The comment period for a Securities and Trade Fee proposal to broaden the kind of investments topic to custodial oversight by advisers to issues like bodily commodities, digital belongings and art work is about to run out on Monday, Could 8, although a number of trade associations are asking for a 60-day extension.

The SEC first proposed an modification to the “custody rule” concerning adviser-led investing on February 15, citing the various developments in expertise, advisory providers and custodial practices because the rule was final amended in 2009. The SEC’s proposal additionally modifications the title of the “custody rule,” initially included within the Investment Advisers Act of 1940, to the “safeguarding rule.”

The brand new rule, as proposed, would broaden its software past simply securities and funds to all belongings in a custodian’s custody. Bodily commodities, actual property, art work, brief positions and digital belongings would all be topic to the brand new rule. The SEC has explained that this understanding of the time period asset is meant to be “evergreen” in order that the protections of the rule don’t “depend on which type of assets the client entrusts to the adviser.”

With the modification, advisers can be required to acquire sure written assurances from their custodians of funding gadgets. These assurances would come with affirmation: that the consumer’s belongings are segregated in order that they’re protected within the case of chapter; that the custodian will present data to the SEC at their request; of the adviser’s authority to impact transactions; and that the custodian can have insurance coverage to indemnify the consumer in opposition to losses as a result of custodian’s recklessness.

The rule would additionally make clear explicitly that if an adviser has the authority to commerce a consumer’s belongings on a discretionary foundation, then that adviser is topic to the rule.

A joint comment letter signed by trade actors, together with the ABA Securities Council, the American Bankers Affiliation, the Investment Adviser Affiliation, the Investment Firm Institute and the Securities Business and Monetary Markets Affiliation, requested an extension of the remark interval for an extra 60 days from its preliminary February 15 submitting. The organizations defined that with a purpose to remark in a radical method, they have to coordinate amongst numerous forms of market constituents to grasp the rule’s true impact.

The letter additionally argues that the general tempo of the SEC’s rulemaking justifies an extended remark interval, which is a standard grievance levied in opposition to the SEC below Chairman Gary Gensler.

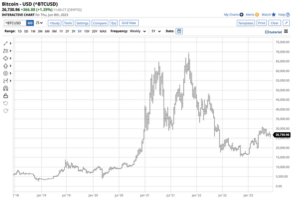

The Workplace of the Lawyer Common for Massachusetts, below Andrea Pleasure Campbell, wrote in support of the proposal. She expressed concern about buyers in digital belongings, one of many major motivations for the proposal, and approval for the rule’s skill to guard them. She defined that her workplace has seen a “sharp increase in consumer complaints related to cryptocurrency investments” lately. She elaborated that “consumers misperceived centralized exchanges such as FTX as stable custodians. This misconception cost Massachusetts consumers millions of dollars.”

#SEC #Safeguarding #Rule #Expand #Investment #Oversight #Crypto #Artwork #PLANADVISER

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Buy and Sell Shares in PRE-IPO Companies with PREIPO®. Access Here.

- Source: https://cryptoinfonet.com/regulation/sec-safeguarding-rule-would-expand-investment-oversight-to-crypto-artwork-planadviser/

- :has

- :is

- 15%

- 8

- a

- About

- acquire

- Act

- actors

- Additionally

- advisory

- All

- Although

- American

- amongst

- an

- and

- approval

- ARE

- Argues

- Art

- artwork

- AS

- asset

- Assets

- associations

- At

- authority

- bankers

- BE

- because

- below

- brand

- Brand New

- broaden

- business

- buyers

- by

- CAN

- case

- centralized

- Centralized Exchanges

- chairman

- Chapter

- clear

- client

- come

- comment

- Commerce

- Commodities

- Common

- complaints

- Concern

- consumer

- Consumers

- continue

- coordinate

- Cost

- could

- Council

- coverage

- crypto

- cryptocurrency

- custodial

- custodian

- custodians

- Custody

- data

- Days

- defined

- developments

- digital

- discretionary

- dollars

- Dont

- elaborated

- Exchanges

- Expand

- expertise

- expressed

- extension

- extra

- February

- fee

- final

- Firm

- First

- For

- forms

- Foundation

- from

- FTX

- funding

- funds

- Gadgets

- Gary

- Gary Gensler

- General

- Gensler

- grasp

- Guard

- Have

- her

- HTTPS

- if

- Impact

- in

- included

- Increase

- initially

- Institute

- insurance

- investing

- investment

- Investments

- issues

- ITS

- joint

- jpg

- Kind

- lawyer

- letter

- like

- LINK

- losses

- major

- make

- many

- Market

- Markets

- massachusetts

- method

- millions

- misconception

- Modifications

- Monday

- Monetary

- motivations

- Navigation

- New

- number

- numerous

- of

- on

- ONE

- opposition

- order

- organizations

- out

- Oversight

- past

- period

- plato

- Plato Data Intelligence

- PlatoData

- pleasure

- positions

- practices

- present

- property

- proposal

- proposed

- protected

- providers

- purpose

- radical

- Reading

- recklessness

- related

- request

- requested

- required

- result

- Rule

- Run

- safeguarding

- SEC

- Securities

- seen

- segregated

- she

- signed

- simply

- skill

- Software

- stable

- standard

- such

- support

- Tempo

- that

- The

- their

- Them

- then

- These

- they

- this

- time

- Title

- to

- together

- topic

- trade

- Transactions

- true

- type

- understanding

- various

- was

- which

- will

- with

- within

- Work

- Workplace

- would

- written

- zephyrnet