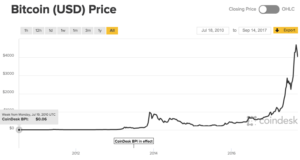

While stock investors were trying to secure a 12-15% return on their investments, those who had invested in bitcoins were laughing away straight to their banks with returns of over 1500%.

Mind blown?

That’s the normal reaction. But, if you are ever constructing a serious investment portfolio, adding cryptocurrency will be a lot of risk to take. But, if you tread carefully, you might be able to minimize your risks by enjoying the lucrative profits that the cryptocurrency market has to offer.

Here is a complete lowdown on how to invest in the cryptocurrency market, the smart way. Let’s begin.

What Not To Do?

Before learning the strategies that could help you make money in the cryptocurrency market, it would be a good idea to learn what not to do. These tips will help you maneuver through the cryptocurrency market and deter you from making the same mistakes that other people have committed in the past.

Don’t Give into the Fear

When you see your colleague putting in his money in a new cryptocurrency, and it gives you a sense of urgency too. You may feel like that everyone is getting rich and you are the only one who is not getting a piece of action. But, you are wrong here. Seasoned investors believe that following a crowd mentality is a surefire way to lose money in the markets.

Buy when the market is down and sell when it’s up.

When something is making a lot of news, it is a good indicator that it is a bad time to invest. Why? Because everybody, just like you, will be doing the same. You will buy at a higher price and eat into your own profits. Do not give into this fear of losing out. It will only force you to make hasty and uninformed decisions.

Do Not Buy Only because it’s Cheap

After the Bitcoin price chart went in an upward swing, people took a shine to cryptocurrencies. No wonder over a 1600+ cryptocurrencies have hit the market. Of course, not all of them are doing well or are ever going to.

So, the lesson here is that do not spend your money on any cryptocurrency that you find cheap.

They may never go up or worse, disappear and take your hard-earned money with them.

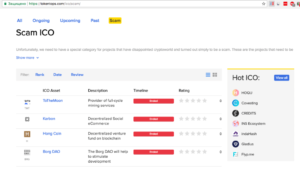

Do Not Trust Every Cryptocurrency Exchange

As the cryptocurrencies gained popularity, many exchanges dealing in cryptocurrency mushroomed too. Mining is not the easiest way to get your hands on cryptocurrency, so these exchanges are very welcome. But, they are very different from the well-established stock exchanges.

Forget the fact that they are completely virtual, there is another factor that is more worrisome. They are unregulated. This means there is no agency that vets them. So, if tomorrow a scammer posing as an exchange takes your money never to be seen, you can pretty much do nothing.

You cannot complain anywhere because there is no agency supervising the activities of these exchanges, and you are definitely not getting the money back. So, do not trust every exchange you come across.

Do Not Sell Too Quickly

Cryptocurrencies are a rather new development and the tax services are still learning to deal with this new asset. But, since it is an investment, the longer the period of investment, the higher is the tax benefit you receive. Apart from the tax benefits, you should also know that market investments usually yield good results only in the long term.

Sure, the surge the Bitcoin went through recently could have been tempting. But, do not sell quickly after reading every news report that you come across.

What To Do?

Now, that you know what the don’ts of the cryptocurrency market are, you are in a good position to apply the dos. So, here are the tips for you to invest smartly in the wild cryptocurrency market.

Know Your Cryptocurrency

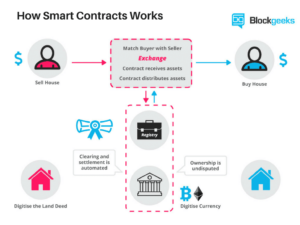

Research is key to any kind of investment, and the same is true for cryptocurrencies as well. For every cryptocurrency out there, there is an accompanying white paper. From this document, you will be able to understand everything about the underlying technology and its applications.

This should also give you a fair idea about the vision behind developing the currency. If the technology solves a real-world problem, then it is here to stay.

Find Out Who is Backing the Currency

Whenever you invest in a company’s stock, what kind of information do you gather to make sure it fares well in the future? You look at the balance sheet of the company, the profits it has posted in the past, and the profile of the promoters, among all other things.

When you invest in the cryptocurrency market, you should also carry out this kind of analysis. Find out the developers who created the cryptocurrency, and what kind of credentials do they have. If they are a reputed set of developers, this means that the currency is legit. Secondly, find out about the size of the community that supports the cryptocurrency you are interested in.

This is again a good way to ascertain the legitimacy of the currency. Also, the positive sentiment in the community will tell you that the currency has a strong user base that is optimistic about its growth. With cryptocurrencies primarily deriving their value from the market sentiment, this will serve you well in making your investment strategy.

