Car sales in September held steady during September and throughout the third quarter, industry analysts predicted, despite the shadows cast over the industry by the United Auto Workers strike against Detroit’s automakers.

Those shadows may get longer too as the UAW is preparing to expand the strike against General Motors, Ford and Stellantis as soon as this Friday. Union president Shawn Fain will break that new during a Facebook Live address Friday at 10 a.m.

Good third quarter numbers

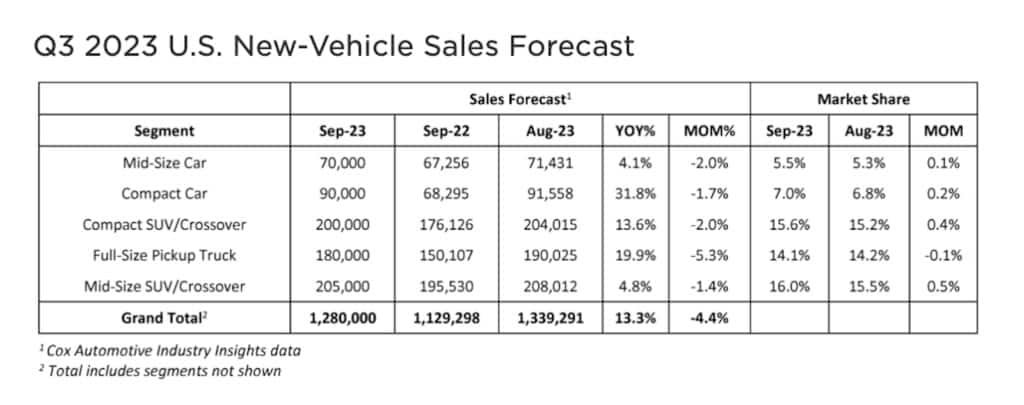

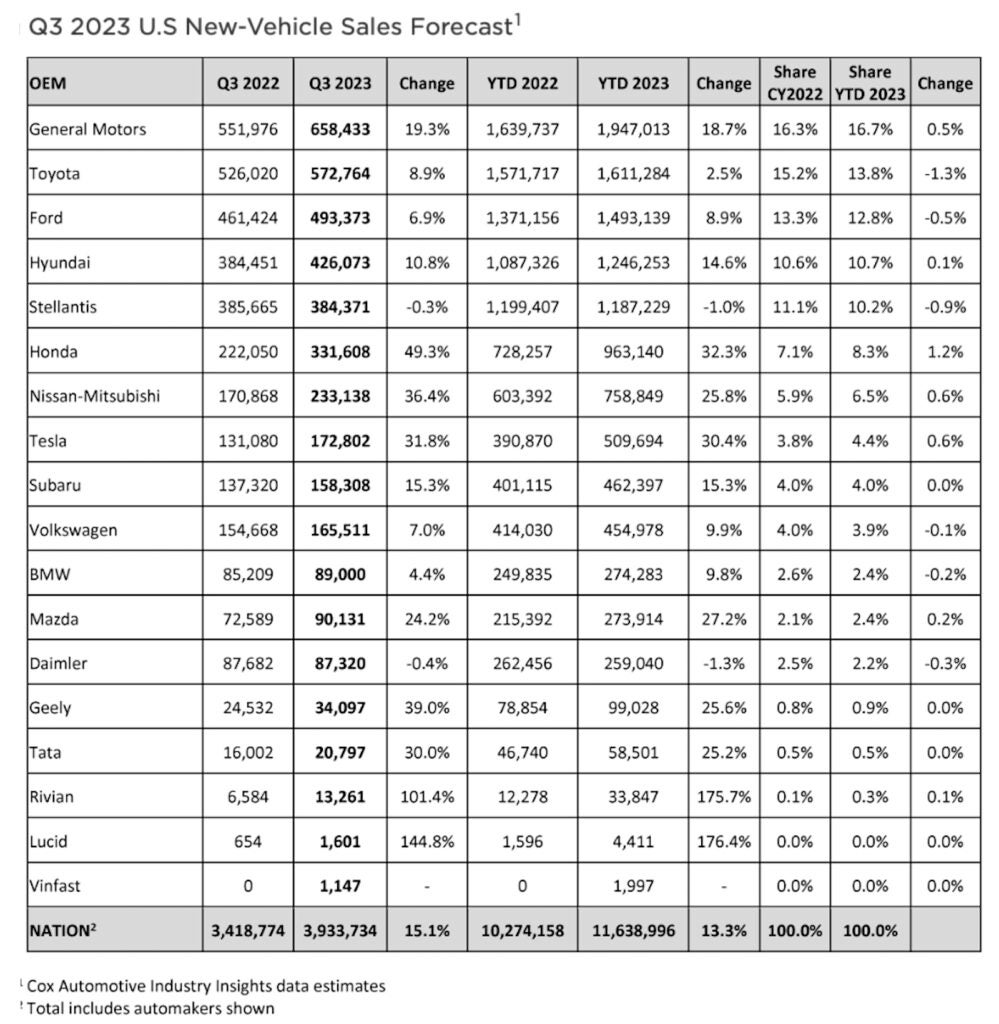

The U.S. auto industry is expected to finish the third quarter with another strong year-over-year sales gain, a new forecast from Cox Automotive predicts.

