And how should you navigate the red seas?

Unless you’ve been living under a rock for the last week, you’ve probably witnessed a colossal collapse of the NFT market, specifically, for PFP projects.

Sure there’s been some recovery, but if we zoom out even further, we’ve been in a downwards death spiral for many, many months actually.

It’s probably worth looking why this might be happening and how to put together a framework and strategy for surviving the bear.

In this Newsletter I’m going to cover:

-

The NFT Market Collapse

-

Ponzinomics / NFTs as Meme Coins

-

External Dependencies

-

What would I be buying in this market?

-

Mental Fortitude

This Newsletter is sponsored by the HeyMint launchpad, the most comprehensive and gas efficient no-code toolbox for creating and launching an NFT collection.

Whether you’re an independent artist, a project founder or a large-scale creator, HeyMint is the answer to your NFT needs.

I personally use and love this product — all ZenAcademy NFTs are released using HeyMint. Try them out here, and support this Newsletter in the process.

If you’d like to sponsor this Newsletter and have your company seen by 20,000+ crypto enthusiasts, please reach out to hello@zenacademy.com.

The NFT market collapse

Go back to 2021 and listen to literally anyone half-brained that was commenting on the space and you’d hear the same: 99% of projects are going to zero.

So how surprising is it really that we’re seeing a lot of projects trend towards zero?

The reality is that the vast, vast, vast majority of NFT projects are built on nothing more than hype, speculation, and ponzinomics. A veritable house of cards.

Combine a monstrous oversupply with a macro bear and near all-time low worldwide interest in NFTs, and it starts to paint a pretttty bad picture.

ETH and Bitcoin pumping doesn’t do much to help either, and there are even concerns that the marketplace wars and incentive structures are damaging floors.

Okay so this all explains why NFTs might be tanking in a grander sense. On a shorter term time frame, we can probably single-handedly point at Azuki for beginning the recent collapse.

They ran a FOMO-inducing, mass-liquidity-extracting event at a time when the market was already down bad and struggling for liquidity. A 20,000 ETH mint for an additional collection, “Azuki Elementals”. This type of thing would have been absorbed by the market no problem if this were 2021, or even early 2022, but it clearly sent ripples throughout the entire space in the current climate.

What made this significantly worse was the reveal of these Elementals. The art is objectively fantastic, but the issue is that they look incredibly similar to the OG collection, and they did not at all manage expectations well going into the mint. This led to their community being unhappy and a mass exodus from the project.

When you combine a liquidity extracting event with a floor collapse, it is easy for this to become contagious. One of the reasons is that when the space loses faith in one of the largest and most successful to-date projects, they tend to lose faith in all projects. “If Azuki can’t even get it right, what hope does _____ have?”

At the end of the day though there is one and only one reason that prices have been going down (and also why they are going up again a bit over the last 48hrs):

SUPPLY vs DEMAND.

It’s Economics 101 but it truly does boil down to something so simple. Now entire novels could be written on why there might be low or high demand at any given time, and I will try to expand on the point a bit in the next couple of sections – but ultimately this is indeed what it all comes down to.

The supply for all NFTs is continually increasing. The supply for the Azuki ecosystem increased significantly. The demand for NFTs as a whole are at all time lows. Do the math, it is not rocket science here to see why numbers go down a lot.

It has also been all-the-more amplified by the adoption of lending + borrowing against NFTs. Numerous protocols have emerged over the last 6 months that have made it increasingly easier for people to take loans out against their NFTs, and effectively leverage their exposure to the NFT market. This can lead to higher highs but also much lower (and swifter) lows, especially when mass liquidations occur.

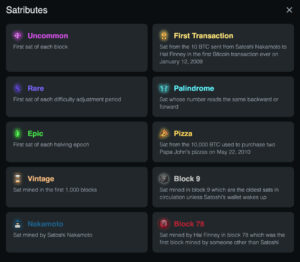

Ponzinomics / NFTs as Meme Coins

A couple of months ago I wrote an entire Letter on this topic, so I won’t rehash everything and instead encourage people to give that a read. But I wanted to re-mention it here because back then it was mentioned in the context of meme coin season, and now, it is worth looking at as a standalone idea.

The harsh reality of NFTs, like most things people buy, but especially most things people buy in the crypto space, is that the vast majority of purchasing is done with a view to make money.

People buy a thing because they want to, at some point in the future, sell the thing to someone else at a higher price. That might not be the ONLY reason they buy the thing, it might not even be the majority reason. But I think if most people are being truly honest, it is part of the reason.

