- The Japanese Yen builds on the overnight gains against the USD amid geopolitical risks.

- Hopes for an imminent shift in the BoJ’s policy stance further lend support to the JPY.

- Bulls might prefer to wait for the outcome of a two-day FOMC meeting on Wednesday.

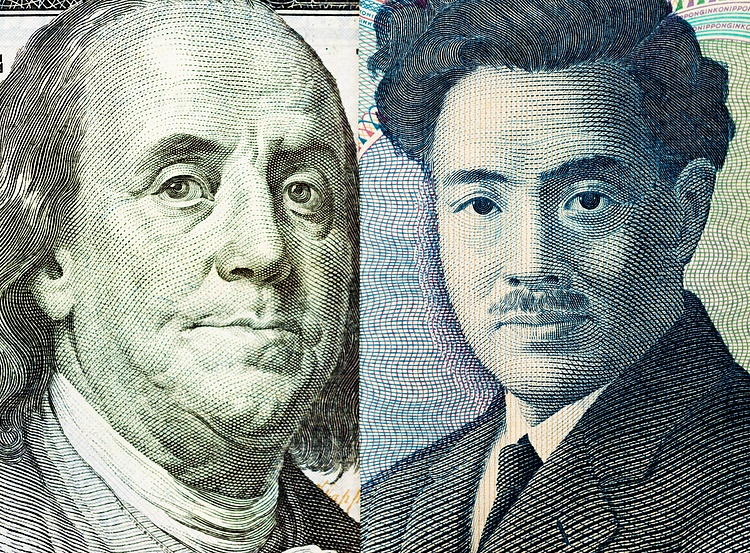

The Japanese Yen (JPY) gains positive traction against its American counterpart for the second straight day on Tuesday, dragging the USD/JPY pair to the 147.25 region during the Asian session. President Joe Biden is expected to authorize US military action in the Middle East in response to the drone attack by pro-Iranian militias near the Jordan-Syria border that killed three American soldiers. This raises the risk of a further escalation of geopolitical tensions, which, in turn, is seen as benefiting the JPY's relative safe-haven status.

Meanwhile, the Bank of Japan (BoJ) signaled last week that conditions for phasing out huge stimulus and pulling short-term interest rates out of negative territory were falling into place. Moreover, expectations that another substantial round of pay hikes by Japanese firms could fuel consumer spending and demand-driven inflation should allow the central bank to pivot away from its ultra-loose monetary policy settings. This, to a larger extent, overshadows signs of slowing inflation in Japan and continues to underpin the JPY.

The US Dollar (USD), on the other hand, is weighed down by the overnight sharp decline in the US Treasury bond yields and turns out to be another factor contributing to the offered tone surrounding the USD/JPY pair. Traders, however, might refrain from placing aggressive directional bets and prefer to wait for more cues about the timing of when the Federal Reserve (Fed) will start cutting interest rates. Hence, the focus will remain glued to the outcome of the highly-anticipated two-day FOMC policy meeting starting today.

Daily Digest Market Movers: Japanese Yen attracts some haven flows amid escalating Middle East tensions

- Against the backdrop of the Bank of Japan's hawkish tilt, fears that a further escalation of conflicts in the Middle East could engulf the region in a wider war benefit the safe-haven Japanese Yen.

- Reports suggest that President Joe Biden will authorize US military action in the Middle East, which would likely begin in the next couple of days and come in waves against a range of targets.

- The US Treasury lowered its forecast for federal borrowing to $760 billion from a prior estimate of $816 billion, dragging the US bond yields lower across the board and undermining the US Dollar.

- The downside for the USD/JPY pair seems limited as traders might prefer to wait for the outcome of a two-day FOMC policy meeting on Wednesday for cues about the timing of the first rate cut.

- Investors have been scaling back their expectations for a more aggressive policy easing by the Fed in 2024 in the wake of the upbeat US macro data and signs that the economy is still in good shape.

- Heading into the key central bank event risk, traders on Tuesday might take cues from the release of the Conference Board’s Consumer Confidence Index and JOLTS Job Openings data.

- Investors this week will also confront the release of important US macroeconomic data scheduled at the beginning of a new month, including the Nonfarm Payrolls (NFP) on Friday.

