You want to retire, but you’ve got credit debt, auto loans, and student loans. It feels like every time you get your paycheck, it quickly slips away, and at the end of every month, you’re left in the same position, or worse, than thirty days prior. What’s happening, and why is it SO hard to get out of debt? And will you EVER be able to retire if you keep living this way?

Seth Godwin was fired from his job while holding $30,000 in credit card debt. He had no way to pay it off, but somehow, over the next two years, he was able to become debt-free, increase his credit score by hundreds of points, and become one of the internet’s leading financial influencers. After crawling out of debt, Seth began working at a financial institution, looking at car loans, realizing how many people, like him, had been scammed into throwing tens of thousands of dollars away.

Now, on the other side of the financial spectrum, Seth is financially flourishing with a steady stream of income, stable investments, and twenty-seven (!) credit cards—but he’s still debt-free! In this episode, Seth will show you EXACTLY how car salespeople are scamming you, how to escape credit card debt confidently, what to do now that student loans are resuming, and why you SHOULDN’T trade in your old car.

Click here to listen on Apple Podcasts.

Listen to the Podcast Here

Read the Transcript Here

Mindy:

Hello my dear listeners, and welcome to the BiggerPockets Money Podcast, where today we are interviewing Seth Godwin and talking about pulling yourself out of the burden of debt, along with credit scores, student loans, and cars.

Hello, hello, hello. My name is Mindy Jensen, and with me as always is my shiny co-host, Scott Trench.

Scott:

Shiny. What am I supposed to do with Shiny?

Mindy:

It’s a Firefly joke. An homage to Firefly.

Scott:

Oh, okay. Well that’s a nice, light intro Mindy. Light and airy.

Mindy:

It was a TV show, Scott. It was only on for one year, and I think you were like three when it came out. Scott and I are here to make financial independence less scary, less just for somebody else, to introduce you to every money story, because we truly believe financial freedom is attainable for everyone, no matter when or where you are starting.

Scott:

That’s right. Whether you want to retire early and travel the world, go on to make big time investments in assets like real estate, start your own business, or climb your way out of debt after getting fired from your job at Walmart, we’ll help you reach your financial goals and get money out of the way, so you can launch yourself towards your dreams.

Mindy:

Scott, we have a real treat for our listeners today. I’m so excited to share the interview that we did with Seth Godwin. But before we do, we have a money moment, and today’s money moment is provided by Innago. Start saving money and time with Innago’s free property management software. Find out why Innago is the number one rated property management software. As an exclusive offer to BiggerPockets listeners, you’ll get $25 for using Innago at innago.com/biggerpockets. That’s I-N-N-A-G-O.com/biggerpockets.

All right, today’s money moment is use your tax refund to help with your financial goals. If you are someone who traditionally receives a refund, make a plan for it. Don’t just go and blow it. Use that money to start investing, add it to your emergency fund, or pay off extra debt. Do you have a money tip for us? Email [email protected].

Scott:

Are you tired of spending endless hours managing your rental properties? Innago is here to simplify your life, by saving you time and money with its free property management software. Whether you have one unit or 1,000 residential or commercial properties, Innago is built for you. With Innago, you can say goodbye to complex and costly solutions. Innago is free and easy to use. There’s a reason Innago was rated the number one property management software by G2 for ease of use. Get started in under five minutes at innago.com/biggerpockets. From tenant screening and lease signing, to rent collection and work order management, and everything in between, Innago has you covered. They offer a seamless interface and support representatives to assist you every step of the way. Join thousands of satisfied landlords, and start streamlining your property management tasks today with Innago.

As an exclusive offer to BiggerPockets listeners, you’ll get $25 for using Innago. Visit innago.com/biggerpockets to get started. That’s I-N-N-A-G-O.com/biggerpockets.

Mindy:

Seth Godwin is a 29-year-old content creator who started his journey on TikTok during the pandemic. He now has over 1.8 million followers on that platform, and he focuses on producing educational, yet entertaining content, featuring finances, and talking about cars. Seth Godwin, welcome to the BiggerPockets Money Podcast. I’m so excited to talk to you today.

Seth:

Hey, Mindy and Scott. It’s a pleasure to be here. I appreciate you having me on.

Mindy:

Seth, on your channel, you talk about everything from buying cars, to consolidating debt, to credit cards, to college and investing. Why did you decide to become a finance content creator?

Seth:

To be honest with you, I was just bored during the pandemic and getting fed up at my job, that nobody knew how to buy a car. I used to work at one of the largest financial institutions in the world. I’m not allowed to say who, due to an NDA that I signed after leaving. But I worked there for a few years, mainly processing loans. And a majority of those loans were car loans, and the amount of deals that I saw come in that were just atrocious, just baffled me.

So during the pandemic when I had nothing else to do, I was like, “I’m just going to get on TikTok because it’s easy, and talk about the correct way to purchase a car.”

Scott:

Can you give us some examples of these atrocious loans, and what really got you going?

Seth:

For sure. Yeah, absolutely. A majority of the time it came down to loan to value, which means if we’re going to lend money on a car, we’ve got to make sure that it’s worth it on our end if something happens to that car or something happens to the person buying the car, that it’s got to be worth it for us to recoup the costs of that car. We would go up to about 110% of what a car is worth. So if a car is worth $10,000, we’d lend up to 110% of that. And we would see loans every day, 150 to 170% above loan to value, and people were just putting the cash down to cover that difference instead of trying to negotiate the deal.

Scott:

Walk us through, why do you think people were getting such horrible loans, and what is the process that the consumer goes through to arrive at that incredibly lopsided situation?

