GM Defiers!

Ethereum’s long-awaited Shapella upgrade is live on mainnet, and the network is successfully processing withdrawals of staked ETH. Meanwhile, zkSync Era has attracted 60x the TVL of Polygon zkEVM as airdrop farmers pile in, and a buggy smart contract led to $3.4M in losses at SushiSwap over the weekend. And finally, we have a report from SenseiNode looking at the potential price impact of Shapella based on blockchain data.

✍️ In today’s newsletter:

- Ethereum’s Shapella upgrade enables withdrawals of staked ETH

- Airdrop farmers favor zkSync Era over Polygon zkEVM

- Sushiswap plans to reimburse victims of $3.4M exploit

- Predicting the Impact of Stake Withdrawals on Ethereum’s Market Dynamics

🙏 Sponsored:

📈 Markets in last 24 hrs:

BTC

Bitcoin

$30,073

+0.650%

ETH

Ether

$1,916.8

-0.0300%

MKR

Maker

$727

+0.140%

SPY

S&P500

$407.2

-0.670%

UNI

Uniswap

$5.94

-0.100%

LDO

Lido DAO

$2.26

-2.84%

Ethereum

Staked ETH Withdrawals Activated in Major Upgrade

TLDR Ethereum’s long-awaited Shapella upgrade has allowed stakers of ETH to withdraw their cryptocurrency for the first time since the Beacon Chain went live 28 months ago.

SO WHAT While some analysts fear that ETH will drop due to validators selling off their stakes, others predict that Shapella will lead to increased staking participation, as institutional investors have greater confidence in staking ETH to generate yield. Ethereum is currently the largest Proof of Stake network by staked capitalization at $35.8 billion.

THANKING OUR NEWSLETTER SPONSORS

| Newsletter continues below |

| Get paid for doing what’s good for you. MEV Blocker protects you from sandwich attacks and frontrunning, and pays you when others backrun your transactions. And it’s completely free to use. Add MEV Blocker to your wallet today. It’s a no-brainer. |

| Cartesi is an application-specific rollups execution layer with a Linux runtime. Cartesi’s RISC-V virtual machine allows developers to import decades of open-source wisdom to blockchain applications and build decentralized applications with their favorite libraries, compilers, and other time-tested open-source tooling. Learn more. |

| Tripple Card – the first ever truly decentralized Web3 credit card. Your keys, your crypto, your cash. No wallet creation needed – connect your existing crypto wallet and instantly use it for your everyday needs. |

| Satsuma is a subgraph hosting platform that helps dApps ship faster with 99.9% uptime, 2x+ faster indexing, and more. Decentraland, Aragon, and GMX are happy users. Sign up today! |

Layer 2

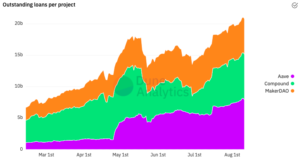

zkSync Era Crosses $200M In TVL While Polygon zkEVM Trails

TLDR Ethereum scaling solutions zkSync Era and Polygon’s zkEVM both use zero-knowledge rollups to reduce transaction costs, but zkSync Era has attracted $218M of user deposits in 19 days while Polygon’s zkEVM holds just $3.6M. Analysts attribute the difference to the fact that zkSync Era users are chasing a potential airdrop, while Polygon already has a token.

SO WHAT The disparity in the value bridged between the two solutions highlights the power of airdrops in driving capital flows across crypto. However, the number of users who have used zkSync’s bridge only once indicates that not all of the activity on the platform is sustainable.

Buggy Code

Sushi Plans To Reimburse Victims Of $3.4M Exploit

TLDR SushiSwap, a decentralized cryptocurrency exchange, suffered losses of over $3.4M due to a faulty smart contract, which caused vulnerabilities that allowed hackers to drain funds approved for trading by unsuspecting users. The team is working on a claim process to make affected users whole.

SO WHAT The incident highlights the importance of maintaining stringent security practices when transacting on-chain. Protocols that are trusted in the community and battle-tested over time can still suffer exploits or ship faulty code, resulting in significant losses.

Research

Predicting the Impact of Stake Withdrawals on Ethereum’s Market Dynamics

TLDR The Shanghai update on the Ethereum network introduces stake withdrawals for users participating in the Proof of Stake consensus mechanism. This could lead to a decline in staked ETH, potentially impacting the network’s security and staking rewards, and influencing the number of active validators. However, increased market liquidity due to stake withdrawals may cause short-term price volatility but could also attract more users to the Ethereum network, positively impacting its long-term value.

