- The total crypto market cap stands at $808.95 billion after a 0.21% increase.

- There are still two events lingering over the crypto community which could bring prices down.

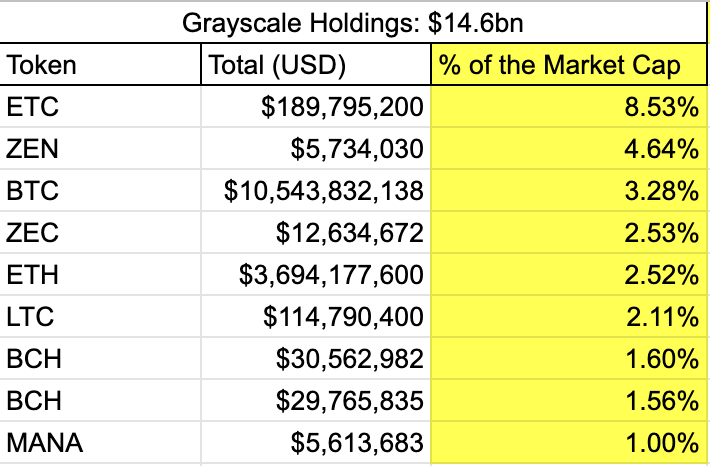

- Grayscale may be forced to sell its balance sheet which totals $14.6 billion.

The total crypto market cap is up for the day at press time according to the crypto market tracking website CoinMarketCap. It currently stands at $808.95 billion after a 0.21% increase over the last day.

It is expected that the crypto market will experience a relief rally leading up to the FED meeting, which is more than 4 weeks away at this point, and as the new year kicks off for the global financial markets. This could result in the prices of the top 30 coins by market cap rising over the next few weeks.

Despite this projected bullishness, two events remain over the crypto community that could bring prices down for the final time in the bear cycle.

The first event is the potential bankruptcy filing by DCG (Digital Currency Group). This group has invested in several distributed ledger technologies and a bankruptcy filing by the group could result in a crypto market tumble given the magnitude of their portfolio.

The next event that crypto investors should look out for, according to a crypto analyst that goes by the name of KARL_Ox, is Grayscale being forced to sell its balance sheet which totals $14.6 billion.

In a Tweet made by the analyst, Grayscale may be forced to sell its balance sheet to cover Genesis’ creditors. Should this be the case, a handful of cryptos will be negatively impacted. The list of cryptos that may be affected includes ETH, BTC, BCH, LTC, ZEC, and a few other altcoins.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Post Views: 12

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://coinedition.com/markets-positive-start-to-2023-may-come-to-an-abrupt-end/

- a

- According

- Action

- affiliates

- After

- All

- Altcoins

- analysis

- analyst

- and

- Balance

- Balance Sheet

- Bankruptcy

- Bankruptcy Filing

- BCH

- Bear

- being

- Billion

- bring

- BTC

- cap

- case

- Coin

- Coin Edition

- CoinMarketCap

- Coins

- come

- community

- could

- cover

- creditors

- crypto

- crypto analyst

- crypto community

- Crypto investors

- Crypto Market

- crypto market cap

- cryptos

- Currency

- Currently

- day

- DCG

- digital

- digital currency

- digital currency group

- diligence

- direct

- distributed

- Distributed Ledger

- down

- edition

- ETH

- events

- expected

- experience

- Fed

- fed meeting

- few

- Filing

- final

- financial

- First

- given

- Global

- global financial

- Goes

- good

- Grayscale

- Group

- handful

- Held

- HTTPS

- impacted

- in

- includes

- Increase

- information

- invested

- Investors

- IT

- Kicks

- Last

- leading

- Ledger

- List

- Look

- loss

- LTC

- made

- Market

- Market Cap

- Markets

- max-width

- meeting

- more

- name

- negatively

- New

- new year

- next

- Opinions

- Other

- own

- plato

- Plato Data Intelligence

- PlatoData

- Point

- portfolio

- positive

- potential

- press

- price

- Price Analysis

- Prices

- projected

- published

- rally

- Reader

- readers

- relief

- remain

- research

- result

- rising

- Risk

- sell

- several

- shared

- should

- Source

- stands

- start

- Still

- Technologies

- The

- the Fed

- the information

- their

- time

- to

- top

- Total

- total crypto market cap

- Tracking

- tweet

- views

- Website

- Weeks

- which

- will

- year

- ZEC

- zephyrnet