Almost one year ago, Sens. Chuck Schumer (D-N.Y.) and Joe Manchin (D-W.Va.) announced a new piece of legislation on the Senate floor — the Inflation Reduction Act (IRA). The 759-page bill was unprecedented in its design to tackle rising inflation, Medicare costs and climate initiatives.

For the first time in decades, a piece of climate legislation with major funding was not only introduced, but likely to pass the Democratic-controlled House and Senate before landing on President Joe Biden’s desk.

Before that happened though, I had some questions. It’s not often a bill with an estimated $369 billion of climate initiatives stands a chance, and I wanted to know what exactly to expect should the IRA actually become law.

So as we gear up to commemorate the one-year anniversary of the IRA, I thought it beneficial to start by answering some of my initial questions.

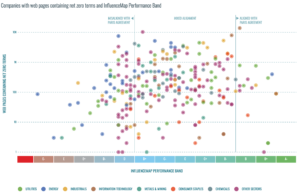

Will the bill’s proposed tax credits benefit emerging technology companies or bolster already established corporations?

The simple answer: Yes. Both startups and corporations — whether via corporate venture capital arms or direct tax incentives for changed practices — received a wave of funding for climate tech-related activities.

For example, in February, Ford Motor Co. took advantage of the IRA’s 45X Advanced Manufacturing Production Credit — designed to support the development of a domestic supply chain for renewable energy technology and energy storage — by announcing a $3.5 billion investment to build an electric vehicle battery plant in Michigan. The main draw of 45X is a tax credit of $45 per kilowatt-hour for every battery module produced. Ford is estimating that the plant will employ about 2,500 by 2026.

Over the past year, GreenBiz has covered examples of both startup and corporate ecosystems benefiting from the law:

As explained previously, the number of funding deals for women-led businesses is still abysmally low, and the current data doesn’t break down the number of businesses led by entrepreneurs who are Black, Indigenous or people of color. Will the ability to take advantage of the financial incentives include diversity and equity requirements?

According to a study from the Just Solutions Collective, the IRA provisions around $40 billion total for environmental justice provisions, with 7.1 percent of the bill’s total tax revenues, expenditures and appropriations going to environmental justice. That includes the Clean Electricity Investment Tax Credit (48E) and the Increase in Energy Credit for Solar and Wind Facilities Place in Service in Connection with Low-Income Communities Tax Credit (48E(h)).

Who will oversee the permitting and pipeline development process? Federal agencies? Or will it be on a state-to-state basis?

So this answer is slightly complicated. Permitting reform wasn’t covered in the IRA, but instead left (contentiously) unaddressed until the passage of the debt ceiling bill in June. So, technically, we do have an answer to this question — a specific office designated under the National Environmental Policy Act was created to review and pass judgment on permitting applications — just not within the IRA.

It was reported that Alaskan land and the Gulf of Mexico will be available for new oil and gas drilling leases. Will the influx of previously unavailable fossil fuels affect the market for renewable energy in deference to the familiar oil and gas? If yes, is there a contingency plan in place to combat that particular effect on the market?

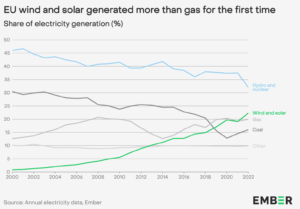

The nuanced answer to this set of questions requires more than a simple yes or no. Since the passing of the IRA, renewable and clean energy deals have skyrocketed, with a total of 29 deals worth $30.1 billion announced, according to a PWC report.

And the outlook for the future of renewable energy is bright. A recent report from IREC estimates that the total number of solar jobs in the United States will reach 530,000 by 2032, up from 263,883 as of December. Meanwhile, researchers from Dartmouth and Princeton estimate that the combination of the IRA’s clean energy tax credits and the aforementioned 45X manufacturing tax credit will create a total of 1.6 million additional solar and wind jobs by 2035.

So, no. The influx of previously unavailable fossil fuels isn’t negatively affecting the renewable energy marketplace. Could those numbers be even higher if fossil fuels were actively phased out instead of granted special provisions to appease Sen. Manchin? We’ll never know.

But we do know that oil companies aren’t wasting their moment of reprieve.

In March, fossil fuel companies secured leases for 1.6 million acres in the Gulf of Mexico while the Biden administration approved the Willow drilling project in Alaska. And in July, the Guardian reported that oil juggernauts such as BP scaled back emissions reductions goals, ExxonMobil withdrew funding from a project to convert algae into a low-carbon fuel and Shell announced that it would not increase its investments into renewable energy this year.

Additionally, Exxon CEO Darren Woods confirmed at an industry conference that Exxon was planning to double U.S. oil production in the next five years.

So is there a contingency plan within the IRA to combat a revival of fossil fuels? No. It could be argued that the IRA itself is the contingency plan, but considering the law is the actor throwing a lifeline to the fossil fuel industry, that argument falls flat.

What does the word "manufacturing" mean in the context of the IRA? Literal construction of solar panels and wind turbines? Or just energy production?

All of the above. The IRA prioritizes the domestic construction of renewable energy components with multiple tax credits, such as 45X and the Advanced Energy Project Investment Tax Credit (48C ITC), which provides a tax credit for purchasing and commissioning property to build an industrial or manufacturing facility. A list of eligible solar and battery components can be found here, and a list of eligible wind turbine components can be found here.

What’s happening with the corporate alternative minimum tax (CAMT), or the 15 percent tax for corporations with an income of $1 billion or more?