So now we have an ecosystem where everyone is buying things hoping to sell to other people at higher prices. They have a word for these things…

The issue is further complicated with airdrops and free claims of more “things”. Yes there IS underlying value to a lot of these assets – as art, as collectibles, as membership tokens to a community, as IP, as status symbols.

But how much is all of that really “worth”, for any given NFT in any given collection? Nobody knows, and nobody can know. All we can know is what the market decides to price things at. It’s worth noting as well that market is very irrational and can remain irrational for very long periods of time.

At the end of the day the price value of a thing is what someone else is willing to pay for it. We are seeing this play out in real time. It is a fascinating experiment to watch, and to be a part of, and I have no idea where things will settle or end up.

I truly believe there is cultural value in a tonne of NFTs, that there is art value in a tonne of NFTs, and that there is value to being a member of many of these NFT communities. What is the price value of such things though?

Alas, my crystal ball is for decorative purposes only.

Nobody knows; nobody can know.

External Dependencies

This is something I think far too few people think about.

What are external dependencies? Basically — if the value of a thing is reliant on a person or team of people to “do stuff” in order for that value to be maintained (or for it to appreciate), the value is dependent on external factors.

The opposite is internal dependencies, where there is no centralized entity required to act in order for the price of a thing to do well. The value is in the thing itself, not in the “utility” of it.

A simple cheatsheet is: if the project has a roadmap, it has external dependencies.

A good comparison is Crypto Punks vs Bored Apes. The value of Punks is largely in being historical, cultural, collectible, pieces of art. Nobody buys a Punk expecting airdrops, or events, or a metaverse, or a game. They are status symbols and collectors items.

The value of a Bored Ape is largely in the hopeful future utility that Yuga Labs will provide. Airdrops, tokens, staking. Games, a metaverse. Access to events, virtual and IRL. Partnerships, collaborations. Utility. Yes they are also art, and status symbols, but those are not the majority elements of the tokens. You can say the same for Azuki, Doodles, Moonbirds, DeGods, etc.

There is nothing wrong with a project having external dependencies.

I want to make sure to highlight this fact. There is nothing at all wrong with it — indeed, if a project with external dependencies can pull off what they’re going for, the ceiling may be higher than that of a purely collectible project that “does nothing”.

IF.

That one little word is so loaded and makes such a huge difference. If they can do all these things, and continue doing all these things, and the community like that they’re doing all these things that they’re continuing to do – GREAT. If not… well, that’s when things spiral downwards; quickly.

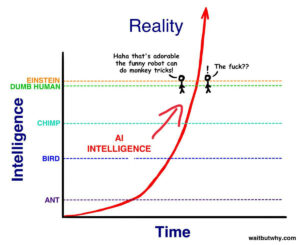

There is execution risk when it comes to holding a project with a team, with a roadmap. If they execute well, great. If not, yikes. This is compounded all the more when you consider the Impossible Expectations our space places on these projects.

It might be that the potential ceiling is higher for a project with external dependencies, but that the potential to go to zero or near-zero is also higher. Basically, higher risk, higher reward (an important thing to note is that the reward is not necessarily proportional to the risk).

We saw this play out when the BAYC floor reached a higher all-time high than the Punk floor, but today, the BAYC floor is lower than the Punk floor.

Higher highs, lower lows.

For an excellent further read into this idea, I highly recommend taking this time to read this post by Derek Edws: Storing Value in Digital Objects.

What would I be buying in this market?

We all know the old adage – if for no other reason than I have mentioned it several times previously in this very Newsletter. But for those who might be new..

“Be fearful when others are greedy, and greedy only when others are fearful.” – Warren Buffett

Now of course this is all relative. Just because something is down 90% doesn’t mean it can’t go down another 90%, or another 90% after that. But it is certainly a better time to consider buying things when they have precipitously dropped in price and when general sentiment is at all time lows.

If you have conviction in a project, if you really believe in it, and if you somehow have liquidity left to fire off — this is a good time to be looking.

I cannot tell you what to buy. You need to have your own conviction and thesis for purchasing, because without that, you are probably going to capitulate at the first sign of weakness (or the second, or the third). You will not be able to sleep well at night if the prices are fluctuating if you bought a thing just because someone else told you to buy the thing.

I can suggest though to take some time to look over the market and see what deals there might be out there. Come up with a list of things that you want to keep an eye on. Make some stink bids, put out some offers, and as always, only spend what you can reasonably afford to lose.

I personally believe this is a good time to be buying things with little-to-no external dependencies: pure art, pure collectibles.

The types that have no ponzinomics involved, preferably.

If you are looking for the higher risk plays and want to bet on teams with roadmaps: look for ones that have figured out a sustainable revenue stream, or at least have a strong path towards one. Look for ones whose founders have vision, and passion, and the ability and expertise to execute.

