apps due to established players and regulatory hurdles. | PayPal | Primarily known for online payments, PayPal has expanded its services to include features like savings, credit, and shopping tools, moving towards a super app model. |

Challenges and Insights

Super apps, despite their increasing popularity and utility, face several challenges including:

- Super apps often operate across multiple sectors and, which can bring them under the scrutiny of various regulatory bodies. Regulatory hurdles and compliance with diverse and sometimes conflicting regulations in different jurisdictions can be challenging.

- With super apps collecting vast amounts of personal and financial data, ensuring data privacy and security is paramount. The challenge is to maintain robust data protection measures while offering seamless user experiences.

- In regions where multiple super apps are vying for dominance, there is a risk of market saturation. Super apps have to continually innovate and diversify their offerings to stay competitive and relevant.

See: Interview with Inter CEO: Insights into the Super App’s Success

- Developing and maintaining a super app that integrates various services smoothly is technically challenging. Ensuring reliability, scalability, and seamless integration of different services requires substantial investment in technology and expertise.

- Balancing the complexity of multiple services with a user-friendly interface is crucial. A cluttered or unintuitive app design can deter users, making it essential to focus on a seamless and engaging user experience.

- Super apps need to be culturally and regionally adaptable to succeed in different markets. What works in one region may not necessarily appeal to users in another, requiring localized strategies and customization.

- Finding effective monetization models while keeping the app attractive to users is a delicate balance. Super apps need to devise strategies that generate revenue without compromising user experience or data privacy.

- Users must trust the app with sensitive data and transactions. Building and maintaining this trust, especially in regions with skepticism towards digital services, is a significant challenge.

- Dependency Risks: The centralization of multiple services in one app creates a dependency risk. If the app faces downtime or security issues, it can disrupt several essential services for users.

- Keeping Pace with Technological Advances: The rapid pace of technological advancement means super apps must continually evolve and innovate to stay relevant and meet changing consumer expectations and technological capabilities.

3 Impacts on the Average Person

- Super apps will streamline daily activities, from shopping and banking to social interactions and entertainment, offering a more integrated lifestyle management system.

See: SEC Intensifies Probe of Wall Street’s Use of Messaging Apps

- With advanced data analytics and AI, super apps will offer highly personalized experiences, recommendations, and services tailored to individual preferences and habits.

- In regions with high unbanked populations, super apps will provide access to financial services, enhancing financial inclusivity and economic empowerment. To overcome smart phone affordability issues, communities can look at shared devices, subsidized programs and offline functionality.

3 Impacts for Businesses

- Businesses will leverage super apps as new marketing channels, utilizing their broad reach and data analytics for targeted advertising and customer engagement.

- Traditional businesses may need to shift their business models to fit the super app ecosystem, focusing more on digital services and customer experience.

- The convenience and immediacy of super apps will raise customer expectations, pushing businesses to enhance their customer service and support capabilities.

Image courtesy of DALL E

Image courtesy of DALL EExample Customer Journey Touchpoints

- 6:30 AM - Morning Wake-Up: Emily's day begins with the soft chime of her alarm through her super app. She quickly checks her schedule on the same app, a convenient hub for her daily planner.

- 7:15 AM - Commute Planning: While having breakfast, she opens her super app to book a ride to work. The integrated transport services offer real-time updates on traffic and public transport, making her commute hassle-free.

- 12:30 PM - Lunch Break: During lunch, Emily uses the super app to order food delivery. She browses through multiple cuisines and restaurants available within the app, enjoying the ease of in-app payment.

See: The Customer’s Voice: Harnessing Feedback for Continuous Improvement

- 3:00 PM - Midday Errands: She receives a notification from the super app reminding her to pay her utility bills. With a few taps, she completes the transaction smoothly, appreciating the app's one-stop financial management capability.

- 6:00 PM - Evening Wind Down: After work, Emily plans to catch up with friends. She uses the app's social feature to coordinate and book a table at a popular restaurant, all within the same platform.

