Despite high-interest rates, plunging fintech valuations, and a slowdown in external deal activity, the environmental, social and governance (ESG) fintech sector is proving resilient and continuing to thrive as evidenced by the ESG fintech investment reaching an all-time high just recently.

This is spurred by the urgent imperative to transition to a low-carbon emission model and commitment of large corporations to ESG standards, a new report by KPMG in Singapore and the Monetary Authority of Singapore (MAS) says.

The report, titled “Accelerating Transformation Amidst Economic Slowdown: The Resilient ESG Fintech Sector”, shares new insights into the global ESG fintech sector, delving into global investment trends, estimated in-house spend across key industries, and regional disparities.

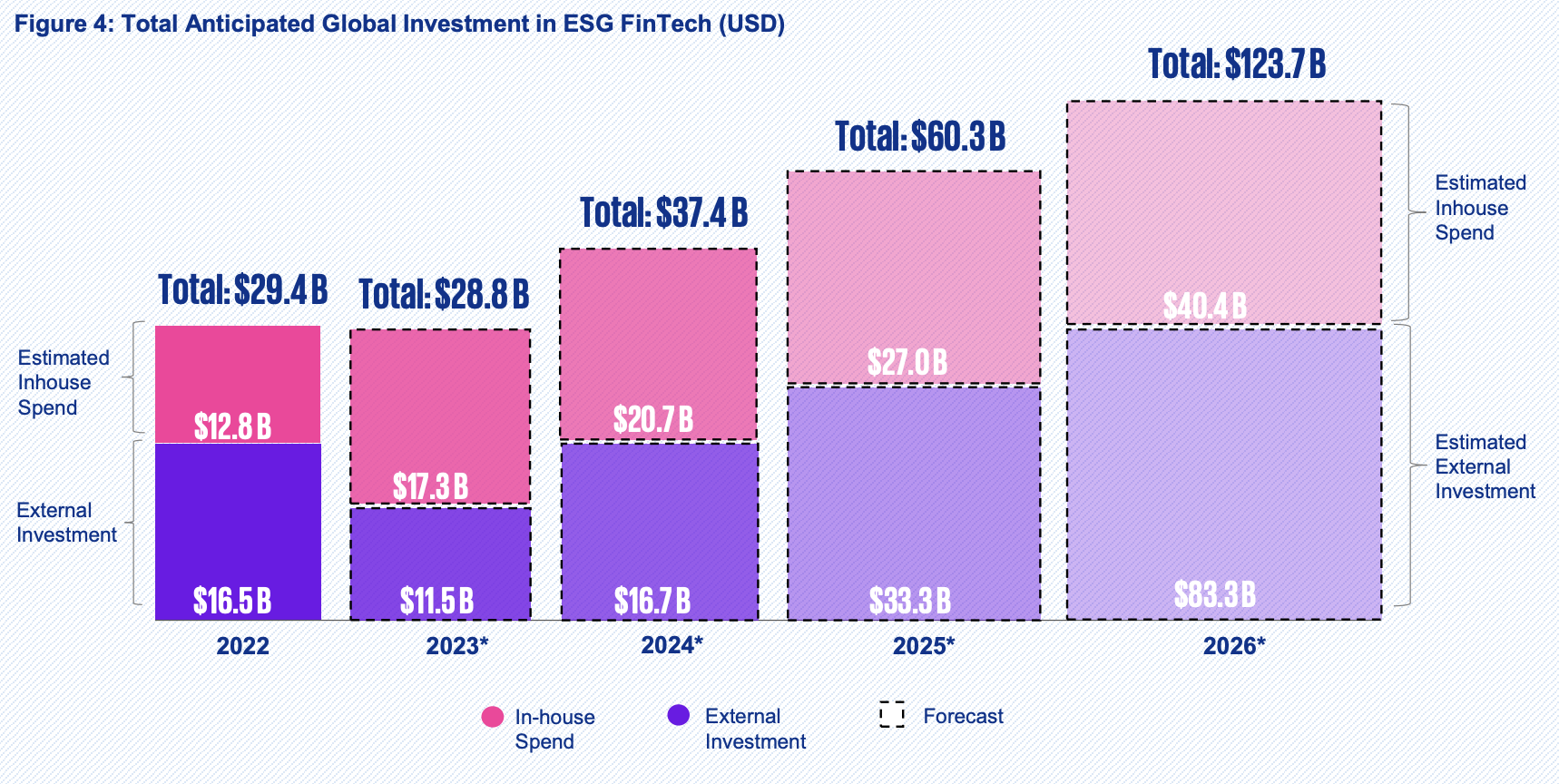

According to the report, global investment in ESG fintech will reach US$28.8 billion this year, slightly below the all-time high of US$29.4 billion invested in 2022. This small drop showcases stability and dynamic growth in the sector amidst challenging economic conditions, underscoring ESG fintech’s significance in the broader financial ecosystem, the report says.

Moving forward, KPMG in Singapore predicts that ESG fintech investments will accelerate, particularly from 2025 onwards with global investments projected to reach US$123.7 billion by 2026. This acceleration will be driven by sustained in-house spending by the financial services and tech sectors, and will be boosted by updates in standards and regulations, as well as a resurgence in external deal activity.

Total Anticipated Global Investment in ESG fintech (US$), Source: Accelerating Transformation Amidst Economic Slowdown: The Resilient ESG Fintech Sector, KPMG in Singapore, Monetary Authority of Singapore (MAS), Nov 2023

Sustained ESG fintech deal activity in 2023 is being supported by soaring in-house spend and commitment from sector leaders to develop and implement ESG fintech solutions. Globally, budgets allocated to developing and launching ESG financial products and solutions increased by an estimated 34.9% this year, catapulting from US$12.8 billion in 2022 to a sizable US$17.3 billion in 2023.