Execution risk is made far less risky if you bet on people with a proven record of executing well.

Mental Fortitude

Last but certainly not least. This is a trying market. It has battered and bruised the best of us. I know a lot of people who have left the space, down and out. Trading anything is not for the faint hearted. Most humans are not successful traders, and would do better to buy and hold some low-risk basket of assets, both financially and emotionally.

Trading NFTs is monumentally riskier than most other assets. Short term, long term, whatever; you’re gonna see insane swings in every direction, both in the price of the NFT itself and that of the underlying currency (ie ETH).

Don’t be too hard on yourself if you’ve lost money. If you made a lot, and lost it all, and then some. If you’re in debt. It sucks, I know. Nobody can change the past but we can at least hope to learn from it, and use what we have learned to better prepare for the future.

I have written extensively on this topic before, and can highly recommend reading some of my previous Letters:

Infinite Regret (a must read)

Red Candles (June 2022)

The Current Bear Market (September 2021, lol)

The Mental Game of NFTs (July 2021)

Thanks for reading! If you enjoyed this, please consider subscribing – I send out a free Newsletter every week with my thoughts on the market and deep dives on interesting topics related to web3.

If you want to take it a step further, pick up a free ZenAcademy Student ID and hop into our Discord server to join the conversation.

If you want to take it another step further, consider buying a ZenChest — our paid membership token that will get you access to our upcoming PFP project, as well as additional utility within our content/education-based ecosystem.

Finally, if you want to join my most exclusive community with direct access to me and the ability to schedule video calls with me, consider a 333 Club Pass.

No matter the path you take – I would absolutely love to have you as part of ZenAcademy. We are a community of lifetime learners.

We prefer book clubs over night clubs 📚

Disclaimer: The content covered in this newsletter is not to be considered as investment advice. I’m not a financial adviser. These are only my own opinions and ideas. You should always consult with a professional/licensed financial adviser before trading or investing in any cryptocurrency related product.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://zeneca33.substack.com/p/letter-42-why-did-the-nft-market

