Who is to blame for the crash in non-fungible token prices? Some NFT enthusiasts point the finger at a new trading platform. This is wishful thinking. The real culprit is a toxic combination of rising rates, falling cryptocurrency prices and complete lack of utility.

Early last year an NFT land grab was under way across Big Tech. Meta was working on ways to allow users to show off NFT ownership in their Facebook profile. Heralded as integral to the decentralised next phase of the internet, NFT transactions would be recorded on the blockchain instead of verified via banks or other third parties. NFT marketplace OpenSea hit a $13.3bn valuation.

Prices have since collapsed. Take Bored Ape Yacht Club NFTs from Yuga Labs. These easily recognisable monkey cartoons, backed by celebrities like Paris Hilton, exemplify the sector’s exuberance. Bored Ape 8817, which featured a ‘rare’ monkey with gold fur, sold on Sotheby’s metaverse marketplace for $3.4mn in late 2021. Now the floor for prices has dropped to around $50,000.

It should be lower. Claims made about the value of these digital collectibles remain hard to prove. Trading still requires connection to centralised services. Major tech companies have dropped plans to mint, trade or offer digital NFT showcases.

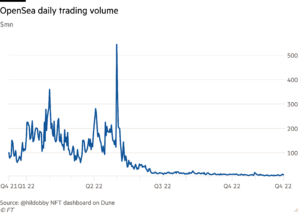

One OpenSea investor is reported to have marked down the value of its investment by three quarters. Some of the fall in OpenSea’s trading volume can be attributed to the emergence of rival Blur, with its eye-catching offer of free tokens. But declines cannot be disentangled from the broader digital asset sector collapse. The crypto market has halved in value from its peak, according to digital assets brokerage K33, which pins the total value at about $180bn. Ether prices, the tokens used for most NFT transactions, are down 60 per cent from their late 2021 peak too.

A few NFTs may continue to change hands for high prices thanks to die hard believers, but the transformation they promised has failed to materialise.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.ft.com/content/3c2f7244-fcd6-4068-a52d-b3987523b660

- :has

- :is

- $3

- 000

- 2021

- 60

- a

- About

- According

- across

- allow

- an

- and

- APE

- ARE

- around

- AS

- asset

- Assets

- At

- backed

- Banks

- BE

- believers

- Big

- big tech

- blockchain

- blur

- Bored

- BORED APE

- Bored Ape Yacht Club

- broader

- brokerage

- but

- by

- CAN

- cannot

- celebrities

- centralised

- change

- claims

- club

- collapsed

- collectibles

- combination

- Companies

- complete

- connection

- continue

- Crash

- crypto

- Crypto Market

- cryptocurrency

- decentralised

- Declines

- Die

- digital

- Digital Asset

- Digital Assets

- digital collectibles

- down

- dropped

- easily

- emergence

- enthusiasts

- Ether

- Eye-catching

- Failed

- Fall

- Falling

- featured

- few

- finger

- Floor

- For

- Free

- from

- FT

- further

- Gold

- grab

- halved

- Hands

- Hard

- Have

- High

- Hilton

- Hit

- HTTPS

- in

- instead

- integral

- Internet

- investment

- investor

- ITS

- jpg

- Labs

- Lack

- Land

- Last

- Last Year

- Late

- like

- LINK

- lower

- made

- major

- marked

- Market

- marketplace

- May..

- Meta

- Metaverse

- mint

- most

- New

- next

- NFT

- nft marketplace

- NFTs

- non-fungible

- non-fungible token

- now

- of

- off

- offer

- on

- OpenSea

- or

- Other

- paris

- parties

- Peak

- per

- phase

- pins

- plans

- platform

- plato

- Plato AiStream

- Plato Data Intelligence

- PlatoAiCast

- PlatoData

- Point

- Prices

- Profile

- promised

- Prove

- Rates

- real

- recognisable

- recorded

- remain

- Reported

- requires

- rising

- Rival

- sector

- Services

- should

- show

- since

- sold

- some

- Still

- Take

- tech

- tech companies

- thanks

- The

- their

- These

- they

- Thinking

- Third

- third parties

- this

- three

- to

- token

- Tokens

- too

- Total

- trade

- Trading

- Trading Platform

- trading volume

- Transactions

- Transformation

- under

- used

- users

- utility

- Valuation

- value

- verified

- via

- volume

- was

- Way..

- ways

- Web3

- which

- with

- working

- would

- Yacht

- Yacht Club

- year

- Yuga

- Yuga Labs