JNK India has filed its Draft Red Herring Prospectus (DRHP) with the capital market regulator, Sebi. The move aims to secure funds for the company’s Initial Public Offering (IPO). JNK India IPO entails a fresh issue of up to INR 300 crore and an offer for sale (OFS) of up to 84.2 lakh equity shares. Retail investors will be eligible to get 35% of the shares in the upcoming IPO.

The fresh issue’s proceeds are proposed to be used towards the company’s working capital requirements and general corporate pursuits, reinforcing JNK India Ltd.’s foundation for future endeavors.

The company also plans a pre-IPO placement of INR 60 crore. In the event of the pre-IPO placement being successful, final JNK IPO size will be reduced by this amount.

JNK India IPO: OFS Details

The shareholders offloading their shareholding through the OFS include:

- Goutam Rampelli: Up to more than 10 lakh equity shares

- Dipak Kacharulal Bharuka: Up to 8.67 lakh equity shares

- JNK Heaters Co. Ltd: Up to 21.8 lakh equity shares

- Mascot Capital and Marketing Private Limited: Up to 39.4 lakh equity shares

- Milind Joshi: Up to 4.19 lakh equity shares

JNK India IPO: Dominance in Process Fired Heaters

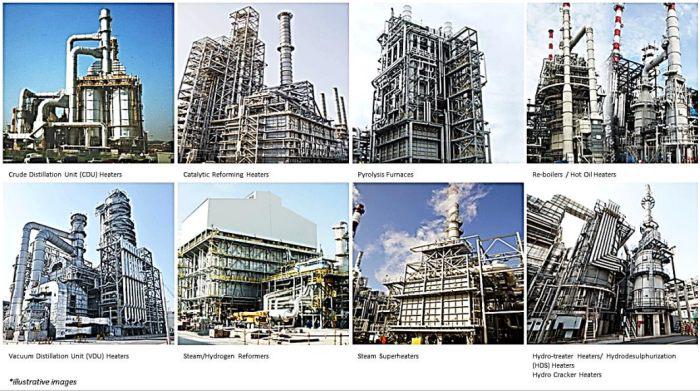

In the realm of heating equipment in India, few companies can match the prowess of JNK India. Specializing in thermal designing, engineering, manufacturing, supplying, installing, and commissioning process-fired heaters, reformers, and cracking furnaces, the company’s capabilities are remarkable.

JNK India stands as a dominant force in India’s process fired heaters sector. Its exceptional market share of approximately 27% in new order bookings during Fiscal 2023 attests to its leadership. During the years spanning from Fiscal 2021 to Fiscal 2023 too, JNK India was the frontrunner in new order bookings.

As of 31 March 2023, the company boasts an impressive order book valued at INR 868.27 crore. This remarkable figure underscores the company’s staggering growth, showcasing a sixfold increase from INR 143.58 crore on 31 March 2021.

Read Also: Groww Vs Angel One: Stock Broker Comparison

JNK IPO: Beyond Heating Equipment

Green Hydrogen Revolution

Under its subsidiary JNK Renewable Energy Private Limited, the company embraces the green hydrogen movement. This innovative approach includes onsite hydrogen production, hydrogen fuel stations, and solar photovoltaic – EPC, all integral components of the green hydrogen value chain. Diversification extends to waste gas handling systems, encompassing flares and incinerator systems.

Global Footprint: Projects and Collaborations

JNK India’s prowess isn’t confined to Indian borders. The company has successfully executed projects in various Indian states and internationally in countries like Nigeria, Mexico, Oman, Algeria, and Lithuania. Its international projects, combined with its domestic ventures, highlight the company’s global impact.

An Enduring Partnership with JNK Heaters

JNK India maintains a steadfast partnership with JNK Heaters, a South Korean company. This collaboration extends to corporate promotion, with JNK Heaters holding a significant stake of 25.79% as per the latest shareholding pattern.

JNK India IPO: All-round Strong Financial Performance

In the fiscal year 2023, JNK India celebrated impressive growth. Consolidated revenue from operations surged by 37.42%, soaring to INR 407.30 crore from the previous year’s INR 296.40 crore. Similarly, net profit also witnessed a remarkable rise, jumping 28.84% from INR 35.98 crore in fiscal 2022 to INR 46.36 crore in fiscal 2023.

JNK India’s income distribution is testament to its diverse operations. The oil and gas sector contributes a significant 77.25% of the company’s income, while the petrochemical industry follows suit with 16.17%. The remaining revenue sources stem from the fertilizer sector and various other industries.

