I have learned, and continue to learn, many lessons from our two years of trying to get Argos Education to escape velocity. Learning from failure—especially painful failure—is a process. I expect to write a number of pieces over time as I sort through my experience and get a little distance from it.

The most immediate piece that I feel able to write about today is dealing with venture capitalists. Obviously, I can’t tell you all the secrets to success since we didn’t succeed. I can only tell you some things that I wish I knew sooner.

The core lesson of today’s post is that you’ll stay saner if you think of VC behavior in terms of culture. They have their own constraints, their own customs, and their own ways of doing things. Yes, there will be bad behavior, and yes, some of it will be maddening. I could say the same for customers, partners, and co-workers. Founding a start-up is every bit as painful and exhausting as people will tell you it is.

One of the hardest parts for me was not being able to make sense of what was happening in the moment. There’s definitely a “fog of war” element to it. But the war analogy can be overdone. In reality, each one of the groups I mentioned—VCs, customers, partners, and co-workers—is often embedded in a different culture. Bridging all those cultures is a necessary part of making your company work.

For me, the most alien culture was VC culture. So I’ll share some of what I learned about it and some tips for dealing with it.

VC culture values politeness over bluntness

Former Instructure CEO Josh Coates loved to say “All VCs lie.” I heard him say it a handful of times. Josh is a bit of a bomb thrower, but he’s also a smart guy and a successful serial entrepreneur. So I knew he meant something when made a statement like that.

It turns out he meant most VCs lie.

That’s harsh. I’m going to tone it down momentarily. But let’s stick with Josh’s formulation for a moment. Because I tested that language with a few VCs to see what they thought of it. None of them denied it. Or even protested that it was unfairly harsh. One successful serial entrepreneur, when I told him that a VC firm would be interested in funding us when we reach $X in revenues, replied, “You know how VCs say ‘no,’ right?” The answer, of course, is they give you a revenue target that is sufficiently far away that you definitely won’t hit it for a while.

One former VC who I count as a friend told me he never says “no” directly because it needlessly breaks off the relationship when you might find another way to work together in the future. That seems to be the common, if unspoken, value. They will rarely tell you that your idea is bad. In fact, it’s easy to walk away with the impression that they are impressed with your pitch because they tell you that it’s “interesting.” VCs live in a world where network connections are everything and they’re making a lot of guesses about their investments. If they say, “Let’s talk again when you hit $X in revenue,” they don’t make an enemy of you. And if you surprise them by succeeding they might be able to invest later, when their risk is lower.

Also, saying “no” is hard. I personally couldn’t thrive in a job where I’d have to say “no” to 95% of the entrepreneurs who come to me, passionately and often desperately asking for my help. It must be painful. Instead of saying “no,” the VC community has developed a culture of avoiding saying “yes.”

So if you get an encouraging-sounding answer that amounts to “not yet,” ask a lot of questions and listen to the answers very carefully. Sometimes “not yet” really does mean “not yet.” Sometimes it means “no.” And sometimes it means, “I don’t know what to think of you, so I’m kicking the can down the road.” If you probe and pay attention, you can get better at figuring out what the answer really means.

Sometimes you will feel like you are being lied to. Sometimes you will be lied to. A lot of the time, it’s both more accurate and better for your mental health to think about the obfuscation as a cultural norm. Try not to waste time feeling offended. Instead, focus on trying not to waste time. The best way to tell how serious a VC is about your company is how quickly they follow up. If they don’t, then make a judgment about why. If they’re just not that into you, then think seriously about how much time you’re going to invest in chasing them.

Relatedly, it’s common within VC culture to ghost founders that they don’t want to talk to anymore. I wouldn’t say it’s pervasive; more often than not, it turns out they’ve gone dark because they’ve been overwhelmed with work, some of which they can’t or won’t tell you about. (More on that in a bit.) But genuine intentional ghosting is much more common with VCs than with any other business culture I’ve interacted with. And because it’s common for them to drop out of touch for a while, you often can’t know in the moment whether you’re being ghosted.

As with “not yet,” you will want to pay close attention. Does the VC respond to a follow-up nudge? Does she pop back up randomly from time to time? Or is the silence prolonged and consistent? Don’t give up easily, but try not to spend too much time obsessing. It’s hard to resist. But that way lies madness.

Learn their context

As a first-time founder, there’s a lot I didn’t understand about the VC business (and a lot more I probably still don’t, two years later). For example, I didn’t know how much of their time they spend fundraising. Just as we were out knocking on doors looking for money, they were doing the same. They won’t always tell you that they’re fundraising. But one reason why they might go quiet on you is that they’re off doing exactly what you’re doing. Fundraising for their lives.

It’s not like you’ll never get feedback. You’ll get plenty if you’re persistent and look for it. Much of it will be contradictory. You may well be warned of this in advance. But it is less likely that anybody will tell you why it is happening or how to sort through the mess of conflicting feedback.