Stay Updated

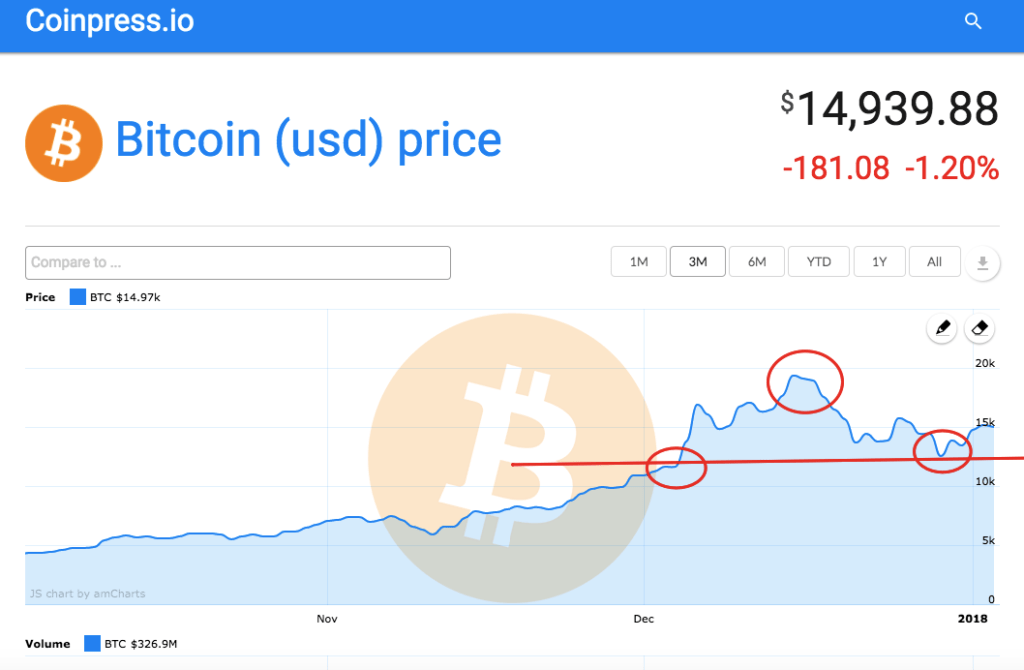

This one is hugely important. Know which cryptocurrencies are being backed by the big corporations. It will be a good indication that the prices of the cryptocurrency are going to soar. The recent meteoric rise in the value of Bitcoin left even the most seasoned investors stunned.

They expected a hike, but not this much. And why did they expect it? Because one of the biggest banks in South Korea was testing bitcoin wallets. Also, the likes of NASDAQ and CME hedge fund are planning to offer bitcoin futures. So, those who knew about these breaking news, knew a bitcoin high was on the horizon.

So, it was a good time to sell. No prizes for guessing that they made a lot of money. So, staying about what is happening across the world will make the chaotic world of cryptocurrencies make a little more sense.

Understand the Legal Issues

In many countries, trading in cryptocurrencies is completely banned. So, before making any big investments in cryptocurrencies make sure that you have consulted a lawyer. In the lure of benefitting from the new wave of cryptocurrencies, you may end up losing money in fines, or worst, get arrested for indulging in an illegal activity.

Liquidity Issues

Cryptocurrencies are a tad more complicated than traditional assets like gold. You cannot just go to the market and get money in lieu of them. It is possible that after you bought the cryptocurrency, its popularity went down. Hence, the cryptocurrency does not have any buyers in the market right now.

So, make sure that you research well to find about the ease of trading a currency. Bitcoin is the most famous cryptocurrency and even that cannot be used to transact freely for all the goods and services in the market. So, make sure that you buy a cryptocurrency that you can easily liquify when the time comes.

Spread Your Portfolio

Cryptocurrencies are a volatile asset to add to your investment portfolio. But, there are some that are less volatile than others. Do not invest all your money in one cryptocurrency. Find at least 3 cryptocurrencies that you want to invest in, and allocate your funds as you want.

This way, in case one cryptocurrency bombs completely, all your money will not go down the drain. You will have other currencies to make you some money.

Source: https://crypo.io/blog/smartly-cryptocurrency/- Action

- activities

- All

- among

- analysis

- applications

- arrested

- asset

- Assets

- Banks

- Biggest

- Bitcoin

- Bitcoin Futures

- Bitcoin Price

- bitcoin wallets

- BTC

- buy

- community

- company

- Corporations

- countries

- Credentials

- cryptocurrencies

- cryptocurrency

- cryptocurrency market

- currencies

- Currency

- deal

- dealing

- developers

- Development

- DID

- eat

- exchange

- Exchanges

- fair

- funds

- future

- Futures

- Gold

- good

- goods

- Growth

- here

- High

- How

- How To

- HTTPS

- idea

- Illegal

- information

- investment

- Investments

- Investors

- IT

- Key

- korea

- LEARN

- learning

- Legal

- List

- Long

- Making

- Market

- Markets

- money

- Nasdaq

- net

- news

- offer

- Other

- Paper

- People

- planning

- portfolio

- price

- Profile

- reaction

- Reading

- report

- research

- Results

- returns

- Risk

- sell

- sense

- sentiment

- Services

- set

- Share

- shine

- Size

- smart

- So

- South

- South Korea

- spend

- stay

- stock

- Strategy

- Supports

- surge

- tax

- Technology

- Testing

- the world

- time

- tips

- Trading

- Trust

- value

- Virtual

- vision

- Volatility

- Wallets

- Wave

- What is

- white paper

- WHO

- world

- Yield