The stock market has seen its worse year since the Great Recession, despite the economy seeing good growth for the first half of the year, and despite there being no banking collapse.

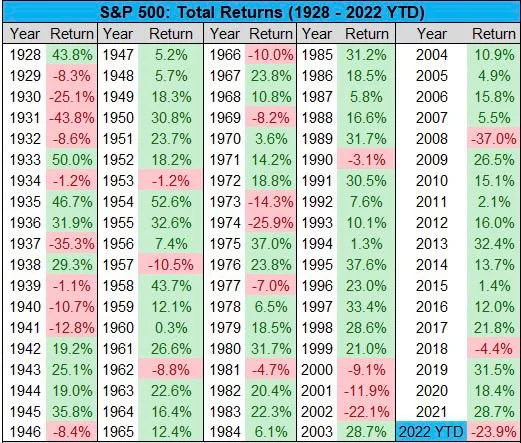

Still, S&P500 is down 24% this year, far more than in 2018 when banks last raised interest rates to 2.5%.

It fell just 4.4% in that 2018, and gained every other year except for a 37% drop in 2008. If we ignore 2008, we’d have to go to 1974, half a century ago, for a slightly bigger drop of 25.9%.

The severity of the fall this year may well be in great part due to speculation as where fundamentals are concerned, interest rates have had a far bigger effect than in 2018 when they last rose, suggesting there’s some other contributing factor to the scale of the drop.

The dollar strength index (DXY) can potentially explain, but DXY fell in 2018 while interest rates were rising, and was a lot lower in 2008, though around similar levels in 2002 when stocks also dropped 22%.

In that 2002 however, interest rates were going down as the economy was slowing, dropping to 1% by 2004.

Making it difficult to attribute a single cause as stocks have fallen when interest rates have gone up and down, and same for DXY.

The severity therefore is perhaps better explained by anticipation, rather than fundamentals.

Some months ago if you might recall Jim Cramer was on TV telling his audience to sell everything. His unqualified advice directly correlated interest rates as if they’re some laws of physics, and spoke like a math teacher that risk on assets are to be sold.

That same Cramer is now being inversed in a new ETF, though in this case he wasn’t too wrong. The question of course being whether he was part of the cause.

The media narrative for months has now also been the cost of living ‘crisis.’ Their obsession with negativity so reaching a new level, to the point the BBC, and especially Newsnight, have come across as almost trying to overthrow the new British Prime Minister Liz Truss.

She has a very positive agenda, at least narratively, but you won’t find on the BBC any analysis of why the British GDP is still at same levels as 2008, or any analysis about what exactly can be done.

Blaming just the media however, although the BBC took a lot of blame in 2008 too for fueling a panic, might be just a partial answer.

Another one is China. Their economy has slowed down considerably this year, and some would even say it has crashed.

Though in the medium term that may translate to a stronger US/EU economy as they grab more of the investments, in the short term many companies have plenty of business in China and so they have been affected.

The Russian stock market crash also you might think is both too small and peripheral to matter, yet from observation, the move down on MOEX after the mobilization appeared to coincide with some red in US and European stocks.

Welcome to the global economy, and it is still very global, with much of the hit in US stocks therefore perhaps mostly due to events outside its own borders.

Is It All Over?

That’s the big question: is macro changing? And at least someone thinks so with Bloomberg reporting the recovery on S&P500 on Wednesday was all down to a single trader who spent $31 million, they say:

“The trade included buying 20,000 S&P 500 calls expiring in October with a strike price of 4,500 and 14,000 bullish contracts expiring in March at a strike of 4,300, while selling 48,000 calls maturing in January with an exercise price at 4,500 — a bet that essentially says stocks would rally in coming months.”

It does sound a bit of an exaggeration to put the movement of a $100 trillion market on the bets of a $31 million trader.

But it shows where sentiment currently is: tentatively wondering whether to bull at least a little bit.

The reasons for that would be numerous. First, on interest rates, do they even matter anymore at this point and at these levels? Is there such a huge difference between 3.25% and 4%, especially when most expect that 4% anyway and so has been priced in?

The difference may be on the other side instead, if they don’t move or if we get small moves, especially even a -0.25%.

The same for inflation or the cost of living ‘crisis.’ Is this now a was? With moves to effectively cap energy prices to $2,500 in UK for an average family, and equivalent caps in other countries as well as for businesses, inflation expectations logically now should be down, not up anymore.

That feeds into the ‘wage spiral’ theory which concerns the Fed as it risks causing a self-fulfilling prophecy.

In UK there’s a debate on whether benefits for the poorest should rise in line with inflation (10%) or wages (5%).

The government wants to go with the latter, and in any other circumstance no one would say a thing as how can you expect taxpayers to pay more for those not working than they’re getting paid themself.

In the current circumstance however, silly politics is silly as Labor wants its: ‘taking from the poor and giving it to the rish.’

It’s just a $5 billion difference so realistically no one cares, but when it comes to wages, if inflation expectations now move towards it falling, then demanding a permanent rise in wages for what may be temporary inflation may be a hard sell.

China is having its Great Congress soon and they’re all in best behavior, so nobody move. But, the question here is whether the crash is done, and now they move to a new reality of slower growth, or whether the crash has more to go.

Regardless, at this stage anything new from China would probably be on the monetary easing front, unless there’s some blackswan obviously.

Basically, and obviously we’ll have to see what happens next year but bar any blackswan, the worst here is probably US’ 2008 where fiat money tries to cancel out the economic slowdown or even contraction.

And where Russia is concerned, well they are a periphery and too small in global markets, with the vast majority of their leverage used at this point in giving us what may turn out to be a double top in both gas and oil.

The worst of the macro therefore may be in the past, and although some of it may still continue, looking to summer from now, you’d think a lot of these concerns would have been for this year.

No one can predict however, but bitcoin has been refusing to go lower, stocks have crashed the most in 15 years, and we may find out the economy has actually been growing.

Obviously there may still be down, but is the upside more than the downside is the question, and at this stage it is not too clear where more downside would come from.

Compare now to November 2021 when there was this whole tsunami of problems coming stocks way: lockdowns (in China), war, inflation, rising interest rates.

They all came and we’re here so what now? Well, let’s see the Q3 data. If growth remains, then the economy has become more robust and may well be on a good growth trajectory. If it doesn’t, then interest rates maybe even have to be cut in addition to fiscal measures, perhaps British style.

Leaving little room for proper falls, but who knows. Though since no one can time exactly, there may be an opening to at least speculate that maybe there can be up.

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- news

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- Platoblockchain

- PlatoData

- platogaming

- Polygon

- proof of stake

- Second

- Stocks

- Trustnodes

- W3

- zephyrnet