According to Goldman Sachs Research, the push to bring the global economy to net zero emissions is reaching a turning point. Certain clean technologies like solar and batteries have experienced shifts in their costs in 2023; some become more costly while others become more financially accessible, enhancing the affordability of decarbonization.

Riding the Cost Waves: 2023’s Clean Tech Shifts

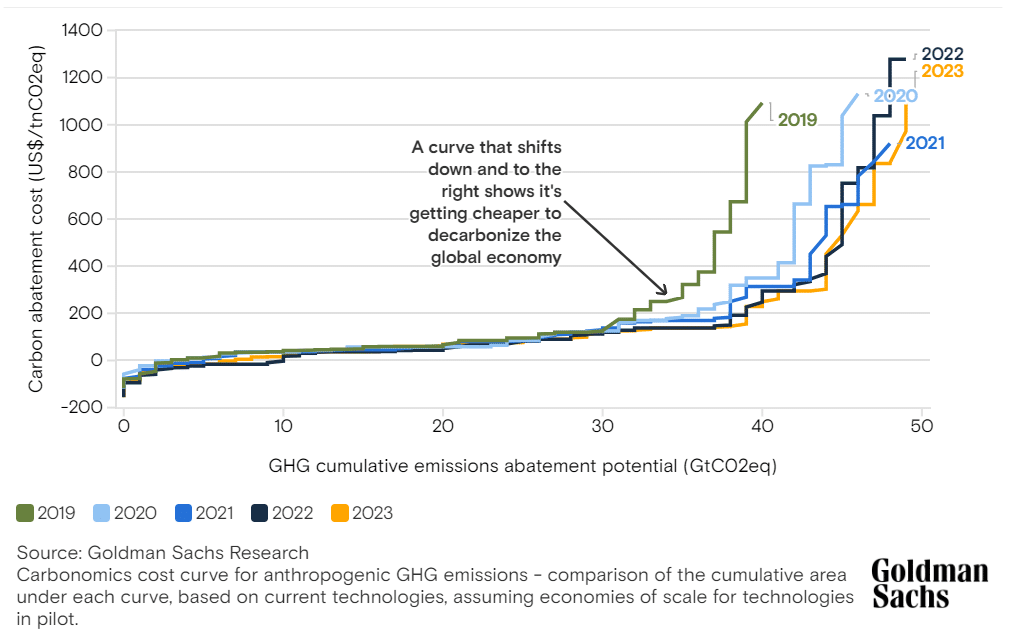

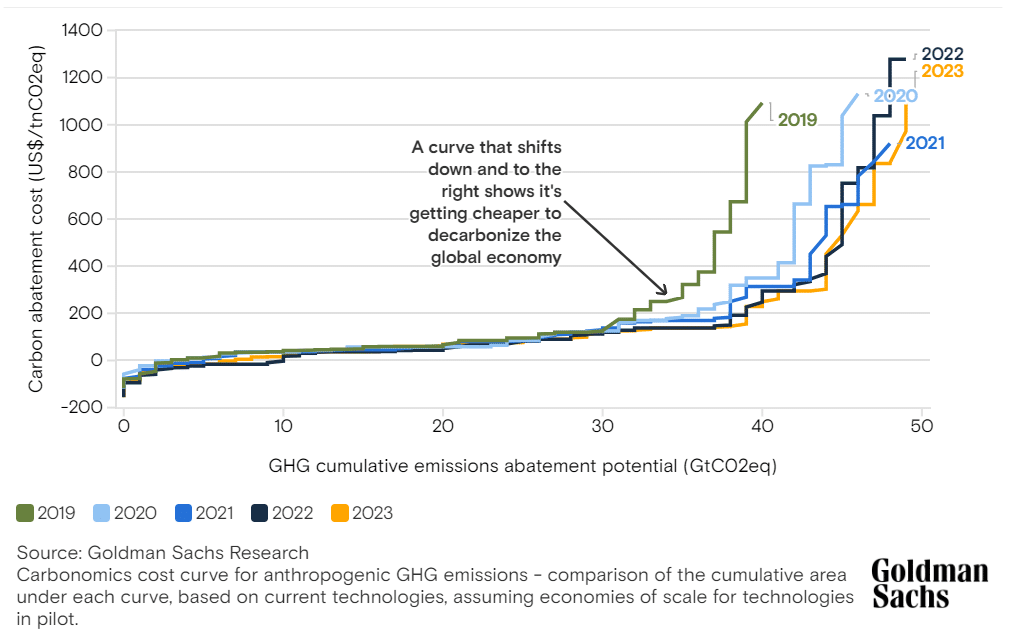

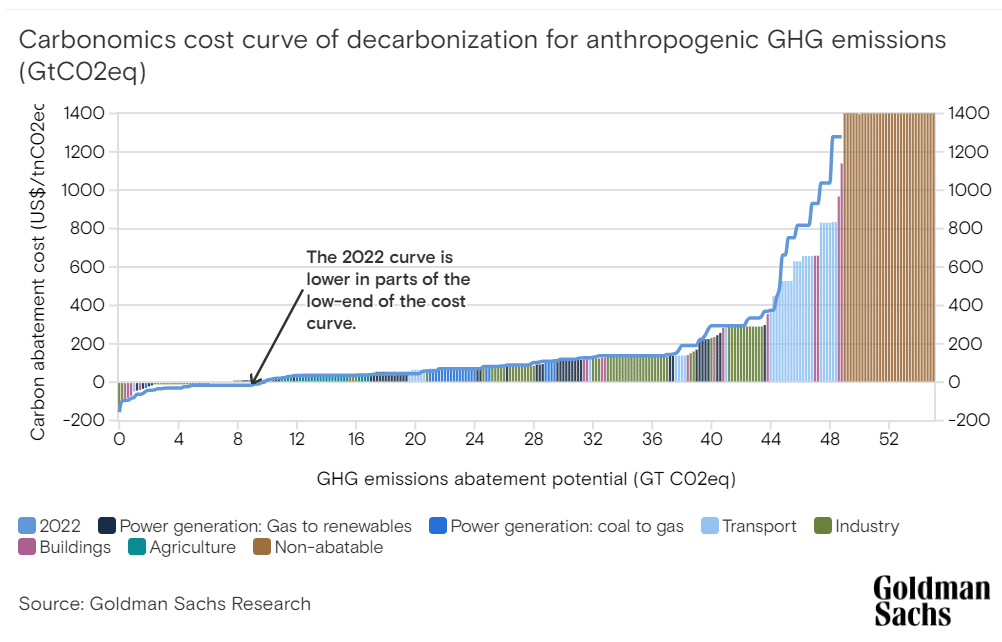

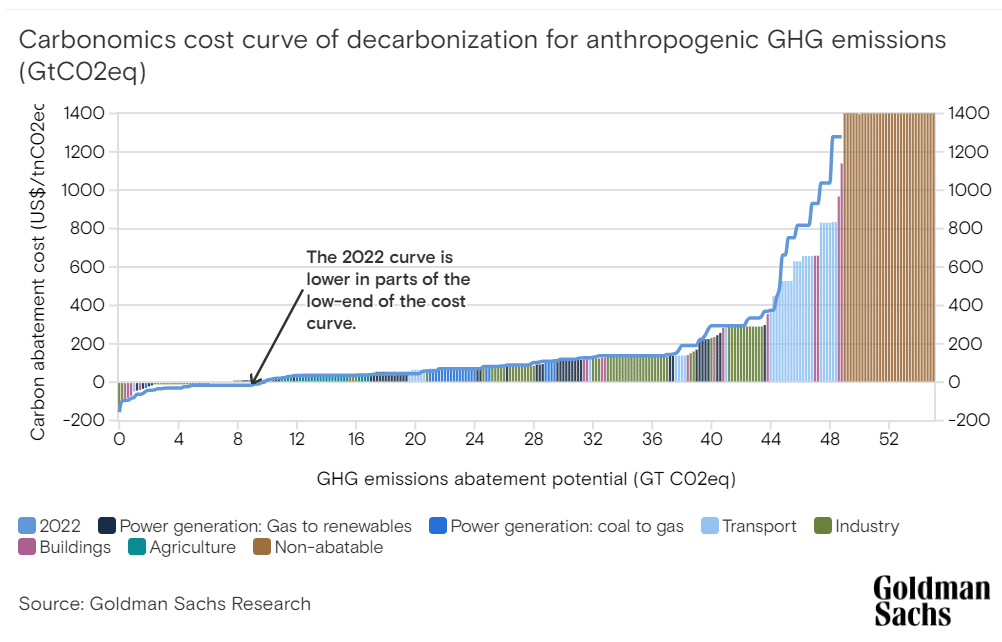

Goldman Sachs’ analysis of the Carbonomics cost curve for 2023 reveals the influence of reduced energy prices coming from fossil fuels. This can consequently increase the cost of renewable energy sources.

