SNEAK PEEK

- Ripple’s quest for clarity on LBRY Credits’ security status faces delays.

- Judge refrains from ruling on secondary market sales of LBRY Credits.

- LBRY’s classification as a security remains uncertain after court verdict.

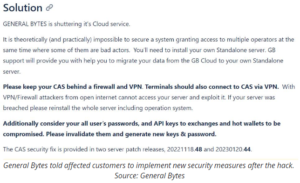

Ripple’s anticipation for clarity on the status of LBRY Credits (LBC) as a security may be prolonged, as a district court judge in the United States has refrained from making a definitive ruling.

In a lawsuit instigated by the U.S. Securities and Exchange Commission (SEC), Judge Paul Barbadoro of the District Court for the District of New Hampshire delivered his verdict on July 11 regarding LBRY, a decentralized content platform.

Judge Barbadoro declined to determine whether the registration requirement covers secondary market sales of LBC at this time. It is important to note that securities are typically traded in a secondary market, while direct transactions with the issuing corporation occur in a primary market.

Recently, American attorney John Deaton, representing numerous XRP token holders, reached out to Barbadoro to seek clarification on the classification of LBC as a security. Notably, Barbadoro’s stance has changed since a January appeal hearing, where he concurred with Deaton’s argument that the secondary sale of LBC did not constitute a securities offering.

I say it’s better than nothing because in the Coinbase case the SEC cited the LBRY Judge’s summary judgment Opinion and argued that he made no distinction between direct sales from the issuer (LBRY) and secondary sales on exchanges. This implies the Judge considered them all… pic.twitter.com/9XcGbyvNCz

— John E Deaton (@JohnEDeaton1) July 12, 2023

During the appeal hearing, the New Hampshire court explained that LBC only becomes a security when sold through an intermediary. Similarly, the SEC did not consider the sale of LBCs on the secondary market as securities.

Previously, the SEC secured a summary judgment in its favor in November 2022, but during the appeal hearing on January 30, it opted to settle for a $22 million penalty. However, in May, the SEC revised its stance, urging the court to impose a punishment of $111,000 due to LBRY’s financial constraints and near-defunct status.

The implications of the SEC v. LBRY ruling are being analyzed by pro-Ripple attorney Jeremy Hogan. Notably, Judge Barbadoro did not address secondary sales or the Major Questions Doctrine, which he observed. Instead, the court issued an injunction against further violations and imposed a fine. Hogan openly ponders whether a similar outcome is even conceivable in the Ripple case.

The final ruling is out in the SEC v. LBRY case.

The Judge did not rule on secondary sales (or, not surprisingly, the Major Questions Doctrine). He enjoined further violations and issued a penalty.

Is a similar result possible in the Ripple case? https://t.co/6bOl34UKpo

— Jeremy Hogan (@attorneyjeremy1) July 11, 2023

In the coming months, another district court judge, Analisa Torres, will rule on the SEC’s complaint against Ripple. This verdict could potentially serve as a useful precedent for her. Consequently, the Ripple community eagerly awaits the outcome, hoping for further clarity regarding the regulatory status of cryptocurrencies.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://investorbites.com/ripples-awaited-clarity-on-lbry-credits-as-security-hits-a-snag-in-court/

- :has

- :is

- :not

- :where

- 000

- 11

- 12

- 13

- 2022

- 22

- 30

- 9

- a

- address

- After

- against

- American

- an

- Analisa Torres

- analyzed

- and

- Another

- anticipation

- appeal

- ARE

- argued

- argument

- AS

- At

- attorney

- BE

- because

- becomes

- being

- Better

- between

- but

- by

- case

- Center

- changed

- cited

- clarity

- classification

- coinbase

- coming

- commission

- community

- complaint

- Consequently

- Consider

- considered

- constitute

- constraints

- content

- content platform

- CORPORATION

- could

- Court

- covers

- Credits

- crypto

- crypto exchange

- cryptocurrencies

- decentralized

- definitive

- delays

- delivered

- detailed

- Determine

- DID

- direct

- distinction

- district

- district court

- due

- during

- e

- eagerly

- Even

- exchange

- Exchanges

- explained

- external

- faces

- favor

- final

- financial

- fine

- For

- from

- further

- Hampshire

- he

- hearing

- her

- his

- Hits

- holders

- hoping

- However

- HTTPS

- implications

- important

- impose

- imposed

- in

- instead

- intermediary

- internal

- investigation

- investor

- Issued

- Issuer

- issuing

- IT

- ITS

- January

- Jeremy Hogan

- John

- John Deaton

- judge

- July

- lawsuit

- LBC

- Lbry

- made

- major

- Making

- Market

- Market News

- May..

- million

- months

- New

- news

- no

- notably

- nothing

- November

- numerous

- observed

- occur

- of

- offering

- on

- only

- openly

- Opinion

- or

- out

- Outcome

- Paul

- Paul Barbadoro

- platform

- plato

- Plato Data Intelligence

- PlatoData

- possible

- potentially

- Precedent

- primary

- quest

- Questions

- reached

- regarding

- Registration

- regulatory

- remains

- representing

- requirement

- result

- Ripple

- Ripple News

- Rule

- ruling

- s

- sale

- sales

- say

- SEC

- secondary

- Secondary Market

- Secured

- Securities

- security

- Seek

- serve

- settle

- similar

- Similarly

- since

- sold

- States

- Status

- SUMMARY

- than

- that

- The

- The Coinbase

- Them

- this

- Through

- time

- to

- traded

- Transactions

- typically

- u.s.

- U.S. Securities

- Uncertain

- United

- United States

- urging

- Verdict

- Violations

- What

- What is

- when

- whether

- which

- while

- will

- with

- xrp

- zephyrnet