Ford Motor Co. will invest $3.5 billion to set up a new plant in Marshall, Michigan to produce a type of battery that should help it lower the cost of its entry-level electric vehicles, the company announced Monday.

The automaker originally planned to build the facility in Virginia, a move scuttled by Governor Glenn Youngkin, the Republican calling it a “Trojan horse” meant to help the Chinese get a foothold in the American market. The project pairs Ford with China’s CATL, one of the world’s largest producers of EV batteries.

The new facility will be located on 1,900 acres and employ 2,500 people at full production — most being Ford employees. Marshall Mayor Jim Schwartz said there is a “possibility” of future expansion of the facility.

“I believe building in America now matters more than ever,” said Bill Ford, Ford’s executive chair. He also believes the savings will be significant.

Closer to parity with ICE

While Ford officials declined to say what the final costs of the new formula will be, both Executive Chair Ford and CEO Jim Farley believe it will come close to the parity point so many executives and experts have been talking about.

Through the new Inflation Reduction Act, producing EV batteries in the U.S. will net as much as $45/kWh credit due, in part, to the prices of raw materials with LFP being cheaper than the NCM cells, officials said during press briefing earlier today. The lower costs of LFP batteries could come down to about $100/kWh when domestic production begins, then if you add the $45/kWh credits through the IRA, it drops below $60/kWh the range where experts claim parity with internal combustion power begins.

To reduce opposition at a time at mounting frictions between the U.S. and China, the project has been structured to limit CATL’s long-term role, though Ford will still purchase equipment and license the production process from the Chinese manufacturer, explained Lisa Drake, vice president of EV Industrialization for Ford Model e.

“This project is aimed at de-risking” the possibility of serving as a starting point for the Chinese to grow their presence in the U.S. EV battery market, Drake told reporters during a conference call. It has been structured so that “Ford has control.” The plant will be built by the automaker and virtually all employees will be on Ford’s payroll. But the executive acknowledged that some equipment will come from China, while a small number of CATL employees likely will remain at the plant once it begins operation in 2026.

Wave of electrics coming

Like virtually all automotive manufacturers, Ford is rapidly expanding its presence in the emerging EV market. It currently has two long-range models, the Mustang Mach-E crossover and the F-150 Lightning pickup. With combined sales of 61,575 of those vehicles last year, it is the second-largest EV manufacturer in the U.S., behind Tesla. And it aims to be producing at run rate of 600,000 all-electric vehicles annually by the end of this year as it expands capacity and works through bottlenecks.

