For years, we’ve been hearing about how the single-family rental market is being bought up by hedge funds, iBuyers, and institutional investors. For the average investor, it seems like the corporate landlords are getting an unfair advantage—they have better data, better financing, full-time staff, and deep pockets to buy whatever and wherever they want. But a new single-family rental survey shows that the big players aren’t the ones controlling the market—it’s the little guys.

To walk us through this massive, single-family rental survey, is Rick Palacios Jr., Director of Research at John Burns Research and Consulting. Rick’s team accomplished the seemingly impossible task of measuring activity for 270,000 single-family rental homes to see how landlords are faring in 2023 and what their plans are for 2024. And while this survey focuses on REITs (real estate investment trusts), private groups, and other larger-type buyers, it provides invaluable insights for the small-time landlord.

Rick will walk us through rent growth (and decline) from the past year, where he believes rents will be in 2024, whether or not expenses could continue to rise, how high mortgage rates are affecting buyers, and why institutional investors are struggling in this market while mom-and-pops are buying!

Click here to listen on Apple Podcasts.

Listen to the Podcast Here

Read the Transcript Here

Dave:

Hey, everyone. Welcome to On the Market. I’m your host, Dave Meyer, joined today by my co-host, James Dainard. James, I think I got a little early Christmas present for you. What if I told you we could dig into the insights from 270,000 single-family rentals today?

James:

Well, that’s a lot to unpack. So as long as you do all the analytics and deliver it to me.

Dave:

You don’t have to do it. We have a guest who’s going to do it. We actually have Rick Palacios Jr. who’s the Director of Research and the Managing Principal at John Burns Research and Consulting. If you don’t know this company, they are one of the best data providers in the entire industry. We’ve had their founder, John Burns, on the show a couple of times, and Rick is joining us today because they do a survey. They’ve been doing this for years where they pull 270,000 individual single-family rentals. I’ve never heard of a survey sentiment index anything that is this big. So I think we’re going to get some really incredible insights from Rick today. Anything you’re looking forward to or anything about the single-family rental market you really want to know?

James:

I’m looking forward to just talking a little bit about what the hedge fund guys are doing, where the opportunities could go, and whether we think some more inventories come into market. Because as we know, inventory is tight, but people are thirsty for investments right now, so I’m hoping more loosen up so we can get more deals in 2024.

Dave:

I’m thirsty.

James:

2023’s been a thirsty year.

Dave:

It’s going to be a very thirsty year. We got to drink up next year.

James:

Yeah, let’s turn the faucet on please and get some deal flow going through.

Dave:

Before we get Rick in here, I just want to say Rick is really in-depth information. He’s going to talk about all sorts of topics, really easy to understand, but there’s two things he’s going to talk about. One is NOI. If you don’t know that acronym, it stands for net operating income. You can then think of it like profit, but basically it takes all of your income from a property and then you subtract your operating expenses. It does not include your financing costs or your CapEx, so that’s just what that is. If you’re not familiar, you can think of it like a measurement of profit for a property.

And then we also talk about the lock-in effect. We talk about this all the time on the show, but if you’re new to the show, what that is is basically this phenomenon over the last couple of years that rising interest rates has not only pulled demand out of the market, it’s also pulled supply out of the market because a lot of people who own homes at a really low interest rate don’t want to sell their home because they really love their low mortgage rate and they’re not getting another good one. And so that is the lock-in effect. It’ll all make sense when we talk about it with Rick.

All right, so we are going to take a quick break and then we’ll be back with Rick Palacios Jr.

Rick Palacios, welcome to On the Market. Thanks for joining us.

Rick:

Yeah. Thank you for having me, Dave.

Dave:

Well, Rick, we’ve had John Burns from John Burns Research and Consulting join us, but tell us what you do for the firm.

Rick:

I am technically our Director of Research and what that means is I have my hands in everything that we do. And I know you’ve had John on a few times, but quick background on the firm. We’ve been around for 20 years. I’ve been covering housing my whole career for about 17, 18 years or so. Most of that with John. And so we touch home builders, the rental space, which I know we’re going to get into, building products, you name it. So if it matters for housing, we generally are doing something around it for our clients.

Dave:

I can definitely attest to that. You guys produce such incredible data, and all the other analysts and people who I really respect are always citing your data as well. So we appreciate all the insights that you deliver.

Rick:

And you used data, ton of great data, but then you also use the word insights. I think that’s what we try to do. It’s blend both of those things.

Dave:

Yeah, it’s super interesting. And I think only a few of us really like looking at raw data. I think most people really just want to get to the “So what?” of it all, and you guys do a great job with that.

Rick:

Yes.

Dave:

Today, we’re going to dive into a new report that you have produced about single-family rentals. Can you just tell us a little bit about this report? What’s the scope? What’s the methodology?

Rick:

We have been doing a survey of institutional single-family rental operators all the way going back to 2019, and it’s a very good sample size. It’s in partnership with the National Rental Home Council, but the sample size is about, I believe, 270,000 properties under management, and so good sample size. And it’s a mix of public entities, the REITs that we all know, but then a lot of the private groups as well. And if you’re a data nerd, you realize that it’s the private groups that really drive this market, even though the press would like you to believe that it’s not the case.

