Crypto markets rallied on Wednesday after the U.S. Federal Reserve raised its benchmark interest rate by 0.75% for the second time in two months in a widely telegraphed move.

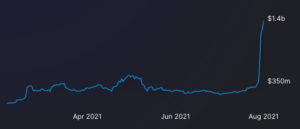

Ether is up 12% to $1,620 in the past 24 hours, according to data from The Defiant’s newly released charting tool. Bitcoin rose 7.4% to $22,750.

The Dow Industrials, S&P 500 and Nasdaq indices consolidated gains in the wake of the news.

Repeated interest rate hikes this year by the Fed and other central banks may be working, the Fed said in announcing its decision.

“Recent indicators of spending and production have softened,” it said in a news release. But other metrics — namely the unemployment rate and, of course, the consumer price index — suggest an economy that is still running hot, and the Fed indicated more interest rate hikes would be forthcoming.

Such hikes increase the cost of borrowing in the broader economy. The cascading effect — less spending by businesses and consumers, less revenue for businesses, and, eventually, layoffs — is meant to cool demand for goods and services, easing upward pressure on prices.

Markets typically drop as interest rates rise. But observers had expected Wednesday’s 75 basis point hike, and were relieved the Fed did not take more aggressive action than forecast.

“The outlook hasn’t looked this good in a while,” Hal Press, the founder of crypto hedge fund North Rock Digital, tweeted. “We just got first signs of a real fed pivot, earnings are better than feared and there’s no more meetings for two months.”

Wednesday’s rally wasn’t limited to Layer 1 tokens. DeFi tokens surged after the Fed’s decision, according to data from The Defiant Terminal, with Lido’s LDO up 33%, AAVE up 15%, UNI up 13.7% and Curve’s CRV up 9.1%.

Layer 2 rollup Optimism’s OP is up 27% in the past day.

LDO, like ETH, has outperformed over the past couple of weeks as anticipation builds for The Merge, Ethereum’s long-awaited transition to the environmentally friendly proof-of-stake transaction consensus mechanism.

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- decentralized

- DeFi

- Digital Assets

- ethereum

- machine learning

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- Platoblockchain

- PlatoData

- platogaming

- Polygon

- proof of stake

- The Defiant

- W3

- zephyrnet