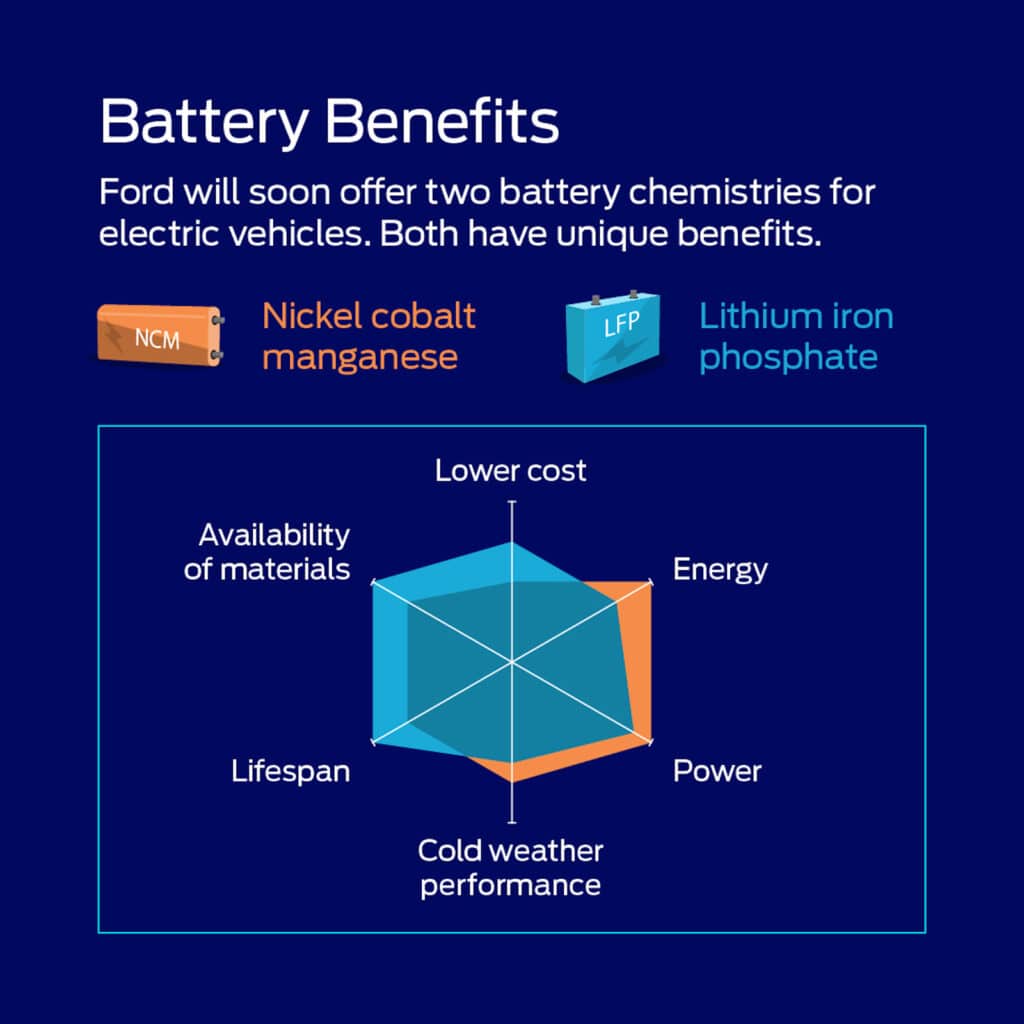

Currently, those vehicles rely on a form of lithium-ion battery technology known as NCM, short for nickel-cobalt-manganese. Those materials provide extended range by are in relatively short supply, driving up prices. The new formulation also charges faster.

Like several key competitors, notably Tesla, Ford is looking to reduce costs by adopting a second battery chemistry, LFP, or lithium iron phosphate. It uses more readily available — and substantially less expensive — materials, though it is primarily suited to shorter-range vehicles.

According to Mark Gjaja, Ford Model e’s Chief Customer Officer, the LFP technology will be used primarily for lower trim, shorter range versions of the Mach-E, Lightning — and other EVs to follow. Ford CEO Jim Farley said the company will begin using imported LFP batteries in the Mach-E this spring.

This will be “an ultra-low-cost battery that accelerates our plan to deliver EVs that are great for customers and also profitable for Ford,” he said.

Production capability

The soon-to-be-built Michigan plant will have a capacity to produce about 35 gigawatt-hours of batteries, added Drake, enough to power about 400,000 vehicles — roughly 20% of the mid-decade target for the second-largest Detroit automaker.

The company in 2021 announced plans to produce about 120 gWh of NCM cells at a trio of plants going into Kentucky and Tennessee. One of those will be placed at the 5 square-mile BlueOval City complex now under construction near Memphis. That manufacturing center also will come on line by 2026, Ford previously announced.

With the alliance with CATL, Ford now is positioned to be the first automaker in the U.S. that will produce two distinct battery chemistries for its EVs. Tesla has also teamed up with CATL but currently purchases its LFP cells from China.

Ford did not announce a production cost target for the new batteries. But analysts at J.D. Power, AlixPartners and others have estimated that prices need to fall to around $75 a kilowatt-hour for EVs to become fully competitive with gas-powered vehicles. Prices for older, more powerful lithium-ion chemistries had been falling for the past decade, some companies expecting to get down below $100 by mid-decade. But costs have surged since the pandemic began due to shortages of critical materials like cobalt and nickel.