So yeah, fantastic sample size. And we’re asking all the things, I think, that matter that we think about in the space rents occupancy forward looks six months out. And then I think what I love too is that I love when I start getting a lot of questions in my inbox from clients and then I can go and selfishly steer a unique question that we can ask either monthly or quarterly to get a read on things. And so that’s what I love doing. And so when it’s thematic and timely, we’ll try to drop in a question. And I think we might get into some of the things that we asked this most recent quarter. But it’s to my knowledge, one of the longest running surveys in the space. So we like it.

Dave:

That’s great, 270,000 properties. And I just want to clarify, Rick. So a lot of the people who listen to this podcast are probably smaller investors who own a couple of properties. Are those people represented in the survey too or are these mostly large-scale companies?

Rick:

They’re generally larger-scale, professionally managed companies.

Dave:

Great.

Rick:

We probably should look at trying to capture more of the smaller mom and pops because like I mentioned earlier, they’re essentially 97% of the entire market.

Dave:

Did you say 97%?

Rick:

Yeah. The stat around who owns single-family rentals across the country, the institutions which are some people say 100 plus, 1,000 plus, it’s right around 3% ownership. And then it’s normal people across the country that have rolled up portfolios or become accidental landlords after their first home that are the other 97%, yeah. So they are the market.

James:

That’s crazy. Everyone always thinks that the hedge funds are buying all the rentals, but there’s still a lot of room in that.

Rick:

Yeah.

James:

Rick, do you think there’s a big difference between the reporting from these big hedge funds and REITs that own these single-family housing? They have a lot of good reporting. They have a lot more staff behind them. Do you think there’s a big variance between the mom and pops operator and the big hedge funds or institutional as far as what happens with vacancy rates, rental? Some of the hedge funds are a lot more disciplined about raising rents and do you think there’s a big variance between those two?

Rick:

I think one of the, in a more simplistic way that we’ve thought about it, is your average mom and pop landlord, rental operator, manager or whatever you want to call it, they’re probably not going to be pushing rents exponentially. And the reason there is because for them, if it’s one property they have, cashflow is critical. And so you miss out on a month or two months, God forbid more when you’re having to turn that property because maybe you push rents too much, then that becomes a really big issue for them.

And I think it’s probably one of the reasons why too, and again, you’ve seen the survey that we do, but then gosh, we do a ton of other reports on this space. And one of the things that I like to look at in talking to people, especially people that are fairly new to the space, is they ask, “Well, how does this sector perform over time?” And I bring it back to that rent comment. You can go back and look at, and we have our own index that tracks rents across 99 markets throughout the country on single-family rental specifically, and historically national rent growth tracks pretty closely to what broader inflation is doing. And then it also tracks pretty closely to what household income growth is doing. So it’s a historically vanilla, somewhat boring asset class when you look at it from that perspective.

Dave:

And so what has happened this year, Rick? Have rents from the audience that you surveyed followed inflation?

Rick:

I would say if I had to label this year for the single-family rental industry, it would be a normalizing year. And the thesis that we had coming into 2023 was we don’t expect this industry, single-family rental, to collapse, freeze up by any means. And I’m talking about the fundamentals, not the capital markets, and we can get into that later if you want. It was more of a, “Hey, things are going to cool off but they’re going to normalize. We’re not going to fall off a cliff.”

And so what I mean by that is everything that we experienced from the kickoff of COVID in spring 2020 up until 2022, you have to throw that out and think of it as this once in a lifetime event where migration was on steroids. You had household decoupling. And what that basically means is you might’ve had two, three people living together, COVID hits and they go, “Well, I’m going to go out to the suburbs. I need to go have my own place working from home.” And that was just like steroids for the entire rental market, both multifamily as well as single-family rental.

So you had that, you had migration, and those things have now come off. And so what we’re seeing now, and this is in our survey too, rent growth trends, occupancy trends, everything is really reverting back to what we saw in our survey around 2019. And then beyond the survey work that we do, I mentioned we have proprietary data points for 99 markets across the country. We track on this. And that’s really the theme is things are just normalizing back to what this asset class has looked like from a fundamentals’ perspective pre-2020.

And so that is, you look at what’s happened in the multifamily space this year, not great. Got way oversupplied. You can make a case that some of that is hitting built-to-rent as well, but the single-family rental asset class has performed in a pretty healthy way. And I think that’s really been part of the core reason why people like this asset class, is you don’t get massive volatility, especially in rents. Home prices have been different this time around. And so you can plan around that. It’s not going to go nuts up or down. It’s pretty recession-proof from the metrics we’ve looked at, and that’s playing out as of right now.

Dave:

I think it’s really important for people to know that historically, rents grow around inflation or a little bit above inflation as Rick had said. And that what we saw over the last few years perhaps if you got into real estate investing since the pandemic was anomalously high growth. And James, I’m curious about your opinion, but I think seeing 3 to 5% growth even though it’s lower than it has been over the year, I personally like seeing that. I like a return to normalcy.

James:

I was pretty happy with a 5% growth this year. I was anticipating it to be a little bit flatter just based on the hockey stick we saw throughout the pandemic. And historically, like you said, we track a little bit above inflation on it. When we’re looking at a long-term pro forma on a multifamily property or single-family rental, we’re anticipating 3 to 4% rent growth every year. And I feel like because the pandemic, it was so crazy, it’s like we got off the freeway. And we took the turn ramp and we’re still going to where we’re supposed to be going but it just feels like it’s way slower because it’s not the same. But 5% growth, if we hit 5% growth every year, we’re going to be pretty happy with that return. And so I think that’s important for people to remember is like Rick said, that was not normal. You have to throw out those years because steady growth is really what you get out of real estate, not these hockey sticks like we’ve seen.