Seth:

So sometimes, it has to do with a car that they’re trading in, that they have negative equity on, so they owe more on the car than it’s actually worth. So that was, I’d say about half of the deals. And there’s not really a whole lot that you can do about that aside from putting money down. But a lot of the time, dealers are incentivized to add on all of these ridiculous programs, or warranties, or things that people they know aren’t going to use, and people just don’t realize that they don’t actually need them. So it’s a lot of cleaning services.

I’ve seen dealerships add on $1,000 for those little bitty pinstripe stickers. It’s ridiculous stuff like that. And people are just none the wiser, and a lot of times it’s buried in the fine print, and people never read the contract so they don’t even know that they’re getting screwed over.

Scott:

One last question here on this topic here. What would your general advice be to avoid that situation as a consumer?

Seth:

Yeah, absolutely. So it really comes down to knowing what the car is actually worth, and there are multiple resources online that will tell you. There’s J.D. Power, there’s Kelley Blue Book, and they’ll tell you what the car is actually worth. And if you pay above that, then you’re generally getting a bad deal.

Scott:

Seth, as a general rule then, would you just say if the loan balance is going to be greater than the car, and assuming you’re not in an underwater situation coming in, one of these weird things that could make it a reasonable decision even though it’s an unfortunate one, would you say just avoid all of those upsells entirely if it’s going to put you in a negative equity position on a car purchase?

Seth:

Strictly in a negative equity position, yes, absolutely.

Mindy:

Why are you selling your car to buy another car when you’re in a negative equity position? When does that make sense?

Seth:

It only makes sense if there is something catastrophically wrong with the car. Most people get a ding on their car, or a new technology comes out in a newer model and they’re like, “I have to have that,” and they just go into more debt in order to have those new features that they’re going to get bored with in a week and a half or two weeks. It’s a very emotionally charged thing, and people need to take a step back and realize this is robbing them of their future.

Mindy:

I like that phrase. I mean, I hate that phrase, but I like that phrase so much. You are literally robbing yourself of your future when you take this perfectly good car, assuming it doesn’t have these catastrophic issues, taking a perfectly good car that you’re bored with, and trading it in, and taking more debt on because you have negative equity on your car, because what is that saying? As soon as you drive it off the lot, it’s worth 40% less or something like that.

So yeah, it’s just a means of transportation. It’s just a way to get you from point A to point B. Does anybody remember what kind of car anybody else drove? I mean, yeah, we all remember that one super cool guy in high school who had the hot car. But nobody really caress. It’s just such a poor financial decision. Seth, let’s talk about the best cars to buy. In your opinion, what should somebody who needs a car there is… America’s huge. Most people don’t live near where they work. Assuming that that’s not an option to move, I need a new car. What should I be buying right now?

Seth:

Even in the craziness of the last couple of years, and the craziness that we’re probably about to see, even though they’re a little bit more expensive, they last on average three times as long. And this is why I say generational wealth is built on Toyotas and Hondas. They last forever. And yeah, you’re going to have a bit more of an upfront cost. But as long as you have decent, and I mean the least mechanical knowledge possible, if you know how to do an oil change, you’re probably going to be okay, because these things just don’t break down as much as other cars do.

Scott:

Yeah, I have a Corolla for 10 years now, and I’ve literally had one issue with it where a nail got in one of the tires, and that was it. I’ve not had any other issues. I never, ever think about will it start. And this is something that I think some people are worried about with other cars that are 9, 10, 12 years old or whatever. So I completely agree with that, and obviously love my Corolla. How do you finance that purchase? What’s your optimal approach there?

Seth:

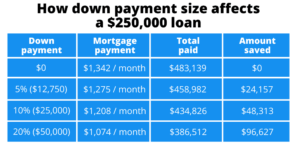

I’ve always said even when rates were lower, if you can get below a 6% interest rate on a car, you’re probably doing okay. If you can’t get below a 6%, then you probably need to start saving up some cash, because you need to work on your credit and just purchase the car outright.

Scott:

Awesome. What would you say to somebody listening who is arguing, “No, no, no. Gas powered vehicles are going to be obsolete within the next 10 to 15 years, and you’re going to experience much faster depreciation,” which I’ve heard from some folks who really think hard about the car market. Do you agree with that argument or would you say, “Nope, not a factor. Gas is going to be here to stay for the next couple of decades.”

Seth:

I don’t want to get too political or anything, but the way that our government operates, and the way that lobbying is in its current form, I don’t see big oil going anywhere for the next couple of decades. I know that we’re transitioning, and most automakers have pledged to stop making gas powered vehicles by 2035, but that’s when they’re going to start getting phased out.

I think we’re still going to have gas stations at every corner. We’re still going to have gas powered vehicles. There are literally millions, upon millions, upon millions of gas powered cars. They’re not going to go way overnight. And whenever they do start getting phased out, I think it’s still going to take 30, 40 years before they’re actually gone.

Mindy:

I wish I could disagree with you, Seth, but I can’t because you are correct.

Seth:

I don’t like to be correct on that point. Just for the record, I think electric vehicles are cool. They’re a lot of fun to drive. The zero to 60 thing in 2.7 seconds is amazing, but it is a sad reality that we have.

Scott:

Zero to 60 in 13.1 for me.

Seth:

I’ve got a hybrid, and that sucker, I’m surprised at how fast it gets up to 60. It’s only like seven seconds. It’s pretty wild.

Mindy:

I have a stick shift car. It takes a long time to get up to 60. Okay. Let’s transition over to credit. You recently posted a TikTok about how you fixed your credit after almost going bankrupt, and I’d be interested to learn a bit more about your personal financial journey, and how did you actually fix your credit?

