SEATTLE — Years before U.S. consumers felt the impact of semiconductor supply chain shortages, the Defense Advanced Research Projects Agency was already mulling how to tackle the long-term technological barriers facing commercial industry and the national security community.

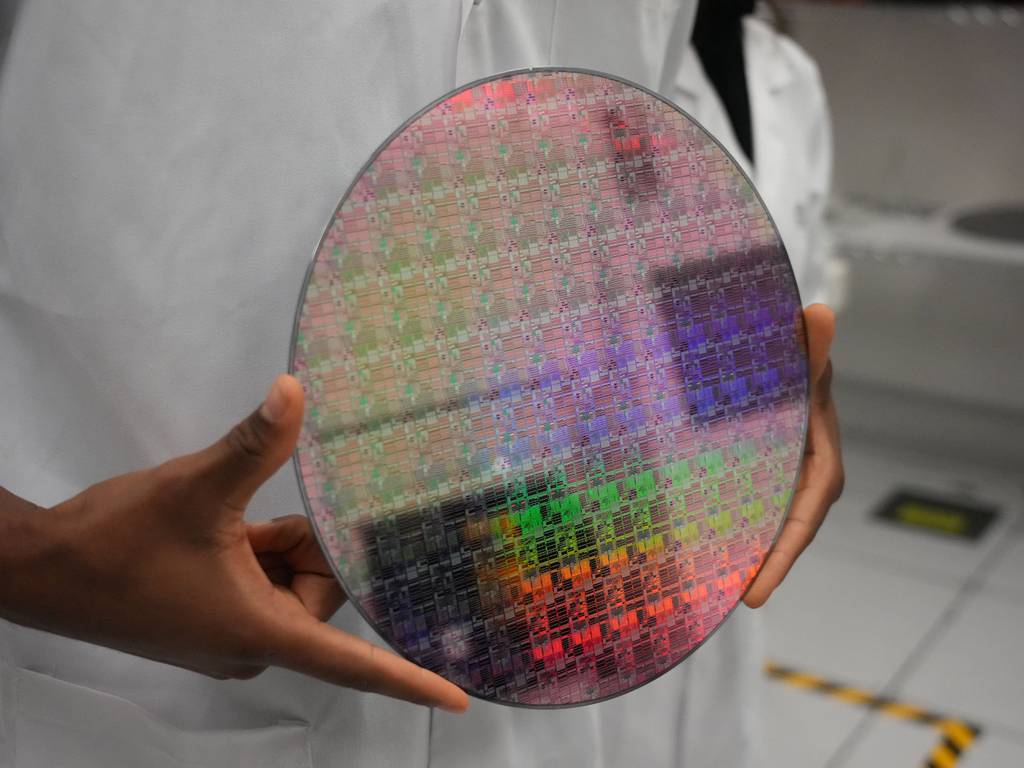

In the last 30 years, the U.S. has gone from producing 37% of the global microchip supply to around 12%. Today, Taiwan produces most of the world’s supply of advanced semiconductors and China exports a large portion of its microchips to the United States. These chips power everything from cell phones to cars to the Pentagon’s premier fifth-generation fighter aircraft, the F-35.

Concern around the resulting U.S. dependency on overseas microelectronics supply chains hit the mainstream during the COVID-19 pandemic when a microchip supply shortage caused car prices to skyrocket. But DARPA, the Pentagon’s hub for high-risk, high-reward research and development, had been working to get ahead of the problem for years before that.

The agency’s heritage in microelectronics research dates back decades and includes programs such as the Metal Oxide Silicon Implementation Service in the 1980s, which sought to quickly produce microelectronic devices. More recently, and following the release of a 2017 report from the President’s Council of Advisors on Science and Technology that highlighted how technological limits were impeding U.S. semiconductor innovation, DARPA began formulating a plan to help push against some of those limits.

“Before the urgency of the discussion was happening, we had people who really recognized that it was a pretty urgent problem,” DARPA Director Stefanie Tompkins told C4ISRNET in an Aug. 22 interview.