Rick:

Most people that have been investing in this space for a long time are totally fine with that. It’s the fly by night that got in late and said, “Oh, I can underwrite to 10% rent growth for the next five years.” Those are the individuals and entities that are having issues and then obviously now run into the buzz, saw of what’s going on in the capital markets too.

Dave:

That explains and gives us some insight into what has happened on the income side of the equation. Can you tell us a little bit more about the expense side?

Rick:

I’m glad you bring that up because that has been one of the more volatile pockets of the… And you just think about the math of your NOI. That has thrown a wrench into things. And I think you’re hearing that from smaller groups as well as the big institutions and there’s a couple components of it.

I think one is we think about asset values and appreciation being fantastic. And it is typically, but when you get 10, 20% upwards even more on price appreciation, that eventually then rolls into your property taxes in a lot of states. You get hit unless you’re in California, which they have Prop 13. But I think that that took a lot of groups by surprise and it was like in the moment, “Oh, this is fantastic. The values are reaping,” and then you get the property tax bill, you’re like, “Oh crap, we didn’t model this.” So I think that’s one component of it.

And then I think, too, the other component of it that on the expense side is insurance costs. That is coming up over and over and over again. We just had our big client conference in New York and this was a theme throughout it for both home builders, rental operators, where on the rental side, and I’ll focus on that single-family and build-to-rent too, they’re getting hit with insurance costs on renewal notices that are going up 10, 20, 30 plus percent. And so what that does is it immediately has an impact for you on the expense side. And then also if you then have to model that in going forward, you’re not going to be able to acquire because the math immediately changes for your acquisition targets and your buy box.

And so I think that has become a big issue for a lot of groups. And you talk about Florida, you talk about Texas, California. There’s a lot of groups that are just no longer writing policies, and it doesn’t sound like that’s going away anytime soon. So that has been a big issue. So the expense side of the equation hasn’t looked all that ideal for a lot of groups lately.

James:

For us is we do a lot of apartment syndications. We have a lot of different rental properties. Our insurance bill is a real cost on these properties. And not only that. When you’re doing value add, your construction plans, those have almost doubled on the cost. So that short-term financing when you’re getting it through stabilization and bringing it up to a new code, if you’re buying an old building right now, the costs are through the roof. And to touch on California, it is a complete nightmare. I just purchased my first property in California. It took me over three weeks to find an insurance policy for a single-family house. And the cost were absurd. Some of my quotes were coming in at $50,000 annually for a single-family house.

Rick:

Where is this house? Is it on a cliff where the water’s coming up?

Dave:

It’s a nice house.

James:

It is on a cliff. It was absurd and we got it down, but it took forever. And I’m used to… Insurance has never been an issue. It takes us 24 hours to get underwritten and a policy in play. And the fact that it took two to three weeks to get the insurance in play and then the cost of it, it’s astronomical. And from what our insurance providers and brokers are telling us is this is not getting better.

Rick:

No.

James:

This is going to get worse. And it’s making a huge difference in our overall operational costs and what it’s doing to the bottom line. In addition to the insurance cost, the labor cost has been really getting us. The cost to hire your property managers and to run your book of business correctly has increased at least 25% on wages of what we have to pay to get anybody good that will stick. That’s not going to have high turnover. The lower end, your turnover is so high, you might as well just pay the higher wages.

Rick:

It’s not even worth it.

James:

Yeah.

Dave:

Oh, it’s brutal.

Rick:

What’s the time comparison you’re using on that 25% increase? Is that over the last two years, three years? Because that’s a lot.

James:

Typically, with our property managers in the Pacific Northwest, if we’re a salary employee, the average salary was 55 to 60 grand. If we hire that 55, which I don’t think is a bad wage for that position, but if we hire at that 55,000 kind of medium price right there, the turnover is every four to six months, they’re gone. And so what we found is we’ve had to go from 55 to 60 to 65 to even 70 for the really good ones that can keep things turned because they reduce your vacancy rates. Your good employees are worth keeping but it’s a huge jump when you’re talking 55 to 65. That’s a big, big increase. And that was over the last 12 to 18 months we saw that big increase, but it’s still staying pretty heavy in the Pacific Northwest.

Rick:

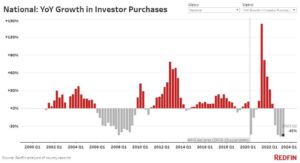

And that’s a big part of why conversations we have and then the data that we actually track on this across the country. On the acquisition side, things have just slowed down massively because you have all of these inputs rolling through that we’ve now talked about the expense side is not looking fantastic. You do have rent growth normalizing, cooling off. And then cost of capital has just blown out. And so immediately that just forces people to go pencils down or at least like, “Hey, we need to sharpen our pencils a bit here and figure this out.” And for the time being, the acquisition side has just shut off for the most part from what we’ve seen.

Dave:

Rick, you just mentioned the cost of capital as a major impediment to acquisition. What about the availability of capital? You hear a lot about just in the commercial market that it’s difficult to get a loan. Credit’s tight. Same thing going on in single-family?

Rick:

I think so, especially if your lens is today versus when SOFR was at zero.

Dave:

Rick, can you just explain what SOFR is?

