Automakers and suppliers concerned about the availability of access to raw materials for electric car batteries are turning their attention to alternative sources: scrap from battery production and recyclable metals from end-of-life batteries.

The expected increase in global EV sales by the end of the decade will put huge pressure on the supply chain for critical battery raw materials such as cobalt, nickel and lithium. For example, despite a current surplus in lithium, demand projections for the mineral will likely be in deficit by 2027, according to a forecast by S&P Global Market Intelligence. That will create a bottleneck for automotive supply and drive the industry's focus toward battery recycling to keep EV battery costs down, according to a S&P Global Mobility analysis.

In addition to the ecological costs of mining, there are humanitarian concerns accessing certain battery-grade raw materials — such as sourcing cobalt from the Democratic Republic of the Congo, where a variety of geo-political issues are in play. There are also macroeconomic concerns regarding the regional monopoly of mainland China in vertically integrating material supply and refining. In addition to investing heavily in offshore mines, mainland China controls most of the world's cobalt and lithium refining — the crucial middle step between mining and cell manufacturing. More than 60% of both cobalt and lithium are refined in mainland China.

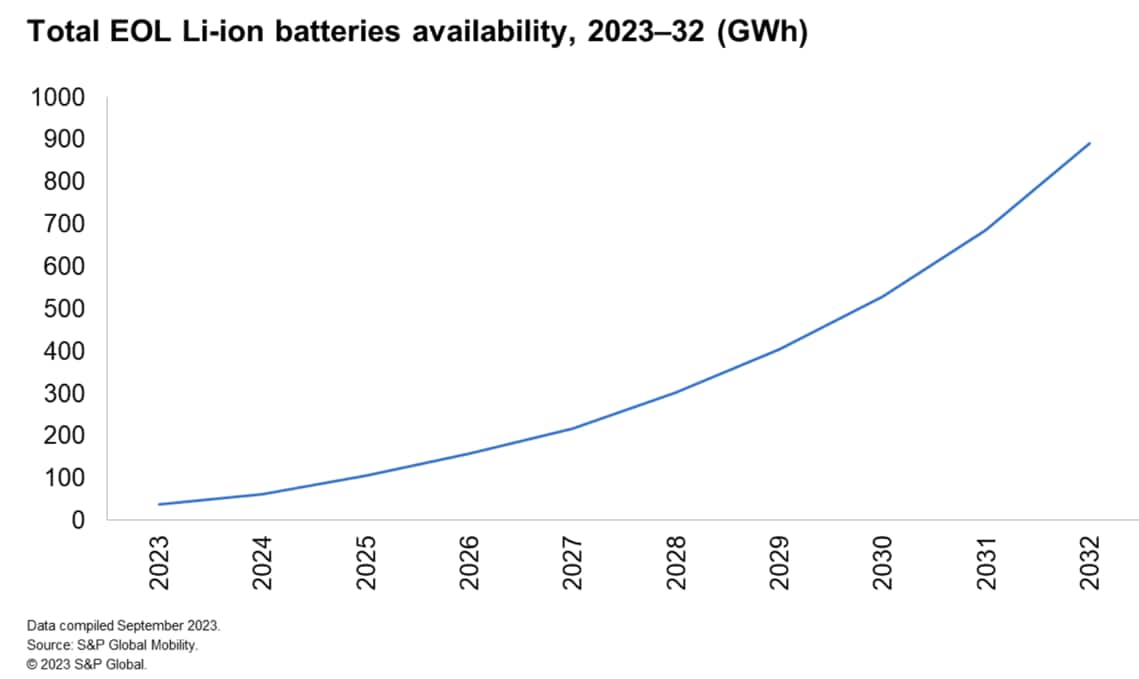

In response, several countries have been mandating increased local sourcing of raw materials. But countries not having natural reserves for these materials will have to rely on recycling end-of-life (EOL) batteries for their resources. By 2032, S&P Global Mobility estimates around 900 GWh of EOL batteries will be available for recycling. That's the equivalent of batteries for 12 million electric vehicles.

Foreseeing a challenge in securing raw materials, several automakers have established partnerships with raw-material suppliers and recyclers. For example, Volkswagen and Audi have partnered with Redwood Materials in North America, Umicore in Europe, and Ganfeng Lithium in mainland China for battery recycling.

Some automakers are setting up in-house operations. Early in 2023, Mercedes-Benz broke ground on a battery recycling plant in Kuppenheim, Germany, that had been scheduled to begin mechanical dismantling of EV batteries by year's end. Tesla also has announced plans for its battery factories to recycle batteries on-site.

In addition, production scrap is seen as a key play. Scrap

generated during battery manufacturing includes rejected or

defective batteries and materials or components that do not meet

quality standards. It consists of metals, electrolytes, and other

components. Scrap from cell production accounts for a large part of

the total production scrap, followed by battery-pack production

scrap and battery-module production scrap.

