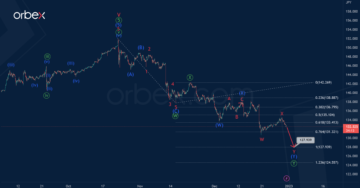

XAGUSD attempts recovery

Silver awaits a full recovery from the recent bounce at $22 as traders are eyeing the Fed’s policy meeting. The precious metal is still grinding the support-turned-resistance of 23.00. Last week’s recovery saw a bullish rally, which suggests possible rejection levels if price action reaches the mid-23.00 area. The current choppy price action might have prompted buyers to take some chips off the table. On the downside, 22.90 is the immediate support and its breach could cause a run to the next round number at 22.00.

USDJPY grinds resistance

The Japanese yen finds limited support from a rise in the December unemployment number. The recent low of 146.60 and the 20-day moving average (147.50) are compressing the price range, and a breakout would dictate the next move in the medium term. Intraday-wise, the pair is trying to hold on to its recent support. A close above 147.80 would first send the greenback towards the highest consolidation point at 148.55. On the downside, a breakout could trigger a bearish continuation.

US 30 continues to push

The Dow Jones 30 hits another record high as the market awaits the Fed’s policy guidance. The rally has recently stalled in the supply zone around 38200, right under the previous swing high. A combination of profit-taking and fresh selling could lower the price action for now. A bullish MA cross on the chart is an encouraging sign as bulls are expected to buy the dip. 38350 is the first level to gauge the strength of follow-up interest with 38600 as a second layer. Any signs of a correction first need to test 38000.

Test your forex trading strategy with Orbex

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.orbex.com/blog/en/2024/01/intraday-analysis-usd-keeps-the-high-ground

- :has

- :is

- 10

- 22

- 23

- 30

- 35%

- 50

- 52

- 60

- 750

- 80

- 90

- a

- About

- above

- Action

- Amid

- an

- analysis

- analyst

- and

- Another

- any

- app

- approaches

- ARE

- AREA

- around

- articles

- AS

- At

- Attempts

- author

- avatar

- average

- bearish

- before

- Blog

- Bounce

- breach

- breakout

- Bullish

- Bulls

- buy

- buy the dip

- buyers

- Cause

- Chart

- Chips

- Close

- combination

- consolidation

- continuation

- continues

- could

- Cross

- Current

- David

- December

- decisions

- depicting

- description

- dictate

- Dip

- displaying

- dow

- Dow Jones

- downside

- encouraging

- Ether (ETH)

- everyday

- expected

- experience

- eye

- Fed

- Fed's meeting

- financial

- finds

- First

- Focus

- For

- forex

- Forex Trading

- fresh

- from

- full

- fundamental

- gauge

- Greenback

- grinding

- Ground

- guidance

- Have

- helping

- High

- highest

- Highs

- his

- Hits

- hold

- HTTPS

- if

- image

- immediate

- in

- informed

- interest

- Investors

- ITS

- Japanese

- Japanese Yen

- jones

- Keen

- Last

- layer

- Level

- levels

- Limited

- live

- Low

- lower

- macroeconomics

- make

- Market

- market volatility

- Markets

- max-width

- medium

- meeting

- metal

- might

- Mobile

- Mobile app

- move

- moving

- moving average

- Need

- next

- now

- number

- of

- off

- on

- over

- pair

- passionate

- photo

- plato

- Plato Data Intelligence

- PlatoData

- Point

- policy

- possible

- Precious

- previous

- price

- PRICE ACTION

- Psychology

- rally

- range

- Reaches

- recent

- recently

- record

- recovery

- Renowned

- research

- Resistance

- right

- Rise

- round

- Run

- s

- saw

- Second

- Selling

- send

- showing

- sign

- Signs

- some

- special

- Still

- Strategist

- Strategy

- strength

- Suggests

- supply

- support

- Swing

- table

- Take

- term

- test

- The

- the Fed

- Through

- to

- towards

- Traders

- Trading

- trading strategy

- trigger

- trying

- under

- unemployment

- URL

- us

- USD

- Volatility

- which

- with

- would

- years

- Yen

- Your

- zephyrnet

- zone