SO WHAT Evaluating on-chain metrics like staked ETH, number of validators, staking rewards, withdrawn stake, ETH price, daily transaction volume, and gas prices can provide insights into the potential consequences of the upgrade.

🔎 FROM OUR REPORTERS

Here’s what Sam’s watching this week👀

🌍 ELSEWHERE

- Blockchain Association Files Amicus Brief In Support of Tornado Cash (Twitter)

- Bankrupt Crypto Exchange FTX Has Recovered $7.3B (Reuters)

- 2023 State Of Crypto Report (a16z)

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://thedefiant.io/staked-eth-withdrawals-are-live/

- :is

- $3

- $UP

- 1

- 100

- 28

- 8

- a

- across

- active

- activity

- airdrop

- Airdrops

- All

- allows

- already

- Analysts

- and

- applications

- approved

- aragon

- ARE

- AS

- Association

- At

- Attacks

- attracted

- based

- beacon

- beacon chain

- below

- between

- Billion

- blockchain

- blockchain applications

- blockchain data

- border

- BRIDGE

- bridged

- build

- by

- CAN

- capital

- capitalization

- card

- Cash

- Cause

- caused

- chain

- claim

- code

- community

- completely

- confidence

- Connect

- Consensus

- consensus mechanism

- Consequences

- continues

- contract

- Costs

- could

- creation

- credit

- credit card

- crypto

- crypto exchange

- Crypto exchange FTX

- Crypto wallet

- cryptocurrency

- Cryptocurrency Exchange

- Currently

- daily

- DApps

- data

- Days

- decades

- Decentraland

- decentralized

- Decentralized Applications

- Decline

- DeFi

- deposits

- developers

- difference

- doing

- driving

- Drop

- enables

- Era

- ETH

- eth price

- ethereum

- ethereum network

- ethereum scaling

- Ethereum's

- EVER

- everyday

- exchange

- execution

- existing

- exploits

- farmers

- faster

- faulty

- Favorite

- fear

- Files

- Finally

- First

- first time

- Flows

- For

- Free

- from

- frontrunning

- FTX

- funds

- GAS

- gas prices

- generate

- GMX

- good

- greater

- hackers

- happy

- Have

- helps

- highlights

- holds

- hosting

- However

- http

- HTTPS

- Impact

- import

- importance

- in

- incident

- increased

- indicates

- influencing

- insights

- Institutional

- institutional investors

- Introduces

- Investors

- IT

- ITS

- jpg

- keys

- largest

- Last

- layer

- lead

- Led

- libraries

- like

- linux

- Liquidity

- live

- long-awaited

- long-term

- looking

- losses

- machine

- mainnet

- major

- make

- Market

- Markets

- May..

- Meanwhile

- mechanism

- months

- more

- needed

- needs

- network

- Newsletter

- number

- of

- on

- On-Chain

- open source

- Other

- Others

- paid

- participating

- participation

- pays

- plans

- platform

- plato

- Plato Data Intelligence

- PlatoData

- Polygon

- Polygon zkEVM

- Polygon’s

- potential

- potentially

- power

- practices

- predict

- price

- Prices

- process

- processing

- proof

- Proof-of-Stake

- protocols

- provide

- reduce

- report

- resulting

- Reuters

- Rewards

- Rollups

- sandwich attacks

- scaling

- security

- Selling

- shanghai

- short-term

- significant

- since

- smart

- smart contract

- Solutions

- some

- Sponsored

- stake

- Staked

- Staked ETH

- stakers

- Staking

- Staking Rewards

- State

- Still

- subgraph

- Successfully

- support

- sushiswap

- sustainable

- team

- that

- The

- their

- time

- to

- today

- today’s

- token

- tornado

- Tornado Cash

- Trading

- transacting

- transaction

- transaction costs

- Transactions

- trusted

- TVL

- Update

- upgrade

- uptime

- use

- User

- users

- validators

- value

- victims

- Virtual

- virtual machine

- Volatility

- volume

- Vulnerabilities

- Wallet

- watching

- Web3

- weekend

- What

- which

- while

- WHO

- will

- wisdom

- with

- withdraw

- Withdrawals

- working

- Yield

- Your

- zephyrnet

- zero-knowledge

- zkEVM

- zkSync