Rick:

It’s secure overnight financing rate and it replaced LIBOR. And for people in this space, that is the benchmark that they will look at when thinking about financing deals. And so when we were in a zero interest rate policy world, SOFR was right around zero, I believe for two years, March 2020 to around 2022. And then obviously the Fed comes in and does their thing. And today, it’s hovering I think around 5 and change last time I checked, and it hasn’t come in like the rest of the yield curve has. So you look at two-year rates, five-year rates, 10-year rates, those have all come in but SOFR is still unmoved. It’s right around there.

So I think that’s a big part of why. You can buy a 10-year treasury at 4,015 and SOFR right now is at 5 plus, so it’s like it makes doing deals in this space pretty tough right now. And so I think everybody is hoping that… We’ll find out today. We’re recording this on December 13th and the Fed is about to say what they’re going to do, at least guide to what they’re going to do next year. And I think everybody in this space is really hoping that yes, we do have a soft landing and that there are some cuts next year because that should roll through into what SOFR financing will do.

And again, taking a longer-term view of this sector, I think one of the reasons that people fell in love with this space when rates were at zero was, and that was for a while, it was very hard to get yield anywhere. I mean, anywhere. And so people looked at this asset class and said, “Oh yeah, I can borrow. I lever it up. I get rent growth. I get home price appreciation.” And that’s a pretty decent yield in a world where yield almost doesn’t exist. And so now, it’s almost like a 180 where today, yield is everywhere and it’s… Oh, by the way, it’s risk-free. So that’s where it gets a little bit tougher to do deals in this space. And capital is now looking at other places too.

James:

We have noticed over the last 12, I would say 12 to 18 months, these big hedge funds have really slowed down on buying these single-family houses. And right now with the interest rates, it’s hard to make deals cover. But there is a little bit more opportunities out there. Right now, I know the mom and pops investor, they’re getting pretty high interest rates. When you’re looking at buying a rental property, your rate is getting quoted at the best case, 7.5 to 8% right now. And it can make it hard to cover, but what we have found is because some of these big institutions have pulled out, and not only that, the seasonal investor has also pulled out of the market, the ones that were, like you were saying, are projecting the 10% rent growth that have only been in that hot market. They’ve pulled out.

So we have seen some opportunities, but what do you think is going to happen for that small mom and pops investor? Do you think that their appetite’s going to increase to buy rental properties? Because it still feels like the tone is, “Oh, rates are too high. You can’t make a pencil.” We’ve seen opportunities and we’ve been buying properties, but it comes with a lot of hair on them a lot of times. You got to do a lot of value add to get it there to create the equity position, to get the basis low enough. Do you think that the mom and pops investors are going to continue to be purchasing throughout the 2024 or do you think it’s going to be a little bit flatter like it was in 2023?

Rick:

If what we talked about earlier and we do get a soft landing, rates do start to come in next year, I think that will lend itself favorably to more groups coming in and hopefully some of the smaller mom and pops. What we’ve seen in the data that we track is that the institutions for the last probably year or so, really ever since the Feds started jacking rates and they’ve hovered at what they’re today, they have pulled out massively. They’re almost gone for the most part. But the smaller groups that you’re referring to, the smaller mom and pops, they’re still in there. And I think what we see in our data market by market is that they’re buyers throughout cycles so they’re always there, always playing. I think what you said on there’s some hair on it and it’s value add, which is a euphemism for it’s stressful, this is not an easy deal.

Dave:

Not for James. He finds that very comforting.

Rick:

That’s probably where you are finding opportunity right now. We look at what the REITs are reporting and talking about, and one of my favorite stats from this last quarter that American Homes for Rent mentioned, AMH, I think is what they’re now officially called, I think the stat that they said was this. Because they’re always having deals that they’ll roll through their underwriting models, and so I think it was like 22,000 homes that they ran through their underwriting model and they only bought eight.

Dave:

Whoa.

Rick:

So only eight of those 22,000 fit with what they needed in terms to acquire those homes. So that right there is a microcosm for what we’re seeing in the data across the country right now for the bigger groups.

Dave:

Wow, that’s not encouraging. I don’t want to run numbers on 22,000 deals to get eight.

Rick:

Your model’s probably not as sophisticated as theirs.

Dave:

Definitely not. Rick, I’d love to get your thoughts on what might change in the single-family rental space in 2024. Just in broad strokes, what are you looking out for next year?

Rick:

Our broad brush thesis is we don’t get a recession. And so if that holds, that’s good for the sector. So then you think about rent growth, and this goes back to our comments earlier. Do not pro forma double-digit rent growth because that’s, again, throw that out. That’s probably once in a lifetime.

Dave:

Forever. Yeah, forever.

Rick:

The way to think about the space is probably 95, 96% occupancy rates. In most markets, you’re getting 3 to 5% rent growth. And this is us thinking about it from a new lease perspective. And that’s a pretty vanilla type backdrop for this asset class. And then you think about acquisition volumes. And this is where I think if you do… Actually as I’m talking through this, I’m glad we’re breaking this up. Because one of the other things I think that has worked well for the single-family rental sector is that you haven’t had a lot of listings come into the market for rent this cycle. And so a big part of that is what happens in SFR, single-family rental, on the listing side is usually a flow through of what’s happening on single-family for sale side, meaning when listings pop up on for sale, the lion’s share of acquisitions for rental groups, they come through the MLS.