Seth:

Sure, absolutely. So I worked in management at Walmart, and then I unfortunately got fired in 2017. And that led me down a path of discovering that I was not nearly as financially secure as I thought. I was taking out credit card debt left and right, not paying it off, paying just the minimum balance, as you know. I was the bank’s best friend, I was their ideal customer.

Unfortunately, whenever I did get fired, I didn’t have a second source of income. I was like most people and just thought, “Well I’ll be here forever and that’s that.” So I started falling behind on my payments. The only thing that I really kept up was my car payment, because my grandmother had co-signed on the loan for me, and there was no way I was taking her down with me. So I just worked odds and ends jobs until I got something more secure.

But that took about a year before I found something that was really for me, and I had just defaulted on all of my cards. All of my balances were just way higher. A lot of them were double what they had started at, because of all the fees and interests that had been tacked on over that period.

So that’s when I started looking into YouTubers like Graham Stephan, and of course I found Dave Ramsey as well. I followed his Baby Steps programs. I paid off a lot of those collections and a lot of those negative balances. Unfortunately, that didn’t really help my credit as I think most people know, paying off collections doesn’t really help your credit score, but it gets you back into better standing with the banks, which is what I was ultimately after.

Scott:

Let’s frame the story here. What year did you have this aha moment? “Shoot, I’m getting fired. Everything is not in a good place for my financial position.” When was this?

Seth:

Yeah, I got fired in May of 2017.

Scott:

May of 2017. And then we have this journey that I think begins. There’s content, there’s the Dave Ramsey, there’s Graham Stephan, there’s all this other stuff. How long, and what were some of the big milestones that you went along to get out of this situation and back into a strong financial position?

Seth:

I’d say it took about three years for things to start feeling comfortable again, and that’s when I got approved for my first credit card that was not secured. That was with an institution called Navy Federal Credit Union. I went with them because they were known as the home of the high limits, and they’ll help you restore your credit.

And that was true. It was true. I got an unsecured card from them, and I built my credit back with them, and then I got into the bigger stuff with American Express and stuff like that. And here we are in 2023, and I have like 27 credit cards now.

Mindy:

Some people would argue that that’s maybe not the best route to go, 27 credit cards, but we at this podcast-

Scott:

So Dave Ramsey no longer-

Mindy:

Yeah, Dave Ramsey [inaudible 00:15:22] this isn’t the Dave Ramsey show. He’s not here to tell us that that’s a bad idea.

Scott:

It’s travel rewards.

Mindy:

Exactly. That’s why you’ve got it. I’m assuming that’s why you’ve got it, Seth. I should probably ask you that question.

Seth:

Yeah.

Mindy:

Do you have that many credit cards because of the rewards?

Seth:

That’s exactly it. It came down to signup bonuses, because once I actually learned the credit card game thanks to people like Graham Stephan, I pushed the Dave Ramsey no credit side of things away, and I learned how to play the game the right way. And that is a very risky thing to do. I understand why Dave says not to go down that route, because it takes a lot of discipline that most people don’t have.

Scott:

How low was your credit score at the bottom point there?

Seth:

The lowest I remember seeing it, because I just stopped looking at it after a while, the lowest I remember seeing it was 480 something.

Scott:

So 480. And then how quickly are you able to get it back into the six, 700 range? Did that take you the full three years, or were you able to make some progress in a pretty good spurt there?

Seth:

It was a very, very, very slow game for me, because it was very trial and error. I wish that I had talked to, actually gotten people’s advice, but I was ashamed to talk about it. So I’d say it took a little over two years to get into the 600s, and then after that third year, I was back up in the 700s.

Mindy:

So I think that some people don’t realize the range of credit scores. Because in this area, in this community, we talk about I would love to have an 850 credit score. I haven’t gotten there yet. I’m stuck in the 817s. And after 740, it doesn’t really matter. But it goes from 350 to 850. This is your FICO score. And there’s a bunch of different ones, but that’s the one that really counts. And it doesn’t get into good territory until you get closer to 700.

I don’t think people realize how skewed it is towards the top. In the middle, that’s still garbage credit according to everybody who is giving out money and giving out credit. And when you had a secured credit card, can you explain what a secured credit card is to our listeners who don’t know what that is?

Seth:

For sure. So this is where you give the bank a cash deposit, let’s say $200, and then they give you a credit card with that same amount of the cash deposit. So you give them $200, they give you a credit card that has a limit of $200. And as long as you use that properly, and properly meaning you pay off your balance, you don’t go over 10%… 30% is what’s suggested, but really 10% is where you want to be for reported credit utilization, if you want to have the biggest impact on raising your credit score. As long as you do that for multiple months, generally six to 12 months, then you get your cash deposit back, and you have an unsecured regular credit card.

Mindy:

Did you ever consider becoming an authorized user on somebody else’s card? Have you ever one down that route or ever talked about that route?

Seth:

I didn’t know what authorized users were until I had already rebuilt my credit. But had I known about that, I probably would’ve asked a few people like my grandmother who’s cosigned on my car loan for me, and maybe even a few friends to add me as an authorized user, get my credit score back up to where it needed to be, and just never use the cards.

Scott:

So you were at that financial place for a year and a half, and then you start TikToking. Is TikToking a legitimate way to make money? Were you able to then generate an income from this gig to leave job at the financial institution? How does that work?

Seth:

I didn’t realize I could have success with making money on TikTok until about that six months in, is when I realized that just having a link in your bio with an affiliate could actually garner some pretty high income, if you market yourself the correct way.

And once I had made… God, it was very quick. I went from making a few hundred bucks a month from affiliate income, to making five figures a month in affiliate income. And it was just from doing my regular videos, and just talking about some products that I actually used and I actually liked.

