By Mark Delaney, FourKites Vice President, Industry Strategy, Retail & CPG.

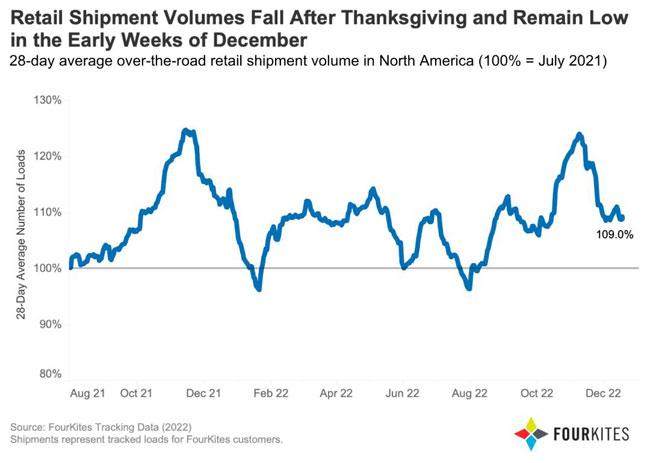

The slowdown in retail shipments is a sign of cautious consumer spending and retailers’ wish to salvage as much margin as they can by keeping inventories as low as possible. They’re walking a tight rope as they try to balance shopper demand with the hope to not have to slash prices after the holidays, kicking off what will likely be a tough year.

Retail imports from China will continue to be under pressure, as Covid, Lunar New Year and economic headwinds collide. I expect imports of durable goods to remain slow in the months ahead, while luxury and a select few categories could remain insulated from meaningful declines a bit longer.

North America trends

In comparison to last year, retail shipment volumes remained strong leading up to Thanksgiving for Big Box & Apparel and Grocery sub-industries for FourKites customers. Big Box & Apparel shipments in North America were up 2.9% in September and up 4.5% in October year-over-year, while Grocery shipments were up 8.3% in September and up 2.3% in October. Home & Electronics has seen decreased shipment volumes since last year, down by 4.0% and 2.6% year-over-year in September and October respectively.

During November and December month-to-date (through December 17th), FourKites has started to see a slowdown in retail shipments compared to last year across all retail sub-industries. For Big Box & Apparel, shipment volume in North America is down by 3.5% and 2.8% year-over-year in November and December respectively, while Grocery shipments are down by 0.6% and 3.8% year-over-year over the same months. Home & Electronics has seen the biggest decrease in December so far, with month-to-date shipment volume down by 6.5% year-over-year in December so far.

Asia Pacific trends

From late September through November, FourKites saw a consistent decline in the retail shipments from the Asia-Pacific (APAC) region to North America, where the 28-day average shipment volume for FourKites customers decreased by 28.1% month-over-month in November. While the decline has slowed since the start of December, APAC retail shipment volumes remain low.

Given China’s large presence in APAC retail imports, the sharp 28.1% decline in the APAC retail imports in the month of November from the previous month coupled with the high rates of delayed shipments from APAC reflect the potentially far-reaching impacts of China’s COVID policies on the global supply chain. Indeed, as of late, the 28-day average retail shipment volume from APAC to North America in December is down by 50% since the beginning of October.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.logisticsit.com/articles/2023/01/02/retail-shipment-volumes-in-north-america-and-asia-pacific

- 28

- a

- across

- After

- ahead

- All

- america

- and

- APAC

- apparel

- asia

- asia pacific

- average

- Balance

- Beginning

- Big

- big box

- Biggest

- Bit

- Box

- categories

- cautious

- chain

- China

- Chinas

- Collide

- compared

- comparison

- consistent

- consumer

- continue

- could

- coupled

- Covid

- cpg

- Customers

- December

- Decline

- Declines

- decrease

- Delayed

- Demand

- down

- Economic

- Electronics

- Ether (ETH)

- expect

- far-reaching

- few

- from

- Global

- goods

- grocery

- headwinds

- High

- holidays

- Home

- hope

- HTTPS

- Impacts

- imports

- in

- industry

- keeping

- large

- Last

- Last Year

- Late

- leading

- likely

- longer

- Low

- Lunar

- Luxury

- Margin

- mark

- meaningful

- Month

- months

- New

- new year

- North

- north america

- November

- october

- Pacific

- plato

- Plato Data Intelligence

- PlatoData

- policies

- possible

- potentially

- presence

- president

- pressure

- previous

- Prices

- Rates

- reflect

- region

- remain

- remained

- retail

- same

- September

- sign

- since

- slow

- Slowdown

- So

- so Far

- Spending

- start

- started

- Strategy

- strong

- supply

- supply chain

- Thanksgiving

- The

- Through

- to

- under

- Vice President

- volume

- volumes

- walking

- What

- while

- will

- year

- zephyrnet