Here’s the deal: Different funds have wildly different investment disciplines and therefore are looking for wildly different kinds of pitches from founders. Their public theses don’t tell you enough for you to judge if you’re a likely fit for them or how to pitch them. They have all kinds of constraints about how they need to invest. They have an entire machine that converts a pitch and a spreadsheet into an investment analysis. A lot of that is specific to the circumstances, investment methodology, and leadership personalities at the firm. VCs usually won’t volunteer information about any of that but some will tell you more if you ask. Before you take their advice on how to improve your pitch or change your company’s focus, do everything you can to understand how their own decision-making process works. Some of their advice will be specific to them. If you interpret it as general advice, you may put yourself in worse shape for the next VC that has an entirely different way of working.

Also, be prepared for the process to work differently than advertised. The press loves to cover big deals. Most first-time entrepreneurs are fooled by what they read. I was, and I have more exposure to the business than many. Nobody says, “Look, the last three seed deals you read about were for startups that all had famous founders with previous experience making their investors money. Don’t expect to get that kind of a deal.” Or “You’re going struggle raising in EdTech because many of the investors at this level, including us, are primarily looking to make their money by getting you to the next round. While everybody wants a home run, most of the time we’re swinging for singles and doubles. The payoff for your company is too risky for us in the time frame we care about.” Or “The rules we gave you about why we can’t invest in you right now apply until we get excited or afraid of missing out and decide to throw the rules away.”

Time is money

On multiple occasions, we spoke with VCs who religiously read every word of every long, long, loooooong post I write but were unwilling to give us more than 15 minutes to explain our company. And really, if we didn’t have them in 60 seconds, the next 14 minutes were basically about them being polite. I could rage about this. I have raged about it. I still do on occasion.

But fundamentally, their business is all about deal flow. If they pass on 95% of the pitches they hear, then they need to hear a lot of pitches to find their investments. They don’t have a lot of time, even if they think highly of you as a person. That’s not just about the “hook,” either. Remember that evaluation machine behind the scenes that I mentioned? They’re listening for the bits of information they need to get your start-up through the machine without it getting barfed out. They are listening for particular numbers that matter to them. (Which numbers matter in which ways varies from VC to VC.) They’re thinking about how the individuals on their investment committee will react. Will they understand the pitch? Does it resonate with their own perspectives? Does it bring back bad memories of a failed prior investment?

The better you understand their process, the better off you will be. But you won’t understand much of it most of the time because most VCs don’t have the time or the cultural predisposition to explain it to you. Try to avoid filling the information vacuum with your own narrative. That won’t help. It will just mess with your head.

It’s about your sanity

By this point, regular e-Literate readers may be thinking, “Why is Michael being so charitable and understanding toward VCs? He’s not that nice to anyone!”

(Which is fair.)

The reason is that it’s not about them. VCs are humans, which means that some of them are wonderful, some of them are shits, and a whole lot are in the middle of humanity’s bell curve, just trying to do their job the way the people they work for taught them to do it. The net effect of VC culture can seem like pervasive, horrific gaslighting to a founder. It’s easy to feel angry, resentful, offended, confused, hurt, worthless, and stupid. I felt all of those things at times.

I’m saying, if you’re a founder, you can choose to think about it differently. You might be more successful than we were if you do. You’ll probably be mentally healthier. Try to frame it in your head as culture, process, and business. And try to separate the question of whether they like you from whether they are going to fund you. VCs are not in a position to judge you as a person. They are only in a position to judge the business opportunity that your company represents to their firm. And even within that narrow frame, most of them succeed a relatively small percentage of the time. Their job is to make big decisions about investments based on a small amount of information regarding companies whose critical success factors may well be outside their areas of expertise. This is why they have to hear so many pitches, and why the percentage of their successful investments is typically low. Your company’s survival may depend on their investment decisions. But don’t confuse their decision process with one that can accurately judge your personal value or even the value of your idea. That’s not even its purpose, never mind its actual effect.

You can like the VCs you meet. You can even be friends with some of them. Later. In retrospect, my warm relationships with some VCs probably hurt both my ability to pitch them successfully and my ability to maintain those warm relationships. Remember, VC business culture values politeness and depends on network connections. I didn’t sense the switch flipping from “friendly colleague mode” to “business mode” because the surface behaviors were very similar. But under the hood, they were entirely different. The person across the table from you may be nice, but when they’re doing their job as a VC, at least some of their niceness is performative.

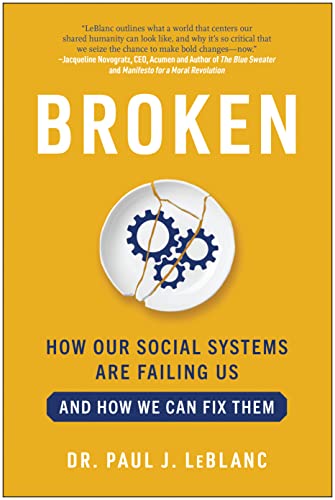

Founders have to crawl across the proverbial broken glass to succeed. Our culture tends to valorize that suffering, which sucks. There’s nothing glorious about pain. But it is real. If you decide to make a go at founding a company you will almost certainly experience prolonged and excruciating pain. That’s part of the deal. Unfortunately, you can easily make it infinitely worse for yourself by buying into the start-up mythology and getting spun around by VC culture. Try to replace any impulse you feel to like and be liked by VCs with a discipline to understand and be understood by them. You’re attempting to broker a transaction with counterparts who operate under particular business constraints and likely inhabit a very different business culture than the one you’re used to. Eyes on the prize and all that.

