Ethereum’s EIP-1559 improve is quick approaching, however derivatives information exhibits merchants are lower than optimistic about ETH’s short-term prospects.

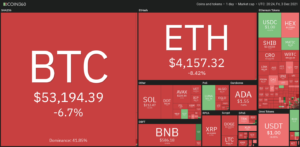

Derivatives information exhibits that Ether (ETH) merchants are feeling much less bullish when in comparison with Bitcoin (BTC). Even although the altcoin captured an almost 200% acquire within the first half of 2021 versus Bitcoin’s modest 22% worth enhance, merchants appear to be extra affected by Ether’s current underperformance.Institutional movement additionally backs the decreased optimism seen in Ether derivatives, as ETH funding autos suffered file outflows this previous week whereas Bitcoin flows started to stabilize. According to information from CoinShares, Ether funds skilled a file outflow of $50 million this previous week.Ether (orange) versus Bitcoin (blue) costs. Source: TradingViewTake discover of how Ether is underperforming Bitcoin by 16% in June. The London onerous fork is scheduled for July, and its core proposal — dubbed as EIP-1559 — will cap Ethereum’s gasoline charges. Therefore, the value motion could possibly be associated to unhappy miners because the community migrates out of Proof-of-Work (PoW).For this cause, Ether traders have cause to concern as a result of uncertainties abound. Perhaps miners supporting a competing smart-contract chain or another surprising flip of occasions may additional negatively impression Ether worth.Whatever the rationale for the present worth motion, derivatives indicators are actually signaling much less confidence when in comparison with Bitcoin.Ether’s December futures premium exhibits weak spotIn wholesome markets, the quarterly futures ought to commerce at a premium to common spot exchanges. In addition to the alternate danger, the vendor is ‘locking up’ funds by deferring settlement. A 4% to eight% premium within the December contracts must be sufficient to compensate for these results.The same impact happens in virtually each derivatives market, though cryptocurrencies are likely to current greater dangers and have greater premiums. However, when futures are trading beneath this vary, it alerts that there’s short-term bearish sentiment.OKEx BTC (blue) vs. ETH (orange) December futures premium. Source: TradingViewThe above chart exhibits the Bitcoin December futures premium recovering to three.5% whereas Ethereum contracts did not comply with. While each belongings displayed a neutral-to-bearish indicator, there’s proof that the altcoin traders are much less optimistic a few short-term restoration.Related: Key Bitcoin worth indicator flashes its ‘fifth purchase sign in BTC historical past.’Another leg down will do much more hurt to altcoinsAnother thesis that would negatively impression Ether’s premium is the impression of a possible adverse 30% efficiency from Bitcoin. Filbfilb, an impartial market analyst and the co-founder of the Decentrader trading suite, stated {that a} 30% crash within the Bitcoin may immediate altcoins to drop twice as onerous.Clem Chambers, the chief govt of the monetary analytics web site ADVFN, additionally predicted one other potential leg down, which might repeat the late-2018 crypto winter interval. Chambers claims Bitcoin may capitulate and fall again in direction of $20,000.While the general market sentiment is neutral-to-bearish, it appears smart to foretell a extra daunting state of affairs for Ether, together with uncertainties from the transition to Proof-of-Stake (POS).The views and opinions expressed listed here are solely these of the creator and don’t essentially replicate the views of Cointelegraph. Every funding and trading transfer includes danger. You ought to conduct your individual analysis when making a call.

Source: CoinTelegraph.com

- 000

- Additional

- Altcoin

- Altcoins

- analysis

- analyst

- analytics

- bearish

- Bitcoin

- BTC

- Bullish

- call

- Cause

- charges

- chief

- claims

- Co-founder

- CoinShares

- Cointelegraph

- Commerce

- Common

- community

- confidence

- contracts

- Costs

- Crash

- creator

- crypto

- cryptocurrencies

- Current

- Derivatives

- DID

- Drop

- efficiency

- ETH

- Ether

- Ether (ETH)

- ethereum

- Exchanges

- First

- fork

- funding

- funds

- Futures

- General

- Govt

- here

- How

- HTTPS

- Impact

- information

- Institutional

- IT

- July

- Key

- London

- Making

- Market

- Markets

- Merchants

- Meta

- million

- Miners

- OKEx

- Opinions

- Other

- PoS

- PoW

- Premium

- present

- proof

- Proof-of-Stake

- proof-of-stake (PoS)

- Proof-of-Work

- proposal

- purchase

- Results

- sentiment

- settlement

- smart

- Spot

- started

- State

- Traders

- Trading

- value

- Versus

- web

- week

- within

- worth