- :has

- :is

- :not

- :where

- $UP

- 000

- 07

- 1

- 10

- 14

- 15%

- 16

- 20

- 2021

- 2022

- 24

- 7

- 72

- 9

- a

- ability

- Able

- About

- absolutely

- access

- Act

- actually

- Additional

- Adoption

- advice

- After

- again

- against

- ago

- Airdrops

- All

- all-time low

- already

- also

- always

- Amplified

- an

- and

- Another

- answer

- any

- anyone

- APE

- Apes

- appreciate

- ARE

- Art

- artist

- AS

- Assets

- At

- auto

- Azuki

- back

- Bad

- ball

- Basically

- basket

- bayc

- BE

- Bear

- because

- become

- been

- before

- Beginning

- being

- believe

- BEST

- Bet

- Better

- Bit

- Bitcoin

- blockchain

- body

- book

- Bored

- BORED APE

- Bored Apes

- Borrowing

- both

- bought

- built

- but

- buy

- Buying

- Buys

- by

- call

- Calls

- CAN

- cannot

- Cards

- ceiling

- centralized

- certainly

- change

- claims

- clearly

- Climate

- club

- clubs

- Coin

- collaborations

- Collapse

- Collectible

- collectibles

- collection

- collectors

- COM

- combine

- come

- comes

- Commenting

- Communities

- community

- company

- comparison

- complicated

- comprehensive

- Concerns

- Consider

- considered

- content

- context

- continually

- continue

- continuing

- Conversation

- conviction

- could

- Couple

- course

- cover

- covered

- Creating

- creator

- crypto

- Crypto Punks

- crypto space

- cryptocurrency

- Crystal

- cultural

- Currency

- Current

- damaging

- day

- Deals

- Death

- Death Spiral

- Debt

- deep

- DeGods

- Demand

- dependent

- DID

- difference

- digital

- direct

- Direct access

- direction

- discord

- do

- does

- Doesn’t

- doing

- done

- Doodles

- down

- dropped

- Early

- easier

- easy

- Economics

- ecosystem

- effectively

- efficient

- either

- elements

- else

- emerged

- encourage

- end

- enthusiasts

- Entire

- entity

- especially

- etc

- ETH

- Even

- Event

- events

- Every

- everyone

- everything

- Exclusive

- execute

- executing

- Exodus

- Expand

- expectations

- expecting

- experiment

- expertise

- Explains

- Exposure

- extensively

- external

- eye

- fact

- factors

- faith

- false

- fantastic

- far

- fascinating

- few

- figured

- financial

- financially

- Fire

- First

- Floor

- For

- founder

- founders

- FRAME

- Framework

- Free

- from

- further

- future

- game

- Games

- GAS

- General

- get

- Give

- given

- Go

- going

- good

- great

- Greedy

- Happening

- Hard

- Have

- having

- hear

- help

- here

- High

- higher

- Highlight

- highly

- Highs

- historical

- hold

- holding

- hope

- hopeful

- hoping

- House

- How

- How To

- HTTPS

- huge

- Humans

- Hype

- i

- idea

- ideas

- if

- image

- important

- in

- Incentive

- increased

- increasing

- increasingly

- incredibly

- independent

- INSANE

- instead

- interest

- interesting

- internal

- into

- investing

- investment

- involved

- IP

- irl

- issue

- IT

- items

- itself

- join

- July

- june

- just

- Keep

- Know

- Labs

- large-scale

- largely

- largest

- Last

- launching

- lead

- LEARN

- learned

- least

- Led

- left

- lending

- less

- letter

- Leverage

- lifetime

- like

- liquidations

- Liquidity

- List

- little

- living

- Loans

- LoL

- Long

- Look

- looking

- lose

- Loses

- lost

- Lot

- love

- Low

- low-risk

- lower

- Lows

- Macro

- made

- Majority

- make

- make money

- MAKES

- manage

- many

- Market

- Mass

- math

- Matter

- May..

- me

- mean

- member

- membership

- meme

- meme coin

- mental

- mentioned

- Metaverse

- might

- mint

- money

- months

- Moonbirds

- more

- most

- much

- must

- Must Read

- my

- Navigate

- Near

- necessarily

- Need

- needs

- New

- Newsletter

- next

- NFT

- NFT collection

- nft market

- NFT projects

- NFTs

- night

- no

- nothing

- noting

- now

- numbers

- numerous

- occur

- of

- off

- Offers

- Old

- on

- ONE

- ones

- only

- Opinions

- opposite

- or

- order

- Other

- Others

- our

- out

- over

- own

- paid

- paint

- part

- partnerships

- passion

- past

- path

- Pay

- People

- periods

- person

- Personally

- pfp project

- pick

- picture

- pieces

- Places

- plato

- Plato AiStream

- Plato Data Intelligence

- PlatoAiCast

- PlatoData

- Play

- plays

- please

- Point

- Post

- potential

- prefer

- Prepare

- previous

- previously

- price

- Price Value

- Prices

- probably

- Problem

- process

- Product

- project

- projects

- protocols

- proven

- provide

- pumping

- punks

- purchasing

- purely

- purposes

- put

- Pyramid

- quickly

- RE

- reach

- reached

- Read

- Reading

- real

- real-time

- Reality

- really

- reason

- reasons

- recent

- recommend

- record

- recovery

- Red

- related

- relative

- released

- remain

- required

- reveal

- revenue

- Reward

- right

- ripples

- Risk

- Risky

- roadmap

- roadmaps

- Rock

- rocket

- rocket science

- round

- same

- saw

- say

- schedule

- Science

- Search

- Season

- Second

- sections

- see

- seeing

- seen

- sell

- send

- sense

- sent

- sentiment

- September

- settle

- several

- Short

- should

- sign

- significantly

- similar

- Simple

- sleep

- So

- some

- Someone

- something

- Space

- specifically

- speculation

- spend

- sponsor

- Sponsored

- Staking

- standalone

- starts

- Status

- Step

- Strategy

- stream

- strong

- Struggling

- Student

- successful

- such

- suggest

- supply

- support

- sure

- surprising

- sustainable

- Swings

- Take

- taking

- team

- teams

- tell

- term

- than

- that

- The

- The Future

- their

- Them

- then

- There.

- These

- thesis

- they

- thing

- things

- think

- Third

- this

- those

- though?

- throughout

- time

- times

- to

- today

- together

- token

- Tokens

- too

- Toolbox

- topic

- Topics

- towards

- Traders

- Trading

- Trend

- Trends

- true

- truly

- try

- type

- types

- Ultimately

- under

- underlying

- upcoming

- us

- use

- using

- utility

- value

- Vast

- very

- Video

- View

- Virtual

- vision

- vs

- want

- wanted

- warren

- was

- Watch

- we

- weakness

- Web3

- week

- WELL

- were

- What

- What is

- whatever

- when

- WHO

- whole

- whose

- why

- will

- willing

- with

- within

- without

- witnessed

- Word

- worldwide

- worse

- worth

- would

- written

- Wrong

- yes

- you

- Your

- yourself

- Yuga

- Yuga Labs

- zero

- zoom