Technical Analysis: USD/JPY is likely to attract fresh buyers near last week’s swing low, around the 146.65 region

From a technical perspective, the USD/JPY pair currently trades around the 100-day Simple Moving Average (SMA) pivotal point. With oscillators on the daily chart holding comfortably in the positive territory and still far from being in the overbought zone, any subsequent slide below the 147.00 mark is likely to find decent support near last week's swing low, around the 146.65 region. Some follow-through selling, however, will be seen as a fresh trigger for bearish traders and pave the way for deeper losses.

On the flip side, the 147.65 area could act as an immediate hurdle ahead of the 148.00 round figure and the 148.30-148.35 zone. The next relevant hurdle is pegged near the monthly peak, around the 148.80 region. Bulls might wait for a sustained strength beyond the latter before placing fresh bets. The USD/JPY pair might then surpass the 149.00 mark and accelerate the positive move towards the 149.30-149.35 intermediate hurdle en route to the 150.00 psychological mark.

Japanese Yen price today

The table below shows the percentage change of Japanese Yen (JPY) against listed major currencies today. Japanese Yen was the strongest against the .

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.00% | 0.04% | -0.02% | -0.03% | -0.09% | 0.00% | 0.03% | |

| EUR | 0.00% | 0.03% | -0.02% | -0.03% | -0.09% | 0.00% | 0.02% | |

| GBP | -0.03% | -0.03% | -0.06% | -0.06% | -0.13% | -0.02% | -0.01% | |

| CAD | 0.03% | 0.04% | 0.06% | 0.00% | -0.07% | 0.03% | 0.05% | |

| AUD | 0.04% | 0.04% | 0.07% | 0.00% | -0.07% | 0.02% | 0.05% | |

| JPY | 0.09% | 0.10% | 0.14% | 0.07% | 0.03% | 0.09% | 0.12% | |

| NZD | 0.00% | 0.00% | 0.03% | -0.03% | -0.03% | -0.10% | 0.02% | |

| CHF | -0.03% | -0.02% | 0.01% | -0.04% | -0.04% | -0.11% | -0.01% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

Japanese Yen FAQs

The Japanese Yen (JPY) is one of the world’s most traded currencies. Its value is broadly determined by the performance of the Japanese economy, but more specifically by the Bank of Japan’s policy, the differential between Japanese and US bond yields, or risk sentiment among traders, among other factors.

One of the Bank of Japan’s mandates is currency control, so its moves are key for the Yen. The BoJ has directly intervened in currency markets sometimes, generally to lower the value of the Yen, although it refrains from doing it often due to political concerns of its main trading partners. The current BoJ ultra-loose monetary policy, based on massive stimulus to the economy, has caused the Yen to depreciate against its main currency peers. This process has exacerbated more recently due to an increasing policy divergence between the Bank of Japan and other main central banks, which have opted to increase interest rates sharply to fight decades-high levels of inflation.

The BoJ’s stance of sticking to ultra-loose monetary policy has led to a widening policy divergence with other central banks, particularly with the US Federal Reserve. This supports a widening of the differential between the 10-year US and Japanese bonds, which favors the US Dollar against the Japanese Yen.

The Japanese Yen is often seen as a safe-haven investment. This means that in times of market stress, investors are more likely to put their money in the Japanese currency due to its supposed reliability and stability. Turbulent times are likely to strengthen the Yen’s value against other currencies seen as more risky to invest in.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.fxstreet.com/news/japanese-yen-attracts-some-haven-flows-remains-confined-in-a-familiar-range-against-usd-202401300147

- :has

- :is

- 1

- 150

- 2024

- 25

- 31

- 32

- 35%

- 36

- 41

- 65

- 80

- a

- About

- accelerate

- across

- Act

- Action

- against

- aggressive

- ahead

- allow

- along

- also

- Although

- American

- Amid

- among

- an

- analysis

- and

- Animate

- Another

- any

- ARE

- AREA

- around

- AS

- asian

- At

- attack

- attract

- Attracts

- authorize

- average

- away

- back

- backdrop

- Bank

- bank of japan

- Bank of Japan (BoJ)