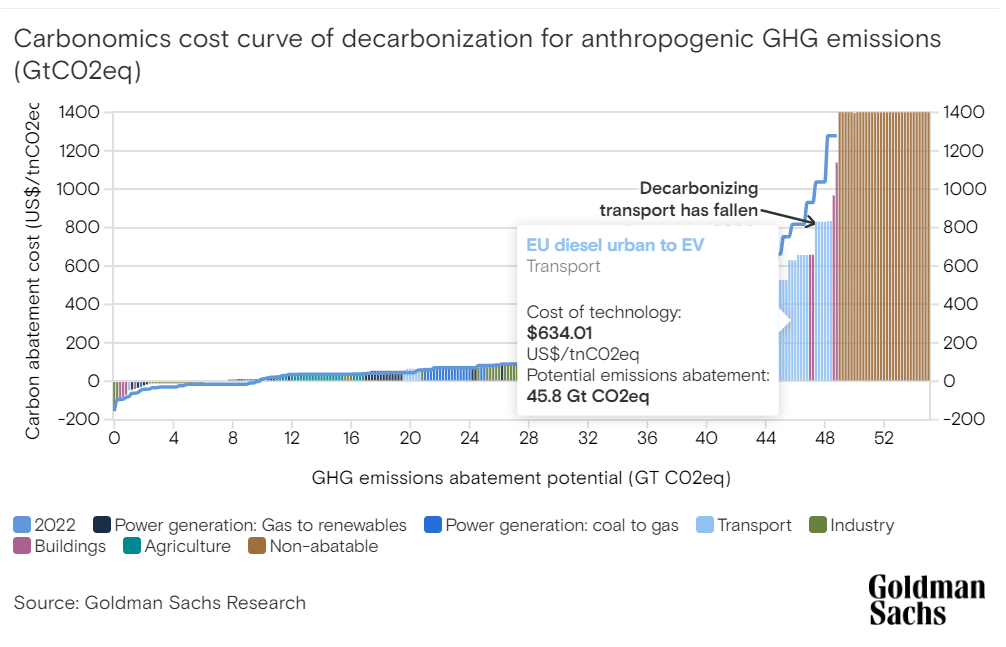

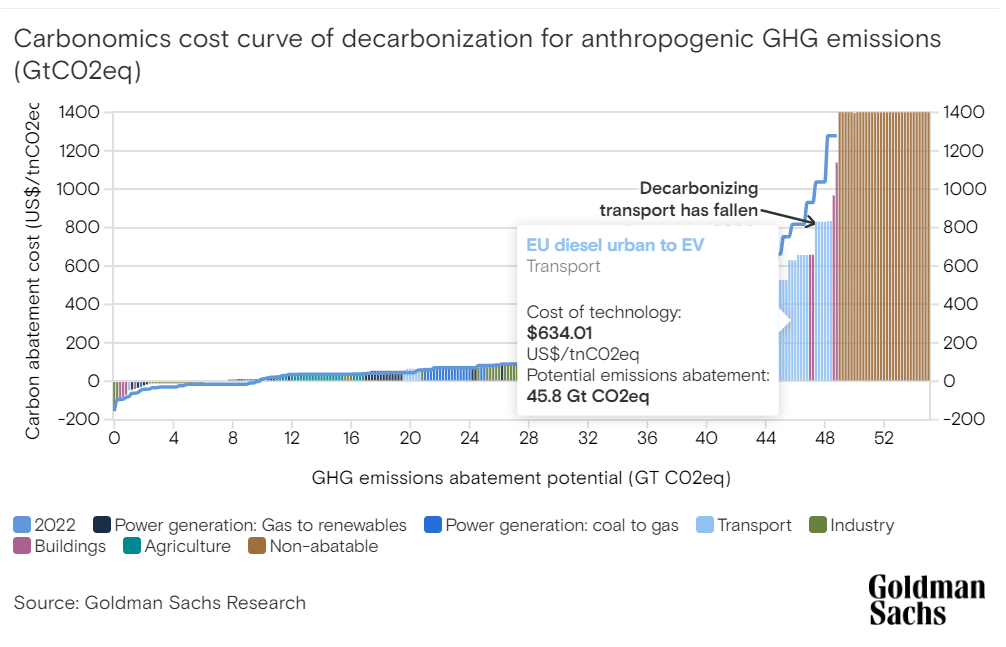

Moreover, rising interest rates have also made construction expenses for projects most costly such as offshore wind energy. On the other hand, declining battery costs and the benefits of scaling up production of electric vehicles have made these technologies more economically viable.

Michele Della Vigna, leading Natural Resources Research in Europe, the Middle East, and Asia at Goldman Sachs Research, highlights a pivotal shift in the affordability of clean technology. He stated that:

“From here on, the deflationary forces [solar and batteries] are likely to win, and this brings back an affordability to the decarbonization path that not only accelerates it but makes it more attractive to the consumer.”

