Happy Sunday Friends!

The private jet sector experienced an unprecedented surge in customers, spurred by pandemic-induced health apprehensions and a rising global standard of living. In response to this ballooning demand, numerous players including Wheels Up, FlexJet, VeriJet, Surf Air Mobility, and, most recently, Volato, have declared intentions to go public via SPACs. Yet, the rapid growth hasn’t been without its challenges. Supply chain disruptions, workforce shortages, inflation, and a challenging macroeconomic environment are currently diminishing both sales and profit margins. Amidst these broader challenges, can Volato restructure its operations to address the present-day challenges and simultaneously leverage the setbacks faced by its rivals to grow its market share?

Soaring Above the Storm

Volato is an aviation company with a focus on fractional ownership, that primarily operates with 18 HondaJets, each with four seats. The company also has larger Gulfstream G280 jets for bigger groups. It serves a mix of business and leisure travelers, offering flights starting at $5,000, linking cities like New York to popular spots like Martha’s Vineyard.

While Volato sees promise in the Global Business Jet Market, currently worth around $29 billion, the industry’s track record sends a cautionary note to investors on the deal. Big names like Wheels Up and Blade Urban Mobility have seen their shares drop significantly after going public in 2021. Others, like Flexjet and Verijet, quickly backed out from going public via SPACs. Surf Air Mobility, after a change in its public listing strategy, also saw a huge dip.

These companies have faced a series of challenges including Maintenance delays, long waiting times for parts, rising costs from suppliers, and a shortage of workers, especially pilots. Earlier, most of these companies passed on the rising costs to customers. But with a weaker macroeconomic backdrop, they now have to bear these costs themselves, leading to higher losses.

Volato, on the other hand, has a different plan. Instead of trying to be the next big thing like Airbnb or Uber in the jet world, the company is focusing on a specific market, which includes passengers who want four seats or fewer for short flights of two to three hours. This includes 70% of private domestic flights and enables the company to streamline operations.

Want to Find the Best De-SPACs? Try Benzinga

(Offer Expires 11-10-2023)

I use tons of trading software to help me better understand the market and make smarter trading decisions. One thing I love about Benzinga Pro is its versatility. It wasn’t built for just one type of trader but for a wide range of experienced investors like myself. I can create custom watchlists, and then quickly monitor the performance of my investments.

Some great news – Benzinga is giving all subspac readers a free two week trial!

Fractional Freedom

Volato’s primary strategy is to target flyers of the Phenom 300. The proposition is straightforward enough for flyers who have experienced Private flying costs escalate by over 30% since 2020. The HondaJet offers superior legroom, and better cabin ambiance and is more pocket-friendly, especially for flights under two hours.

The company is optimistic about sidestepping the pitfalls currently faced by its competitors. Both its fractional and jet card programs cater to travelers within and between select base regions. Customers who venture outside these zones incur repositioning fees. Notably, the company’s jet card programs operate on an as-available basis.

This implies that while clients are locked into fixed or capped rates, Volato only pledges an aircraft when one is at hand. Many competitors, in contrast, guarantee availability, forcing them to source jets externally when their fleet falls short. Additionally, Volato refrains from assuring recovery flights at initial prices in case of mechanical glitches, which can lead to substantial costs. Volato claims to have reimagined fractional ownership in an industry first. While the purchase model remains traditional, beginning with a 1/16th aircraft share, owners enjoy unlimited freedom in their flight frequency.

This contrasts with the standard fractional contracts where a share directly correlates with a capped annual flight duration, making Volato’s model far more flexible. Volato also offers owners a slice of the revenue from their aircraft, mitigating some ownership costs. plus, the program’s design ensures tax perks on aircraft ownership, irrespective of the flight’s nature, be it leisure or business.