Notably, financial services, comprising banks, insurance companies, and asset managers, are spearheading this surge in in-house spending by allocating US$14.36 billion in ESG fintech in 2023. The sum represents more than 80% of total in-house spend in 2023, and a 35.6% increase from 2022’s US$10.59 billion.

This surge in in-house spending reflects a strategic shift towards incorporating sustainable and green finance products across more channels, the report notes, and reveals that institutions are taking substantial steps towards transitioning their financial products into the green economy, aligning themselves with ESG principles.

External ESG fintech investment, on the other hand, is experiencing a contrasting trajectory, plummeting by more than 30% in 2023 to reach US$11.5 billion. The slowdown can be in part explained by the challenging macroeconomic environment that’s been plagued by soaring inflation and climbing interest rates. These factors are also impacted the boarder fintech landscape which saw global funding pull back by 17% between H2 2022 and H1 2023.

Looking ahead, KPMG in Singapore forecasts a promising outlook for the ESG fintech sector, projecting that total ESG fintech investment will increase by 30% to reach US$37.4 billion in 2024. This growth will be driven primarily by a continued surge in in-house spend by the financial and tech sectors, and a rebound of external deal activity to levels reminiscent of 2022 as interest rates stabilize at their current high levels or start a slow descent, the firm says.

Beyond 2024, KPMG in Singapore anticipates an even more promising outlook with a strong acceleration of ESG investment spending from 2025 onwards. This rise will be fueled by large companies hastening their transition towards a majority of ESG-enabled financial products, which will prompt a significant uptick in external deal activity. Additionally, the easing of monetary policy conditions on a global scale should provide further impetus to the growth of the ESG fintech sector, the firm says.