I think if you’re a genuine person and you talk about things that actually interest you, people realize that you’re not just trying to sell them something. And I think that’s the best way to actually build an online brand. People can smell BS, especially on TikTok, from a mile away.

Scott:

So you post about this regularly. You post a monthly income update. Can you share a recent month’s example of how much you made and from what sources?

Seth:

Sure, absolutely. So let’s just take September for example. I made about five grand just strictly in affiliate income. My sponsorships brought in about seven grand, and then the TikTok Creator Fund brought in about 10 grand. It was just under 10 grand.

Mindy:

That’s like $22,000.

Scott:

That’s all of your debt.

Seth:

It’s insane to think about. Yeah, I was 30 grand in debt, to now making close to that a month. And I think that’s a perfect testament to sticking it out and grinding on what you love.

Mindy:

Okay, you’ve got a hat on that says invest. Where are you putting that money?

Seth:

Most of it honestly is just going into really boring ETFs, low cost ETFs. I don’t care about trading. I see all this stuff about life insurance, and IULs, and all this other stuff on… Not for me, not for me. Just give me the low cost ETFs.

Mindy:

I love that answer.

Scott:

Okay, so you got a big audience, and you’re getting paid because you’re talking to a lot of Gen Z and a lot of millennials, and they’re resonating with it. And you’re talking about products that you love and use. What are the questions or the problems that you’re seeing your audience have? What are they coming to you with, and what are they engaging with most?

Seth:

Most people are just terrified that they’re never going to reach a point where they can actually retire. And it comes down to people… I used to do these financial audits kind of Caleb Hammer style, but I’d never filmed them. It was just a one-on-one kind of thing, where I’d go over what people were actually spending their money on.

And I kid you not, 95% of the time, most people were just spending way too much money on food, and not wanting to not go out to eat. And I hate to say it, because there are legitimately people that cannot afford much of anything else, and I’m obviously not speaking on those people. But people have gotten accustomed to a lifestyle of ease and comfort that they don’t want to give up. And I think that’s one of the biggest problems most people are facing when it comes to their finances.

Scott:

Are you seeing fixable problems, or are you seeing a lot of people who are really, truly stuck?

Seth:

The people who are very truly stuck and just don’t have many other options are minimal, because most of the people that came to me were earning over six figures and still living paycheck to paycheck. And to me, they just need a slap in the face as, “You’re not doing something right. Let’s get on the right track here so that not only can you retire early.” But if you really got disciplined, you could absolutely retire earlier.

Mindy:

Yeah. I think that there’s this misconception, especially from people who are in six figure jobs who are living paycheck to paycheck. “I can’t be living paycheck to paycheck. I’m rich. I make six figures.” Look, if you’re spending every dime that comes in, you’re paycheck to paycheck. If you can’t save anything, if you have to charge it and hope that you get paid before your credit card payment comes due, you’re living paycheck to paycheck. And if you’re making six figures, I don’t care what city you’re living in, in America, if you’re making six figures, you could be saving money.

Seth:

Totally, 100%. I just had an argument with somebody who said you couldn’t live on $100,000 in Manhattan. I was like, “You could. You absolutely could.” Again, you have to sacrifice some stuff if you want to live there.

Mindy:

Let’s talk about student loans. We’re recording this on October 3rd, and student loans are real popular to talk about, since they just became due again. And you’ve posted quite a bit about college and student loans recently. What advice do you have for someone who’s contemplating going to college or not going to college?

Seth:

I want to preface this by saying having a college education is a great thing to have. I think college can be a wonderful wealth building tool if used properly. The networking aspect is incredible. The people and the knowledge that you gain while attending college is great. Unfortunately, nowadays you have to look at college more so as a business decision than an enjoyment or an educational decision, because it’s just not how our system works anymore.

Scott:

How do you think that somebody should be thinking about the decision about whether to go and get a college degree in today’s economy?

Seth:

In today’s economy, Dr. Brad, my friend Dr. Brad Klontz has also done some studies about the impact that a college degree has on your income. And on average, college graduates make about a million dollars more in their lifetime, from what he’s concluded from his studies. Unfortunately, not all college degrees get you there.

So because of that, you have to look at college as a business decision more so nowadays than you had to a long time ago, even I think 20, 30 years ago. And unfortunately, it’s just college degrees aren’t paying what they used to. The ROI on these degrees is nowhere near what people need to live nowadays.

Scott:

Yeah, absolutely. And we interviewed Preston Cooper from FREOPP, back, what episode was that Mindy? Episode 251 and 293 of the BiggerPockets Money Podcast. And Preston and FREOPP have done a very comprehensive analysis on 30,000 undergraduate degrees, and countless more master’s and graduate degrees to compute the ROI. And the answer is, is college worth it? Well, it depends on degree, right? Some degrees are very low ROI or deeply negative, and some are very, very high ROI.

And what’s great about 2023 is that we now have the research and the data to help you make an informed decision about whether a degree you’re pursuing is likely to be ROI positive, and some of them are tremendously ROI positive. So just do your homework before select that degree.

And the good news for college students who are in colleges and still have some time to think about this, is the degree matters more than the school. An engineering degree or an economics degree is often ROI positive, while humanities and liberal arts degrees can be often deeply negative ROI or low ROI.

Seth:

That is the world we live in.

Mindy:

Yeah. And I actually just had a conversation with my 16-year-old about this podcast episode, about this study that Preston did, because I’m trying to get her to think about college not in terms of, “Look at all this stuff that they offer on campus,” but instead after the fact, “Look at that $350,000 in student loan debt that you have, and the $60,000 a year job that you are able to get with that degree.” That’s going to have you paying off student loans for the rest of your life. And of course, I’m going to help her pay for that, but I don’t want to tell her that right now and have her not apply for literally every scholarship she can possibly apply for, because I don’t want her to be saddled with massive student loan debt. But I also don’t want to pay $350,000 for her education either. And part of me is like, “This is a great thing. I should make her listen to this episode.” Now I’m like, ooh.