And so what we didn’t see this cycle, and there’s a ton of reasons why, lock-in, I won’t get into that, we just did not see a spike in listings activity. And so by definition, you did not see a transition for some of those coming into the rental space. What we do envision though for 2024 is that we do think, and you can see this in the data, peak lock-in was around middle of 2022. We are starting to see more for sale listings coming into the market at a very unseasonal period. We just ran this analysis of one of our reports this month. And so I think you start to think about that and you fast-forward to 2024 and you go, “Okay. Well, that probably tells me that we may start to see more activity in terms of single-family rental listings coming into the market acquisition opportunities,” because that supply really was just locked up for the last year or so.

And so that’s also part of our thesis on okay, so you’ll probably get more incremental supply. You probably should think about rent growth normalizing a bit compared to prior years. So that’s a bit of the minutia of our way of thinking about it next year too.

Dave:

That’s super interesting. And I am curious. Do you think the lock-in effect will continue to trickle, phase out slowly, or do you think there’s this magic point where if mortgage rates get down to a certain point, we’ll start to see a flood of supply?

Rick:

Yeah, I hate using the word flood because usually you only get flood if there’s massive distress.

Dave:

Yeah, true.

Rick:

That is not in our thesis. I haven’t heard anybody calling for that unless they’re just a perma bear. So I do think the lock-in effect is just going to slowly… The keys on the handcuffs are just going to slowly start to unlock incrementally more and more people. And I think too, if you do have a world where mortgage rates, so let’s think about mortgage rates, market mortgage rates touched 8 for a week, early November. Now, they’re back to 7 and change. And I think if people get more comfortable with the idea of, “Hey, we’re not going back to a 3% 30-year fixed mortgage world anytime soon,” so I got to give up hope for that. And now I’m a year, two years longer into this higher for longer backdrop, and so you know what? Life happens and I’m going to re-transact. I’m not going to wait for 3%, 4% mortgage rates again. And so I think that slowly but surely, that is going to start to happen.

And the other thing, this is a wild card in this where you talk about the ability for inventory to unlock. One of the reasons that the new home space, home builders, and we’re very close to that space, have just had a phenomenal run this year is, A, not much resale supply so not much to compete with. But then, B, on the entry level specifically, they’ve been buying down mortgage rates to 5. Some builders are still advertising below 5, which is amazing. And I bring that up because they’ve had a fantastic run using that. You’re starting to see some groups that could do something like this for the resell market.

And so what I mean by that is brokerages are starting to have conversations on like, “Hey, is this a tool that we can use for our clients?” And because that’s really a huge advantage where new homes coming in at 5, 5 1/2 mortgage rate, a resale home, you got to pay 7%, maybe 7% plus. And so if some of that resale inventory can get down to a competing rate that the builders are doing, that’s where I think you start to have more inventory come into the market. And there’s a group. I feel like we almost forgot about the iBuyers, but they’re out there still. And there’s a group called Offerpad where you can go on their website, poke around. And I was doing this the other day for Phoenix, and you can see that they’re advertising homes that they’ve acquired and they’re now selling at a 5% mortgage rate.

Dave:

Wow.

Rick:

So they are buying down that rate for the takeout, which is a retail buyer. That’s where I do think that that’s a potential for the resale market to get their arms around this financial tool that builders have been using and go, “Okay, let’s start doing that too and we’ll probably get some sales.”

Dave:

That’s super interesting, Rick. I just want to explain to everyone just to make sure everyone understands. Basically, over the last year or two, just based on builder’s business model, they are incentivized to move product quickly, generally faster than existing homes. And so they’re buying down people’s interest rates. These are temporary things where the buyer pays a couple of thousand dollars to lower your interest rate by 1 or 2 or 3% for one or two or three years.

And that is one of the reasons we’re seeing a big uptick in as we were discussing people buying new construction. And it’s made it more attractive relative to existing homes than it has been in the past. But it sounds like, Rick, you’re saying that agents, brokerages are trying to figure out ways or offer or considering similar incentives to maybe level the playing field a little bit in terms of interest rates so that more sellers are motivated to sell and get some more supply on the market.

Rick:

Exactly, exactly. Yeah. And the one thing I would say is sometimes they’re temporary buy-downs, but the lion’s share of them is in terms of what builders have been doing, are the full three-year fixed.

Dave:

Oh, really?

Rick:

Yeah. So then-

Dave:

That’s great.

Rick:

That is a huge tool because you think about that and the consumer, obviously there’s a lot of demand out there for home purchases. And if you can have the conversation with a retail buyer and say, “Hey, market rates are up here at 7 1/2 or whatever they were,” now they’re 7, “but we can get you in at 5. And oh, by the way, that’s the entire duration of the 30-year loan.” That’s a great sales tool.

Dave:

Absolutely.

Rick:

Poke around on builder’s webpages and almost all of them are leaning into 30-year fixed buy-downs. Some of them are starting to advertise adjustable mortgages again, and we can get into that if you want. But I think the consumer psyche around adjustable rate mortgages is like, “Oh no, I remember those. I remember what those did and I don’t want that.” And so most consumers are leaning in towards the 30-year fixed buy-down, and that’s why builders are leaning into.

Dave:

Rick, while I got you here, can I run a theory or a question I have by you? It’s not in your report, but I’ve been reading a lot and we’ve been talking on the show a lot about the oversupply and a lot of overbuilding in the multifamily space, and you’re starting to see weakness in rents there. Occupancy rates are declining a little bit. Do you think there’s a risk that spills into the single-family rental space?