The hardest aspect of the battery manufacturing process to get consistently correct is cell production, due to its complexity. Therefore, this process inherently generates most scrap. For the cell, S&P Global Mobility estimates a rate of 4-12% scrap for steady production, based on the type of supplier and cell type. But that number can be as high as 15-30% for companies in their start-up phase. In contrast, for the battery module and pack, a 0.5% to 1.5% scrap rate is closer to the norm.

However, production scrap may see a diminishing rate of return based on optimization of manufacturing processes, changing battery chemistries, and even the evolution of the shape of the battery cell.

Recycling is projected to provide significantly more battery metals over the next 10 years. In 2023, around 40,000 metric tons of nickel and 8,400 metric tons of cobalt will be recovered from recycled lithium ion (Li-ion) batteries and production scrap globally. Nickel will see a 28.1% compound annual growth rate (CAGR) to around 382,000 metric tons by 2032, while cobalt will increase by a 22% CAGR to 51,000 metric tons, according to S&P Global Mobility analysis.

As a result, recycled cobalt from EOL recycled batteries and production scrap is expected to meet more than 21% of the global cobalt demand in 2032, up from around 12% in 2023. More than 19% of the total demand of nickel in 2032 is expected to be met from these recycled sources.

The economics of EV battery recycling

Even though there will be an estimated 95 million out-of-warranty electric vehicles by 2033, it's not a straightforward equation for high-voltage battery recyclers. Although recycling requires less energy and generates less pollution compared with mining, the economics of recycling may not always be favorable without policy support.

A recent report by S&P Global Mobility (subscription required) noted that differing regional government policies can hinder consistent strategic plans for OEMs. For example, while the EU passed regulations in July 2023 mandating EV battery recycling, the US does not have similar legislation in place - opting instead for incentives for manufacturing with local content, as outlined in its Inflation Reduction Act.

Western OEMs and suppliers must also contend with the ascendancy of mainland China - the largest market for end-of-life new-energy vehicles (NEVs) - which is projected to dominate the skyrocketing recycling scene. Total production scrap is expected to rise from 40 GWh in 2023 to 135 GWh in 2032, with end-of-life batteries expected to rise from 16 GWh in 2023 to 438 GWh in 2032, according to S&P Global Mobility analysis.

Despite the size of the Chinese market, there is little opportunity for new, foreign players to enter the battery-recycling business there. The 10 largest hydrometallurgy battery recycling plants in mainland China already process a total of more than 1 megaton of batteries. In addition, in 2022, China had nearly 8,000 recycling players (each with more than RMB 10m, or $1.5m, in registered capital); that number grew to 20,000 in 2023. Most of these firms currently focus on production scrap, but EOL recycling is projected to exceed production scrap in China in 2026, and in the rest of the world in 2027.

As such, recyclers looking to get into the game will likely have better chances and more opportunity setting up shop in the EU and US, the S&P Global Mobility report stated.

Not that EOL recycling is an easy task. Changes in EV battery systems will potentially make recycling more difficult. Dismantling the pack, the crucial step in pre-treatment for recycling, is labor intensive in that it must be done manually for a high-voltage battery cell and module. That will become more complicated as the industry moves from cell/module/pack to cell/pack - where the cell body will be nearly impossible to disassemble manually because of its module configuration. And by 2030 the pack and body configuration is set to be in nearly 50% of EVs.

Changing battery chemistries affect processes

Availability of metals for recycling will vary significantly by region and technology rollout. Owing to current demand for lithium iron phosphate (LFP) batteries, mainland China will generate a much higher availability of lithium from recycled batteries than other regions. But the availability of cobalt and nickel will be much lower for those batteries.

However, growth in demand for new-tech nickel cobalt manganese (NCM) batteries in mainland China will ramp up much faster than LFP batteries - thus increasing nickel recovered from EOL batteries in the long term.

North America will have a stronger share of high-nickel batteries. Between 2023 and 2032, availability of cobalt, nickel, and lithium from EOL batteries and production scrap should grow at CAGRs of 23.8%, 26.2% and 27.3%, respectively, according to S&P Global Mobility estimates.

The US will likely be among the most active markets moving toward cobalt-free Li-ion batteries, which will keep the demand for cobalt from the region in check.

Europe is expected to have the highest levels of battery recycling across all regions until the end of the decade, owing to tightening local-sourcing regulations. Between 2023 and 2032 in Europe, the availability of cobalt, nickel, and lithium from EOL batteries and production scrap will likely grow at CAGRs of 24.7%, 33.4% and 32.1%, respectively.

Other than just serving as a source for critical battery raw materials, recycling will play a key role in reducing the environmental impact of batteries. During the life cycle of an EV, battery cell manufacturing and raw material mining make the largest contribution toward CO2 emissions. As such, battery recycling can be seen as a win on the sustainability front, as it will improve the mine-to-wheel ESG score for EVs.

Matthew Beecham and Srikant Jayanthan contributed to this report.

