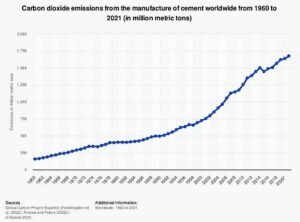

Carbon-intensive practices likely come from manufacturing, where both mass-produced goods and the associated production processes contribute significantly to CO₂ emissions. As such, there has been a growing interest among founders and venture capitalists in greener manufacturing solutions.

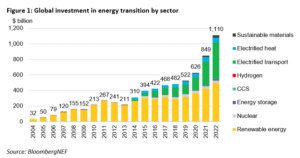

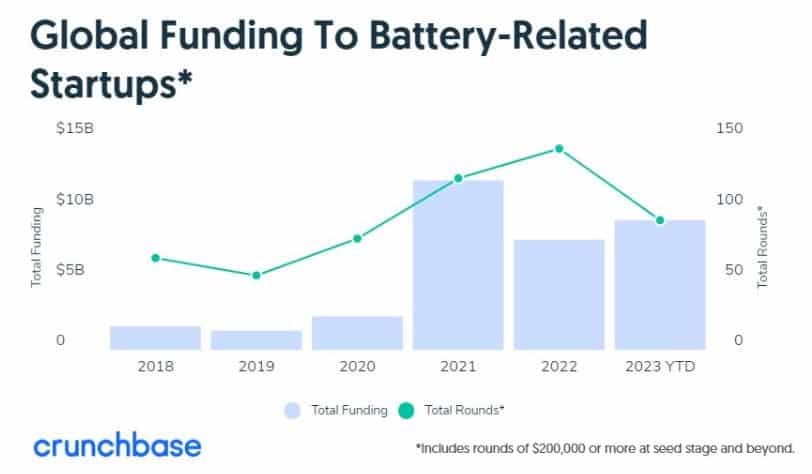

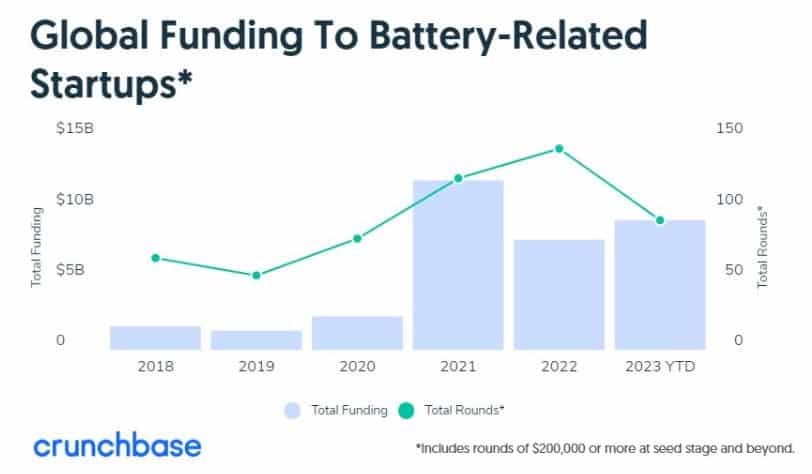

Despite a more subdued funding environment, the space gained traction. It witnessed over $10 billion in global investments across substantial funding rounds, as per Crunchbase analysis.

Crunchbase’s close examination of the data reveals prominent sectors and investment themes within greener manufacturing. Some key areas that stand out include battery recycling and the development of green steel.

The following list highlights significant financings that showcase the diverse range of investments within this burgeoning sector. Three areas particularly stood out:

Battery Startups Sparking a Sustainable Revolution

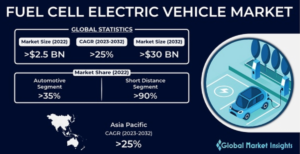

Battery funding has experienced significant growth in recent quarters, primarily fueled by the increasing adoption of electric vehicles (EVs). The interest in funding startups developing technologies for longer-lasting, more affordable, and environmentally friendly batteries has surged.

Europe has emerged as a hub for battery-related funding, with notable investments going to Verkor. This French startup specializes in low-carbon battery manufacturing. Another company based in Stockholm and known for its lithium-ion batteries, Northwolt, got massive funding.

Just recently, the European Commission has approved Germany to provide €902 million ($987mn) in state aid to Northvolt. This marks the first-ever application of a landmark rule allowing EU nations to be competitive with foreign subsidies to prevent investments from diverting outside the region.

Battery recycling has also become a prominent focus, with substantial funding rounds for companies like the Nevada-based Redwood Materials. Ascend Elements, based in Massachusetts, specializing in sustainable materials recovered from discarded lithium-ion batteries, also got a substantial investment.

According to market research, the demand for battery power will rise to 2,035 GWh by 2030, an 11-fold increase from the 2020 level. The majority of this demand comes from the transportation sector alone. When it comes to size, the global battery market is projected to go over $475 billion by 2032.

Transportation Startups Redefining Mobility

Several funded startups are directing their efforts toward developing more environmentally friendly transportation modes and components.

For instance, Infinitum, based in Texas, has secured over $350 million in funding to develop engines that claim to be 50% lighter and smaller than traditional iron-core motors. The company envisions applications in mobility and has garnered significant interest for its innovative approach.

San Francisco-based Glydways focuses on creating small, autonomous EVs for public transport. The startup has secured over $90 million in funding by contributing to the evolution of sustainable and efficient transportation solutions.

Electrification of the global transportation sector has been ramping up as national governments push for supporting policies.

The United States government has shown its commitment to reshaping the transportation landscape in the country by providing a $623 million grant to propel the growth of EVs.

