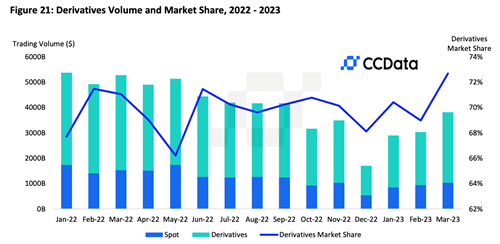

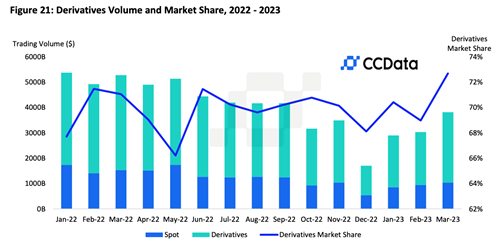

The trading volumes of cryptocurrency derivatives have experienced a three-month growth streak for the first time since January 2022. These products include financial contracts like futures and options related to digital currencies.

CCData’s latest Outlook Report reveals that derivatives trading accounted for approximately 74% of the nearly $4 trillion crypto market volume in March. Although the majority of this trading occurred on centralized exchanges (CEX), decentralized exchanges (DEX) contributed $68.7 billion to the market.

As the potential of DEXs offering derivatives trading becomes increasingly clear, a growing trend has emeged with spot decentralized exchanges incorporating derivatives trading on their platforms, or partnering with other exchanges to do so.

PancakeSwap, for instance, has introduced derivatives trading in collaboration with Apollo Exchange. However, when compared to centralized crypto exchanges, the dominance of on-chain derivatives trading remains relatively low. In fact, the trading volume for derivatives on centralized exchanges is approximately 2.5 times greater than spot trading volume.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Source: https://www.cryptocompare.com/email-updates/daily/2023/apr/17/

- :is

- 2022

- 2023

- 7

- a

- Although

- analysis

- and

- apollo

- approximately

- becomes

- Billion

- centralized

- Centralized Exchanges

- CEX

- clear

- collaboration

- compared

- contracts

- contributed

- crypto

- Crypto Exchanges

- Crypto Market

- crypto market volume

- CryptoCompare

- cryptocurrency

- currencies

- decentralized

- decentralized-exchanges

- Derivatives

- derivatives trading

- Dex

- DEXs

- digital

- digital currencies

- Dominance

- exchange

- Exchanges

- experienced

- financial

- First

- first time

- For

- Futures

- greater

- Growing

- Growth

- Have

- However

- HTTPS

- in

- include

- incorporating

- increasingly

- instance

- introduced

- January

- latest

- like

- Low

- Majority

- March

- Market

- Market Analysis

- nearly

- occurred

- of

- offering

- on

- On-Chain

- Options

- Other

- partnering

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- potential

- Products

- related

- relatively

- remains

- report

- Reveals

- since

- So

- Spot

- Spot Trading

- that

- The

- their

- These

- time

- times

- to

- Trading

- trading volume

- trading volumes

- Trend

- Trillion

- volume

- volumes

- with

- zephyrnet