Federal regulations provide “zero tolerance” for miscalculating real estate transaction taxes when providing TILA-RESPA integrated disclosure to borrowers, Black Knight warns.

New markets require new approaches and tactics. Experts and industry leaders take the stage at Inman Connect New York in January to help navigate the market shift — and prepare for the next one. Meet the moment and join us. Register here.

A wave of voter-approved real estate transfer tax increases like the “mansion tax,” approved by Los Angeles voters in November to address homelessness, can be a potential liability for mortgage lenders who can be penalized if they fail to incorporate the higher fees when providing quotes to borrowers.

That’s according to mortgage tech provider Black Knight, which says it has updated software lenders rely on to calculate estimated fees when providing loan estimates to borrowers as required by the federal Truth in Lending Act (TILA) and Real Estate Settlement Procedures Act (RESPA).

Black Knight’s Ernst Fee Service solution “has been enhanced to help clients address the challenges that are resulting from a growing number of municipalities requiring additional and more complex real estate transaction taxes,” the company announced Monday.

Getting real estate transaction taxes right when providing loan estimates as mandated by the federal TILA-RESPA integrated disclosure (TRID) rule is a big deal because TRID classifies them as “zero tolerance fees.”

“Except under specific circumstances, fees that fall into the zero-tolerance category should not increase after the delivery of the loan estimate,” Black Knight warns. “If they do, lenders may have to pay borrowers a fee cure covering the difference between the amount they were quoted and the amount they were charged.”

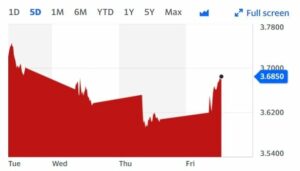

Los Angeles voters on Nov. 8 approved a ballot measure increasing the transfer tax on properties that sell for more than $10 million to 5.5 percent. After April 1, the transfer taxes on a $10 million property will increase from $45,000 to $595,000.

According to the National Association of Realtors, which opposes real estate transfer taxes, California voters approved 13 out of 20 transfer tax initiatives that were placed on the ballot between 2010 and 2020. A number of cities in Pennsylvania have also raised local transfer taxes, along with states like New York, Delaware and Washington.

Black Knight says data it collects for its Ernst Fee Service solution has illuminated “a fast-rising trend … with municipalities implementing real estate transaction fee changes to support local policy issues. These changes are frequently marked by complex, variable schedules, short implementation timelines and substantial fee increases, making them difficult for lenders to track and adhere to.”

Richard Gagliano

According to Rich Gagliano, president of Black Knight Origination Technologies, it used to be that such fees were implemented “with great uniformity,” and at the state level.

“But the paradigm has shifted, and there is a growing disconnect between the localities that are rapidly implementing variable tax tiers for specific neighborhoods and the resources it takes for lenders to compliantly implement these changes at scale and on time,” Gagliano said in a statement. “By doing the heavy lifting and the legwork for our clients, the Ernst Fee Service helps lenders roll new requirements into production workflows on time and meet increasingly short deadlines.”

Get Inman’s Extra Credit Newsletter delivered right to your inbox. A weekly roundup of all the biggest news in the world of mortgages and closings delivered every Wednesday. Click here to subscribe.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.inman.com/2022/12/19/real-estate-transfer-tax-hikes-create-headaches-for-mortgage-lenders/

- $10 million

- 000

- 1

- 2020

- 9

- 98

- a

- According

- Act

- Additional

- address

- adhere

- After

- All

- amount

- and

- Angeles

- approaches

- approved

- April

- Association

- because

- between

- Big

- Biggest

- Black

- borrowers

- california

- Category

- challenges

- Changes

- charged

- circumstances

- Cities

- clients

- COM

- company

- complex

- Connect

- covering

- create

- credit

- cure

- data

- deal

- Delaware

- delivered

- delivery

- difference

- difficult

- disclosure

- doing

- enhanced

- estate

- estimate

- estimated

- estimates

- experts

- FAIL

- Fall

- Federal

- fee

- Fees

- frequently

- from

- great

- Growing

- headaches

- help

- helps

- here

- higher

- Hikes

- homelessness

- HTML

- HTTPS

- implement

- implementation

- implemented

- implementing

- in

- incorporate

- Increase

- Increases

- increasing

- increasingly

- industry

- integrated

- issues

- IT

- January

- join

- Join us

- Knight

- leaders

- lenders

- lending

- Level

- liability

- lifting

- loan

- local

- los

- Los Angeles

- Making

- Market

- Markets

- Meet

- million

- moment

- Monday

- more

- Mortgage

- Mortgages

- Municipalities

- National

- Navigate

- New

- New York

- news

- next

- November

- number

- ONE

- paradigm

- Pay

- penalized

- Pennsylvania

- percent

- plato

- Plato Data Intelligence

- PlatoData

- policy

- potential

- Prepare

- president

- procedures

- Production

- properties

- property

- provide

- provider

- providing

- raised

- rapidly

- real

- real estate

- regulations

- require

- required

- Requirements

- Resources

- resulting

- Rich

- Roll

- roundup

- Rule

- Said

- Scale

- sell

- service

- settlement

- shift

- Short

- should

- Software

- solution

- specific

- Stage

- State

- Statement

- States

- subscribe

- substantial

- such

- support

- tactics

- Take

- takes

- tax

- Taxes

- tech

- Technologies

- The

- The State

- the world

- time

- to

- tolerance

- track

- transaction

- transfer

- Trend

- under

- updated

- us

- voters

- Warns

- washington

- Wave

- Wednesday

- weekly

- which

- WHO

- will

- workflows

- world

- Your

- zephyrnet