Financials and Valuation

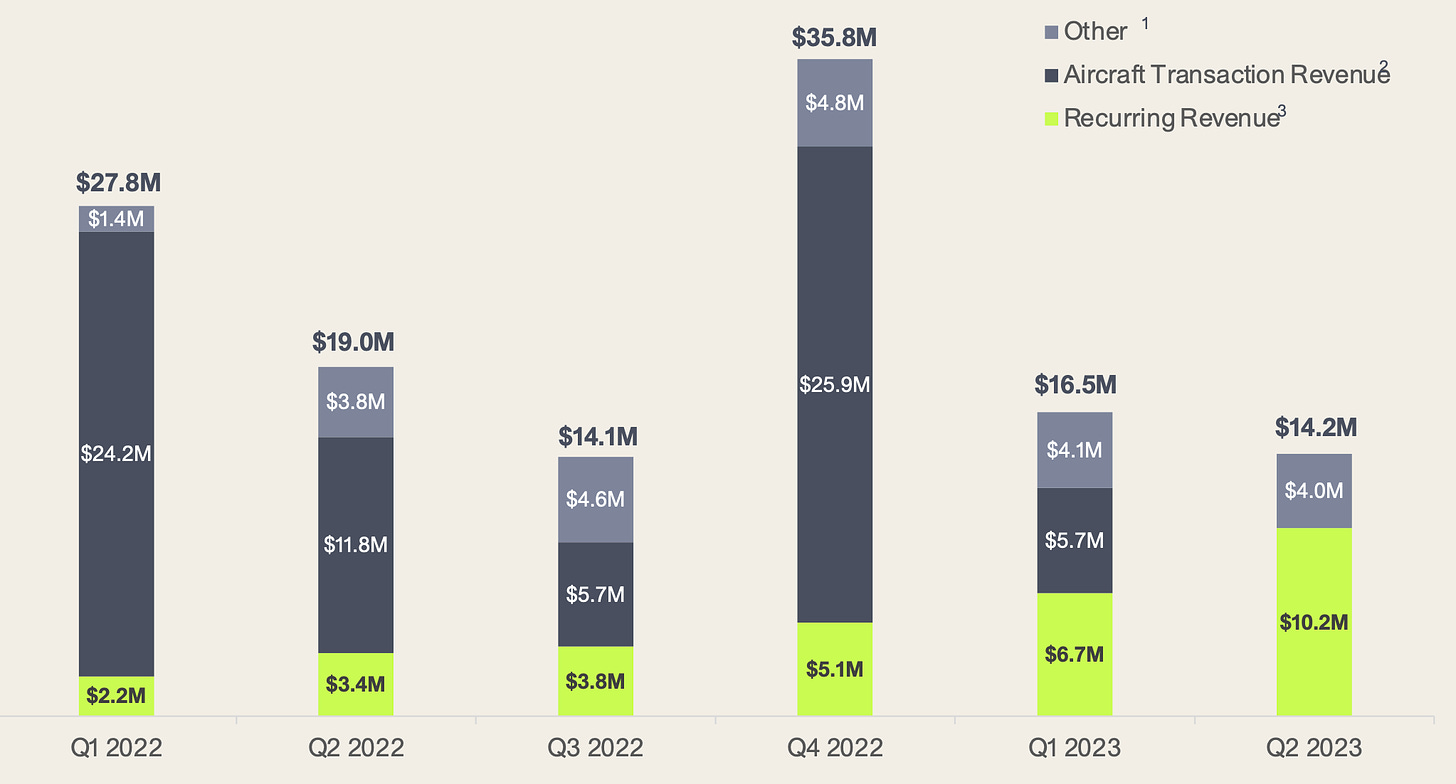

In 2022, Volato boasted revenues amounting to $96 million. However, this growth has decelerated in 2023, with the company registering just $30.7 million in revenues in the first half of the year. Most of this revenue is attributed to entire aircraft and fractional sales. Over the long term, Volato expects a spike in growth as its fleet approaches optimal scalability.

To further bolster its growth trajectory, the company has expressed intentions to augment its fleet with more HondaJets, which should help grow revenues over the long term. In the lead-up to the SPAC deal, the company secured $10 million via financing, with previous convertible notes, valued at $38 million, being converted into Series A preferred equity. The impending SPAC transaction is projected to yield $70 million in gross proceeds.

Post-merger, existing Volato stakeholders will own 63.5% ownership of the company. While the path to profitability remains ambiguous in terms of timeframe, Volato’s business model, which is centered around its fractional and jet card programs, is more cost-efficient, potentially positioning it ahead in the profitability race compared to its peers. Despite this, the short-term future is muddled with challenges. The company is currently grappling with declining revenues.

Projections indicate a potential drop of 30%-40% in revenues, resulting in the 2023 revenue being between $60 million to $70 million. As a result, the anticipated Price/Sales ratio hovers between 2.9x to 3.1x, which is a premium valuation, especially considering present market challenges, supply chain hitches, and workforce deficits. Only time will tell if the company can outpace its competitors and deliver on its promise.

Bottom Line

Volato, like its peers in the private aviation sector, is looking to capitalize on the pandemic-driven surge in customers. Yet, it hasn’t been immune to industry-wide challenges such as supply and labor shortages, inflation, and a slowing macroeconomic landscape. Volato is striving for bolstered margins, and reach profitability ahead of its competitors, by innovating in its fractional ownership and jet card programs. However, with an overarching slowdown in demand, the company might face significant hurdles in the short term, particularly concerning its revenue growth. Time will tell if the company can take advantage of the current struggles of its competitors, capture market share, and justify its lofty valuation.

