Crypto Market Remains Stable Despite Global Conflicts

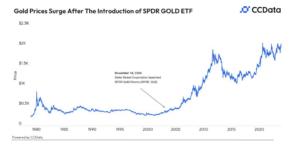

On 13 October 2023, Santiment reported that the cryptocurrency market has remained relatively stable during the first week of renewed attention on the Israel-Palestine conflict. In contrast, gold and silver have experienced significant price increases, mirroring their behavior during the initial weeks of the Russia-Ukraine conflict in February and March 2022.

Bearish Sentiment Could Ironically Boost Prices

Also on 13 October 2023, Santiment highlighted that there has been a surge in discussions around topics like inflation and bear markets. These discussions indicate a growing bearish sentiment among traders toward the crypto market. Interestingly, Santiment posits that the more traders expect prices to fall, the higher the likelihood that prices will actually rise.

Surge in Shark and Whale Wallets Since February 2022

<!--In a post dated 14 October 2023, Santiment revealed that there has been a significant increase in the number of large cryptocurrency wallets, often referred to as “shark” and “whale” wallets, holding at least 10 bitcoins Over the past 20 months, 11,806 new addresses have reached this threshold, marking an 8.12% total increase.

Bitcoin Whale Wallets Continue to Accumulate

Later that day, Santiment announced that the number of Bitcoin whale wallets had seen another significant increase. Specifically, 16 more wallets now hold between 100 and 1,000 BTC. This growth correlates with smaller wallets moving up to higher tiers, strengthening the case for a bullish outlook on Bitcoin’s future.

Latest Action in the Crypto Market

Interestingly, over the past weekend, the crypto market experienced a small rally led by Bitcoin, which is currently trading at around $27,699, up 3.4% in the past 24-hour period. Bitcoin’s price surge is probably due to (1) increasing optimism over the chances of approval of a spot Bitcoin ETF in the U.S. and (2) increasing geopolitical tensions leading to some people purchasing gold and Bitcoin as safe-haven assets.

Featured Image via Midjourney

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.cryptoglobe.com/latest/2023/10/analytics-firm-santiment-sheds-light-on-crypto-market-amid-global-conflicts-and-rising-whale-activity/

- :has

- :is

- :not

- $UP

- 000

- 1

- 10

- 100

- 11

- 13

- 14

- 16

- 20

- 2022

- 2023

- 8

- a

- accumulation

- Action

- actually

- addresses

- Ads

- All

- Amid

- among

- an

- analyzes

- and

- announced

- Another

- approval

- around

- AS

- Assets

- At

- attention

- Bear

- bear markets

- bearish

- been

- began

- between

- Bitcoin

- Bitcoin ETF

- Bitcoin Whale

- Bitcoins

- boost

- BTC

- Bullish

- by

- case

- chances

- conflict

- conflicts

- continue

- contrast

- could

- crypto

- Crypto Market

- crypto trends

- cryptocurrency

- cryptocurrency market

- cryptocurrency wallets

- CryptoGlobe

- Currently

- dated

- day

- Despite

- discussions

- due

- during

- ETF

- Ether (ETH)

- expect

- experienced

- Fall

- February

- First

- For

- future

- geopolitical

- Global

- Gold

- Growing

- Growth

- had

- Have

- higher

- Highlighted

- historic

- hold

- holding

- HTTPS

- image

- in

- Increase

- Increases

- increasing

- indicate

- inflation

- initial

- Ironically

- jpg

- large

- leading

- least

- Led

- like

- likelihood

- March

- Market

- Markets

- marking

- met

- MidJourney

- mirroring

- months

- more

- moving

- New

- now

- number

- october

- of

- often

- on

- Optimism

- Outlook

- over

- past

- People

- period

- plato

- Plato Data Intelligence

- PlatoData

- Post

- price

- price surge

- Prices

- probably

- purchasing

- rally

- reached

- referred

- relatively

- remained

- remains

- renewed

- Reported

- Revealed

- Rise

- rising

- s

- Santiment

- Screen

- screens

- seen

- sentiment

- Shark

- significant

- Silver

- since

- sizes

- small

- smaller

- some

- specifically

- Spot

- Spot Bitcoin Etf

- stable

- strengthening

- surge

- tensions

- that

- The

- their

- There.

- These

- this

- threshold

- to

- Topics

- Total

- toward

- Traders

- Trading

- Trends

- true

- u.s.

- use

- Wallets

- week

- weekend

- Weeks

- Whale

- which

- will

- with

- zephyrnet