What are REITs?

A Real Estate Investment Trust (REIT) is a company that owns, operates or finances income-generating real estate. These trusts are designed to allow investors to access real estate markets without directly buying, managing, or financing properties.

The Main Types of REITs

- Equity REITs: Primarily own and manage income-producing real estate. Revenue is generated from rental properties and capital appreciation.

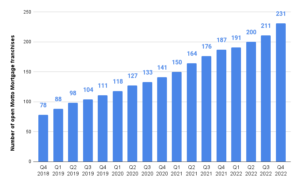

- Mortgage REITs: Also known as mREITs, these focus on financing real estate by investing in mortgages or mortgage-backed securities. Income comes from the interest on these loans.

- Hybrid REITs: Combining elements of equity and mortgage REITs, hybrid REITs invest in physical properties and mortgages.

Public vs. Private REITS

- Public and private REITs differ primarily in their accessibility and liquidity. Public REITs are listed on stock exchanges, allowing investors to buy and sell shares. They provide liquidity, as their market prices are readily available. They’re also heavily tied to the stock market and can experience immediate highs and lows as the market fluctuates.

- Private REITs are not traded on public exchanges and are typically offered through private placements. Private REITs often involve longer investment horizons and may have less liquidity due to the absence of a secondary market for shares, but are often less impacted by temporary stock market volatility. While public REITs offer the advantage of easy market entry and exit, private REITs may appeal to investors seeking potentially higher returns with a willingness to accept more extended holding periods and lower liquidity.

How is the Arrived Single Family Residential Fund Different?

With the Arrived Single Family Residential Fund, investors can diversify across several properties in multiple markets simultaneously, giving them a seamless option to add real estate to their portfolio. The Arrived Single Family Residential Fund also comes with a host of benefits:

- Closer tracking to real estate values: While public REITs often have share price fluctuations caused by non-real estate events — like different economic indicators, interest rates and market sentiment — private REITs like the Arrived Single Family Residential Fund more closely follow the underlying real estate asset values.

- High asset transparency: The Fund is designed to offer more transparency in a consumer-friendly way. Each single-family residential home in the Fund is showcased along with its address, photographs and other key features.

- Market coverage and expansion strategy: The Arrived Single Family Residential Fund leverages Arrived’s proprietary operating model, which benefits from established relationships with third-party property managers in dozens of markets. This means the Fund can quickly diversify into the more than 55 markets Arrived currently operates in. Arrived’s operating model is also nimble, allowing Arrived to quickly move into emerging markets as well as purchase single-family residential homes in secondary and tertiary markets that may not fit a larger public REIT portfolio, diversifying the Fund even further.

- Modern purchase experience: The Arrived Single Family Residential Fund leverages Arrived’s modern investing platform to provide investors with real estate investing education, radical transparency of investment assets, post-purchase performance reporting and consistent quarterly dividend payments. Additionally, by combining the Arrived Single Family Residential Fund with Arrived’s individual property offerings, investors can build a highly tailored portfolio to match their investment goals.

Arrived, the real estate investment platform backed by world-class investors, helps you unlock the benefits of real estate investing with rental income and appreciation. Browse expert-curated properties or transparent, diversified funds, invest in a few clicks with as little as $100, and then sit back as Arrived takes care of the management and operations.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.inman.com/2024/01/15/public-reits-vs-private-reits/

- :is

- :not

- a

- Accept

- access

- accessibility

- across

- add

- Additionally

- address

- ADvantage

- allow

- Allowing

- along

- also

- and

- appeal

- appreciation

- ARE

- arrived

- AS

- asset

- Assets

- available

- back

- backed

- benefits

- build

- but

- buy

- Buying

- by

- CAN

- capital

- care

- caused

- closely

- combining

- comes

- company

- consistent

- coverage

- Currently

- designed

- differ

- different

- directly

- diversified

- diversify

- dividend

- dozens

- due

- each

- easy

- Economic

- economic indicators

- Education

- elements

- emerging

- emerging markets

- entry

- equity

- established

- estate

- Even

- events

- Exchanges

- Exit

- expansion

- experience

- extended

- family

- Features

- few

- Finances

- financing

- fit

- fluctuates

- fluctuations

- Focus

- follow

- For

- from

- fund

- funds

- further

- generated

- Giving

- Goals

- Have

- heavily

- helps

- higher

- highly

- Highs

- holding

- Home

- Homes

- Horizons

- host

- HTTPS

- Hybrid

- immediate

- impacted

- in

- Income

- Income-generating

- Indicators

- individual

- interest

- Interest Rates

- into

- Invest

- investing

- investment

- investment goals

- Investors

- involve

- ITS

- Key

- known

- larger

- LEARN

- less

- leverages

- like

- Liquidity

- Listed

- little

- Loans

- longer

- lower

- Lows

- Main

- manage

- management

- Managers

- managing

- Market

- Market Prices

- market sentiment

- market volatility

- Markets

- Match

- May..

- means

- model

- Modern

- more

- Mortgage

- Mortgages

- move

- multiple

- nimble

- of

- offer

- offered

- Offerings

- often

- on

- operates

- operating

- Operations

- Option

- or

- Other

- own

- owns

- payments

- performance

- periods

- photographs

- physical

- placements

- platform

- plato

- Plato Data Intelligence

- PlatoData

- portfolio

- potentially

- price

- Price Fluctuations

- Prices

- primarily

- private

- properties

- property

- proprietary

- provide

- public

- purchase

- quarterly

- quickly

- radical

- Rates

- readily

- real

- real estate

- real estate markets

- Relationships

- Reporting

- residential

- returns

- revenue

- seamless

- secondary

- Secondary Market

- Securities

- seeking

- sell

- Sell Shares

- sentiment

- several

- Share

- Shares

- showcased

- simultaneously

- single

- sit

- stock

- stock exchanges

- stock market

- Strategy

- tailored

- takes

- temporary

- tertiary

- than

- that

- The

- their

- Them

- then

- These

- they

- third-party

- this

- Through

- Tied

- to

- Tracking

- traded

- Transparency

- transparent

- Trust

- Trusts

- types

- typically

- underlying

- unlock

- Values

- Volatility

- vs

- Way..

- WELL

- which

- while

- Willingness

- with

- without

- world-class

- you

- zephyrnet