By producing the LFP batteries in the U.S., Drake and Gjaja agreed that Ford — and its customers — should qualify for various incentives included in the Inflation Reduction Act passed by Congress last year. But a key issue to yet lock down is sourcing raw materials from the U.S. and the handful of other countries approved by the IRA.

That would further reduce production costs while also providing federal credits of up to $7,500 to EV buyers — a potentially significant competitive advantage.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://www.thedetroitbureau.com/2023/02/ford-confirms-plans-for-3-5b-ev-battery-plant/

- $3

- 000

- 1

- 2021

- a

- About

- accelerates

- Act

- added

- Adopting

- ADvantage

- aims

- All

- all-electric

- all-electric vehicles

- Alliance

- america

- American

- Analysts

- and

- Announce

- announced

- Annually

- approved

- around

- automotive

- available

- batteries

- battery

- become

- began

- behind

- being

- believe

- believes

- below

- between

- Bill

- Billion

- Briefing

- build

- Building

- built

- buyers

- call

- calling

- Capacity

- catl

- Cells

- Center

- ceo

- Chair

- charge

- charges

- cheaper

- chemistry

- chief

- China

- Chinas

- chinese

- City

- claim

- Close

- combined

- come

- Companies

- company

- competitive

- competitors

- complex

- Conference

- Congress

- control

- Cost

- Costs

- could

- countries

- credit

- Credits

- critical

- Currently

- customer

- Customers

- decade

- deliver

- DID

- distinct

- Domestic

- down

- driving

- Drops

- during

- Earlier

- Electric

- electric vehicles

- emerging

- employees

- enough

- entry-level

- equipment

- estimated

- EV

- EV batteries

- EVER

- executive

- executives

- expanding

- expands

- expansion

- expecting

- expensive

- experts

- explained

- Facility

- Fall

- Falling

- faster

- Federal

- final

- First

- follow

- Ford

- form

- formula

- from

- full

- fully

- further

- future

- get

- going

- Governor

- great

- Grow

- handful

- help

- HTTPS

- important

- in

- Incentives

- included

- inflation

- internal

- Invest

- IRA

- issue

- IT

- J.D. Power

- Jim

- Kentucky

- Key

- known

- largest

- Last

- Last Year

- License

- lightning

- likely

- LIMIT

- Line

- lithium

- located

- long-term

- looking

- Manufacturer

- Manufacturers

- manufacturing

- many

- mark

- Market

- materials

- Matters

- max-width

- Mayor

- Michigan

- model

- models

- Monday

- more

- most

- Motor

- move

- Near

- Need

- net

- New

- Nickel

- notably

- number

- Officer

- ONE

- operation

- opposition

- Other

- Others

- pairs

- pandemic

- parity

- part

- passed

- past

- Payroll

- People

- Pickup

- plan

- planned

- plans

- plants

- plato

- Plato Data Intelligence

- PlatoData

- Point

- positioned

- possibility

- potentially

- power

- powerful

- presence

- president

- press

- previously

- Prices

- primarily

- process

- produce

- Producers

- Production

- profitable

- project

- provide

- providing

- purchase

- purchases

- qualify

- range

- rapidly

- Rate

- Raw

- reduce

- relatively

- remain

- Republican

- Role

- roughly

- Run

- Said

- sales

- Savings

- Second

- second-largest

- serving

- set

- several

- Short

- shortages

- should

- significant

- since

- small

- So

- some

- Sourcing

- spring

- Starting

- Still

- structured

- substantially

- supply

- Surged

- talking

- Target

- teamed

- Technology

- Tesla

- The

- their

- this year

- Through

- time

- to

- today

- u.s.

- under

- various

- Vehicles

- Vice President

- virtually

- What

- while

- will

- works

- world’s

- would

- year

- zephyrnet