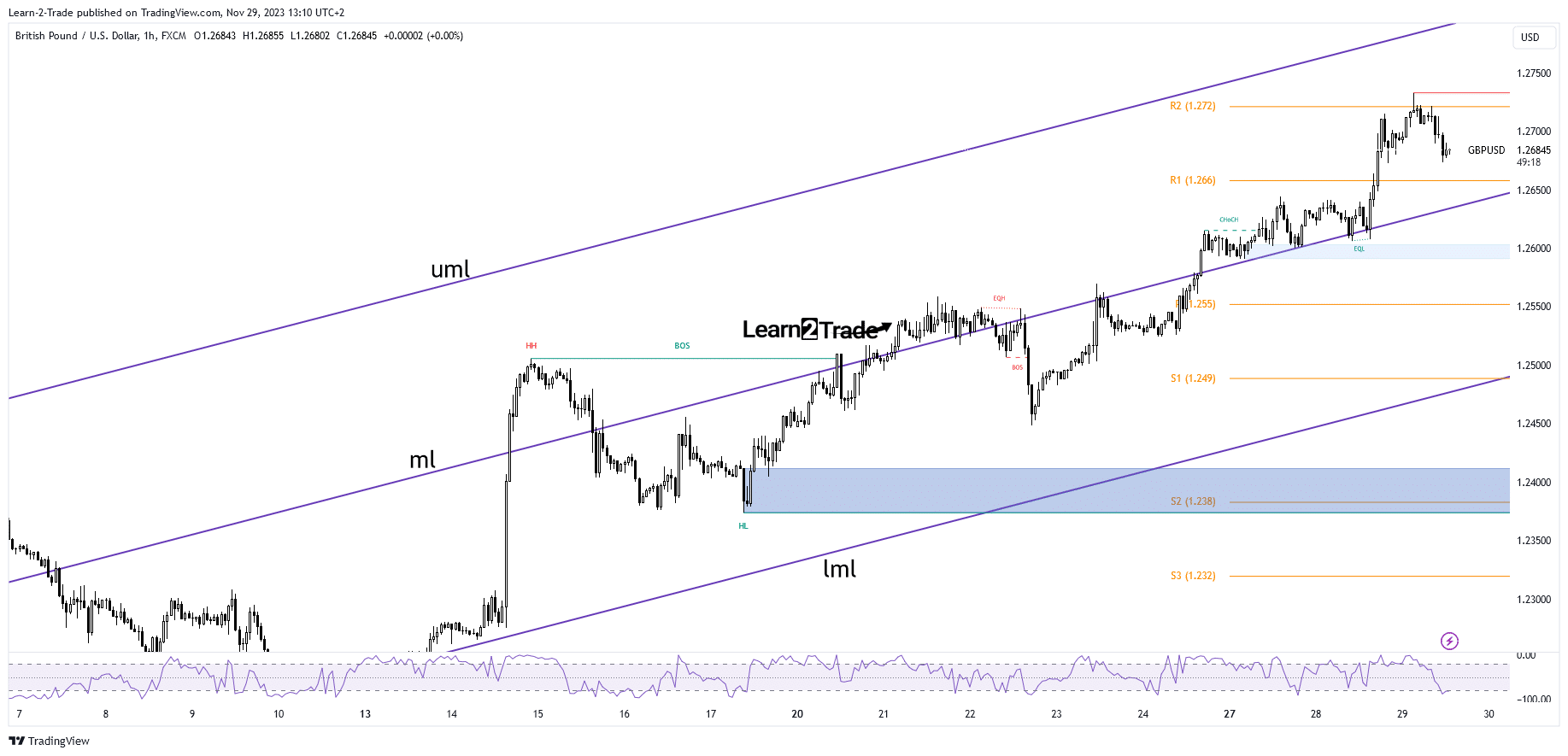

- The GBP/USD pair maintains a bullish bias as long as it stays above the median line.

- It could only test and retest the support levels before turning to the upside.