Scott:

This is the safest place to confess that Mindy, because she ain’t listening to this.

Mindy:

Exactly. So Seth, when I was growing up, you went to college, you graduated high school, and then you went to college. That was what was pushed, and trade school was a dirty little secret. Nobody talked about it. Nobody was pushed into it. That was for that one kid in high school that was never going to go to college.

And I think that that’s a really bad idea. We had Tinian Crawford on the show and he said, “I got my associate’s degree, which is a two-year degree, in just six short years, because college was not for me.” And then he went and got his electrician’s degree, and now he’s an electrician, and he loves his job.

At the same time, we are seeing a huge shortage in the trades in general. There’s lots of factors. First, I think is because of my generation not being encouraged to go into the trades when college wasn’t the right choice for them. So what is your thought on trades, and trade schools, and what would you recommend for our audience?

Seth:

I couldn’t agree more with what you said, because it was the same for me and a lot of my friends. Our parents pushed us to go to college. And I knew I didn’t want to go to college, but I also wanted to make my parents happy. So I did. I did two years of college. I didn’t even get my associate’s degree. I dropped out because I was like, “I cannot mentally handle this anymore. I’m done. I’m out. I’m going into the workforce. And that’s the way that it is.” I wish I had even known what a trade school was. It was such a foreign concept to me and a lot of my friends. We didn’t even know that we had a trade school right up the road from where we lived. It never crossed our minds.

But I think we have to start pushing trade schools, at least informing people of them. Because now we have a shortage, at least in our area, and I’ve read a few articles about all over the country. Electricians, the jobs outnumber the people that are actually qualified for them. Plumbers are the same thing. We need these people. And down here in Florida, we don’t have enough boat mechanics for the amount of boats that we have. These things are not talked about nearly enough.

So I think if you’re somebody who likes working with your hands, if you’re somebody who likes solving problems in more complex ways than data sheets, then yeah, trade school is definitely something that you should at least consider. Look into what’s going on, what trades your schools offer in your area, and really explore the opportunity of going to these things, because most trades have a high return on their investment.

Scott:

Yeah, I love it. I couldn’t agree more. I think that a lot of folks are like, “Well I like history, so I’m going to major in history,” right? Well, look, if you’re going to major in history, you better be an all out, passionate, totally invested person in there. You can make money as a history major, if you’re an author, if you’re like this, Ron Chernow, who’s a great author, wrote a bunch of biographies I really like about some founding fathers that are really, really long. You can be successful in those fields, but you better actually be super, super really passionate about it, like you’re spending your free time studying up on these things and writing essays.

If you’re not, go to trade school, and get a degree, and then learn about history on the side as your hobby, with that millions of other people do, like I do. I would love to major in history, would’ve been my favorite subject. But instead, I read biographies, and pursue it as a little bit of a side hobby, and go with that.

And that’s what I think more people need to do is understand the economics here. Unfortunately, we don’t live in a world where the subject you’re more mildly interested in is going to necessarily pay you, and you should pursue the high ROI initiative. Unless again, it’s an all out true burning passion, in which case you can be successful. You just got to know the odds are a little bit against you.

Now, let’s go back to student loans for a second here though, because that’s a hot topic. A lot of people, in the past were there. Mindy, I know you use your fashion degree on a daily basis still.

Mindy:

Oh sure.

Scott:

But the degree is there, the decision is in the past, I have student loans. They’re now coming out of forbearance, and this is an issue that I think is looming in the economy. I wonder if it’s going to start showing up on the scoreboard at the highest level, in the sense that it will impact inflation as consumer spending pulls back, as these things get going forward. So big, big issue impacting millions and millions of people around the country. What’s your advice to somebody who’s dealing with that, and are you seeing this pop up among your followers?

Seth:

Oh yeah. It’s one of the most hot topic comments that I have. Regardless of what the video’s about, people are asking, “What do I do about my student loans?” The first thing I think you should do is sit down, take 15, 20 minutes, and find out where your budget’s at. Budgeting is not fun, but it’s something that everybody that is dreading their finances, especially when it comes to student loans, you have to do. You’ve got to find out where your budget’s at, where these student loan payments fit in, on top of discovering what kind of student loan relief do you qualify for. I’m a big proponent of if they’re offering it, take it.

Scott:

So really, Seth, you’re saying, “Yeah, this is going to be a painful wake-up call. You’re going to have to stare it down. Do your research and see if there’s anything. Do not bury your head in the sand, because these payments will come due and they’ll be very real, and they will come out of your discretionary spending budget,” or they’ll put pressure on other life decisions if you carry debt, rent, or household… You may be facing a forced reduction in lifestyle that could be very painful, if you’re not planning ahead and preparing in advance by doing the boring, hard work of accounting and budgeting here. Is that what you’re saying?

Seth:

Absolutely. 100%. You have to do a little bit of the dirty work in order to have a little bit more peace of mind. And yeah, there are going to be a lot of people who are going to have to start cutting out a lot, but you can only cut out so much before your life gets miserable and you just give up on ever getting these things paid off. So I think there, you also have to start looking into side hustles as well. Because yeah, you can only cut so much. You’ve got to increase your income at some point as well.