Source: Runway to Payday

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://spacfeed.com/runway-to-payday

- :has

- :is

- :where

- $10 million

- $UP

- 000

- 1100

- 2020

- 2021

- 2022

- 2023

- 220

- 300

- 7

- a

- About

- above

- Additionally

- address

- ADvantage

- After

- ahead

- AIR

- Airbnb

- aircraft

- All

- also

- ambiance

- amidst

- an

- and

- annual

- Anticipated

- approaches

- ARE

- around

- AS

- At

- augment

- availability

- aviation

- backdrop

- backed

- base

- basis

- BE

- Bear

- been

- Beginning

- being

- Benzinga

- BEST

- Better

- between

- Big

- bigger

- Billion

- BLADE

- bolster

- both

- Break

- broader

- built

- business

- business model

- but

- button

- by

- CAN

- capitalize

- capture

- Capturing

- card

- case

- cater

- Cautionary

- centered

- chain

- challenges

- challenging

- change

- Cities

- claims

- clients

- Companies

- company

- compared

- competitors

- concerning

- considering

- contracts

- contrast

- contrasts

- converted

- Costs

- create

- Current

- Currently

- custom

- Customers

- deal

- decisions

- Declining

- delays

- deliver

- Demand

- Design

- Despite

- different

- diminishing

- Dip

- directly

- disruptions

- Domestic

- down

- Drop

- duration

- each

- Earlier

- enables

- enjoy

- enough

- ensures

- Entire

- Environment

- equity

- escalate

- especially

- Ether (ETH)

- existing

- expects

- experienced

- expressed

- externally

- Face

- faced

- Falls

- false

- far

- Fees

- fewer

- financing

- Find

- First

- fixed

- FLEET

- flexible

- flight

- Flights

- flying

- Focus

- focusing

- For

- forcing

- four

- fractional

- Free

- Freedom

- Frequency

- from

- further

- future

- gif

- Giving

- Global

- global business

- Go

- going

- good

- grappling

- great

- gross

- Group’s

- Grow

- Growth

- guarantee

- Half

- hand

- Have

- Health

- help

- higher

- HOURS

- However

- HTTPS

- huge

- Hurdles

- i

- identify

- if

- image

- immune

- Impact

- impending

- in

- includes

- Including

- indicate

- industry

- inflation

- initial

- innovating

- instead

- intentions

- into

- Investments

- Investors

- irrespective

- IT

- ITS

- Jets

- jpg

- just

- just one

- labor

- landscape

- larger

- lead

- leading

- Leverage

- like

- linking

- listing

- living

- ll

- locked

- lofty

- Long

- looking

- losses

- love

- Macroeconomic

- maintenance

- make

- Making

- many

- margins

- Market

- market share

- me

- mechanical

- might

- million

- mitigating

- mix

- mobility

- model

- Monitor

- more

- most

- my

- myself

- names

- Nature

- New

- New York

- news

- next

- notably

- note

- Notes

- now

- numerous

- of

- offer

- offering

- Offers

- on

- ONE

- only

- operate

- operates

- Operations

- optimal

- Optimistic

- or

- Other

- Others

- out

- outside

- over

- overarching

- own

- owners

- ownership

- particularly

- parts

- passed

- path

- peers

- performance

- perks

- Pilots

- plan

- plato

- Plato Data Intelligence

- PlatoData

- players

- plus

- Popular

- positioning

- Posts

- potential

- potentially

- preferred

- Premium

- present

- previous

- Prices

- primarily

- primary

- private

- Pro

- proceeds

- Profit

- profitability

- Program

- Programs

- projected

- promise

- proposition

- public

- public listing

- purchase

- quickly

- Race

- range

- rapid

- Rates

- ratio

- reach

- readers

- recently

- record

- recovery

- regions

- registering

- reimagined

- remains

- response

- restructure

- result

- resulting

- revenue

- revenue growth

- revenues

- rising

- rivals

- runway

- s

- sales

- saw

- Scalability

- sector

- Secured

- seen

- sees

- sends

- Series

- Series A

- serves

- Setbacks

- Share

- Shares

- shares drop

- Short

- short-term

- shortage

- shortages

- should

- significant

- significantly

- simultaneously

- since

- Slice

- Slowdown

- Slowing

- smarter

- Software

- some

- Source

- SPAC

- SPAC deal

- SPACs

- specific

- spike

- spots

- stakeholders

- standard

- Starting

- straightforward

- Strategy

- streamline

- striving

- Struggles

- substantial

- such

- sunday

- superior

- suppliers

- supply

- supply chain

- surf

- surge

- T

- TAG

- Take

- Target

- tax

- tell

- term

- terms

- that

- The

- their

- Them

- themselves

- then

- These

- they

- thing

- this

- three

- time

- timeframe

- times

- Title

- to

- tons

- track

- trader

- Trading

- traditional

- trajectory

- transaction

- travelers

- true

- try

- trying

- two

- type

- Uber

- under

- understand

- unlimited

- unprecedented

- urban

- use

- Valuation

- valued

- venture

- versatility

- via

- Waiting

- want

- wasn

- we

- webp

- week

- when

- which

- while

- WHO

- wide

- Wide range

- will

- with

- within

- without

- workers

- Workforce

- world

- worth

- year

- yet

- Yield

- york

- you

- zephyrnet

- zones