Nearly 80 countries around the world now have real-time payment systems, with dozens of other markets in the process of developing their own platforms. Representatives from Brazil and Australia joined the Payments Canada Summit on Thursday to share their experiences.

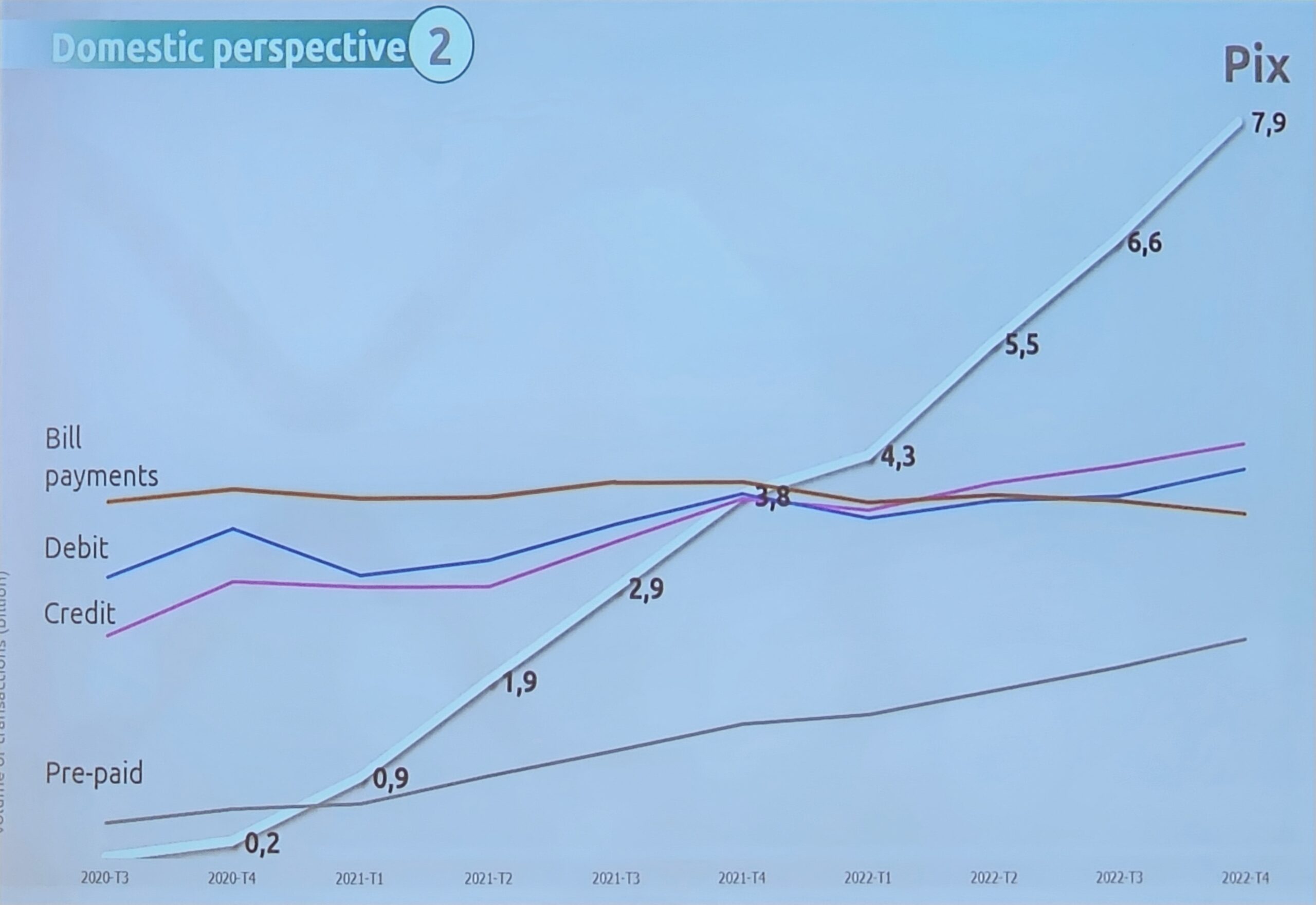

Brazil’s PIX is arguably the most successful real-time payments system yet. Launched in late 2020, in March it hit the milestone of three billion transactions a month.