ESG fintech regional insights

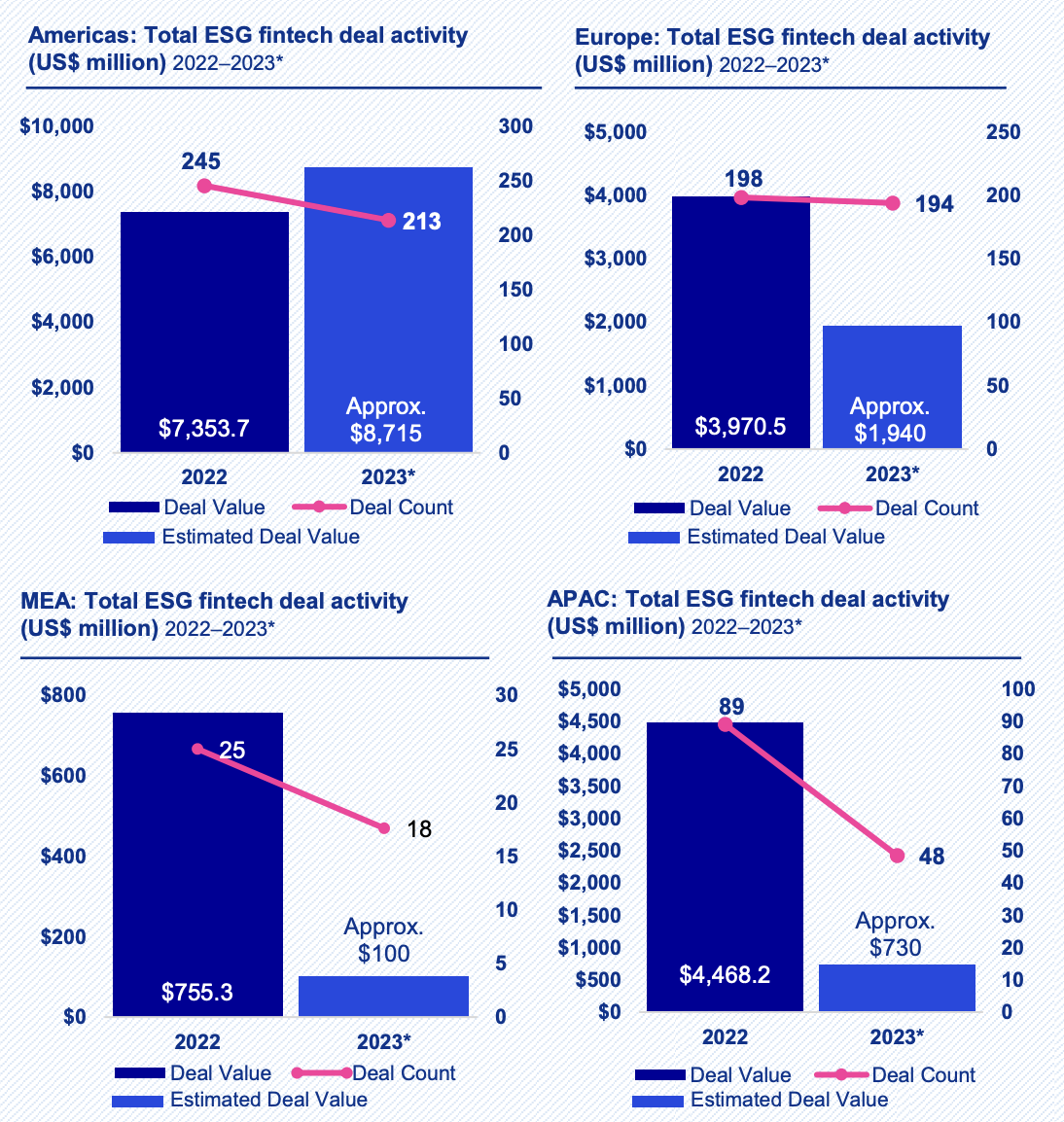

Looking at regional trends, the study found that the Americas is the only region to witness a rise in ESG fintech funding this year, a growth that’s driven primarily by the US where large banks and insurers are starting to take part in large rounds of development capital for late-stage startups.