It’s not unusual for DARPA to show up early to a problem set — in fact, that’s part of the agency’s mission. Mark Rosker, director of DARPA’s Microsystems Technology Office, said the agency was designed to protect the Defense Department from technological surprise, which means it’s often looking 10 to 15 years into the future to anticipate what challenges the national security community will be facing at that time.

“Inherently what that does is it puts us in a position where we’re looking for technologies that are going to be disruptive, that will cause change that’s not anticipated,” he said in an Aug. 23 interview. “I think that often puts us in a position, typically, of higher risk and often — not always, but often — longer timescale.”

Where DARPA fits

The agency in 2017 established a sweeping research effort called the Electronics Resurgence Initiative, or ERI, announcing it would invest more than $1.5 billion over a five-year period in a slate of programs designed to get after the key technological barriers facing commercial industry and national security agencies as they sought to advance microelectronics research and development and manufacturing.

Last year, DARPA reupped its commitment to forward-leaning microelectronics research, launching ERI 2.0 with an emphasis on cutting-edge manufacturing opportunities as well as technologies that can help electronic systems operate in extreme environments. DARPA plans to spend another $3 billion on these efforts over the next five years.

Today, as federal agencies like the Department of Commerce and Department of Energy, look to reinvigorate the microelectronics ecosystem by investing in foundries and supporting U.S. research in areas that are “relatively understood,” DARPA’s niche is in tackling longer term technology challenges.

“Trying to develop the kinds of capabilities that lead to disruption, I think in the long run will keep U.S. manufacturing capabilities ahead of our competitors,” Rosker said. “I think our friends at other agencies . . . agree with us that this is complementary to what they’re doing.”

Driven by the growing urgency within the U.S. around addressing microelectronics supply chain vulnerabilities, Congress last summer approved the $52 billion Creating Helpful Incentives to Produce Semiconductors, or CHIPS Act. The measure, which runs through 2026, funds semiconductor workforce improvement efforts, research and development and manufacturing. It also provides a 25% tax credit for investments in domestic manufacturing facilities and equipment.

According to an Aug. 9 White House fact sheet, companies have announced more than $166 billion in semiconductor and electronics manufacturing investment in the year since the CHIPS Act passed. The Commerce Department has established the National Semiconductor Technology Center, meant to serve as an innovation center for semiconductor technology. And the Defense Department, which received $2 billion in CHIPS Act funding, is on the verge of choosing regional hubs for its Microelectronics Commons — a network designed to create pathways to commercialize microelectronics research and innovation.

While DARPA didn’t receive CHIPS Act funding, Carl McCants, special assistant to the DARPA director for ERI, said the congressional and presidential interest has deepened the agency’s engagement with DoD’s microelectronics initiatives, the National Semiconductor Technology Center and industry — all partnerships that benefit the organization’s work.

“It leads to more discussions, it leads to more collaborations,” he told C4ISRNET in an Aug. 22 interview.

Electronics Resurgence Initiative

That collaboration, McCants said, is a big part of ERI and its successor ERI 2.0, which aim to tackle technological hurdles that affect both the national security community and the broader commercial industry.

ERI’s original focus was on six challenges it expected the U.S. would face in the next decade. They included efforts to leverage AI hardware to reduce the time it takes sensors to process information, improve manufacturing technology and boost security.

Those focus areas birthed at least 50 DARPA programs through which the agencies developed partnerships with universities, commercial companies and the traditional defense industrial base. According to McCants, many of these organizations had never worked with DARPA.

“It expanded our research, expanded our footprint, expanded, really, the access to a different set of subject matter experts that can help us do what we needed to do and what we’re trying to do,” he said.

One of the ERI programs that has had the biggest impact, according to Rosker, is an effort called Photonics in the Package for Extreme Scalability, or PIPES. The effort uses light to improve electrical data movement between individual chips and boost performance.