JNK India IPO: Post-Listing Opportunities

As the world’s third-largest oil consumer, India’s appetite for oil is well-known and continues to grow. Projections indicate an estimated oil demand of 11 million barrels per day by 2045. This surge in demand underlines the need for heating equipment across various sectors.

The demand projection is mirrored in the Indian market’s requirements for heating equipment. The period spanning Fiscals 2024 to 2029 anticipates a demand of approximately INR 2,708.90 crore. Within this landscape, petrochemicals, refineries, and fertilizers (urea) are poised to be significant contributors. Further analysis showcases the demand distribution across various equipment categories.

In conclusion, JNK India stands as a formidable player in India’s heating equipment industry. With a legacy of innovation, global collaborations, and a steadfast commitment to quality, the company’s trajectory is marked by success and a vision to shape India’s future heating needs. As such, JNK IPO presents an interesting opportunity for investors.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://ipocentral.in/jnk-india-ipo-drhp-filed-what-you-need-to-know/

- :has

- :is

- $UP

- 1

- 10

- 11

- 16

- 19

- 2021

- 2022

- 2023

- 2024

- 25

- 27

- 28

- 30

- 300

- 31

- 35%

- 36

- 39

- 40

- 46

- 60

- 67

- 700

- 77

- 8

- 84

- 90

- 98

- a

- across

- aims

- All

- also

- amount

- an

- analysis

- and

- Angel

- anticipates

- appetite

- approach

- approximately

- ARE

- AS

- At

- barrels

- BE

- being

- Beyond

- boasts

- book

- bookings

- borders

- broker

- by

- CAN

- capabilities

- capital

- capital requirements

- categories

- celebrated

- central

- chain

- CO

- collaboration

- collaborations

- combined

- commitment

- Companies

- company

- Company’s

- components

- conclusion

- consumer

- continues

- contributes

- contributors

- Corporate

- countries

- day

- Demand

- designing

- distribution

- diverse

- diversification

- Domestic

- Dominance

- dominant

- draft

- during

- eager

- eligible

- Embraces

- encompassing

- endeavors

- enduring

- energy

- Engineering

- equipment

- equity

- estimated

- Event

- exceptional

- executed

- extends

- fertilizer

- few

- Figure

- filed

- final

- financial

- Fiscal

- follows

- Footprint

- For

- For Investors

- Force

- formidable

- Foundation

- fresh

- from

- Fuel

- funds

- further

- future

- GAS

- General

- get

- Global

- Green

- Grow

- Growth

- Handling

- here

- High

- Highlight

- holding

- HTTPS

- hydrogen

- Hydrogen Fuel

- Impact

- impressive

- impressive growth

- in

- include

- includes

- Income

- Increase

- india

- Indian

- indicate

- industries

- industry

- initial

- initial public offering

- initial public offering (IPO)

- Innovation

- innovative

- installing

- integral

- interesting

- International

- internationally

- Investors

- IPO

- issue

- ITS

- jpg

- Know

- Korean

- landscape

- latest

- Leadership

- Legacy

- like

- Limited

- LINK

- Lithuania

- Ltd

- maintains

- manufacturing

- March

- marked

- Market

- market share

- Marketing

- Match

- Mexico

- million

- more

- move

- movement

- Need

- needs

- net

- New

- Nigeria

- of

- offer

- offering

- Oil

- Oil and Gas

- oman

- on

- ONE

- Operations

- Opportunity

- order

- Other

- Partnership

- Pattern

- per

- period

- placement

- plans

- plato

- Plato Data Intelligence

- PlatoData

- player

- poised

- pre-IPO

- presents

- previous

- private

- proceeds

- process

- Production

- Profit

- Projection

- projections

- projects

- promotion

- proposed

- prospectus

- prowess

- public

- public offering

- quality

- realm

- Red

- Reduced

- regulator

- remaining

- remarkable

- Renewable

- renewable energy

- Requirements

- retail

- Retail Investors

- revenue

- Rise

- sale

- sector

- Sectors

- secure

- Shape

- Share

- Shareholders

- Shares

- showcasing

- significant

- Similarly

- Size

- sizes

- soaring

- solar

- Sources

- South

- south korean

- spanning

- specializing

- stake

- stands

- States

- Stations

- steadfast

- Stem

- stock

- strong

- subsidiary

- success

- successful

- Successfully

- such

- Suit

- supplying

- surge

- Surged

- Systems

- testament

- than

- The

- The Capital

- their

- thermal

- this

- Through

- to

- too

- towards

- trajectory

- underscores

- used

- value

- valued

- various

- Ventures

- vision

- vs

- was

- Waste

- well-known

- What

- while

- will

- with

- within

- witnessed

- working

- world’s

- year

- years

- you

- zephyrnet