Scott:

Yeah, that’s stark news, right? You got to be ready to cut back and start working nights and weekends, if this is going to really become a painful, significant part of your spending budget and you’re already at cashflow neutral. I think you’re right. I don’t think there is a better answer than that. Maybe for lucky few who will find some relief options if they do their homework in specialty circumstances. But I think this is a big thing that’s going to hit the economy, and everyone’s like, “What is the potential catalyst for recession in 2024?” Well, this is one of those things that could significantly dent consumer spending, especially in the Gen Z, millennial, and even some Gen X, some parts of the Gen X population here. So I think we should be as a society fearful of this forbearance ending, and as an individual, ready to make serious lifestyle choices to attack the problem.

Seth:

Absolutely.

Mindy:

Yeah, I completely agree. I think that this is really a looming issue. I don’t know what the answer is other than get ready for some pain, unfortunately. There was this forbearance. I don’t know that not having forbearance would’ve been a good idea back in 2020. It’s been three and a half years. There’s a lot of arguments for it went on too long. There’s all of the conversation about we should just forgive all student loans. I am not sure what the right answer is, but they are starting up again, and you’re going to harm yourself and your credit if you don’t start making payments.

Scott:

Well Seth, we really appreciate having you on today. Thank you so much for sharing your fantastic story coming out of debt and building a really strong financial position, becoming a TikTok star. Your thoughts on car ownership, and the silliness that can go on in that sector if you’re not being careful. And then the college and student loan degree, student loan situation that we’ve got going on here. Really appreciate it, and look forward to following you and seeing what you get up to in 2024 here.

Seth:

It’s been an absolute pleasure. I can’t thank you enough for having me on. This is one of my favorite discussions I’ve ever had revolving around any of this stuff.

Scott:

Awesome. It was ours too, so really appreciate it, and thank you so much.

Mindy:

All right, Scott, that was Seth Godwin, and that was so much fun. We kind of covered a lot of things, so let’s give our listeners a quick recap. We talked about buying a car. Read the contract, don’t go for upsells. Bottom line, understand what you’re getting yourself into. And, I think one of his biggest tips is don’t just trade in your car because you’re bored with it.

Scott:

Yeah, I mean a car is one of the big three, right? It’s housing, transportation, and food. And the decision you make in your car is going to be very major determinant of whether you’re able to get the snowball rolling and begin accumulating cash to start investing and moving towards that journey to financial independence.

Mindy:

Let’s talk about student loans, Scott. I think that both you and Seth had really good points on student loans. If you haven’t been planning for your student loan payments to be starting up again, and you don’t have, I hate this term, extra money, but you don’t have additional money in your budget that you don’t have earmarked for something else, you are going to have a hard time coming up. I mean, student loan payments are back due. The pause is over. I don’t know what the right way to phrase that is, but your student loan is now due every month and your student loan payments. So you need to be making payments, you need to be making plans to make those payments. And it might be a pinch. Yes, you can try to cut things out of your budget. But as Seth said, there’s only so much you can cut. You may have to start making more money.

Scott:

Yeah. Look, I think it’s a painful situation for everyone. I think you can point the finger in a large number of directions for this problem. And at the end of the day, if you’ve got those student loans, you are in for the pain of beginning to make those payments with interest on a go forward basis. And you need to plan for that, and that is part of the reality of how you budget and design your lifestyle on a go forward basis. All right, Mindy, should we get out of here?

Mindy:

Scott, we should. That wraps up this episode of the BiggerPockets Money Podcast, and we thank you so much for listening. He is Scott Trench, and I am Mindy Jensen saying farewell gazelle.

Scott:

If you enjoyed today’s episode, please give us a five star review on Spotify or Apple. And if you’re looking for even more money content, feel free to visit our YouTube channel at youtube.com/biggerpocketsmoney.

Mindy:

BiggerPockets Money was created by Mindy Jensen and Scott Trench, produced by Kailyn Bennett, editing by Exodus Media, copywriting by Nate Weintraub. Lastly, a big thank you to the BiggerPockets team for making this show possible.

Watch the Podcast Here

Help us reach new listeners on iTunes by leaving us a rating and review! It takes just 30 seconds. Thanks! We really appreciate it!

In This Episode We Cover

- The common auto loan scams that trick you into spending FAR more than you should

- Why you should NEVER trade in a “negative equity” car to upgrade

- The best car makes to buy (and two that rarely break down)

- How to crawl yourself out of credit card debt and come out with a 700/800 credit score

- How much money Seth makes on TikTok every month (it’s WILD!)

- Student loan resumption and whether college is worth the increase in salary

- And So Much More!

Links from the Show

Connect with Seth

Interested in learning more about today’s sponsors or becoming a BiggerPockets partner yourself? Let us know!

Note By BiggerPockets: These are opinions written by the author and do not necessarily represent the opinions of BiggerPockets.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.biggerpockets.com/blog/money-461

