Crowdfunding has emerged as a popular method for entrepreneurs and small businesses to raise funds for innovative projects. With its rising popularity, it is crucial for crowdfunding platforms to ensure compliance with KYC (Know Your Customer) regulations. This article explores the importance of KYC compliance and its impact on crowdfunding platforms.

Understanding KYC Compliance

KYC compliance refers to the process of verifying the identity of customers to prevent fraudulent activities, money laundering, and terrorist financing. It involves collecting and analyzing customer information to assess their risk profile. This process allows businesses to ensure that they are transacting with legitimate individuals or entities.

The Significance of KYC Compliance for Crowdfunding Platforms

- Mitigating Risks: KYC compliance helps crowdfunding platforms mitigate various risks associated with fraudulent activities and money laundering. By verifying the identities of crowdfunding participants, platforms can reduce the chances of unauthorized transactions and protect the interests of backers and project creators.

- Building Trust: KYC compliance fosters trust between crowdfunding platforms, project creators, and backers. By implementing robust KYC measures, platforms demonstrate their commitment to security and legitimacy, attracting more participants and increasing their credibility within the crowdfunding ecosystem.

- Legal Compliance: Crowdfunding platforms are subject to regulatory requirements, including anti-money laundering (AML) and counter-terrorism financing (CTF) regulations. KYC compliance ensures that platforms adhere to these obligations, avoiding legal consequences and potential reputational damage.

- Protecting Investors: KYC compliance plays a crucial role in protecting crowdfunding investors. By verifying the identity of project creators, platforms can evaluate their credibility and track record. This allows investors to make informed decisions, reducing the risk of investing in fraudulent or high-risk projects.

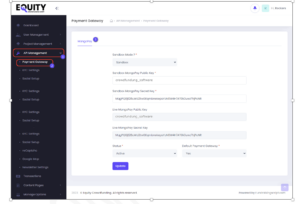

How KYC work in crowdfunding platform ?

[embedded content]

Implementing KYC Compliance Measures

To ensure effective KYC compliance, crowdfunding platforms should consider implementing the following measures:

1. Comprehensive Customer Identification Procedures

Crowdfunding platforms should establish robust customer identification procedures, including the collection of relevant personal and business information. This may involve verifying government-issued identification documents, proof of address, and business registration details.

2. Risk-Based Approach

Platforms should adopt a risk-based approach to KYC compliance. This involves assessing the risk associated with different projects and participants and performing enhanced due diligence on high-risk cases. By tailoring KYC procedures based on risk levels, platforms can allocate resources effectively and streamline the onboarding process.

3. Ongoing Monitoring

KYC compliance is an ongoing process. Crowdfunding platforms should implement systems to monitor customer transactions and detect any suspicious activities. Regular monitoring ensures that platforms stay vigilant and can take immediate action when necessary.

4. Collaboration with Regulatory Authorities

Crowdfunding platforms should collaborate with regulatory authorities to stay updated on the latest compliance requirements. This partnership helps platforms align their KYC processes with regulatory standards, reducing the risk of non-compliance.

In Conclusion

KYC compliance is an essential requirement for crowdfunding platforms. It helps mitigate risks, build trust, ensure legal compliance, and protect the interests of investors. By implementing comprehensive KYC measures and adopting a risk-based approach, crowdfunding platforms can create a safe and secure environment for all participants. Embracing KYC compliance not only strengthens the credibility of crowdfunding platforms but also contributes to the overall growth and stability of the crowdfunding industry.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.fundraisingscript.com/blog/kyc-compliance-a-must-for-crowdfunding-platforms/?utm_source=rss&utm_medium=rss&utm_campaign=kyc-compliance-a-must-for-crowdfunding-platforms

- :has

- :is

- :not

- 1

- 400

- a

- Action

- activities

- address

- adhere

- adopt

- Adopting

- align

- All

- allocate

- allows

- also

- AML

- an

- analyzing

- and

- anti-money laundering

- any

- approach

- ARE

- article

- AS

- assess

- Assessing

- associated

- attracting

- Authorities

- avoiding

- backers

- based

- between

- build

- build trust

- business

- businesses

- but

- by

- CAN

- cases

- chances

- collaborate

- collaboration

- Collecting

- collection

- commitment

- compliance

- comprehensive

- Consequences

- Consider

- content

- contributes

- create

- creators

- Credibility

- Crowdfunding

- crowdfunding platforms

- crucial

- customer

- Customers

- damage

- decisions

- demonstrate

- details

- different

- diligence

- documents

- due

- ecosystem

- Effective

- effectively

- embedded

- embracing

- emerged

- enhanced

- ensure

- ensures

- entities

- entrepreneurs

- Environment

- essential

- establish

- evaluate

- explores

- financing

- following

- For

- fosters

- fraudulent

- funds

- Growth

- helps

- High

- high-risk

- HTTPS

- Identification

- identities

- Identity

- immediate

- Impact

- implement

- implementing

- importance

- in

- Including

- increasing

- individuals

- industry

- information

- informed

- innovative

- interests

- investing

- Investors

- involve

- involves

- IT

- ITS

- Know

- Know Your Customer

- KYC

- KYC (Know Your Customer)

- KYC Compliance

- KYC procedures

- latest

- Laundering

- Legal

- legitimacy

- legitimate

- levels

- make

- May..

- measures

- method

- Mitigate

- money

- Money Laundering

- Monitor

- monitoring

- more

- must

- necessary

- obligations

- of

- on

- Onboarding

- ongoing

- only

- or

- overall

- participants

- Partnership

- performing

- personal

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- plays

- Popular

- popularity

- potential

- prevent

- procedures

- process

- processes

- Profile

- project

- projects

- proof

- protect

- protecting

- raise

- Rate

- record

- reduce

- reducing

- refers

- Registration

- regular

- regulations

- regulatory

- relevant

- requirement

- Requirements

- Resources

- rising

- Risk

- risks

- robust

- Role

- safe

- secure

- security

- should

- significance

- small

- small businesses

- Stability

- standards

- stay

- streamline

- Strengthens

- subject

- suspicious

- Systems

- Take

- terrorist

- terrorist financing

- that

- The

- their

- These

- they

- this

- to

- track

- transacting

- Transactions

- Trust

- unauthorized

- updated

- various

- verifying

- Vote

- when

- with

- within

- Work

- Your

- youtube

- zephyrnet