FOR MORE FROM OUR BATTERY FORECASTING TEAM

AUTOMOTIVE AFTERMARKET INSIGHTS

This article was published by S&P Global Mobility and not by S&P Global Ratings, which is a separately managed division of S&P Global.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: http://www.spglobal.com/mobility/en/research-analysis/ev-raw-materials-supply-crunch-battery-recycling.html

- :has

- :is

- :not

- :where

- ][p

- $UP

- 000

- 1

- 10

- 10m

- 12

- 16

- 2%

- 20

- 2022

- 2023

- 2026

- 2030

- 23

- 24

- 26

- 27

- 28

- 32

- 33

- 40

- 400

- 438

- 51

- 8

- a

- About

- access

- accessing

- According

- Accounts

- across

- Act

- active

- addition

- affect

- All

- already

- also

- alternative

- Although

- always

- america

- among

- an

- analysis

- and

- announced

- annual

- ARE

- around

- article

- AS

- aspect

- At

- attention

- audi

- automakers

- automotive

- availability

- available

- based

- batteries

- battery

- battery production

- BE

- because

- become

- been

- begin

- Better

- between

- body

- both

- Broke

- business

- but

- by

- CAGR

- CAN

- capital

- car

- cell

- certain

- chain

- challenge

- chances

- Changes

- changing

- check

- China

- chinese

- Chinese market

- closer

- co2

- co2 emissions

- Companies

- compared

- complexity

- complicated

- components

- Compound

- concerned

- Concerns

- Configuration

- Congo

- consistent

- consistently

- consists

- content

- contrast

- contributed

- contribution

- controls

- correct

- Costs

- countries

- create

- critical

- crucial

- crunch

- Current

- Currently

- cycle

- decade

- DEFICIT

- Demand

- democratic

- Despite

- differing

- difficult

- diminishing

- dismantling

- Division

- do

- does

- dominate

- done

- down

- drive

- due

- during

- each

- Early

- easy

- Ecological

- Economics

- Electric

- electric car

- electric vehicles

- electrolytes

- Emissions

- end

- energy

- Enter

- environmental

- Equivalent

- ESG

- established

- estimated

- estimates

- EU

- Europe

- EV

- EV batteries

- Even

- evolution

- evs

- example

- exceed

- expected

- factories

- faster

- favorable

- firms

- Focus

- followed

- For

- Forecast

- foreign

- from

- game

- generate

- generated

- generates

- Germany

- get

- Global

- global market

- Globally

- Government

- grew

- Ground

- Grow

- Growth

- had

- Have

- having

- heavily

- High

- higher

- highest

- hinder

- HTML

- HTTPS

- huge

- Humanitarian

- Impact

- impossible

- improve

- in

- Incentives

- includes

- Increase

- increased

- increasing

- industry

- inflation

- inherently

- instead

- Integrating

- into

- investing

- issues

- IT

- ITS

- July

- just

- Keep

- Key

- labor

- large

- largest

- Legislation

- less

- levels

- Life

- likely

- lithium

- little

- local

- Long

- looking

- looming

- lower

- Macroeconomic

- mainland

- mainland china

- make

- managed

- mandating

- manually

- manufacturing

- Market

- Markets

- material

- materials

- May..

- mechanical

- Meet

- met

- Metals

- metric

- Middle

- million

- mineral

- mines

- Mining

- mobility

- module

- more

- most

- moves

- moving

- much

- must

- Natural

- nearly

- New

- next

- Nickel

- North

- north america

- noted

- number

- of

- on

- Operations

- Opportunity

- optimization

- or

- Other

- our

- outlined

- over

- Pack

- part

- partnered

- partnerships

- passed

- phase

- Place

- plans

- plant

- plants

- plato

- Plato Data Intelligence

- PlatoData

- Play

- players

- policies

- policy

- Pollution

- potentially

- pressure

- process

- processes

- Production

- projected

- projections

- provide

- published

- put

- quality

- Ramp

- Rate

- ratings

- Raw

- recent

- recycled

- recycling

- reducing

- reduction

- refined

- refining

- regarding

- region

- regional

- regions

- registered

- regulations

- Rejected..

- rely

- report

- Republic

- required

- requires

- reserves

- Resources

- respectively

- response

- REST

- result

- return

- Rise

- RMB

- Role

- rollout

- s

- S&P

- S&P Global

- scene

- scheduled

- score

- securing

- see

- seen

- serving

- set

- setting

- several

- Shape

- Share

- Shop

- should

- significantly

- similar

- Size

- Source

- Sources

- Sourcing

- standards

- Start-up

- stated

- steady

- Step

- straightforward

- Strategic

- stronger

- subscription

- such

- supplier

- suppliers

- supply

- supply chain

- support

- surplus

- Sustainability

- Systems

- Task

- Technology

- term

- Tesla

- than

- that

- The

- the world

- their

- There.

- therefore

- These

- this

- those

- though?

- Thus

- tightening

- to

- tons

- Total

- toward

- Turning

- type

- until

- us

- variety

- Vehicles

- vertically

- volkswagen

- was

- we

- which

- while

- will

- win

- with

- without

- world

- year

- years

- zephyrnet