Seychelles-based cryptocurrency exchange OKX has implemented the 20th round of its Buy-Back and Burn program, burning nearly 5.5 million OKB tokens this time.

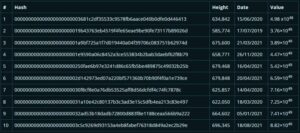

According to a blog post, the total number of OKB tokens bought back from the secondary market and burned was 5,497,312.77, worth $258 million at a 90-day average.

OKX Burns 5.5M OKB Tokens

The crypto exchange launched the Buy-Back and Burn program in May 2019. It started repurchasing OKB from the original supply of 300 million tokens every three months. While the buyback has no specific rules, the repurchase amount depends on the seasonal market and operating performance.

The 20th round of the program was between March 1 and May 31, 2023. As of today, OKX has burned a total of 64,042,314.70 OKB by sending them to an address that nobody can access, leaving roughly 35,957,685 OKB currently in circulation.

“The OKB team will continue to cultivate a strong connection with its global supporters while listening to their feedback for future improvements. It is committed to offering better services to users,” the crypto exchange said.

Notably, the number of tokens burned recently is the third-largest in OKX’s burn history. The largest value was 6.1 million OKB burned in the 5th round between June and August 2019. The second-largest value was over 5.9 million in the 6th round between September and November 2019.

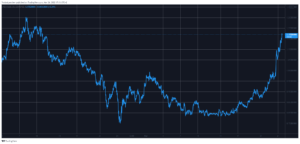

OKB was trading at $44.94 at writing time, signaling a minor increase in the past 24 hours, according to data from CoinMarketCap.

OKX Pushes for Transparency

Besides burning OKB tokens to add value to the crypto asset and make it more appealing to holders, OKX has been a significant force driving crypto adoption. The exchange has made efforts to push the new industry standard of transparency and trust within the crypto ecosystem.

Last month, OKX published its seventh proof-of-reserves (PoR) report, showing reserves of $10 billion in bitcoin (BTC), ether (ETH), and Tether (USDT). While the PoR covered other widely-used crypto assets, it showed that BTC, ETH, and USDT each had reserve ratios of 103%. The exchange also enabled users to independently verify its solvency through the zk-STARK technology.

PrimeXBT Special Offer: Use this link to register & enter CRYPTOPOTATO50 code to receive up to $7,000 on your deposits.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- EVM Finance. Unified Interface for Decentralized Finance. Access Here.

- Quantum Media Group. IR/PR Amplified. Access Here.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Source: https://cryptopotato.com/okx-completes-20th-quarterly-burn-heres-how-much-okb-was-destroyed/

- :has

- :is

- $UP

- 000

- 1

- 2019

- 2023

- 24

- 300

- 31

- 5th

- 70

- 77

- 9

- a

- access

- According

- add

- address

- Adoption

- AI

- also

- amount

- an

- and

- appealing

- AS

- asset

- Assets

- At

- AUGUST

- average

- back

- background

- banner

- been

- Better

- between

- Billion

- binance

- Binance Futures

- Bitcoin

- border

- bought

- BTC

- burn

- burned

- burning

- burns

- Buyback

- by

- CAN

- Circulation

- code

- CoinMarketCap

- color

- committed

- Completes

- connection

- content

- continue

- covered

- crypto

- Crypto adoption

- crypto asset

- Crypto ecosystem

- crypto exchange

- crypto-assets

- cryptocurrency

- Cryptocurrency Exchange

- Cultivate

- Currently

- data

- depends

- deposits

- destroyed

- driving

- each

- ecosystem

- efforts

- enabled

- end

- enjoy

- Enter

- ETH

- Ether

- Ether (ETH)

- Every

- exchange

- Exclusive

- external

- feedback

- Fees

- First

- For

- Force

- Free

- from

- future

- Futures

- Global

- had

- history

- holders

- HOURS

- How

- HTTPS

- implemented

- improvements

- in

- Increase

- independently

- industry

- internal

- IT

- ITS

- jpg

- june

- largest

- launched

- leaving

- like

- Listening

- made

- make

- March

- March 1

- Margin

- Market

- May..

- might

- million

- minor

- Month

- months

- more

- much

- nearly

- New

- no

- November

- number

- of

- off

- offer

- offering

- OKB

- OKX

- on

- operating

- original

- Other

- over

- past

- performance

- plato

- Plato Data Intelligence

- PlatoData

- POR

- Program

- proof-of-reserves

- Push

- Reading

- receive

- recently

- register

- report

- Reserve

- reserves

- roughly

- round

- rules

- Said

- seasonal

- second-largest

- secondary

- Secondary Market

- sending

- September

- Services

- Share

- showed

- showing

- significant

- solid

- Solvency

- special

- specific

- Sponsored

- standard

- started

- strong

- supply

- supporters

- team

- Technology

- Tether

- Tether (USDT)

- that

- The

- their

- Them

- this

- three

- Through

- time

- to

- today

- Tokens

- Total

- Trading

- Transparency

- Trust

- USDT

- users

- value

- verify

- was

- while

- will

- with

- within

- worth

- writing

- Your

- zephyrnet