- 9:30 PM - Entertainment and Relaxation: Back home, Emily relaxes by streaming her favorite show through the super app’s entertainment section, a perfect end to her day.

Throughout the day, Emily's super app seamlessly integrates various aspects of her life, from routine tasks to leisure activities, embodying the essence of convenience and efficiency in her digital-driven lifestyle.

Outlook

These super apps aren't just aggregating services. We're quickly heading into a new era where technology is deeply woven into the fabric of our everyday routines.

See: Rise of the super app

As they continue to evolve and adapt to regional needs and technological advancements, super apps stand poised to reshape not only individual lifestyles but also the landscape of global business and commerce. They promise a future of seamless interaction, heightened connectivity, and endless possibilities. Having said that, clearly not everyone will be thrilled with increased device time!

Download the 13 page PDF report --> here

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://ncfacanada.org/super-apps-are-redefining-daily-life/

- :has

- :is

- :not

- :where

- $UP

- 13

- 15%

- 150

- 2018

- 2024

- 2030

- 25

- 30

- 7

- 9

- a

- ability

- access

- across

- activities

- adapt

- Adoption

- advanced

- advancement

- advancements

- affiliates

- After

- AI

- alarm

- All

- all-in-one

- also

- alternative

- alternative finance

- am

- among

- amounts

- an

- analytics

- and

- Another

- Anticipated

- app

- appeal

- Application

- applications

- appreciating

- apps

- ARE

- Array

- artificial

- artificial intelligence

- AS

- aspects

- Assets

- At

- attraction

- attractive

- available

- average

- back

- Balance

- Banking

- BE

- become

- been

- being

- below

- Billion

- Bills

- blockchain

- bodies

- book

- bookings

- Break

- Breakfast

- bring

- broad

- Building

- business

- businesses

- but

- by

- cache

- CAN

- Canada

- capabilities

- capability

- Catch

- cater

- Centralization

- ceo

- challenge

- challenges

- challenging

- change

- changing

- characteristics

- Chart

- Checks

- Chime

- clearly

- closely

- Collecting

- COM

- comfortable

- Communities

- community

- Commute

- competitive

- Completes

- compromising

- Conflicting

- Connectivity

- consulting

- consumer

- continually

- continue

- continuous

- convenience

- Convenient

- coordinate

- create

- creates

- credit

- Crowdfunding

- cryptocurrency

- culturally

- Currency

- customer

- Customer Engagement

- customer experience

- Customer Journey

- Customer Service

- daily

- data

- Data Analytics

- data privacy

- data protection

- day

- decentralized

- delivery

- Demographics

- Dependency

- Design

- Despite

- device

- Devices

- devise

- different

- digital

- Digital Assets

- digital platforms

- digital services

- Disrupt

- distributed

- diverse

- diversify

- Dominance

- down

- downtime

- drivers

- driving

- due

- during

- dynamic

- e

- e-commerce

- ease

- East

- easy

- Economic

- ecosystem

- Education

- Effective

- efficiency

- efficiently

- enabling

- end

- Endless

- engaged

- engagement

- engaging

- enhance

- enhancing

- enjoying

- ensuring

- Entertainment

- Environment

- Era

- especially

- essence

- essential

- essential services

- essentially

- established

- Ether (ETH)

