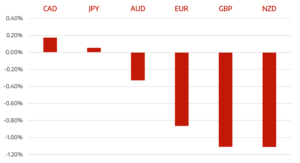

The US 10-year yield has continued its pattern of trending lower during the past 3 months, and the fall during last week’s trading session was the largest in the past year. This decline has now made it to a consecutive 4 week period of lowering US yields. Despite this negative move, the Dollar has held onto some gains against the currency majors and didn’t sell-off as initially anticipated. Covering existing short-positions as we headed into the weekend was a likely contributing factor in the Dollar’s resilience. Additionally, the major resistance levels against the EURO at $1.2200 and Cable at $1.4200 held firmly which avoided a Dollar sell-off.

Heading into Asia, the Dollar traded sideways against the Japanese Yen despite the dropping US yields. However, the range in the Dollar Yen cross was quite narrow during the week. Against the Chinese Yuan the Dollar did experience a slight dip over the past seven days, nonetheless the currency cross is stabilising around these levels. China which was not invited to participate in the G7 meeting did feature in the discussions though, as the US was looking to re-establish itself on the world scene again. The two global rivals are competing to develop their leadership and influence around the world.

The week ahead continues with central banks leading the news on the key releases. After the BOC and ECB providing little clues to their future bond buying programs, investor interest now turns to the US where it is the turn of the FOMC. A combination of higher inflation and weaker than expected employment numbers can lead to a tapering in the FED monetary policy. Other significant data releases during the week are the employment numbers in the UK and Australia. The US will however provide data on the May Retail sales as well as inflation data. In Germany the release of the PPI May numbers can provide some insight if the ECB bond buying programs were correctly left unchanged.

- around

- asia

- Australia

- Banks

- Buying

- Central Banks

- China

- chinese

- continues

- Currency

- data

- develop

- DID

- Dollar

- ECB

- employment

- Euro

- experience

- Feature

- Fed

- future

- Germany

- Global

- HTTPS

- inflation

- influence

- interest

- investor

- IT

- Key

- lead

- Leadership

- leading

- major

- Market

- months

- move

- news

- numbers

- Other

- Pattern

- policy

- Programs

- range

- Releases

- retail

- sales

- Trading

- trending

- Uk

- us

- View

- week

- weekend

- world

- year

- Yen

- Yield

- Yuan