- Banks

- base

- based

- BE

- bearish

- been

- before

- begin

- Beginning

- being

- below

- benefit

- benefiting

- Bets

- between

- Beyond

- biden

- Billion

- board

- boj

- bond

- Bond yields

- Bonds

- border

- Borrowing

- Box

- broadly

- builds

- Bulls

- but

- buyers

- by

- caused

- central

- Central Bank

- Central Banks

- change

- Changes

- Column

- come

- Concerns

- conditions

- Conference

- confidence

- Confidence Index

- conflicts

- consumer

- content

- continues

- contributing

- control

- could

- Counterpart

- Couple

- currencies

- Currency

- currency markets

- Current

- Currently

- Cut

- cutting

- daily

- data

- day

- Days

- decent

- Decline

- deeper

- depreciate

- determined

- Digest

- directional

- directly

- displayed

- Divergence

- doing

- Dollar

- down

- downside

- drone

- due

- during

- each

- easing

- East

- economy

- ends

- escalating

- escalation

- estimate

- EUR

- Euro

- Event

- example

- expanded

- expectations

- expected

- extent

- factor

- factors

- Falling

- familiar

- FAQ

- far

- favors

- fears

- Fed

- Federal

- federal reserve

- fight

- Figure

- Find

- firms

- First

- Flip

- Flows

- Focus

- FOMC

- FOMC policy meeting

- For

- Forecast

- fresh

- Friday

- from

- Fuel

- further

- Gains

- generally

- geopolitical

- good

- hand

- Have

- haven

- Hawkish

- hence

- Hikes

- holding

- Horizontal

- However

- HTTPS

- huge

- hurdle

- if

- immediate

- important

- in

- Including

- Increase

- increasing

- index

- inflation

- interest

- Interest Rates

- Intermediate

- into

- Invest

- investment

- Investors

- IT

- ITS

- Japan

- Japan’s

- Japanese

- Japanese Yen

- Job

- joe

- Joe Biden

- JOLTS Job Openings

- jpg

- JPY

- Key

- larger

- Last

- Led

- left

- LEND

- levels

- likely

- Limited

- Line

- Listed

- losses

- Low

- lower

- lowered

- Macro

- Macroeconomic

- Main

- major

- mandates

- map

- mark

- Market

- Markets

- massive

- means

- meeting

- Middle

- Middle East

- might

- Military

- module

- Monetary

- Monetary Policy

- money

- Month

- monthly

- more

- Moreover

- most

- move

- Movers

- moves

- moving

- moving average

- Near

- negative

- negative territory

- New

- next

- nfp

- Nonfarm

- Nonfarm Payrolls

- of

- offered

- often

- on

- ONE

- openings

- or

- Other

- out

- Outcome

- overnight

- overshadows

- pair

- particularly

- partners

- pave

- Pay

- Payrolls

- Peak

- peers

- pegged

- percentage

- performance

- perspective

- pick

- picked

- Pivot

- pivotal

- Place

- placing

- plato

- Plato Data Intelligence

- PlatoData

- Point

- policy

- political

- positive

- prefer

- president

- president joe biden

- price

- Prior

- process

- psychological

- pulling

- put

- quote

- raises

- range

- Rate

- Rates

- recently

- region

- relative

- release

- relevant

- reliability

- remain

- remains

- represent

- Reserve

- response

- Risk

- risks

- Risky

- round

- Route

- ROW

- s

- scaling

- scheduled

- Second

- seems

- seen

- Selling

- sentiment

- session

- settings

- Shape

- sharp

- shift

- short-term

- should

- Shows

- side

- Signs

- Simple

- Slide

- Slowing

- SMA

- So

- some

- sometimes

- specifically

- Spending

- Stability

- stance

- start

- Starting

- starts

- Status

- sticking

- Still

- stimulus

- straight

- strength

- Strengthen

- stress

- strongest

- subsequent

- substantial

- suggest

- support

- Supports

- supposed

- surpass

- Surrounding

- sustained

- Swing

- table

- Take

- targets

- Technical

- tensions

- territory

- that

- The

- the Fed

- The US Federal Reserve

- their

- then

- this

- this week

- three

- times

- timing

- to

- today

- TONE

- top

- towards

- traction

- traded

- Traders

- trades

- Trading

- treasury

- trigger

- Tuesday

- turbulent

- TURN

- turns

- underpin

- upbeat

- us

- US bond yields

- US Dollar

- US Federal

- us federal reserve

- US military

- US Treasury

- USD

- USD/JPY

- value

- wait

- Wake

- war

- was

- waves

- Way..

- Wednesday

- week

- were

- when

- which

- while

- wider

- will

- with

- world’s

- would

- Yen

- yields

- you

- zephyrnet

- zone