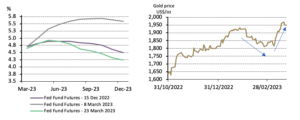

EUR/USD came briefly above 1.10 this week before falling to just below 1.09 today. Economists at Nordea note that the rate differentials continue to point toward a higher EUR/USD ahead.

EUR/USD to move about sideways in the near term

“Given that the ECB has had room for more positive rate surprises than the Fed, a higher EUR/USD is understandable.”

“The better outlook on the Euro Area’s energy balance also points toward a lower risk-premium on the Euro.”

“In the short-term, we see EUR/USD moving about sideways as markets reprice expectations on both the Fed and the ECB, however, it is clear that the rate differentials continue to point toward a higher EUR/USD ahead. China’s reopening also points in that direction due to a better outlook for the global economy.”

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.fxstreet.com/news/interest-rate-differentials-point-to-a-higher-eur-usd-nordea-202302031541

- 1

- 10

- a

- About

- above

- ahead

- and

- Balance

- before

- below

- Better

- briefly

- China

- clear

- continue

- direction

- ECB

- economists

- economy

- energy

- EUR/USD

- Euro

- expectations

- Falling

- Fed

- Global

- Global economy

- higher

- However

- HTTPS

- in

- interest

- INTEREST RATE

- IT

- Markets

- more

- move

- moving

- Near

- Nordea

- Outlook

- plato

- Plato Data Intelligence

- PlatoData

- Point

- points

- positive

- Rate

- Room

- short-term

- sideways

- surprises

- The

- the Fed

- this week

- to

- today

- toward

- understandable

- week

- zephyrnet