Despite challenges like rising interest rates on new-vehicle loans and a strike by the UAW against the major domestic automakers, sales volumes are expected to reach almost 1.3 million in September, an increase of more than 13% from the previous year, according to Cox Automotive Chief Economist Jonathan Smoke.

“In the auto industry right now, interest rates are public enemy No. 1 — the leading factor holding back business,” Smoke said.

Edmunds forecasts 3.94 million new cars and trucks will be sold in the U.S. in the third quarter of 2023, which will be a 16% increase from the third quarter of 2022 but a 4.1% decrease compared to the second quarter of 2023.

“Given high interest rates, conservative inventory and modest incentives, consumers weren’t exactly hit with compelling buy messages throughout the third quarter compared to the traditional summer sales deals and model-year sell-down advertising messages of the past,” said Jessica Caldwell, Edmunds’ head of insights.

“Still, new-vehicle sales have remained somewhat consistent as pent-up demand keeps sales afloat despite economic challenges,” Caldwell said.

Caldwell added the UAW strike could soon begin to throw a monkey wrench into 2023 sales — creating inventory uncertainty among the Detroit Three moving forward. “Right now, the effects are limited, and third-quarter sales were left unscathed. However, the landscape can change dramatically, and quickly, if the strike continues,” Caldwell noted.

Strike could alter sales dynamics

Heading into the UAW strike, recent days-to-turn data from Edmunds reveals that vehicles from the Detroit automakers sat on dealer lots longer than the industry average, Caldwell said.

In the first half of September, while industry-wide days to turn was at 37 days, Stellantis was at 72 days, Ford at 48 days and General Motors at 40 days, according to Edmunds estimates.

“Availability is currently strong for American-branded trucks and SUVs, but shoppers contemplating a new-vehicle purchase from any of the Detroit brands may consider expediting their search process given the strike’s unpredictable impact on supply,” said Ivan Drury, Edmunds’ director of insights.

If the strike lingers, Edmunds analysts advise consumers to keep an open mind on make and model.

“Similar to how shoppers were forced to navigate tight inventory due to chip shortages and other pandemic-related supply chain challenges the past few years, those who plan ahead and remain open to a variety of brands, colors and even vehicle types will leave with the best deals,” said Drury.

“Current Detroit Three lessees with an expiration in the next few months might consider taking action more quickly, either by extending the lease or buying it out at the end of the contract. And for shoppers looking at models with very specific configurations or custom order requirements, I’d suggest locking in the order sooner rather than later,” he added.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.thedetroitbureau.com/2023/09/new-vehicle-sales-increase-in-september/

- :is

- 1

- 1.3

- 10

- 2022

- 2023

- 40

- 72

- a

- According

- Action

- added

- address

- Advertising

- advise

- against

- ahead

- almost

- among

- an

- Analysts

- and

- Another

- any

- ARE

- AS

- At

- auto

- automakers

- automotive

- average

- back

- BE

- begin

- BEST

- brands

- Break

- Bureau

- business

- but

- buy

- Buying

- by

- caldwell

- CAN

- car

- cars

- chain

- challenges

- change

- Chart

- chief

- chip

- compared

- compelling

- conservative

- Consider

- consistent

- Consumers

- continues

- contract

- could

- Cox

- Creating

- Currently

- custom

- Days

- dealer

- Deals

- decrease

- Demand

- Despite

- Director

- Domestic

- dramatically

- due

- during

- Economic

- effects

- either

- end

- estimates

- Even

- exactly

- Expand

- expected

- expiration

- extending

- factor

- few

- finish

- First

- For

- Ford

- Forecast

- forecasts

- Forward

- Friday

- from

- Gain

- General

- General Motors

- get

- given

- graphic

- Half

- Have

- he

- head

- Held

- High

- Hit

- holding

- How

- However

- HTTPS

- if

- Impact

- in

- Incentives

- Increase

- industry

- insights

- interest

- Interest Rates

- into

- inventory

- IT

- ivan

- jonathan

- jpg

- Keep

- landscape

- later

- leading

- Leave

- left

- like

- Limited

- live

- Loans

- longer

- looking

- lots

- major

- make

- max-width

- May..

- messages

- might

- million

- mind

- model

- models

- modest

- months

- more

- Motors

- moving

- Navigate

- New

- next

- no

- noted

- now

- of

- on

- open

- or

- order

- Other

- out

- over

- past

- plan

- plato

- Plato Data Intelligence

- PlatoData

- predict

- predicted

- Predicts

- preparing

- president

- previous

- process

- public

- purchase

- Q3

- Quarter

- quickly

- Rates

- rather

- reach

- recent

- remain

- remained

- Requirements

- Reveals

- right

- Rise

- rising

- s

- Said

- sale

- sales

- Search

- Second

- second quarter

- September

- shawn

- Shoppers

- shortages

- Smoke

- sold

- somewhat

- Soon

- specific

- steady

- strike

- strong

- suggest

- summer

- supply

- supply chain

- Supply Chain Challenges

- SUVs

- taking

- than

- that

- The

- The Landscape

- their

- Third

- this

- those

- three

- throughout

- to

- too

- traditional

- Trucks

- TURN

- types

- u.s.

- Uncertainty

- union

- United

- unpredictable

- variety

- vehicle

- Vehicles

- very

- volumes

- was

- were

- which

- while

- WHO

- will

- with

- workers

- Wrench

- year

- years

- zephyrnet