As per S&P Global projections, lithium-ion battery capacity would reach 6.5 TWh by the decade’s end. Of that, the EV transportation sector will win over a market share of 93%, standing at 3.7 TWh.

Building a Greener Tomorrow

Another activity that’s widely recognized as one of the most carbon-polluting is construction. The building industry is responsible for around 39% of the global greenhouse gas emissions.

Unsurprisingly, there has been an increased interest from investors in startups that adopt greener approaches in building and materials.

Investors are more willing to support environmentally conscious startups addressing various aspects of construction materials.

Oakland-based Mighty Buildings has secured over $150 million in funding for its innovative 3D-printed panels and materials. The company claimed it the design can facilitate faster construction with a reduced carbon footprint.

In the realm of glass technology, California-based Halio is developing dynamic glass that allows windows to change tint. This innovation would result in energy savings in heating and cooling costs.

Some startups are also focusing on manufacturing sustainable building materials to build carbon-negative houses. They’re changing how the world builds by introducing alternative materials that reduce or eliminate the use of carbon-intensive concrete.

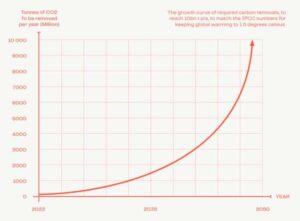

As substantial investments flow into green manufacturing startups, it’s evident that these ventures are capital-intensive, infrastructure-heavy, and carry some risks.

The biggest challenge is to develop manufacturing processes that minimize environmental impact and carbon pollution. Addressing this concern presents an opportunity for substantial rewards. The positive outcomes in sustainability and reduced environmental harm will far outweigh the risks and investments associated with manufacturing startups.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://carboncredits.com/green-manufacturing-startups-secured-over-10-billion-in-funding/

- :has

- :is

- :where

- ][p

- $UP

- 2020

- 7

- a

- across

- activity

- addressing

- adopt

- Adoption

- affordable

- Aid

- Allowing

- allows

- alone

- also

- alternative

- among

- an

- analysis

- and

- Another

- Application

- applications

- approach

- approaches

- approved

- ARE

- areas

- around

- AS

- aspects

- associated

- At

- autonomous

- based

- batteries

- battery

- BE

- become

- been

- Biggest

- Billion

- both

- build

- Building

- Building Materials

- builds

- burgeoning

- by

- CAN

- Capacity

- capitalists

- carbon

- carbon footprint

- carry

- challenge

- change

- changing

- claim

- claimed

- Close

- come

- comes

- commission

- commitment

- Companies

- company

- competitive

- components

- Concern

- concrete

- conscious

- construction

- contribute

- contributing

- Costs

- country

- Creating

- CrunchBase

- data

- Demand

- Design

- develop

- developing

- Development

- directing

- diverse

- dynamic

- efficient

- efforts

- Electric

- electric vehicles

- eliminate

- emerged

- Emissions

- end

- energy

- Engines

- Environment

- environmental

- environmentally

- environmentally friendly

- envisions

- EU

- European

- european commission

- EV

- evident

- evolution

- evs

- examination

- experienced

- facilitate

- far

- faster

- first-ever

- flow

- Focus

- focusing

- following

- Footprint

- For

- foreign

- founders

- French

- friendly

- from

- fueled

- funded

- funding

- funding rounds

- gained

- garnered

- GAS

- Germany

- glass

- Global

- Go

- going

- goods

- got

- Government

- Governments

- grant

- Green

- greener

- greenhouse gas

- Greenhouse gas emissions

- Growing

- growing interest

- Growth

- harm

- highlights

- houses

- How

- http

- HTTPS

- Hub

- Impact

- in

- include

- Increase

- increased

- increasing

- industry

- Innovation

- innovative

- instance

- interest

- into

- introducing

- investment

- Investments

- Investors

- IT

- ITS

- jpg

- Key

- Key Areas

- known

- landmark

- landscape

- Level

- lighter

- like

- likely

- List

- low-carbon

- Majority

- manufacturing

- Market

- market research

- market share

- mass-produced

- massachusetts

- massive

- materials

- max-width

- million

- minimize

- mobility

- modes

- more

- most

- Motors

- Nasdaq

- National

- Nations

- notable

- of

- on

- ONE

- Opportunity

- or

- out

- outcomes

- outside

- over

- panels

- particularly

- per

- plato

- Plato Data Intelligence

- PlatoData

- policies

- Pollution

- positive

- power

- practices

- presents

- prevent

- primarily

- processes

- Production

- projected

- projections

- prominent

- Propel

- providing

- public

- Push

- ramping

- range

- reach

- realm

- recent

- recently

- recognized

- recycling

- Redefining

- reduce

- Reduced

- region

- research

- reshaping

- responsible

- result

- Reveals

- Rewards

- Rise

- risks

- rounds

- Rule

- S&P

- S&P Global

- Savings

- sector

- Sectors

- Secured

- Share

- showcase

- shown

- significant

- significantly

- Size

- small

- smaller

- Solutions

- some

- Space

- specializes

- specializing

- stand

- standing

- startup

- Startups

- State

- States

- steel

- stood

- substantial

- such

- support

- Supporting

- Surged

- Sustainability

- sustainable

- Technologies

- Technology

- texas

- than

- that

- The

- the world

- their

- themes

- There.

- These

- this

- three

- to

- toward

- traction

- traditional

- transport

- transportation

- United

- United States

- use

- various

- Vehicles

- venture

- Ventures

- W3

- webp

- when

- widely

- will

- willing

- win

- windows

- with

- within

- witnessed

- world

- would

- zephyrnet