Just how big is the current web3 B2B SaaS total addressable market (TAM)?

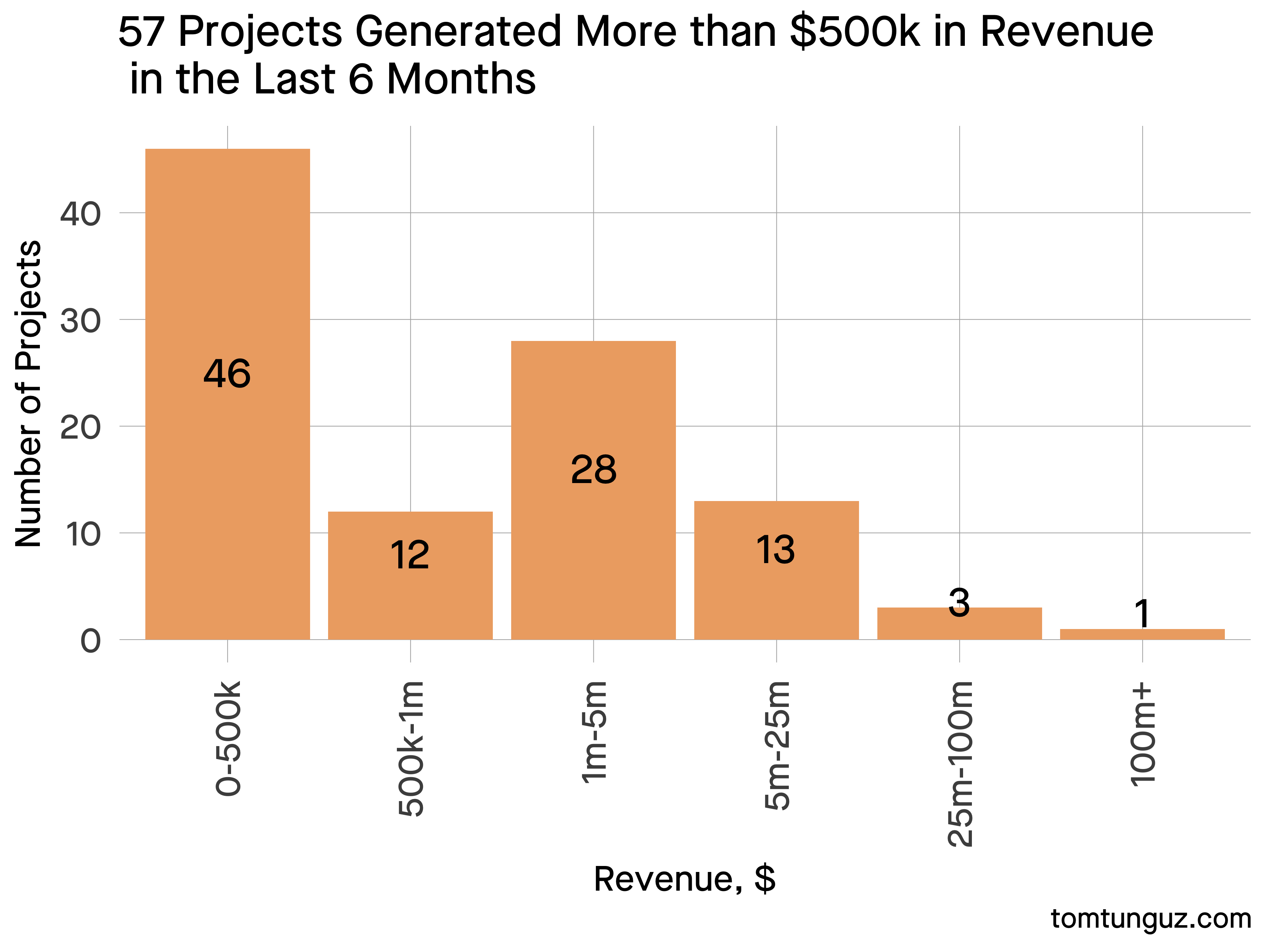

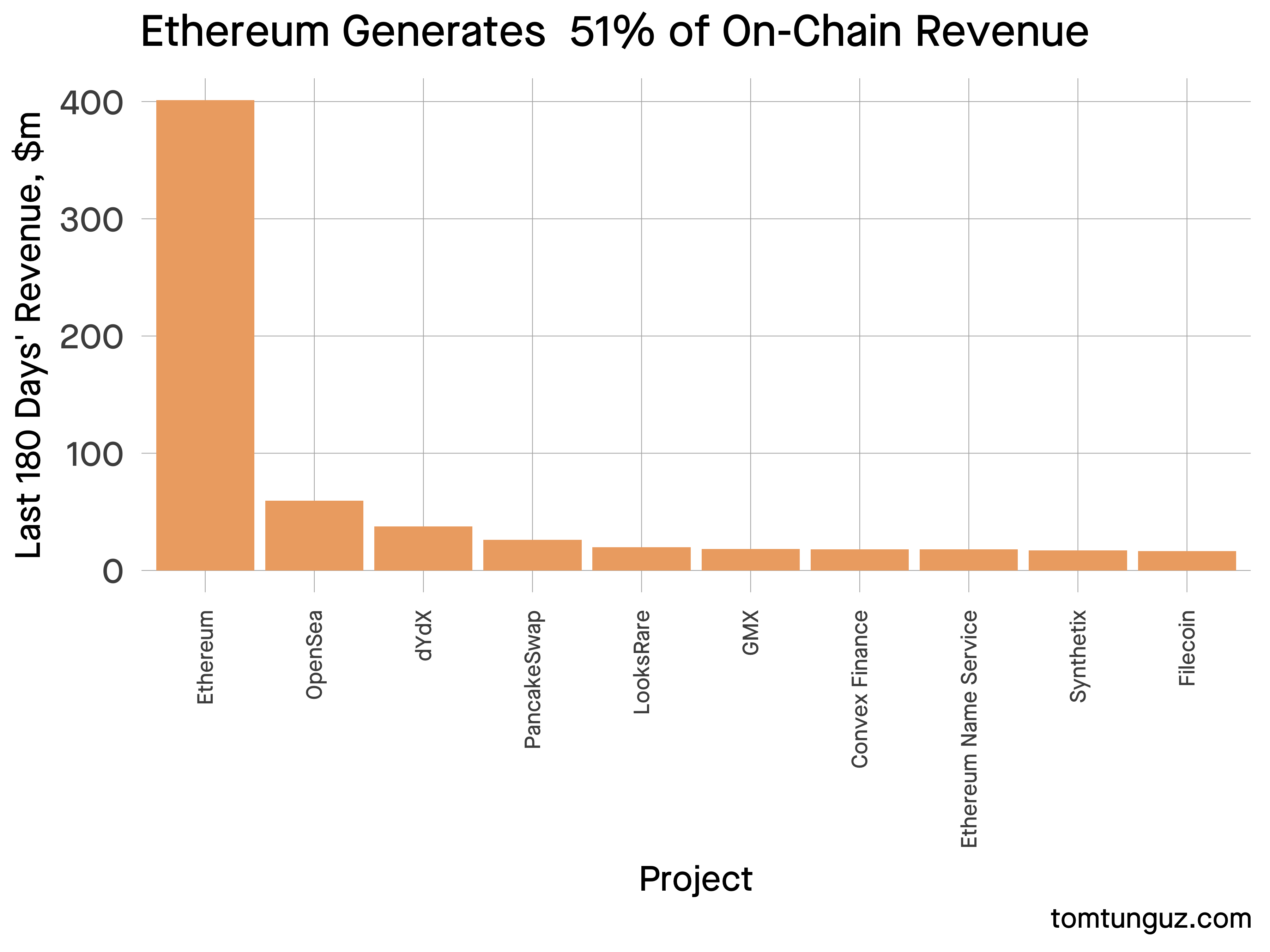

In the last six months, 103 web3 companies generated revenue on-chain, the smallest of which recorded a few hundred dollars of sales & the largest, Ethereum, tallied $401m.