- :has

- :is

- :not

- :where

- $UP

- 000

- 1

- 10

- 12

- 12 months

- 13

- 15 years

- 15%

- 150

- 20

- 2017

- 2020

- 2023

- 2024

- 22

- 24

- 27

- 30

- 3rd

- 40

- 60

- 7

- 700

- 8

- 9

- 95%

- a

- Able

- About

- about IT

- above

- Absolute

- absolutely

- According

- Accounting

- actually

- add

- Additional

- advance

- advice

- Affiliate

- After

- again

- against

- ago

- ahead

- All

- allowed

- almost

- along

- already

- also

- always

- am

- amazing

- america

- American

- American Express

- among

- amount

- an

- analysis

- and

- Another

- answer

- any

- anymore

- anything

- anywhere

- Apple

- Apply

- appreciate

- approach

- approved

- ARE

- AREA

- argue

- argument

- arguments

- around

- articles

- Arts

- AS

- aside

- ask

- asking

- aspect

- Assets

- assist

- At

- attack

- Attainable

- attending

- audience

- audits

- author

- authorized

- auto

- automakers

- average

- avoid

- away

- b

- Baby

- back

- Bad

- Balance

- balances

- Bank

- bankrupt

- Banks

- basis

- BE

- became

- because

- become

- becoming

- been

- before

- began

- begin

- Beginning

- behind

- being

- believe

- below

- BEST

- Better

- between

- Big

- bigger

- Biggest

- Bit

- blow

- Blue

- boat

- bonuses

- book

- border

- Bored

- Boring

- both

- Bottom

- brad

- brand

- Break

- brought

- budget

- budgeting

- build

- Building

- built

- Bunch

- burden

- burning

- business

- but

- buy

- Buying

- by

- call

- called

- came

- Campus

- CAN

- Can Get

- cannot

- car

- card

- Cards

- care

- careful

- carry

- cars

- case

- Cash

- Catalyst

- catastrophic

- change

- Channel

- charge

- charged

- choice

- choices

- circumstances

- City

- Cleaning

- climb

- Close

- closer

- Co-Host

- collection

- collections

- College

- Colleges

- come

- comes

- comfort

- comfortable

- coming

- comments

- commercial

- Common

- community

- completely

- complex

- comprehensive

- Compute

- concept

- concluded

- confidently

- Consider

- consolidating

- consumer

- content

- contract

- Conversation

- Cool

- cooper

- copywriting

- Corner

- correct

- Cost

- costly

- Costs

- could

- country

- Couple

- course

- cover

- covered

- created

- creator

- credit

- credit card

- Credit Cards

- Credit Union

- Crossed

- Current

- customer

- Cut

- cutting

- daily

- data

- Dave

- day

- Days

- deal

- dealing

- Deals

- Debt

- decades

- decent

- decide

- decision

- decisions

- definitely

- Degree

- depends

- deposit

- depreciation

- Design

- DID

- difference

- different

- directions

- discipline

- disciplined

- discovering

- discretionary

- discussions

- do

- does

- Doesn’t

- doing

- dollars

- done

- Dont

- double

- down

- dr

- dreams

- drive

- dropped

- due

- during

- Earlier

- Early

- Earning

- ease

- ease of use

- easy

- eat

- Economics

- economy

- editing

- Education

- educational

- either

- Electric

- electric vehicles

- else

- Else’s

- emergency

- encouraged

- end

- ending

- Endless

- ends

- engaging

- Engineering

- enough

- entertaining

- entirely

- episode

- equity

- error

- escape

- especially

- estate

- ETFs

- Even

- EVER

- Every

- every day

- everybody

- everyone

- everyone’s

- everything

- exactly

- example

- examples

- excited

- Exclusive

- Exodus

- expensive

- experience

- Explain

- explore

- express

- extra

- Face

- facing

- fact

- factor

- factors

- Falling

- fantastic

- far

- farewell

- Fashion

- FAST

- faster

- Favorite

- Features

- Featuring

- Fed

- Federal

- feel

- Fees

- few

- FICO

- Fields

- Figure

- Figures

- finance

- Finances

- financial

- financial freedom

- financial goals

- Financial independence

- financial institution

- Financial institutions

- financially

- Find

- fine

- finger

- fired

- First

- fit

- five

- Fix

- fixed

- florida

- focuses

- followed

- followers

- following

- food

- For

- foreign

- forever

- form

- Forward

- found

- founding

- FRAME

- Free

- Freedom

- friend

- friends

- from

- full

- fun

- fund

- future

- G2

- Gain

- game

- garner

- GAS

- Gen

- Gen Z

- General

- generally

- generate

- generation

- generational

- generational wealth

- genuine

- get

- getting

- Give

- Giving

- Go

- Goals

- God

- Goes

- going

- gone

- good

- got

- Government

- graduate

- graham

- grand

- great

- greater

- grinding

- Growing

- Guy

- had

- Half

- hammer

- handle

- Hands

- Happening

- happens

- happy

- Hard

- hard work

- harm

- hat

- hate

- Have

- having

- he

- head

- heard

- help

- her

- here

- Hidden

- High

- higher

- highest

- him

- his

- history

- Hit

- holding

- homage

- Home

- homework

- honest

- Honestly

- hope

- HOT

- HOURS

- housing

- How

- How To

- HTTPS

- huge

- hundred

- Hundreds

- Hybrid

- i

- I’LL

- idea

- ideal

- if

- Impact

- impacting

- in

- incentivized

- Income

- Increase

- incredible

- incredibly

- independence

- individual

- inflation

- influencers

- informed

- Initiative

- INSANE

- instead

- Institution

- institutions

- insurance

- interest

- INTEREST RATE

- interested

- interests

- Interface

- Interview

- interviewed

- into

- introduce

- Invest

- invested

- investing

- investment

- Investments

- issue

- issues

- IT

- ITS

- J.D. Power

- Job

- Jobs

- join

- journey

- jpg

- just

- Keep

- Kelley

- kept

- Kid

- Kind

- Know

- Knowing

- knowledge

- known

- large

- largest

- Last

- lastly

- launch

- leading

- LEARN

- learned

- learning

- least

- Leave

- leaving

- Led

- left

- legitimate

- LEND

- less

- Level

- LG

- Life

- lifestyle

- lifetime

- light

- like

- likely

- likes

- LIMIT

- limits

- Line

- LINK

- Listening

- little

- live

- living

- loan

- Loans

- lobbying

- Long

- long time

- Look

- looking

- looming

- Lot

- lots

- love

- loves

- Low

- lower

- lowest

- made

- mainly

- major

- Majority

- make

- make money

- MAKES

- Making

- management

- managing

- many

- many people

- Market

- massive

- master’s

- Matter

- Matters

- May..

