Binance CEO Changpeng Zhao (“CZ”) has commented on Twitter about the Department of Financial Services’ (NYDFS) directive to Paxos Trust Co. to stop minting new BUSD. As reported by the Wall Street Journal today, Paxos will continue to manage redemptions of the product.Existing BUSD’s remain fully-backed and redeemable through at least February 2024.

CZ explained that Paxos is regulated by the NYDFS and BUSD is a stablecoin wholly owned and managed by Paxos. As a result, BUSD’s market capitalization will only decrease over time.

Regarding the alleged lawsuit filed by the U.S. Securities and Exchange Commission against Paxos, the Binance CEO has no inside information, although CZ did announce product changes on Binance regarding BUSD.

Binance CEO Is Puzzled

Rumors are currently circulating in the crypto community that U.S. authorities SEC and NYDFS could target stablecoins, attacking a cornerstone of the crypto ecosystem. Crypto journalist Frank Chaparro tweeted:

SEC is on an absolute warpath. […] I wouldn’t be surprised if they are reviewing USDC, specifically. One senior executive at an exchange told me a few days ago that the SEC was effectively embarking on its own crypto version of the ‘Night of the Long Knives.’

Whether the situation is really as dramatic and U.S. authorities want to put an end to stablecoins per se, remains to be seen and is not really clear at the moment. Binance CEO Zhao, for example, said that while he is “not an expert on U.S. laws,” but agrees with Miles Deutscher’s opinion in a tweet that stablecoins cannot be a security themselves.

“The SEC has labeled BUSD as an ‘unregistered security,’ and is suing its issuer, Paxos. But how on earth is a STABLECOIN considered a security, when it clearly doesn’t meet the Howey Test criteria. No one has ever had ‘the expectation of profit’ when buying BUSD,” Deutscher wrote.

Are US Authorities Starting A War On Stablecoins?

This argument will be difficult for the SEC to refute, which illustrates that the U.S. Securities and Exchange Commission may not have a problem with stablecoins per se, but with the issuers’ interest products.

This is further evidenced by the SEC suing Kraken over its interest product, which was not a “true on-chain” staking product, as Coinbase CEO Brian Armstrong explained. Another hint is that Paxos’ USDP stablecoin is not included in the announcement, and that the SEC’s crackdown on BUSD may be solely related to its deposit and interest product.

And Circle has a similar product that earns interest. Presumably that’s why the USDC issuer could come under SEC scrutiny, but not because of the stablecoin itself.

It is hard to imagine how a stablecoin can be classified as a security, otherwise the US dollar would have to be. But since Paxos and Circle operate on U.S. soil and offer interest products, they are easy targets for U.S. authorities.

Therefore, the current news and rumors must be considered carefully. Nevertheless, the attack by the U.S. authorities is of course a risk that stablecoin issuers will have to cope with.

In the long run, however, the current situation should pass and stablecoins should continue to flourish and serve as a cornerstone of the crypto ecosystem, even in the US.

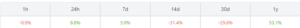

At press time, Bitcoin was dragged down by the news and traded at $21,560. For the moment, BTC was able to stay above the support at $21,465 in the 1-hour chart, although the price saw a dip to a new February low at $21,429.

Featured image from Edwin Hooper / Unsplash, Chart from TradingView.com

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.newsbtc.com/crypto/why-stablecoin-and-binance-fud-might-be-overblown/

- 2024

- a

- Able

- About

- above

- Absolute

- against

- alleged

- Although

- and

- Announce

- Announcement

- Another

- argument

- Armstrong

- attack

- Attacking

- Authorities

- because

- binance

- Binance CEO

- Bitcoin

- Bitcoin BTC

- Brian

- brian armstrong

- BTC

- btc price

- BUSD

- Buying

- cannot

- capitalization

- carefully

- ceo

- Changes

- Changpeng

- Changpeng Zhao

- Chart

- Circle

- circulating

- classified

- clear

- clearly

- coinbase

- Coinbase CEO

- come

- commented

- commission

- community

- considered

- continue

- could

- course

- Crackdown

- criteria

- crypto

- crypto community

- Crypto ecosystem

- Current

- Currently

- CZ

- Days

- decrease

- Department

- deposit

- DID

- difficult

- Dip

- Doesn’t

- Dollar

- down

- dramatic

- earth

- ecosystem

- Edwin

- effectively

- Even

- EVER

- example

- exchange

- executive

- expectation

- expert

- February

- few

- financial

- flourish

- from

- FUD

- further

- Hard

- How

- However

- Howey

- Howey Test

- HTTPS

- image

- in

- included

- information

- interest

- Issuer

- IT

- itself

- journal

- journalist

- knives

- Kraken

- Laws

- lawsuit

- Long

- Low

- manage

- managed

- Market

- Market Capitalization

- max-width

- Meet

- might

- minting

- moment

- Nevertheless

- New

- news

- NewsBTC

- NYDFS

- offer

- ONE

- operate

- Opinion

- otherwise

- overblown

- own

- owned

- Paxos

- plato

- Plato Data Intelligence

- PlatoData

- press

- price

- Problem

- Product

- Products

- put

- redeemable

- redemptions

- regarding

- regulated

- remain

- remains

- result

- reviewing

- Risk

- Rumors

- Run

- Said

- SEC

- Securities

- Securities and Exchange Commission

- security

- senior

- serve

- should

- similar

- since

- situation

- Source

- specifically

- stablecoin

- Stablecoins

- Staking

- Starting

- stay

- Stop

- street

- support

- surprised

- Target

- targets

- test

- The

- The Wall Street Journal

- themselves

- Through

- time

- to

- today

- traded

- TradingView

- Trust

- tweet

- u.s.

- U.S. Securities

- U.S. Securities and Exchange Commission

- under

- Unsplash

- us

- US Dollar

- USDC

- usdp

- version

- Wall Street

- Wall Street Journal

- war

- which

- while

- wholly

- will

- would

- zephyrnet

- Zhao