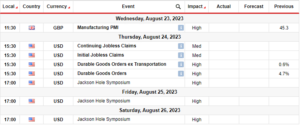

- The US economic data should move the rate.

The GBP/USD price posted a fresh top on Wednesday at 1.2733. However, the pair couldn’t sustain the gains, falling to 1.2682 at the time of writing.

The Dollar Index turned to the upside after its strong drop. A meaningful recovery in the greenback may weigh down the sterling.

–Are you interested to learn more about scalping brokers? Check our detailed guide-

The currency pair reached new highs after some dovish remarks from the FOMC members in the last session. The USD ignored the US CB Consumer Confidence, which came in at 102.0 points versus the expected 101.0 points, compared to the revised 99.1 points in the previous reporting period.

Today, the United Kingdom M4 Money Supply and Mortgage Approvals came in better than expected, while Net Lending to Individuals matched expectations.

Later, the US data should drive the price. The Prelim GDP is expected to report a 5.0% growth compared to the 4.9% growth in the previous reporting period. The Prelim GDP Price Index may announce a 3.5% growth, while the Goods Trade Balance could increase from -86.8B to -86.4 B. Also, the BoE Gov Bailey Speaks could have an impact.

GBP/USD Price Technical Analysis: Corrective Downside

Technically, the GBP/USD price found resistance at the weekly R2 of 1.2720, turning to the downside. It could approach the weekly R1 (1.2660), a static support. The median line (ml) represents a dynamic support.

–Are you interested to learn about forex robots? Check our detailed guide-

The trend is still bullish as the price is still above the key level. The GBP/USD pair could come back down, trying to accumulate more bullish energy before developing a new bullish momentum. Only dropping and stabilizing below the median line (ml) may result in a significant drop.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://www.forexcrunch.com/blog/2023/11/29/gbp-usd-price-stalls-as-buyers-fear-us-prelim-gdp-data/

- :is

- 1

- 102

- a

- above

- Accounts

- Accumulate

- After

- also

- an

- analysis

- and

- Announce

- approach

- approvals

- AS

- At

- b

- back

- BAILeY

- Balance

- before

- below

- Better

- bias

- BoE

- Bullish

- buyers

- came

- CAN

- CB

- CFDs

- check

- come

- compared

- confidence

- Consider

- consumer

- could

- Currency

- data

- detailed

- developing

- Dollar

- dollar index

- Dovish

- down

- downside

- drive

- Drop

- Dropping

- dynamic

- Economic

- energy

- expectations

- expected

- Falling

- fear

- FOMC

- forex

- found

- fresh

- from

- Gains

- GBP/USD

- GDP

- goods

- Greenback

- Growth

- Have

- High

- Highs

- However

- HTTPS

- Impact

- in

- Increase

- index

- individuals

- interested

- Invest

- investor

- IT

- ITS

- Key

- Kingdom

- Last

- LEARN

- lending

- Level

- levels

- Line

- Long

- lose

- losing

- maintains

- matched

- max-width

- May..

- meaningful

- Members

- ML

- Momentum

- money

- money supply

- more

- Mortgage

- move

- net

- New

- now

- of

- on

- only

- our

- pair

- period

- plato

- Plato Data Intelligence

- PlatoData

- points

- posted

- previous

- price

- provider

- r2

- Rate

- reached

- recovery

- report

- Reporting

- represents

- Resistance

- result

- retail

- Risk

- Scalping

- session

- should

- significant

- some

- Speaks

- sterling

- Still

- strong

- supply

- support

- support levels

- Take

- Technical

- Technical Analysis

- test

- than

- The

- the United Kingdom

- The Weekly

- this

- time

- to

- top

- trade

- Trading

- Trend

- trying

- Turned

- Turning

- United

- United Kingdom

- Upside

- us

- US CB Consumer Confidence

- USD

- Versus

- Wednesday

- weekly

- weigh

- when

- whether

- which

- while

- with

- writing

- you

- Your

- zephyrnet