- maybe

- me

- mean

- meaning

- means

- mechanical

- mechanics

- Media

- Middle

- might

- Milestones

- Millennial

- Millennials

- million

- million dollars

- millions

- mind

- minds

- minimal

- minimum

- minutes

- misconception

- model

- moment

- money

- Month

- monthly

- months

- more

- most

- move

- moving

- much

- multiple

- my

- name

- Near

- nearly

- necessarily

- Need

- needed

- needs

- negative

- networking

- Neutral

- never

- New

- New Features

- newer

- news

- next

- nice

- no

- None

- nothing

- now

- number

- obsolete

- october

- Odds

- of

- off

- offer

- offering

- often

- Oil

- Okay

- Old

- on

- once

- ONE

- ones

- online

- only

- open

- operates

- Opinion

- Opinions

- Opportunity

- optimal

- Option

- Options

- or

- order

- Other

- our

- out

- outright

- over

- overnight

- own

- ownership

- paid

- Pain

- painful

- pandemic

- parents

- part

- partner

- parts

- passion

- passionate

- past

- path

- pause

- Pay

- paying

- payment

- payments

- peace

- People

- people’s

- perfect

- perfectly

- period

- person

- personal

- Phased

- Place

- plan

- planning

- plans

- platform

- plato

- Plato Data Intelligence

- PlatoData

- Play

- please

- pleasure

- podcast

- Point

- points

- political

- poor

- pop

- Popular

- population

- position

- positive

- possible

- possibly

- Post

- posted

- potential

- power

- powered

- preparing

- pressure

- pretty

- Prior

- probably

- Problem

- problems

- process

- processing

- Produced

- producing

- Products

- Programs

- Progress

- properly

- properties

- property

- proponent

- protected

- provided

- pulling

- Pulls

- purchase

- pursue

- pursuing

- pushed

- Pushing

- put

- Putting

- qualified

- qualify

- question

- Questions

- Quick

- quickly

- quite

- raising

- range

- rarely

- Rate

- rated

- Rates

- rating

- reach

- Read

- ready

- real

- real estate

- Reality

- realize

- realized

- realizing

- really

- reason

- reasonable

- recap

- receives

- recent

- recently

- recession

- recommend

- record

- recording

- reduction

- refund

- Regardless

- regular

- regularly

- relative

- relief

- remember

- Rent

- Reported

- represent

- Representatives

- research

- residential

- resonating

- Resources

- REST

- restore

- return

- review

- Rewards

- Rich

- right

- Risky

- road

- ROI

- Rolling

- RON

- round

- Route

- Rule

- sacrifice

- safest

- Said

- Salespeople

- same

- SAND

- satisfied

- Save

- saving

- saw

- say

- saying

- says

- School

- Schools

- score

- scores

- scott

- screening

- seamless

- Second

- seconds

- Secret

- sector

- secure

- Secured

- see

- seeing

- seen

- sell

- Selling

- sense

- September

- serious

- Services

- seven

- Share

- sharing

- she

- shift

- Short

- shortage

- should

- show

- showing

- side

- signed

- significant

- significantly

- signing

- simplify

- since

- sit

- situation

- SIX

- Six months

- slow

- Smell

- So

- Society

- Software

- Solutions

- Solving

- some

- somehow

- Someone

- something

- sometimes

- Soon

- Source

- Sources

- speaking

- Specialty

- Spectrum

- Spending

- Sponsors

- Spotify

- stable

- standing

- Star

- stark

- start

- started

- Starting

- Stations

- stay

- steady

- Step

- Steps

- Stick

- stickers

- sticking

- Still

- Stop

- stopped

- Story

- stream

- streamlining

- strong

- Student

- Students

- studies

- Study

- Studying

- style

- subject

- success

- successful

- such

- Super

- support

- supposed

- sure

- surprised

- system

- Take

- takes

- taking

- Talk

- talking

- tasks

- tax

- team

- Technology

- tell

- tenant

- tens

- term

- terms

- territory

- testament

- than

- thank

- thanks

- that

- The

- the world

- their

- Them

- then

- There.

- These

- they

- thing

- things

- think

- Thinking

- Third

- thirty

- this

- those

- though?

- thought

- thousands

- three

- Through

- Throwing

- tiktok

- time

- times

- tip

- tips

- tired

- tires

- to

- today

- today’s

- too

- took

- tool

- top

- topic

- TOTALLY

- towards

- track

- trade

- trades

- Trading

- traditionally

- Transcript

- transition

- transitioning

- transportation

- travel

- treat

- tremendously

- trial

- trial and error

- true

- truly

- try

- trying

- tv

- tv show

- two

- Ultimately

- under

- understand

- underwater

- unfortunate

- unfortunately

- union

- unit

- unsecured

- until

- Update

- upon

- us

- use

- used

- User

- users

- using

- value

- Vehicles

- very

- Videos

- Visit

- Walmart

- want

- wanted

- wanting

- was

- Way..

- ways

- we

- Wealth

- Wealth Building

- week

- Weeks

- welcome

- WELL

- went

- were

- What

- What is

- whatever

- when

- whenever

- whether

- which

- while

- WHO

- whole

- why

- Wild

- will

- with

- within

- wonder

- wonderful

- Work

- worked

- Workforce

- working

- works

- world

- worried

- worse

- worth

- would

- writing

- written

- Wrong

- wrote

- X

- year

- years

- yes

- yet

- you

- Your

- yourself

- youtube

- youtubers

- zephyrnet

- zero