Rick:

The tenant profile is so different. And so that’s where I think, and we have the data that backs this up, the multifamily space, apartment space, historically very volatile. You get supply waves, massive supply waves up, collapses down, bleeds through the rents, rents collapse. And we’re essentially seeing that right now. But for what we’re seeing, you’re not really seeing an impact on the single-family rental side. And I forget the stat, but we have it. It’s like finding a needle on a haystack trying to find a three-bed apartment, and that’s really a big part of single-family rental, it’s, “Hey, we are offering something that works for that cohort in a school district.” And so that’s where when we look at it historically, and I think even this cycle too, we’re forecasting negative rent growth in the apartment space this year next year, and we’re forecasting pretty nice rent growth in single-family rental this year and next year.

So the only thing that I can say is because we do have a single-family rental index where we track new leases across 99 markets, there’s a couple markets where rents have gone negative or pretty close to it, and there is a connection. So Vegas and Phoenix are the markets I’m talking about. And if you’re familiar with the apartment space, Vegas and Phoenix have seen a lot of supply come into the system too. So those are the two markets right now where just from a broad brush standpoint, you could go, “Oh, those two parts of the rental ecosystem, both apartments and single-family rental in those markets, have slowed down considerably.” But across the rest of the country, we haven’t really seen that connection yet.

Dave:

Got it. Thank you. That’s super helpful. Well, Rick, this has been a fantastic conversation. Thank you so much for sharing your research and insight with us. If people want to get the report or learn more about your work, where should they do that?

Rick:

Yeah, you can go to our website and fill out an inquiry. We do a lot of research survey work for our clients, but then I actually think some of our best stuff is through our free newsletter. And so you can sign up there on our website. And then we’ve got a lot of people on social media. If you’re on LinkedIn, you can follow us there. If you’re on Twitter or X, you can follow us there. And then even on Threads, starting to see more people starting to poke around on Threads, so we’ll see.

Dave:

Nice. Well, thanks so much, Rick. We appreciate you joining us.

Rick:

Yeah, likewise. Appreciate it, guys.

James:

Thanks, Rick.

Dave:

So James, does any of this research change your opinion about what’s going to happen next year or what you’re going to do?

James:

You know what, we’re going to keep just doing what we do. We’re on our pro formas and if it hits our buy box numbers, we’re going to keep buying. I think it’s what we anticipated, things we’re going to normalize out. We’re seeing steady rent growth, but we just got to keep tracking those expenses though. It really forecast those expenses to be increased for the next couple of years. And as long as it pencils that way, we’ll keep buying.

Dave:

Yeah, man. It actually reaffirms what I’m planning to do next year. I’ve been investing in multifamily passively for the last few years, but I need to get back and buying single-family homes and small multi-families. It’s a very stable asset class, I think, to match that with some of the more bigger swings I’ve taken in multifamily. It’s just a good way to build out a more balanced portfolio, so it makes me feel good about what I’m planning for next year.

James:

Yeah, it’s like everyone’s like, “Oh, I want to get into multifamily because I want to be in bigger projects.” But at the end of the day, a single-family burr property will give you the most amount of impact in the short term than a multifamily in a long term. It’s just the equity growth and cashflow, it’s unmatched in that asset class. So don’t forget about the little deals. They make money.

Dave:

I know, yeah. Everyone wants to just get 20 units all at once. But unless you got a team, it’s a lot. It’s very effective to just go slowly one at a time and just do a really good job on individual deal instead of trying to get one big grand slam.

James:

Little deals work.

Dave:

Absolutely.

James:

There’s nothing wrong with them.

Dave:

All right. Well, thank you, James, for joining us. And thank you all for listening. We appreciate you. And if you like this episode, please give us a review. We haven’t gotten reviews in weeks. I don’t know what’s going on. So if you’re listening to the show, please go on Apple or Spotify and give us an honest review of On the Market podcast. Thank you all again. We’ll see you next time.

On The Market was created by me, Dave Meyer, and Kaitlin Bennett. The show is produced by Kaitlin Bennett with editing by Exodus Media. Copywriting is by Calico Content, and we want to extend a big thank you to everyone at BiggerPockets for making this show possible.

Watch the Episode Here

Help Us Out!

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds and instructions can be found here. Thanks! We really appreciate it!

In This Episode We Cover:

- What the largest single-family rental survey says about the 2024 housing market

- Rent “normalization” and why those who aggressively projected rising rents will get hit hard

- Rising expenses, insurance costs, and whether or not it could get even worse

- Why institutional investors pulled out of the market while small-time investors thrived

- How long the “lock-in effect” could last as high mortgage rates become the new norm

- Whether or not the multifamily rent crisis could spill over into the single-family market

- And So Much More!

Links from the Show

Connect with Rick:

Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Email [email protected].

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.biggerpockets.com/blog/on-the-market-169