Europe, meanwhile, remains a dynamic region with 2023 sums projected to match 2022 levels; the Middle East and Africa (MEA) is observing a slight decline; and Asia-Pacific (APAC) is experiencing a sharp slowdown in ESG fintech funding in 2023.

Total ESG fintech deal activity, Regional insights, Source: Accelerating Transformation Amidst Economic Slowdown: The Resilient ESG Fintech Sector, KPMG in Singapore, Monetary Authority of Singapore (MAS), Nov 2023

Delving deeper into APAC ESG fintech trends, the report notes a notable shift in fundraising and outlines a lack of large deals that characterized 2022. This trend has led to a substantial drop in ESG fintech investment in the region, which plummeted from US$4.47 billion to an anticipated $730 million this year.

Within APAC, China, India, Australia, and Singapore are emerging as prominent leaders in the sector. China and Australia, in particular, are standing out with the highest deal values, collectively accounting for over two-thirds of the funding in the region.

Singapore, while notching fewer large transactions, is showcasing a vibrant ESG fintech ecosystem through a high volume of smaller deals, numbering 19 and totaling an estimated US$410 million this year, the report says.

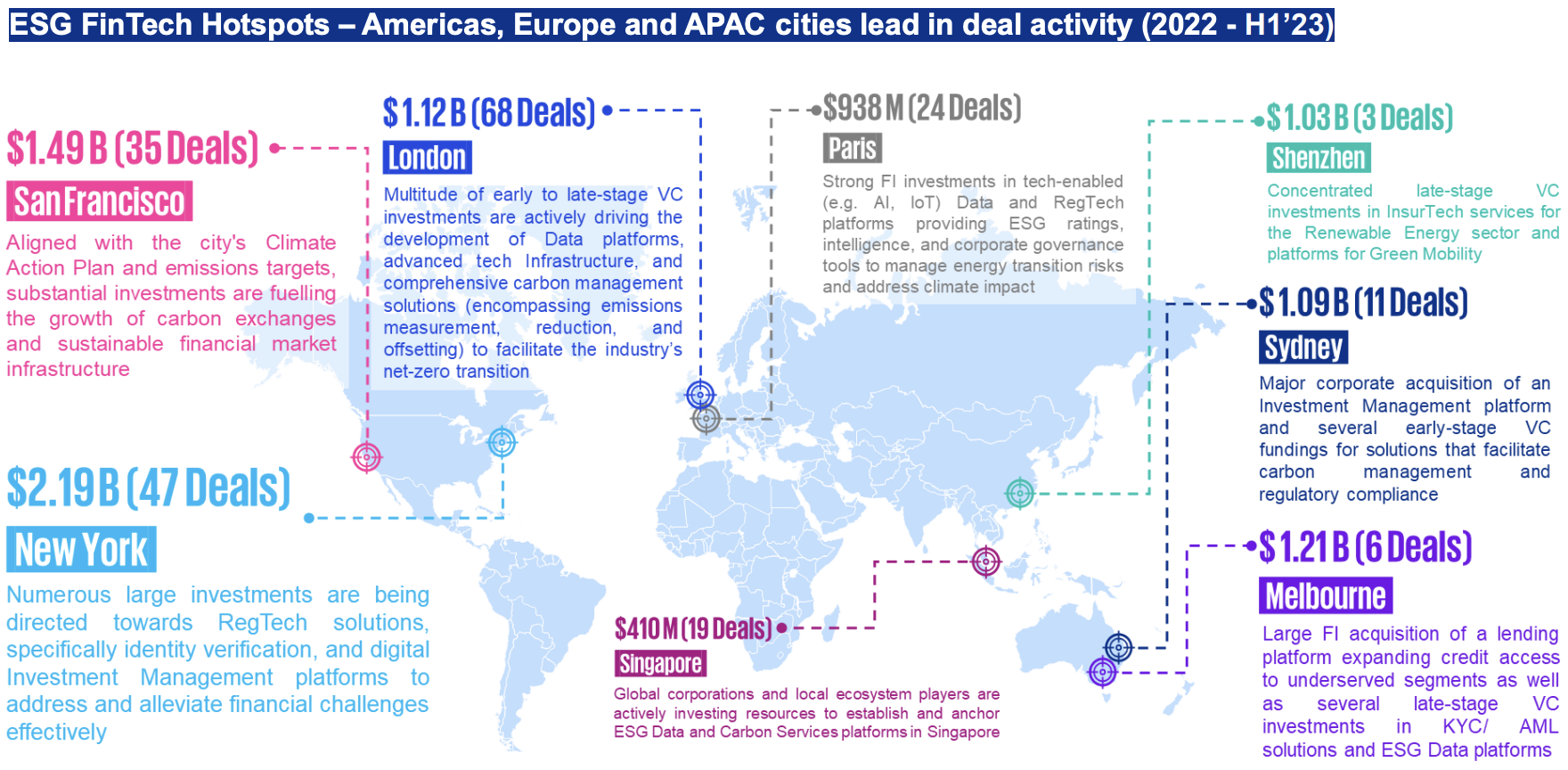

Global map of ESG fintech hubs, Source: Accelerating Transformation Amidst Economic Slowdown: The Resilient ESG Fintech Sector, KPMG in Singapore, Monetary Authority of Singapore (MAS), Nov 2023

Recognized as one of APAC’s top ESG fintech cities, the report notes that Singapore’s ascent as an ESG fintech hub is underpinned by its comprehensive approach to green investments.

Initiatives such as the Singapore Green Plan 2030 and the Green Finance Action Plan are providing frameworks for public and private sector efforts to develop the green fintech economy.

MAS, meanwhile, is playing a critical role in enhancing the regulatory landscape through forward-looking regulations, regulatory sandboxes and innovation grants, attracting startups, investors and venture capitalists to the city-state. Additionally, MAS initiatives such as Project Greenprint and ESG Impact Hub are further supporting the growth of sustainable businesses.

Singapore is also investing significantly in talent development with institutions like the Singapore Green Finance Centre at the Singapore Management University, and the Sustainable and Green Finance Institute at the National University of Singapore, being established under MAS’s guidance. Additionally, the Singapore Exchange is conducting workshops, seminars, and educational programs to enhance awareness and understanding of green finance.