- Europe

- evening

- everyday

- everyone

- evolution

- evolve

- evolved

- evolving

- exchange

- expanded

- experience

- Experiences

- expertise

- extensively

- fabric

- Face

- faces

- factors

- familiar

- favorable

- Favorite

- Feature

- Features

- feedback

- few

- finance

- financial

- financial data

- financial inclusion

- financial innovation

- financial management

- financial services

- fintech

- fintech startup

- fit

- Focus

- focusing

- food

- food delivery

- For

- fragmented

- friends

- from

- Fuel

- functionalities

- functionality

- funding

- funding opportunities

- future

- generate

- get

- Global

- global business

- Globally

- Government

- grocery

- Group’s

- Growing

- Growth

- Handling

- Harnessing

- Have

- having

- Heading

- heightened

- helps

- her

- High

- highlighting

- Home

- How

- http

- HTTPS

- Hub

- Hurdles

- if

- image

- Impacts

- improvement

- in

- include

- Including

- inclusion

- Inclusivity

- increased

- increasing

- increasingly

- individual

- industry

- information

- innovate

- Innovation

- innovative

- insights

- insurance

- Insurtech

- integrated

- Integrates

- Integrating

- integration

- Intelligence

- Intensifies

- interaction

- interactions

- Interface

- Interview

- into

- investment

- issues

- IT

- ITS

- Jan

- journey

- jpg

- jurisdictions

- just

- keeping

- Key

- known

- landscape

- launched

- Laws

- Leverage

- Life

- lifestyle

- lifestyles

- like

- local

- logistics

- Look

- lunch

- maintain

- maintaining

- Making

- management

- managing

- Market

- Marketing

- marketplaces

- Markets

- max-width

- May..

- means

- measures

- Media

- member

- Members

- messaging

- Messaging App

- messaging apps

- Middle

- Middle East

- Mobile

- mobile payments

- model

- monetization

- more

- morning

- moving

- multi-utility

- multiple

- multitude

- must

- necessarily

- Need

- needs

- networking

- New

- notification

- numerous

- observed

- of

- offer

- offering

- Offerings

- offline

- often

- on

- ONE

- online

- online payments

- only

- opens

- operate

- opportunities

- or

- order

- our

- Overcome

- Pace

- page

- partners

- Pay

- payment

- payments

- PayPal

- peer to peer

- perfect

- perks

- personal

- Personalized

- phenomenal

- phone

- planning

- plans

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- players

- please

- pm

- poised

- Popular

- popularity

- possibilities

- potentially

- preferences

- privacy

- Privacy and Security

- privacy laws

- probe

- Programs

- projects

- promise

- propelled

- protection

- provide

- provides

- providing

- public

- published

- Pushing

- quickly

- raise

- range

- ranging

- rapid

- rapidly

- rappi

- RE

- reach

- reaching

- real-time

- receives

- recent

- recommendations

- Redefining

- region

- regional

- regions

- Regtech

- regulations

- regulatory

- regulatory landscape

- relaxation

- relevant

- reliability

- report

- requires

- restaurant

- Restaurants

- revenue

- Revolut

- Ride

- Rise

- Risk

- robust

- routine

- s

- Said

- same

- Savings

- Scalability

- schedule

- scope

- scrutiny

- seamless

- seamlessly

- SEC

- Section

- Sectors

- security

- sees

- sensitive

- service

- Services

- several

- shaped

- shared

- she

- shift

- Shopping

- show

- significant

- significantly

- single

- Skepticism

- smart

- smartphone

- smoothly

- Social

- social media

- Social networking

- Soft

- sometimes

- staggering

- stakeholders

- stand

- startup

- stay

- Stewardship

- stock

- stock trading

- strategies

- streaming

- streamline

- strict

- substantial

- succeed

- success

- such

- Super

- super apps

- Super-app

- support

- T

- table

- tailored

- Taps

- tasks

- technological

- Technologies

- Technology

- that

- The

- The Landscape

- their

- Them

- There.

- they

- this

- thousands

- thrilled

- Through

- titled

- to

- today

- Tokens

- tools

- towards

- Trading

- traditional

- traffic

- transaction

- Transactions

- transformed

- transport

- travel

- Trust

- under

- unintuitive

- Updates

- Usage

- use

- User

- User Experience

- user-friendly

- users

- uses

- utility

- Utilizing

- valued

- variations

- various

- Vast

- vibrant

- visa

- Visit

- Voice

- Wall

- we

- welcome

- What

- which

- while

- wide

- Wide range

- Wikipedia

- will

- wind

- with

- within

- without

- Work

- works

- woven

- X

- zephyrnet