Commercial companies like Intel and Xilinx as well as major defense firms like Lockheed Martin, Northrop Grumman, Raytheon and BAE systems have been working with research teams from the University of Pennsylvania, Sandia National Laboratory and other institutions on PIPES. Rosker said the effort is already changing the way those companies think about building microelectronics.

Another ERI effort, Automatic Implementation of Secure Silicon, aims to design a mechanism for automating the process for building security into a chip’s design. Rosker explained that chip designers are constantly making performance and material trades as they consider how and whether to make a product more secure.

This program, he said, not only brings automation to that process, but it would allow designers to “make those trades in a real way, in a verifiable way.”

ERI 2.0 builds on the initiative’s original research thrusts but adds two more focused on novel manufacturing techniques and developing electronics that can survive in extreme heat or cold.

The centerpiece of ERI 2.0 is an effort called Next-Generation Microelectronics Manufacturing, or NGMM. The program aims to create a U.S.-based center for fabricating what are called 3D heterogeneously integrated microsystems.

At a basic level, the premise of 3DHI research is that by integrating and packaging chip components differently, manufacturers could disaggregate functions like memory and processing to significantly improve performance. It’s a technology area that could not only transform the U.S. industrial base, but that other nations, including Taiwan, have a strong interest in.

In July, DARPA chose 11 industry teams to begin the foundational work to establish the future domestic 3DHI hub. McCants expects to release an industry notice for the next two phases of the program by the end of this year and to have the center established by 2029.

He called that timeline “generic,” adding that he’s hopeful DARPA can move faster.

“As with any DARPA program, things could be sped up or things could be slowed down,” McCants said. “There’s a timeline and a time sensitivity to being able to pull this together and move forward.”

Courtney Albon is C4ISRNET’s space and emerging technology reporter. She has covered the U.S. military since 2012, with a focus on the Air Force and Space Force. She has reported on some of the Defense Department’s most significant acquisition, budget and policy challenges.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- ChartPrime. Elevate your Trading Game with ChartPrime. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.defensenews.com/battlefield-tech/2023/09/08/how-darpa-is-tackling-long-term-microelectronics-challenges/