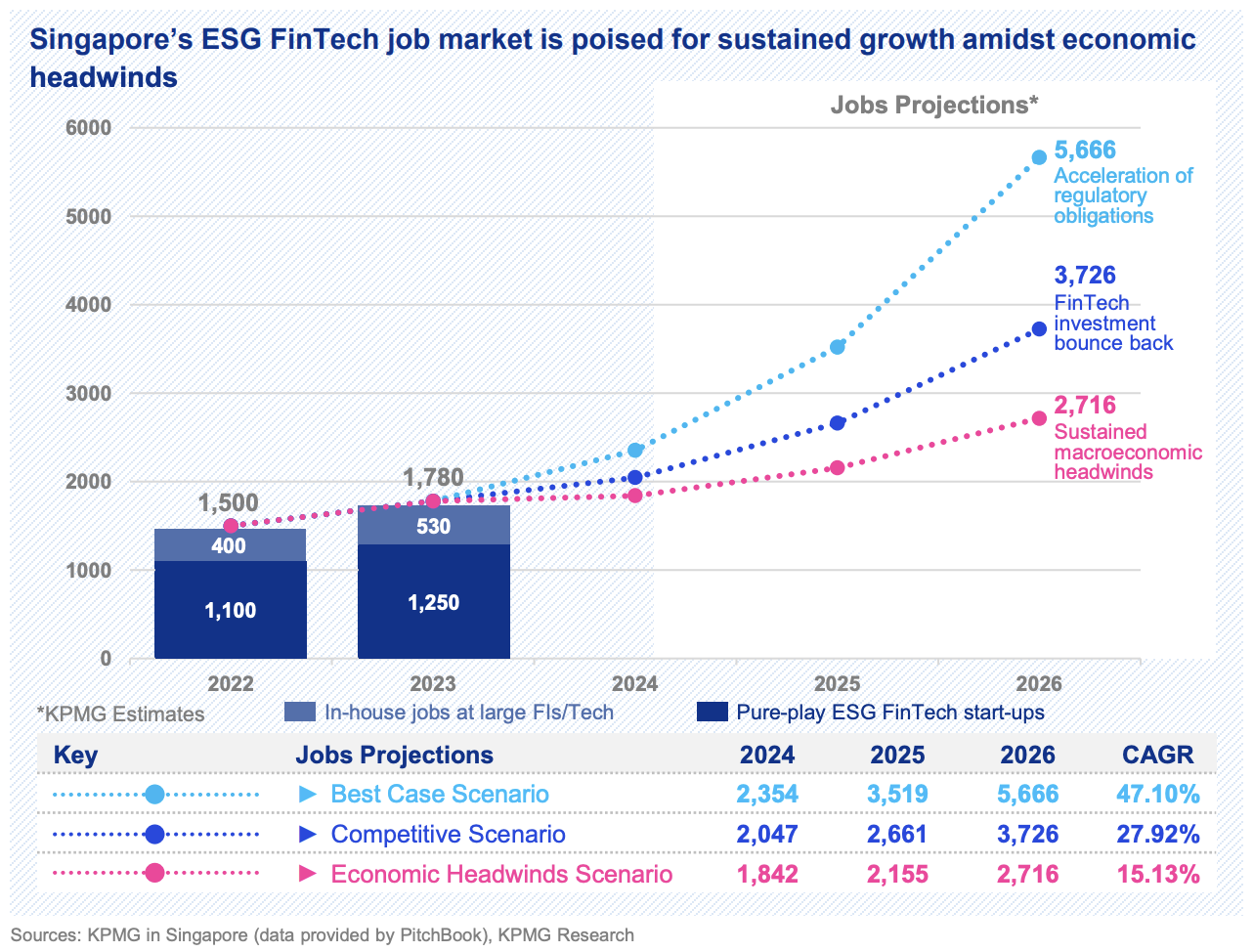

In Singapore, the ESG fintech sector is poised for continued growth and will fuel demand for a specialized workforce. The city-state, which is currently home to about 1,780 ESG fintech professionals, is projected to see its ESG fintech workforce expand at an annual rate of 27.92% (competitive scenario). This growth trajectory would result in an overall increase of about 1,950 professionals over the next three years.

ESG fintech jobs in Singapore, Source: Accelerating Transformation Amidst Economic Slowdown: The Resilient ESG Fintech Sector, KPMG in Singapore, Monetary Authority of Singapore (MAS), Nov 2023

Featured image credit: Edited from freepik

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://fintechnews.sg/81608/green-fintech/esg-fintech-investment/