- :has

- :is

- :not

- :where

- $UP

- 000

- 1

- 10

- 100

- 12

- 13

- 17

- 180

- 20

- 20 years

- 2019

- 2020

- 2022

- 2023

- 2024

- 22

- 24

- 30

- 60

- 65

- 7

- 70

- 8

- a

- ability

- Able

- About

- about IT

- above

- accidental

- accomplished

- acquire

- acquired

- acquisition

- acquisitions

- across

- activity

- actually

- add

- addition

- adjustable

- ADvantage

- Advertise

- Advertising

- affecting

- After

- again

- agents

- aggressively

- All

- almost

- also

- always

- am

- amazing

- American

- amount

- an

- analysis

- Analysts

- analytics

- and

- Annually

- Another

- Anticipated

- anticipating

- any

- anything

- anywhere

- Apartment

- apartments

- Apple

- appreciate

- appreciation

- ARE

- arms

- around

- AS

- ask

- asking

- asset

- asset class

- At

- attractive

- audience

- author

- availability

- average

- away

- b

- back

- backdrop

- background

- backs

- Bad

- Balanced

- based

- Basically

- basis

- BE

- Bear

- because

- become

- becomes

- becoming

- been

- behind

- being

- believe

- below

- Benchmark

- BEST

- Better

- between

- Beyond

- Big

- bigger

- Bill

- Bit

- Blend

- book

- border

- Boring

- borrow

- both

- Bottom

- bought

- Box

- Break

- Breaking

- bring

- Bringing

- broad

- broader

- brokerages

- brokers

- build

- builders

- Building

- burns

- business

- business model

- but

- buy

- BUYER..

- buyers

- Buying

- by

- california

- call

- called

- calling

- CAN

- Can Get

- capital

- Capital Markets

- capture

- card

- Career

- case

- certain

- change

- Changes

- checked

- Christmas

- citing

- class

- client

- clients

- Close

- closely

- Co-Host

- code

- Cohort

- Collapse

- collapses

- come

- comes

- comfortable

- coming

- comment

- comments

- commercial

- Companies

- company

- compared

- comparison

- compete

- competing

- complete

- component

- components

- Conference

- connection

- considering

- construction

- consulting

- consumer

- Consumers

- content

- continue

- controlling

- Conversation

- conversations

- Cool

- copywriting

- Core

- Corporate

- correctly

- Cost

- Costs

- could

- Council

- country

- Couple

- cover

- covering

- Covid

- crazy

- create

- created

- critical

- curious

- curve

- cuts

- cycle

- cycles

- data

- data points

- Dave

- day

- deal

- Deals

- December

- decent

- Decline

- Declining

- deep

- definitely

- definition

- deliver

- Demand

- DID

- difference

- different

- difficult

- DIG

- Director

- disciplined

- discussing

- Display

- distress

- district

- dive

- do

- does

- Doesn’t

- doing

- dollars

- Dont

- doubled

- down

- Drink

- drive

- Drop

- duration

- Earlier

- Early

- easy

- ecosystem

- editing

- effect

- Effective

- either

- Employee

- employees

- encouraging

- end

- enough

- Entire

- entities

- entry

- envision

- episode

- equity

- especially

- essentially

- estate

- Ether (ETH)

- Even

- Event

- eventually

- EVER

- Every

- everybody

- everyone

- everyone’s

- everything

- everywhere

- exactly

- exist

- existing

- Exodus

- expect

- expenses

- experienced

- Explain

- Explains

- exponentially

- extend

- fact

- fairly

- Fall

- familiar

- fantastic

- far

- faster

- faucet

- Favorite

- Fed

- Feds

- feel

- feels

- few

- field

- Figure

- fill

- financial

- financing

- Find

- finding

- finds

- fine

- Firm

- First

- fit

- five

- fixed

- flood

- florida

- flow

- Focus

- focuses

- follow

- followed

- For

- Forces

- Forecast

- forever

- Forward

- found

- founder

- four

- Free

- freeway

- Freeze

- from

- full

- fund

- Fundamentals

- funds

- generally

- get

- getting

- Give

- gives

- Go

- God

- Goes

- going

- gone

- good

- good job

- got

- grand

- great

- Group

- Group’s

- Grow

- Growth

- Guest

- guide

- had

- Hair

- Hands

- happen

- happened

- Happening

- happens

- happy

- Hard

- hate

- Have

- having

- he

- healthy

- hear

- heard

- hearing

- heavy

- hedge

- hedge fund

- Hedge Funds

- helpful

- here

- Hidden

- High

- higher

- hire

- historically

- Hit

- Hits

- hitting

- holds

- Home

- Homes

- honest

- hope

- Hopefully

- hoping

- host

- HOT

- HOURS

- House

- household

- houses

- housing

- How

- HTTPS

- huge

- i

- I’LL

- idea

- ideal

- if

- immediately

- Impact

- important

- impossible

- in

- in-depth

- Incentives

- incentivized

- include

- Income

- Increase

- increased

- incredible

- incremental

- index

- individual

- individuals

- industry

- inflation

- information

- inputs

- inquiry

- insight

- insights

- instead

- Institutional

- institutional investors

- institutions

- instructions

- insurance

- interest

- INTEREST RATE

- Interest Rates

- interesting

- into

- invaluable

- inventory

- investing

- investment

- Investments

- investor

- Investors

- issue

- issues

- IT

- itself

- iTunes

- james

- Job

- John

- join

- Join us

- joined

- joining

- joining us

- jpg

- jump

- just

- Keep

- keeping

- keys

- kickoff

- Kind

- Know

- knowledge

- Label

- labor

- landing

- landlord

- large-scale

- largest

- Last

- Last Year

- Late

- later

- LEARN

- learning

- lease

- least

- leaving

- LEND

- Lens

- Level

- LG

- Life

- lifetime

- like

- Line

- Listening

- listing

- Listings

- little

- living

- loan

- locked

- Long

- long time

- long-term

- longer

- Look

- looked

- looking

- LOOKS

- Lot

- love

- Low

- lower

- made

- magic

- major

- make

- make money

- MAKES

- Making

- man

- managed

- management

- manager

- Managers

- managing

- March

- march 2020

- Market

- Markets

- massive

- massively

- Match

- math

- Matter

- Matters

- May..

