The British pound is in negative territory on Thursday. In the European session, GBP/USD is trading at 1.2174, down 0.29%. We’ll get a look at inflation expectations in both the UK and the US on Friday, ahead of the key US inflation report next week.

It has been a rather quiet week on the economic calendar, save for the November PMIs out of the US and the UK. The PMIs reflect the different directions taken by the UK and US economies. In the UK, the Services PMI remained in negative territory, unchanged at 48.5. This points to contraction in the services sector, which has been hit by the cost-of-living crisis and economic uncertainty, which has dampened consumer spending. In the US, Services PMIs rose to 56.5, above the previous read of 54.4 and the consensus of 53.5. The services sector is showing expansion and this will lend support to the argument that the US economy is resilient enough to absorb additional rate hikes, as the Fed continues to battle high inflation.

BoE expected to raise by 50 bp

Like the Federal Reserve, the BoE has also circled inflation as public enemy number one, but Governor Bailey doesn’t have a strong economy to work with. With GDP in negative territory and inflation at a staggering 11.1%, the economy may already be experiencing stagflation. Despite this grim background, the BoE will have to keep raising rates in order to get the upper hand on inflation and keep inflation expectations in check.

The BoE is expected to raise rates by 50 bp next week, which would raise the cash rate to 3.50%. As rates continue to rise, there is the danger of the recession becoming deeper and lasting longer. This winter is likely to bring a rash of strikes from public workers, which will keep the BoE on guard for signs of a wage-price spiral, which could complicate the Bank’s efforts to curb inflation.

.

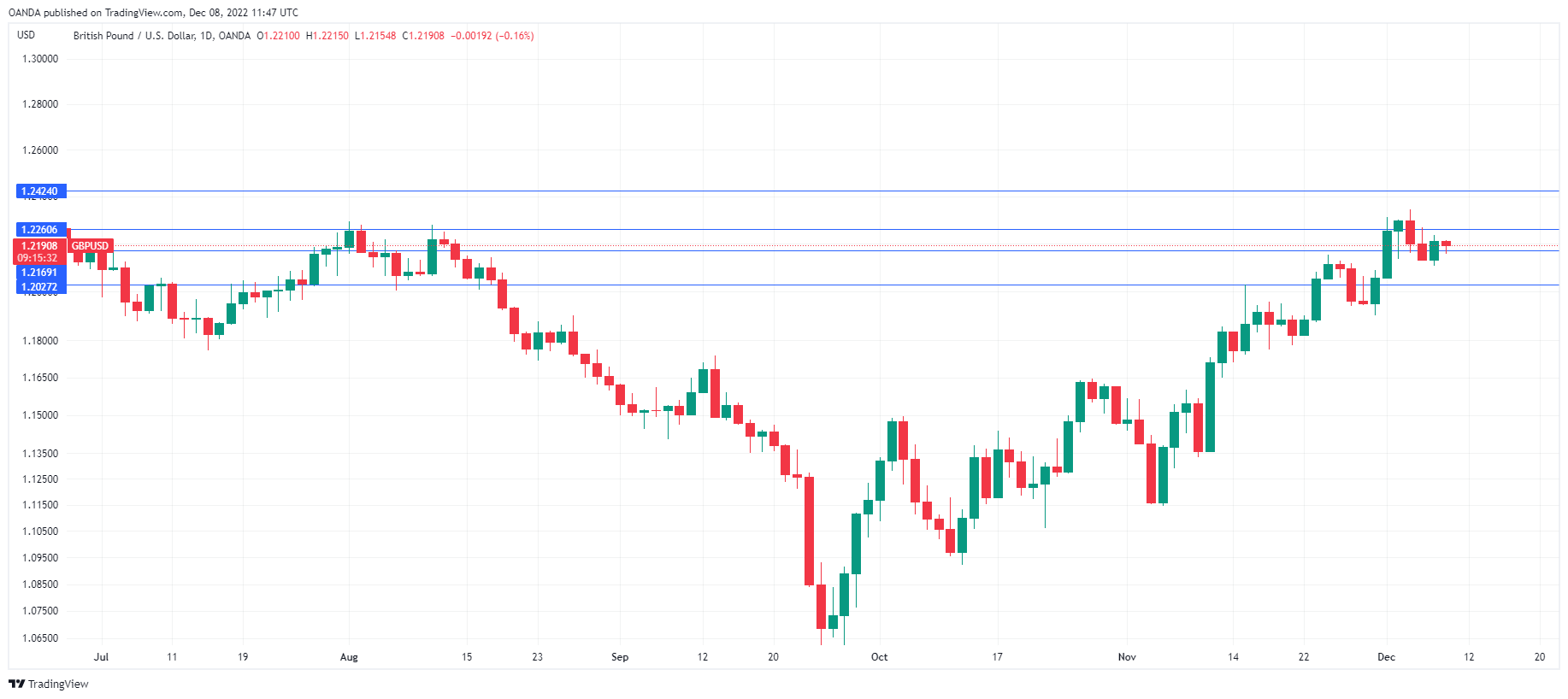

GBP/USD Technical

- 1.2169 and 1.2027 are the next support levels

- GBP/USD is testing support at 1.2169. Below, there is support at 1.2027

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

- Bitcoin

- blockchain

- blockchain compliance

- blockchain conference

- BoE rate meeting

- coinbase

- coingenius

- Consensus

- crypto conference

- crypto mining

- cryptocurrency

- decentralized

- DeFi

- Digital Assets

- ethereum

- federal reserve

- FX

- GBP

- GBP/USD

- machine learning

- MarketPulse

- Newsfeed

- non fungible token

- plato

- plato ai

- Plato Data Intelligence

- Platoblockchain

- PlatoData

- platogaming

- Polygon

- proof of stake

- Technical Analysis

- TradingView

- UK GDP

- UK Inflation

- US Services PMI

- USD

- W3

- zephyrnet