44% of these companies produced less than $0.5m. But a nascent mid-market does exist : 41 companies produced between $5-25m.

| Figure | Value |

|---|---|

| Total Revenue, $M | 771 |

| % of Revenue spent on Software | 30% |

| Implied Web3 Software TAM, $M | 231 |

| Implied Web3 Software TAM (excluding Ethereum), $M | 75 |

The average software company operates at about 70% gross margin, so let’s assume a web3 company is similar. To simplify, we’ll assume the typical web3 company spends all of that cost of goods sold (COGS) on software – about 30% of revenue [1].

That implies the web3 B2B software TAM is roughly $231m in 2022 & $75m excluding Ethereum, which comprises roughly 60% of the revenue.

Web3 software sales must also navigate novel procurement processes with decentralized decision-making, payment for services in kind with tokens, & different permissions models for users.

At a 10x revenue multiple, web3 software should support about $0.75b to $2.3b in startup market cap. Depending on your view on web3 revenue growth, a 10x multiple might be high or low.

The limited number of potential customers challenges web3 vendors. With fewer than 100 accounts willing to spend $20-50k on a software contract, every interaction is precious, especially those larger accounts which dominate revenue.

To contrast with web2, Salesforce counts 150k customers in a market of about 650k who spend $57b annually. This is just the web2 CRM market.

While possible to build a business selling exclusively to web3 companies, the bigger market today is selling web3 technologies to web2 companies. Solutions in gaming, marketing, & financial services where decentralized databases or virtual wallets solve a core business need.

- This is a rough estimate. Most software companies also include customer success in COGS. Fully allocating all COGS to software is aggressive. On the other hand, the software purchased by Sales & Marketing and Research & Development teams isn’t included in that line item. So, this should be a reasonable guess.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.tomtunguz.com/sizing-web3-b2b-market/

- 1

- 100

- 2022

- a

- About

- Accounts

- aggressive

- All

- and

- Annually

- average

- B2B

- between

- Big

- bigger

- build

- business

- cap

- challenges

- Companies

- company

- contract

- contrast

- Core

- Cost

- CRM

- Current

- customer

- Customer Success

- Customers

- databases

- decentralized

- Decision Making

- Depending

- Development

- different

- dollars

- dominate

- especially

- estimate

- Ether (ETH)

- ethereum

- excluding

- exclusively

- few

- financial

- financial services

- fully

- gaming

- generated

- goods

- gross

- Growth

- High

- How

- HTTPS

- image

- in

- include

- included

- interaction

- Kind

- larger

- largest

- Last

- Limited

- Line

- Low

- Margin

- Market

- Market Cap

- Marketing

- mid-market

- might

- models

- months

- most

- multiple

- nascent

- Navigate

- Need

- novel

- number

- On-Chain

- operates

- Other

- payment

- plato

- Plato Data Intelligence

- PlatoData

- possible

- potential

- Precious

- processes

- Produced

- purchased

- reasonable

- recorded

- research

- revenue

- revenue growth

- roughly

- SaaS

- sales

- Sales & Marketing

- salesforce

- Selling

- Services

- should

- similar

- simplify

- SIX

- Six months

- So

- Software

- sold

- Solutions

- SOLVE

- spend

- spent

- startup

- success

- support

- TAM

- teams

- Technologies

- The

- to

- today

- Tokens

- Total

- typical

- users

- vendors

- View

- Virtual

- Wallets

- Web2

- web2 companies

- Web3

- web3 companies

- web3 company

- web3 technologies

- which

- WHO

- willing

- Your

- zephyrnet