Don’t add more broken glass to the pile that’s already in the way.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://eliterate.us/lessons-from-a-failed-start-up-vc-culture/

- 95%

- a

- ability

- Able

- About

- about IT

- accurate

- accurately

- across

- advance

- advice

- alien

- All

- already

- always

- amount

- amounts

- analysis

- and

- Another

- answer

- answers

- Apply

- areas

- around

- attempting

- attention

- avoiding

- back

- Bad

- based

- Basically

- because

- before

- behind

- behind the scenes

- being

- Bell

- BEST

- Better

- Big

- Bit

- bomb

- breaks

- bridging

- bring

- Broken

- broker

- business

- Buying

- Can Get

- capitalists

- care

- carefully

- ceo

- certainly

- change

- Choose

- circumstances

- Close

- come

- Common

- community

- Companies

- company

- Company’s

- confused

- Connections

- consistent

- constraints

- continue

- Core

- could

- course

- cover

- critical

- cultural

- Culture

- curve

- Customers

- customs

- dall-e

- Dark

- deal

- dealing

- Deals

- decision

- Decision Making

- decisions

- definitely

- depends

- developed

- different

- directly

- distance

- doing

- Dont

- doors

- down

- Drop

- each

- easily

- Education

- effect

- either

- embedded

- enough

- Entire

- entirely

- Entrepreneur

- entrepreneurs

- evaluation

- Even

- everything

- exactly

- example

- excited

- expect

- experience

- expertise

- Explain

- Exposure

- Eyes

- factors

- Failed

- fair

- famous

- feedback

- few

- Find

- Firm

- fit

- flow

- Focus

- follow

- For Startups

- Former

- founder

- founders

- founding

- FRAME

- friend

- friends

- from

- fund

- fundamentally

- funding

- Fundraising

- funds

- future

- General

- get

- getting

- Ghost

- Give

- glass

- Go

- going

- Group’s

- Guy

- handful

- Hard

- head

- Health

- healthier

- heard

- help

- highly

- Hit

- Home

- hood

- How

- How To

- HTTPS

- Humans

- Hurt

- I’LL

- idea

- immediate

- impressed

- improve

- in

- Including

- individuals

- information

- instead

- Intentional

- interested

- Invest

- investment

- Investments

- Investors

- IT

- Job

- judge

- Kind

- Knocking

- Know

- language

- Last

- Leadership

- LEARN

- learned

- learning

- lesson

- Lessons

- Level

- likely

- Listening

- little

- live

- Lives

- Long

- Look

- looking

- Lot

- loved

- Low

- machine

- made

- maintain

- make

- Making

- man

- many

- Matter

- means

- Meet

- Memories

- mental

- Mental health

- mentioned

- Methodology

- Michael

- Middle

- might

- mind

- minutes

- missing

- moment

- money

- more

- most

- multiple

- NARRATIVE

- necessary

- Need

- net

- network

- next

- number

- numbers

- occasion

- occasions

- ONE

- operate

- Opportunity

- Other

- Our Company

- outside

- overwhelmed

- own

- Pain

- painful

- part

- particular

- partners

- parts

- Pay

- People

- percentage

- person

- personal

- Personalities

- Personally

- perspectives

- piece

- pieces

- Pitch

- pitches

- plato

- Plato Data Intelligence

- PlatoData

- Plenty

- Point

- pop

- position

- Post

- prepared

- press

- previous

- primarily

- Prior

- prize

- probably

- probe

- process

- public

- purpose

- put

- question

- Questions

- quickly

- Rage

- raising

- reach

- React

- Read

- readers

- real

- Reality

- reason

- regarding

- regular

- relationship

- Relationships

- relatively

- remember

- replace

- represents

- Resonate

- Respond

- revenue

- revenues

- Risk

- Risky

- road

- round

- rules

- Run

- same

- scenes

- seconds

- seed

- seems

- sense

- serial

- serious

- Shape

- Share

- Silence

- similar

- since

- small

- smart

- So

- some

- specific

- spend

- Spreadsheet

- spun

- Start-up

- Startups

- Statement

- stay

- Still

- Struggle

- succeed

- success

- successful

- Successfully

- suffering

- Suit

- Surface

- surprise

- Switch

- table

- Take

- Talk

- Target

- terms

- The

- the information

- their

- therefore

- things

- Thinking

- thought

- three

- Thrive

- Through

- time

- times

- tips

- to

- today

- today’s

- together

- TONE

- too

- touch

- toward

- transaction

- typically

- under

- understand

- understanding

- understood

- us

- usually

- Vacuum

- value

- Values

- VC

- VCs

- VeloCity

- venture

- volunteer

- war

- warm

- Waste

- ways

- What

- whether

- which

- while

- WHO

- will

- within

- without

- wonderful

- Word

- Work

- work together

- working

- works

- world

- would

- write

- years

- Your

- yourself

- zephyrnet