Carlos Eduardo Brandt from the Central Bank of Brazil explained that by building and running the system itself, the bank can be a neutral agent, providing a level playing field for the PSPs that can then compete on service.

Australia launched its New Payments Platform in 2018 and is now seeing five million transactions a day. May Lam from Australian Payments Plus stressed the importance of continuing to build on the platform and add functionality. She told the audience that NPP is now moving to the next stage through the introduction of PayTo, which enables businesses to initiate payments from their customers’ bank accounts.

Brandt and Lam were joined by Steve Haley from the Mojaloop Foundation, which builds open-source software to help with digital payment system interoperability. Haley stressed that while places like Brazil and Australia offer lessons for other countries, there are still significant differences. In much of Africa and Southeast Asia, smartphone, QR code-based services will not work because of the reliance on USSD.

The participants all agreed that building a real-time payments system is a long, complicated process that requires adjustments along the way.

May said that it has taken seven years to get PayTo to market, with delays and hiccups. She stressed the importance of securing majority agreement from industry participants with very different goals and where complete consensus is unrealistic.

Brandt offered a concrete example of a challenge faced in Brazil – the bank noticed that it was getting more rejected QR code payments than expected. It emerged that some PSPs were implementing the system incorrectly and so the bank moved to help and to develop a QR code tester.

The lesson, he said, is to react quickly.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Buy and Sell Shares in PRE-IPO Companies with PREIPO®. Access Here.

- Source: https://www.finextra.com/newsarticle/42265/payments-canada-summit-real-time-payment-success-stories?utm_medium=rssfinextra&utm_source=finextrafeed

- :has

- :is

- :not

- :where

- 2018

- 2020

- a

- Accounts

- add

- adjustments

- africa

- Agent

- Agreement

- All

- along

- and

- ARE

- around

- asia

- audience

- Australia

- Australian

- Bank

- bank accounts

- BE

- because

- Billion

- Brazil

- build

- Building

- builds

- businesses

- by

- CAN

- Canada

- central

- Central Bank

- Central Bank of Brazil

- challenge

- code

- compete

- complete

- complicated

- Consensus

- continuing

- countries

- CSS

- day

- delays

- develop

- developing

- differences

- different

- digital

- Digital Payment

- dozens

- emerged

- enables

- example

- expected

- Experiences

- explained

- faced

- field

- Finextra

- For

- Foundation

- from

- functionality

- Gallery

- get

- getting

- Goals

- Have

- he

- help

- Hit

- HTTPS

- implementing

- importance

- in

- incorrectly

- industry

- initiate

- Interoperability

- Introduction

- IT

- ITS

- itself

- joined

- jpg

- Lam

- Late

- launched

- lesson

- Lessons

- Level

- like

- Long

- Majority

- March

- Market

- Markets

- May..

- milestone

- million

- Month

- more

- most

- moving

- much

- nearly

- Neutral

- New

- next

- now

- of

- offer

- offered

- on

- open source

- Open-source Software

- Other

- own

- participants

- payment

- payment system

- Payment Systems

- payments

- payments system

- Places

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- playing

- plus

- process

- providing

- QR code

- QR code payments

- quickly

- React

- real-time

- real-time payments

- reliance

- Representatives

- requires

- running

- Said

- securing

- seeing

- service

- Services

- seven

- Share

- she

- significant

- smartphone

- So

- Software

- some

- Southeast Asia

- Stage

- Steve

- Still

- Stories

- success

- Success Stories

- successful

- Summit

- system

- Systems

- than

- that

- The

- the world

- their

- then

- There.

- three

- Through

- thursday

- to

- Transactions

- very

- was

- Way..

- were

- which

- while

- will

- with

- Work

- world

- years

- yet

- zephyrnet