- :has

- :is

- :where

- 1

- 100

- 19

- 2022

- 2023

- 2024

- 2025

- 2026

- 250

- 27

- 35%

- 36

- 39

- 7

- 8

- a

- About

- accelerate

- accelerating

- acceleration

- Accounting

- across

- Action

- activity

- Additionally

- africa

- ahead

- AI

- aligning

- allocated

- also

- Americas

- amidst

- an

- and

- annual

- Anticipated

- anticipates

- APAC

- approach

- ARE

- AS

- ascent

- asset

- asset-managers

- At

- attracting

- Australia

- authority

- awareness

- back

- Banks

- BE

- been

- begin

- being

- below

- between

- Billion

- boarder

- Boosted

- broader

- Budgets

- businesses

- by

- CAN

- capital

- capitalists

- caps

- centre

- challenging

- channels

- characterized

- China

- Cities

- Climbing

- collectively

- commitment

- Companies

- competitive

- comprehensive

- comprising

- conditions

- conducting

- content

- continued

- continuing

- Corporations

- credit

- critical

- Current

- Currently

- deal

- Deals

- decade

- Decline

- deeper

- Demand

- develop

- developing

- Development

- driven

- Drop

- dynamic

- easing

- East

- Economic

- Economic Conditions

- economy

- ecosystem

- educational

- efforts

- emerging

- emission

- end

- enhance

- enhancing

- Environment

- environmental

- ESG

- established

- estimated

- Even

- evidenced

- exceed

- exchange

- Expand

- expected

- experiencing

- explained

- external

- factors

- fewer

- finance

- financial

- financial products

- financial services

- fintech

- Fintech Funding

- FinTech investment

- FinTech Trends

- Firm

- For

- forecasts

- form

- Forward

- forward-looking

- found

- frameworks

- from

- Fuel

- fueled

- funding

- Fundraising

- further

- Global

- global investment

- global scale

- Globally

- governance

- grants

- Green

- Green Finance

- Green Fintech

- Growth

- guidance

- hand

- High

- highest

- Home

- hottest

- HTML

- HTTPS

- Hub

- Hubs

- image

- Impact

- impacted

- imperative

- implement

- in

- incorporating

- Increase

- increased

- india

- industries

- inflation

- initiatives

- Innovation

- insights

- Institute

- institutions

- insurance

- insurers

- interest

- Interest Rates

- into

- invested

- investing

- investment

- Investments

- Investors

- ITS

- Jobs

- jpg

- just

- Key

- KPMG

- Lack

- landscape

- large

- launching

- leaders

- Led

- levels

- like

- low-carbon

- Macroeconomic

- mailchimp

- Majority

- management

- Managers

- map

- MAS

- Match

- max-width

- MEA

- Meanwhile

- Middle

- Middle East

- million

- model

- Monetary

- monetary authority

- Monetary Authority of Singapore

- Monetary Authority of Singapore (MAS)

- Monetary Policy

- Month

- more

- National

- New

- news

- next

- notable

- Notes

- nov

- of

- on

- once

- ONE

- only

- onwards

- or

- Other

- out

- outlines

- Outlook

- over

- overall

- part

- particular

- particularly

- plagued

- plan

- plato

- Plato Data Intelligence

- PlatoData

- playing

- plunging

- poised

- policy

- Predicts

- primarily

- principles

- private

- private sector

- Products

- professionals

- Programs

- projected

- prominent

- promising

- provide

- providing

- proving

- public

- Rate

- Rates

- reach

- reaching

- rebound

- recently

- reflects

- region

- regional

- regulations

- regulatory

- regulatory landscape

- remains

- reminiscent

- report

- represents

- resilient

- result

- Reveals

- Rise

- Role

- rounds

- sandboxes

- saw

- says

- Scale

- scenario

- sector

- Sectors

- see

- Services

- sharp

- shift

- should

- showcasing

- significance

- significant

- significantly

- Singapore

- Singapore Exchange

- Singapore’s

- sizable

- slow

- Slowdown

- small

- smaller

- soaring

- Social

- Solutions

- Source

- spearheading

- specialized

- spend

- Spending

- Stability

- stabilize

- standards

- standing

- start

- Starting

- Startups

- Steps

- Strategic

- strong

- Study

- substantial

- such

- sum

- sums

- Supported

- Supporting

- surge

- sustainable

- sustained

- Take

- taking

- Talent

- tech

- than

- that

- The

- their

- themselves

- These

- this

- this year

- three

- Thrive

- Through

- to

- top

- Total

- towards

- trajectory

- Transactions

- Transformation

- transition

- transitioning

- Trend

- Trends

- two-thirds

- under

- underpinned

- understanding

- university

- Updates

- urgent

- us

- US$10

- Valuations

- Values

- venture

- vibrant

- volume

- WELL

- which

- while

- will

- with

- witness

- Workforce

- Workshops

- would

- year

- years

- Your

- zephyrnet