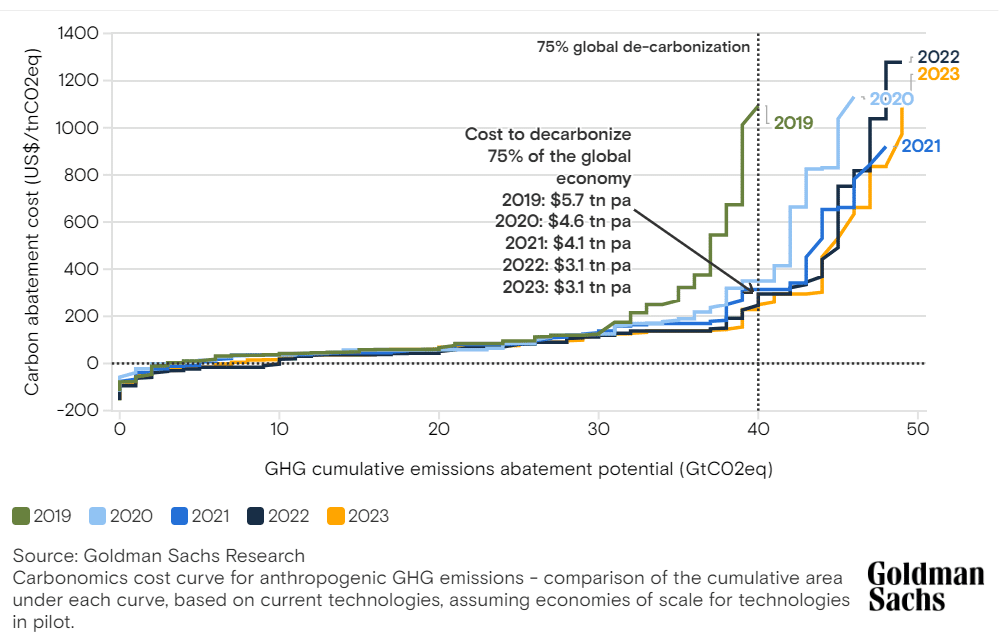

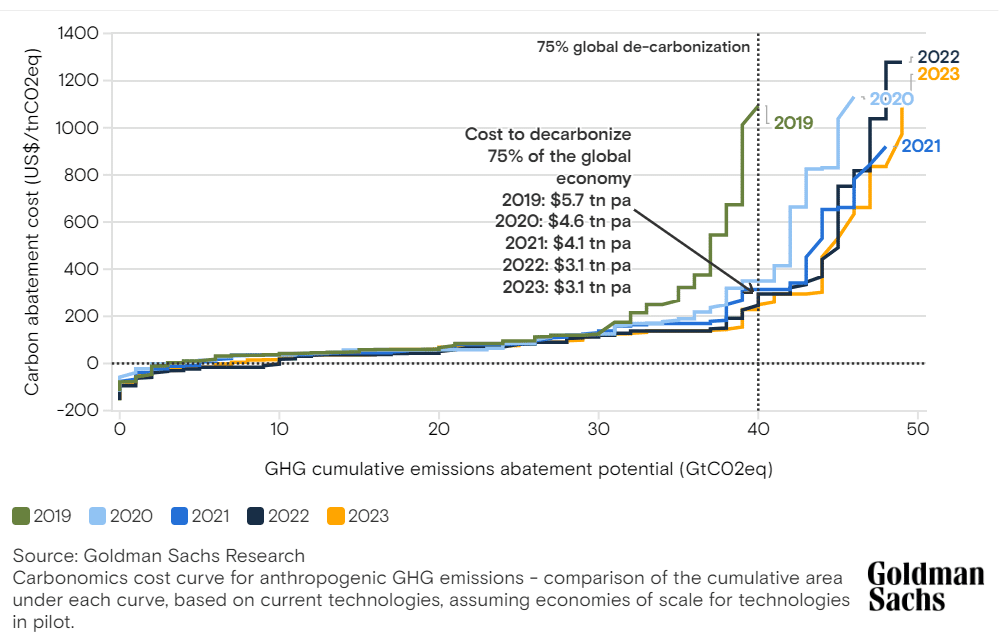

As per their analysis, the result shows a consistent flattening of the cost curve since 2019. The 2023’s curve suggests that the cost to remove 75% of planet-warming emissions remains the same from 2022.

The 2023 results also show an increase in costs in the lower half of the cost curve. This is largely due to increasing interest rates and cost inflation. While the impact of these factors overall is limited, they drive 25% increase in the renewable power sector.

Additionally, a significant improvement in battery costs for the transport sector made the high cost decarbonization more affordable. The sector gets 30% cheaper with improved batteries, lower raw material costs, and simpler cell-to-vehicle integration.

Balancing Policy Support and Climate Goals

Looking ahead to 2024, a significant aspect to monitor will be the level of policy support for decarbonization. Though policy support reached $500 billion through the Inflation Reduction Act (IRA), political uncertainties and delays in certain areas may cause project delays.

Still, Della Vigna expects increased investment from the financial and corporate sectors. This surge in investment will focus on areas of decarbonization that are becoming more accessible and cost-effective. Solar installations and electric vehicles, in particular, stand out in their analysis.

However, the investment and spending currently in place may not be enough to achieve climate goals, Della Vigna added. If the goal is to keep global warming well within 1.5 degrees Celsius, then the world remains off course.

He noted that over the past year, global emissions have risen by 1%, reaching an all-time high. Coal demand has surged by 3%, and there has been a substantial $1 trillion worth of direct incentives for hydrocarbons. These trends don’t align with the pathway to achieve the 1.5-degree scenario.

Moreover, the world is now at the midway point between the 2015 Paris agreement and its 2030 targets. Summing up all the government commitments to decarbonization, the outcome leads to flat, not declining, emissions.

But for the 1.5-degree scenario, emissions would need to decrease by more than 50% by 2030. This stark contrast highlights the significant deviation from the required path to meet the climate objectives.

The Game-Changing Announcements at COP28

When it comes to the recently concluded COP28 climate conference in Dubai, there are three announcements that have the most impact to the market, per Della Vigna:

First is the growing green capex in the Gulf Coast region, estimated by Goldman Sachs Research to be over $600 billion over the next decade.