This question is the topic I’ve heard the least about since the IRA’s passage. Since CAMT began Dec. 31 to take full effect in the 2023 tax year, it's safe to assume that news from corporations on its impact won’t emerge until after the first official tax year concludes. As of July, the most substantial update I’ve noticed is the IRS granting penalty relief for the first year of the tax. “Considering the challenges associated with determining the amount of a corporation’s CAMT liability and whether a corporation is an applicable corporation subject to the CAMT,” the IRS will waive the penalty fee associated with a corporation’s failure to pay the income tax, according to an IRS announcement.

[Want more great analysis of climate tech and innovation? Sign up for Climate Tech Rundown, our free email newsletter.]

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.greenbiz.com/article/looking-back-inflation-reduction-act

- :has

- :is

- :not

- $1 billion

- $3

- $UP

- 000

- 1

- 15%

- 2023

- 2026

- 31

- 500

- 7

- a

- ability

- About

- above

- acres

- Act

- actively

- activities

- actually

- Additional

- administration

- advanced

- ADvantage

- affect

- affecting

- After

- agencies

- ago

- alaska

- already

- alternative

- amount

- an

- analysis

- and

- Anniversary

- announced

- Announcement

- Announcing

- answer

- applicable

- applications

- appropriations

- ARE

- argued

- argument

- arms

- around

- AS

- associated

- assume

- At

- available

- back

- basis

- battery

- BE

- become

- before

- began

- beneficial

- benefit

- benefiting

- biden

- Biden Administration

- Bill

- Billion

- Black

- bolster

- both

- BP

- Break

- Bright

- build

- businesses

- but

- by

- CAN

- capital

- ceiling

- ceo

- chain

- challenges

- Chance

- changed

- clean energy

- Climate

- CO

- Collective

- color

- combat

- combination

- Communities

- Companies

- complicated

- components

- Conference

- connection

- considering

- construction

- context

- convert

- Corporate

- corporate venture capital

- CORPORATION

- Corporations

- Costs

- could

- covered

- create

- created

- credit

- Credits

- Current

- Darren

- data

- Deals

- Debt

- decades

- December

- Design

- designated

- designed

- desk

- determining

- Development

- direct

- Diversity

- do

- does

- Doesn’t

- Domestic

- double

- down

- draw

- Ecosystems

- effect

- Electric

- electric vehicle

- electricity

- eligible

- emerge

- emerging

- Emerging Technology

- Emissions

- energy

- entrepreneurs

- environmental

- Environmental policy

- EPA

- equity

- established

- estimated

- estimates

- Even

- Every

- exactly

- example

- examples

- expect

- explained

- facilities

- Facility

- Failure

- Falls

- familiar

- February

- Federal

- fee

- financial

- First

- first time

- five

- flat

- Floor

- For

- Ford

- fossil

- Fossil fuel

- fossil fuels

- found

- Free

- from

- Fuel

- fuels

- full

- funding

- funding deals

- future

- GAS

- Gear

- Goals

- going

- granted

- granting

- great

- guardian

- had

- happened

- Happening

- Have

- heard

- higher

- House

- HTML

- HTTPS

- i

- if

- Impact

- in

- Incentives

- include

- includes

- Income

- income tax

- Increase

- industrial

- industry

- inflation

- influx

- initial

- initiatives

- Innovation

- instead

- into

- introduced

- investment

- Investments

- IRA

- IRS

- IT

- ITS

- itself

- Jobs

- joe

- jpg

- July

- june

- just

- Justice

- Know

- Land

- landing

- Law

- least

- Led

- left

- Legislation

- liability

- likely

- List

- looking

- Low

- low-carbon

- Main

- major

- manufacturing

- March

- Market

- marketplace

- mean

- Meanwhile

- Medicare

- Mexico

- Michigan

- million

- minimum

- module

- moment

- more

- most

- Motor

- multiple

- my

- negatively

- never

- New

- news

- Newsletter

- next

- no

- number

- numbers

- of

- Office

- official

- often

- Oil

- Oil and Gas

- on

- ONE

- only

- or

- our

- out

- Outlook

- oversee

- panels

- particular

- pass

- passage

- Passing

- past

- Pay

- People

- per

- percent

- Phased

- piece

- pipeline

- Place

- plan

- planning

- plato

- Plato Data Intelligence

- PlatoData

- policy

- practices

- president

- previously

- princeton

- process

- Produced

- Production

- project

- property

- proposed

- provides

- purchasing

- PWC

- question

- Questions

- reach

- received

- reduction

- reductions

- reform

- relief

- Renewable

- renewable energy

- report

- Reported

- Requirements

- requires

- Reuters

- revenues

- review

- rising

- s

- safe

- Senate

- service

- set

- Shell

- should

- sign

- Simple

- since

- So

- solar

- solar panels

- Solutions

- some

- special

- specific

- stands

- start

- startup

- Startups

- States

- Still

- storage

- subject

- substantial

- such

- supply

- supply chain

- support

- tackle

- Take

- tax

- tax credit

- tech

- technically

- Technology

- technology companies

- than

- that

- The

- The Future

- the Law

- their

- There.

- this

- this year

- those

- though?

- thought

- Throwing

- time

- to

- took

- topic

- Total

- turbine

- u.s.

- under

- United

- United States

- unprecedented

- until

- Update

- vehicle

- venture

- venture capital

- via

- want

- wanted

- was

- Wave

- we

- were

- What

- whether

- which

- while

- WHO

- will

- wind

- wind turbine

- with

- within

- Woods

- Word

- worth

- would

- year

- years

- yes

- zephyrnet