Key Points:

- SEC accepts Valkyrie’s spot Bitcoin ETF application, marking progress in the review process.

- The public comment period opens for feedback before the official review begins.

- Acceptance of Bitcoin ETF applications by the SEC suggests increased adoption and potential mainstream acceptance of cryptocurrencies.

The U.S. Securities and Exchange Commission (SEC) has recently acknowledged the filing of Valkyrie’s spot Bitcoin (BTC) exchange-traded fund (ETF) application, marking another significant development in the pursuit of a Bitcoin ETF.

This acknowledgment comes as the SEC continues its comprehensive review process for various ETF proposals.

Valkyrie’s proposal, outlined in an official filing on July 17, seeks a rule change to list and trade a spot Bitcoin ETF on Nasdaq. As part of the regulatory process, the SEC has opened a public comment period, allowing interested parties to provide feedback within 21 days after publication in the Federal Register. This period of public input is an important step before the SEC proceeds with its official review and evaluation.

Eric Balchunas, a senior ETF analyst at Bloomberg, confirmed the acceptance of Valkyrie’s spot Bitcoin ETF application by the SEC. Notably, Valkyrie was the final applicant to submit a spot Bitcoin ETF proposal amid a recent surge of applications. Balchunas also highlighted that Valkyrie has chosen the ticker symbol “BRRR” for the Bitcoin ETF on the Nasdaq exchange.

This move by the SEC to accept Valkyrie’s spot Bitcoin ETF application indicates a growing interest and recognition of the potential benefits of such investment products. Several prominent firms, including BlackRock, VanEck, Invesco, Fidelity, and WisdomTree, have also entered the race to secure SEC approval for their Bitcoin ETF proposals. The increased attention from major financial players highlights the growing acceptance and adoption of Bitcoin in traditional investment vehicles.

The potential approval of a spot Bitcoin ETF holds significant implications for the cryptocurrency market. A spot ETF would involve the purchase and custody of actual Bitcoin, with its price linked to the current market spot price. If a Bitcoin spot ETF receives approval from regulatory bodies like the SEC, it would signify a major step toward mainstream acceptance and legitimacy for Bitcoin. Furthermore, the approval could lead to an influx of institutional capital into the cryptocurrency market, bolstering its liquidity and overall growth.

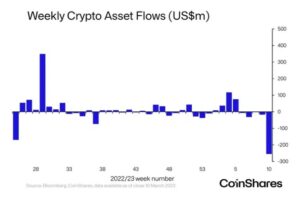

The positive market response to the filing of spot Bitcoin ETFs can already be observed in the price movements of Bitcoin. Following the announcement of the spot Bitcoin ETF filing by BlackRock, Bitcoin experienced a price rally that pushed it above the $30,000 level. Investors are now eagerly awaiting updates on the progress of Bitcoin ETF applications as they anticipate the potential for increased accessibility and institutional participation in the cryptocurrency market.

Overall, the acceptance of Valkyrie’s spot Bitcoin ETF application by the SEC, along with the growing number of similar proposals, reflects a notable shift in the regulatory landscape toward embracing digital assets. While the SEC’s review process is ongoing, these developments indicate a growing recognition of the value and potential of Bitcoin ETFs, bringing the cryptocurrency market one step closer to broader acceptance and integration within traditional investment frameworks.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Source: https://coincu.com/203584-sec-accepts-valkyries-etf-application/

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://bitcoinethereumnews.com/bitcoin/sec-now-accepts-valkyries-spot-bitcoin-etf-application/?utm_source=rss&utm_medium=rss&utm_campaign=sec-now-accepts-valkyries-spot-bitcoin-etf-application

- :has

- :is

- :not

- 000

- 1

- 17

- a

- above

- Accept

- acceptance

- Accepts

- accessibility

- acknowledged

- actual

- Adoption

- advice

- After

- Allowing

- along

- already

- also

- Amid

- an

- analyst

- and

- Announcement

- Another

- anticipate

- Application

- applications

- approval

- ARE

- AS

- Assets

- At

- attention

- auto

- awaiting

- BE

- before

- benefits

- Bitcoin

- Bitcoin ETF

- bitcoin ETF application

- Bitcoin spot etf

- BlackRock

- blockchain

- bodies

- Bringing

- broader

- BTC

- by

- CAN

- capital

- change

- chosen

- closer

- COM

- comes

- comment

- Commentary

- commission

- comprehensive

- constitute

- continues

- could

- cryptocurrencies

- cryptocurrency

- cryptocurrency market

- Current

- Custody

- Days

- Development

- developments

- digital

- Digital Assets

- do

- does

- eagerly

- embracing

- encourage

- entered

- ETF

- ETFs

- evaluation

- exchange

- exchange-traded

- exchange-traded fund (ETF)

- experienced

- Federal

- feedback

- fidelity

- Filing

- final

- financial

- firms

- fluid

- following

- For

- frameworks

- from

- fund

- Furthermore

- General

- Growing

- growing interest

- Growth

- Have

- Highlighted

- highlights

- holds

- HTTPS

- if

- implications

- important

- in

- Including

- increased

- indicate

- indicates

- influx

- information

- input

- Institutional

- integration

- interest

- interested

- into

- Invesco

- investing

- investment

- Investors

- involve

- IT

- ITS

- July

- July 17

- landscape

- lead

- legitimacy

- Level

- like

- linked

- Liquidity

- List

- Mainstream

- major

- Market

- marking

- max-width

- move

- movements

- Nasdaq

- notable

- notably

- now

- number

- observed

- of

- official

- on

- ONE

- ongoing

- opened

- opens

- outlined

- overall

- own

- part

- participation

- parties

- period

- plato

- Plato Data Intelligence

- PlatoData

- players

- points

- positive

- potential

- price

- price rally

- proceeds

- process

- Products

- Progress

- prominent

- proposal

- Proposals

- provide

- provided

- public

- Publication

- purchase

- pursuit

- pushed

- Race

- rally

- receives

- recent

- recently

- recognition

- reflects

- register

- regulatory

- regulatory landscape

- research

- response

- review

- Rule

- s

- SEC

- secure

- Securities

- Securities and Exchange Commission

- Seeks

- senior

- several

- shift

- significant

- signify

- similar

- Spot

- Spot Bitcoin Etf

- spot etf

- Step

- submit

- such

- Suggests

- surge

- symbol

- that

- The

- their

- These

- they

- this

- ticker

- to

- toward

- trade

- traditional

- true

- u.s.

- U.S. Securities

- U.S. Securities and Exchange Commission

- U.S. Securities and Exchange Commission (SEC)

- Updates

- VALKYRIE

- value

- VanEck

- various

- Vehicles

- was

- we

- Website

- while

- WisdomTree

- with

- within

- would

- you

- Your

- zephyrnet