Next is the commitment to ramped up renewable power generation, which can improve affordability of clean technologies. The IEA’s updated Net Zero Roadmap shows that tripping global installed renewable energy capacity to 11,000 GW by 2030 will achieve the most emission reductions.

Last is the Oil and Gas Decarbonization Charter formed by 50 companies, targeting zero methane emissions and ending routine flaring by 2030.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://carboncredits.com/goldman-sachs-research-says-global-net-zero-journey-reaches-a-critical-turning-point-decarbonization/

- :has

- :is

- :not

- $UP

- 000

- 1

- 11

- 2015

- 2019

- 2022

- 2023

- 2024

- 2030

- 50

- a

- accelerates

- accessible

- Achieve

- Act

- added

- affordable

- Agreement

- ahead

- align

- All

- also

- an

- analysis

- and

- Announcements

- ARE

- areas

- AS

- asia

- aspect

- At

- attractive

- back

- batteries

- battery

- BE

- become

- becoming

- been

- benefits

- between

- Billion

- bring

- Brings

- but

- by

- CAN

- Capacity

- Cause

- Celsius

- certain

- cheaper

- clean

- Climate

- Coal

- Coast

- comes

- coming

- commitment

- commitments

- Companies

- concluded

- Consequently

- consistent

- construction

- consumer

- contrast

- Corporate

- Cost

- cost-effective

- costly

- Costs

- course

- critical

- Currently

- curve

- data

- decade

- decarbonization

- Declining

- decrease

- deflationary

- delays

- Demand

- deviation

- direct

- Dont

- drive

- Dubai

- due

- East

- economy

- Electric

- electric vehicles

- emission

- Emissions

- ending

- energy

- energy prices

- enhancing

- enough

- estimated

- Europe

- expects

- expenses

- experienced

- factors

- financial

- financially

- flat

- Focus

- For

- Forces

- formed

- fossil

- fossil fuels

- from

- fuels

- GAS

- generation

- Global

- Global economy

- global warming

- goal

- Goals

- goldman

- Goldman Sachs

- Government

- Green

- Growing

- gulf

- Half

- hand

- Have

- he

- here

- High

- highlights

- HTML

- http

- HTTPS

- if

- Impact

- improve

- improved

- improvement

- in

- Incentives

- Increase

- increased

- increasing

- inflation

- influence

- integration

- interest

- Interest Rates

- investment

- IRA

- IT

- ITS

- journey

- Keep

- largely

- leading

- Leads

- Level

- like

- likely

- Limited

- lower

- made

- MAKES

- Market

- material

- max-width

- May..

- Meet

- Middle

- Middle East

- MidWay

- Monitor

- more

- most

- Natural

- Need

- net

- next

- noted

- now

- objectives

- of

- off

- Oil

- Oil and Gas

- on

- only

- Other

- Others

- out

- Outcome

- over

- overall

- paris

- Paris Agreement

- particular

- past

- path

- pathway

- per

- pivotal

- Place

- plato

- Plato Data Intelligence

- PlatoData

- Point

- policy

- political

- power

- Prices

- Production

- project

- projects

- Push

- Rates

- Raw

- reached

- Reaches

- reaching

- recently

- Reduced

- reduction

- reductions

- region

- remains

- remove

- Renewable

- renewable energy

- required

- research

- Resources

- result

- Results

- Reveals

- Risen

- rising

- routine

- Sachs

- same

- says

- scaling

- scenario

- sector

- Sectors

- shift

- Shifts

- show

- Shows

- significant

- simpler

- since

- solar

- some

- Sources

- Spending

- stand

- stark

- stated

- substantial

- such

- Suggests

- support

- surge

- Surged

- targeting

- targets

- tech

- Technologies

- than

- that

- The

- the world

- their

- then

- There.

- These

- they

- this

- though?

- three

- Through

- to

- transport

- Trends

- Turning

- turning point

- uncertainties

- updated

- Vehicles

- viable

- W3

- waves

- webp

- WELL

- which

- while

- will

- win

- wind

- wind energy

- with

- within

- world

- worth

- would

- year

- zephyrnet

- zero