- maybe

- me

- mean

- meaning

- means

- measurement

- Media

- medium

- mentioned

- Methodology

- Metrics

- Meyer

- Middle

- might

- migration

- miss

- mix

- MLS

- model

- models

- mom

- moment

- money

- Month

- monthly

- months

- more

- Mortgage

- Mortgages

- most

- mostly

- motivated

- move

- much

- my

- name

- National

- necessarily

- Need

- needed

- negative

- net

- never

- New

- New Construction

- New York

- Newsletter

- next

- nice

- night

- no

- None

- normal

- nothing

- November

- now

- numbers

- occupancy

- of

- off

- offer

- offering

- Officially

- oh

- Okay

- Old

- on

- once

- ONE

- ones

- only

- open

- operating

- operating expenses

- operational

- operator

- operators

- Opinion

- Opinions

- opportunities

- Opportunity

- or

- Other

- our

- out

- over

- overall

- overnight

- own

- ownership

- owns

- Pacific

- pandemic

- part

- partner

- Partnership

- parts

- past

- Pay

- pays

- Peak

- pencils

- People

- people’s

- percent

- perform

- performed

- perhaps

- period

- PERMA

- Personally

- perspective

- phase

- phenomenal

- phenomenon

- phoenix

- Place

- Places

- plan

- planning

- plans

- plato

- Plato Data Intelligence

- PlatoData

- Play

- player

- players

- playing

- please

- plus

- pockets

- podcast

- Podcasts

- Point

- points

- Poke

- policies

- policy

- pop

- Pops

- portfolio

- portfolios

- position

- possible

- potential

- present

- press

- pretty

- price

- Prices

- Principal

- Prior

- private

- Pro

- probably

- produce

- Produced

- Product

- Products

- professionally

- Profile

- Profit

- projected

- projects

- prop

- properties

- property

- proprietary

- protected

- providers

- provides

- public

- purchased

- purchases

- purchasing

- Push

- Pushing

- Quarter

- quarterly

- question

- Questions

- Quick

- quickly

- quotes

- raising

- Ramp

- Rate

- Rates

- rating

- Raw

- raw data

- reach

- Read

- Reading

- reaffirms

- real

- real estate

- realize

- really

- reaping

- reason

- reasons

- recent

- recession

- recording

- reduce

- relative

- remember

- Rent

- rentals

- replaced

- report

- Reporting

- Reports

- represent

- represented

- research

- resell

- respect

- REST

- retail

- return

- reverting

- review

- Reviews

- Rick Palacios Jr.

- right

- rising

- Risk

- Roll

- Rolled

- Rolling

- rolls

- roof

- Room

- round

- Run

- running

- Said

- salary

- sale

- sales

- same

- saw

- say

- saying

- says

- School

- scope

- seasonal

- seconds

- sector

- secure

- see

- seeing

- seems

- seen

- sell

- Sellers

- Selling

- sense

- sentiment

- Share

- sharing

- Short

- short-term

- should

- show

- Shows

- shut

- side

- sign

- similar

- simplistic

- since

- SIX

- Six months

- Size

- Slowly

- small

- smaller

- So

- Social

- social media

- Soft

- some

- something

- sometimes

- somewhat

- Soon

- sophisticated

- Sound

- Space

- specifically

- spike

- Sponsors

- Spotify

- spring

- stable

- Staff

- standpoint

- stands

- start

- started

- Starting

- States

- stats

- staying

- steady

- steer

- steroids

- Stick

- Still

- Struggling

- such

- Super

- supply

- supposed

- sure

- surely

- surprise

- Survey

- surveyed

- Swings

- system

- Take

- taken

- takes

- taking

- Talk

- talking

- targets

- Task

- tax

- Taxes

- team

- technically

- tell

- telling

- tells

- temporary

- tenant

- term

- terms

- texas

- than

- thank

- thanks

- that

- The

- The Buzz

- The Capital

- the Fed

- their

- Them

- thematic

- theme

- then

- theory

- There.

- These

- thesis

- they

- thing

- things

- think

- Thinking

- Thinks

- thirsty

- this

- this year

- those

- though?

- thought

- thousand

- three

- Through

- throughout

- time

- timely

- times

- to

- today

- today’s

- together

- told

- Ton

- TONE

- too

- took

- tool

- Topics

- TOTALLY

- touch

- touched

- tough

- towards

- track

- Tracking

- Transcript

- transition

- treasury

- Trends

- true

- Trusts

- try

- trying

- TURN

- Turned

- turnover

- two

- type

- typically

- under

- understand

- understands

- underwriting

- underwritten

- unfair

- unique

- units

- unlock

- unmatched

- until

- upwards

- us

- use

- used

- using

- usually

- value

- Values

- VEGAS

- Versus

- very

- Video

- View

- volatile

- Volatility

- volumes

- wage

- wages

- wait

- walk

- want

- wants

- was

- waves

- Way..

- ways

- we

- weakness

- Website

- week

- Weeks

- welcome

- WELL

- were

- What

- whatever

- when

- whether

- which

- while

- WHO

- whole

- why

- Wild

- will

- with

- Word

- Work

- worked

- working

- working from home

- works

- world

- worse

- worth

- would

- Wrench

- writing

- written

- Wrong

- X

- year

- years

- yes

- yet

- Yield

- yield curve

- york

- you

- Your

- yourself

- youtube

- zephyrnet

- zero