GBP

- The BoE left interest rates unchanged as expected at the last meeting

with no dovish language as they reaffirmed that they will keep rates high for

sufficiently long to return to the 2% target. - Governor Bailey pushed back against rate cuts

expectations as he said that they cannot state if interest rates have

peaked. - The latest employment report missed forecasts with wage growth

coming in much lower than expected and job losses in November. - The UK CPI missed expectations across the board, which is

another welcome development for the BoE. - The UK PMIs showed the Manufacturing sector falling

further into contraction while the Services sector continues to expand. - The latest UK Retail Sales missed expectations across the

board by a big margin as consumer spending remains weak. - The market expects the BoE to start

cutting rates in Q2 2024

JPY

- The BoJ kept its monetary policy unchanged at the last meeting with interest

rates at -0.10% and the 10 year JGB yield target at 0% with 1% as a reference

cap. - Governor Ueda repeated once again that they won’t

hesitate to take easing measures if needed and that they are not foreseeing

sustainable price increases unless wage growth picks up. - The latest Japanese CPIshowed that inflationary pressures

are easing although they remain well above the BoJ’s 2% target. - The latest Unemployment Rate remained unchanged near cycle lows.

- The Japanese Manufacturing PMI fell further into contraction but

the Services PMI ticked higher remaining in expansion. - The latest Japanese wage data missed expectations by a big margin

and as a reminder the BoJ is focusing on wage growth to decide whether to tweak

its monetary policy. - The Tokyo CPI, which is seen as leading indicator

for National CPI, eased further but the Core-Core measure remains stuck at

cycle highs. - The market expects the BoJ to hike

rates in Q2 2024.

GBPJPY Technical Analysis –

Daily Timeframe

GBPJPY Daily

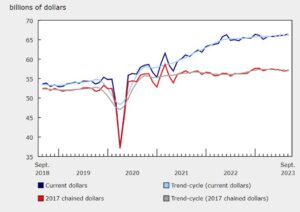

On the daily chart, we can see that GBPJPY is now

at a key resistance around

the 184.45 level. This is where we can expect the sellers to step in with a

defined risk above the level to position for a drop into the 178.00 support.

The buyers, on the other hand, will want to see the price breaking higher to

increase the bullish bets into new highs.

GBPJPY

Technical Analysis – 4 hour Timeframe

GBPJPY 4 hour

On the 4 hour chart, we can see more clearly the

range between the 178.00 support and the 184.45 resistance. The buyers will

also need to be careful as we might get a fakeout, which could be confirmed if

the price after the breakout falls and breaks below the most recent higher low

around the 182.80 level.

GBPJPY Technical Analysis –

1 hour Timeframe

GBPJPY 1 hour

On the 1 hour chart, we can see more

closely the current price action with the JPY losing ground since the miss in

the wage data. It looks more and more likely that the sellers can count only on

rate cuts from the BoE as the BoJ is unlikely to do much with lower inflation

and low wage growth. We can see that we have also a minor trendline that

is supporting the current uptrend. If we see a fakeout and the price breaks

below the trendline, the sellers are likely to pile in again targeting a break

below the 182.80 swing low.

Upcoming Events

Tomorrow we get the US CPI report and the US Jobless

Claims figures, while on Friday we conclude the week with the UK GDP and the US

PPI data.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexlive.com/technical-analysis/gbpjpy-technical-analysis-20240110/

- :is

- :not

- :where

- $UP

- 1

- 10

- 178

- 2%

- 2024

- 80

- a

- above

- across

- Action

- After

- again

- against

- also

- Although

- analysis

- and

- Another

- ARE

- around

- AS

- At

- back

- BE

- below

- Bets

- between

- Big

- board

- BoE

- boj

- Break

- Breaking

- breakout

- breaks

- Bullish

- but

- buyers

- by

- CAN

- cannot

- cap

- careful

- Chart

- claims

- clearly

- closely

- coming

- conclude

- CONFIRMED

- consumer

- continues

- contraction

- could

- CPI

- Current

- cuts

- cutting

- cycle

- daily

- data

- decide

- defined

- Development

- do

- Dovish

- Drop

- easing

- Expand

- expansion

- expect

- expectations

- expected

- expects

- Falling

- Falls

- Figures

- focusing

- For

- forecasts

- foreseeing

- Friday

- from

- further

- GBPJPY

- GDP

- get

- Ground

- Growth

- hand

- Have

- he

- High

- higher

- Highs

- Hike

- hour

- HTTPS

- if

- in

- Increase

- Increases

- Indicator

- inflation

- Inflationary

- Inflationary pressures

- interest

- Interest Rates

- into

- IT

- ITS

- JGB

- Job

- jpg

- JPY

- Keep

- Key

- language

- Last

- latest

- leading

- Level

- likely

- Long

- LOOKS

- losing

- losses

- Low

- lower

- Lows

- manufacturing

- Manufacturing sector

- Margin

- Market

- measure

- measures

- meeting

- might

- minor

- miss

- missed

- Monetary

- Monetary Policy

- more

- most

- much

- National

- Near

- Need

- needed

- New

- no

- November

- now

- on

- once

- only

- Other

- Picks

- plato

- Plato Data Intelligence

- PlatoData

- pmi

- policy

- position

- ppi

- price

- PRICE ACTION

- pushed

- Q2

- range

- Rate

- Rates

- reaffirmed

- recent

- reference

- remain

- remained

- remaining

- remains

- reminder

- repeated

- report

- Resistance

- retail

- return

- Risk

- Said

- sector

- see

- seen

- Sellers

- Services

- showed

- since

- Spending

- start

- State

- Step

- support

- Supporting

- sustainable

- Swing

- Take

- Target

- targeting

- Technical

- Technical Analysis

- than

- that

- The

- the UK

- they

- this

- to

- TradingView

- tweak

- Uk

- UK GDP

- unlikely

- uptrend

- us

- US CPI

- wage

- want

- we

- week

- welcome

- WELL

- whether

- which

- while

- will

- with

- year

- Yield

- zephyrnet