- :has

- :is

- :not

- :where

- $3

- $UP

- 10

- 11

- 15 years

- 15%

- 2012

- 2017

- 2026

- 22

- 23

- 30

- 3d

- 50

- 70

- 9

- a

- Able

- About

- access

- According

- acquisition

- Act

- adding

- addressing

- Adds

- advance

- advanced

- advisors

- affect

- After

- against

- agencies

- agency

- ahead

- AI

- aim

- aims

- AIR

- Air Force

- aircraft

- All

- allow

- already

- also

- always

- an

- and

- announced

- Announcing

- Another

- anticipate

- Anticipated

- any

- approved

- ARE

- AREA

- areas

- around

- AS

- Assistant

- At

- Aug

- automating

- Automation

- back

- BAE Systems

- barriers

- base

- basic

- BE

- been

- before

- began

- begin

- being

- benefit

- between

- Big

- Biggest

- Billion

- boost

- both

- Brings

- broader

- budget

- Building

- builds

- but

- by

- called

- CAN

- capabilities

- car

- Carl

- Cause

- caused

- cell

- cell phones

- Center

- chain

- challenges

- change

- changing

- China

- chip

- Chips

- CHIPS Act

- chose

- cold

- collaboration

- collaborations

- Commerce

- commercial

- commercialize

- commitment

- community

- Companies

- competitors

- complementary

- components

- Congress

- Congressional

- Consider

- constantly

- Consumers

- could

- Council

- covered

- COVID-19

- COVID-19 pandemic

- create

- credit

- cutting-edge

- darpa

- data

- Dates

- decade

- decades

- Defense

- Defense Advanced Research Projects Agency

- Defense Department

- Department

- Department of Energy

- Dependency

- Design

- designed

- designers

- develop

- developed

- developing

- Development

- Devices

- different

- Director

- discussion

- discussions

- Disruption

- disruptive

- do

- does

- doing

- Domestic

- down

- during

- Early

- ecosystem

- effort

- efforts

- Electronic

- Electronics

- emerging

- Emerging Technology

- emphasis

- end

- energy

- engagement

- environments

- equipment

- establish

- established

- everything

- expanded

- expected

- expects

- experts

- explained

- exports

- extreme

- fabricating

- Face

- facilities

- facing

- fact

- faster

- Federal

- firms

- five

- Focus

- focused

- following

- Footprint

- For

- Force

- formulating

- Forward

- friends

- from

- functions

- funding

- funds

- future

- get

- Global

- going

- gone

- Growing

- had

- Happening

- Hardware

- Have

- he

- help

- helpful

- heritage

- high-risk

- higher

- Highlighted

- Hit

- hopeful

- House

- How

- How To

- HTTPS

- Hub

- Hubs

- Hurdles

- i

- images

- Impact

- implementation

- improve

- improvement

- in

- Incentives

- included

- includes

- Including

- individual

- industrial

- industry

- information

- Initiative

- initiatives

- Innovation

- institutions

- integrated

- Integrating

- Intel

- interest

- Interview

- into

- Invest

- investment

- Investments

- IT

- ITS

- jpg

- July

- Keep

- Key

- laboratory

- large

- Last

- lead

- Leads

- least

- Level

- Leverage

- light

- like

- limits

- Lockheed Martin

- Long

- long-term

- longer

- Look

- looking

- Mainstream

- major

- make

- Making

- Manufacturers

- manufacturing

- many

- mark

- Martin

- material

- Matter

- means

- meant

- measure

- mechanism

- Memory

- metal

- Military

- Mission

- more

- most

- move

- move forward

- movement

- National

- national security

- Nations

- needed

- network

- never

- next

- niche

- Notice..

- novel

- of

- Office

- often

- on

- only

- operate

- opportunities

- or

- organizations

- original

- Other

- our

- over

- overseas

- packaging

- pandemic

- part

- partnerships

- pathways

- Pennsylvania

- People

- performance

- phones

- pipes

- plan

- plans

- plato

- Plato Data Intelligence

- PlatoData

- policy

- position

- premier

- presidential

- pretty

- Prices

- Problem

- process

- processing

- produce

- produces

- producing

- Product

- Program

- Programs

- projects

- protect

- provides

- Push

- Puts

- quickly

- real

- really

- receive

- received

- recently

- recognized

- reduce

- regional

- release

- report

- Reported

- reporter

- research

- research and development

- research and innovation

- resulting

- Risk

- Run

- runs

- s

- Said

- Scalability

- Science

- Science and Technology

- secure

- security

- semiconductor

- Semiconductors

- Sensitivity

- sensors

- serve

- service

- set

- she

- sheet

- shortage

- shortages

- show

- significant

- significantly

- Silicon

- since

- SIX

- skyrocket

- Slate

- some

- sought

- Space

- Space Force

- special

- spend

- States

- strong

- subject

- such

- summer

- supply

- supply chain

- Supporting

- surprise

- survive

- Systems

- tackle

- tackling

- Taiwan

- takes

- tax

- tax credit

- teams

- techniques

- technological

- Technologies

- Technology

- term

- than

- that

- The

- The Future

- These

- they

- things

- think

- this

- this year

- those

- Through

- time

- timeline

- to

- today

- together

- trades

- traditional

- Transform

- two

- typically

- u.s.

- understood

- United

- United States

- Universities

- university

- University of Pennsylvania

- unusual

- urgency

- urgent

- us

- uses

- verge

- verifiable

- Vulnerabilities

- was

- Way..

- we

- WELL

- were

- What

- when

- whether

- which

- white

- White House

- WHO

- will

- with

- within

- Work

- worked

- Workforce

- working

- world’s

- would

- year

- years

- zephyrnet