Crypto Market News: The US Federal Reserve‘s target rate decision may likely come on the expected lines but the market would be keenly looking at whether the Federal Open Market Committee (FOMC) shows any signs of cooling down the monetary policy. Amid pressure from the ongoing US regional banking crisis, the markets are expecting that the central bank implements a 25 bps rate hike for the last time in a series of target rate raises. This would take the current target of 475-500 bps to the 500-525 bps range.

Also Read: US SEC Has A Bad Precedent From XRP Lawsuit Judge Analisa Torres

The CME FedWatch Tool indicates that 85% of respondents feel the Fed go for a 25 bps hike. Meanwhile, if Fed Chair Jerome Powell announces any indication of slowing down the rate hikes in upcoming meetings, the Bitcoin price may climb at the back of some correction in recent times.

Also Read: SUI Price Slumps By 72% Amid Mainnet Launch

<!-- --> <!-- -->Live

2023-05-03T00:00:00+5:30

S&P500 & Crypto Markets Turn Green Following FED Hike

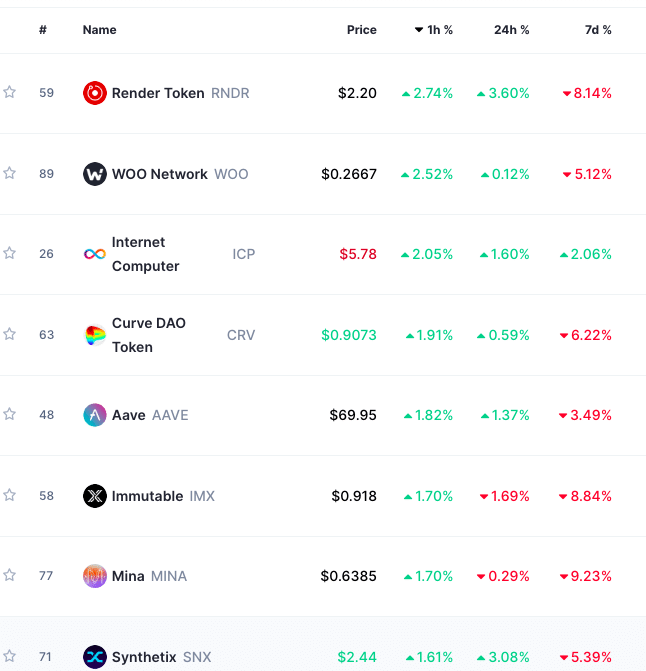

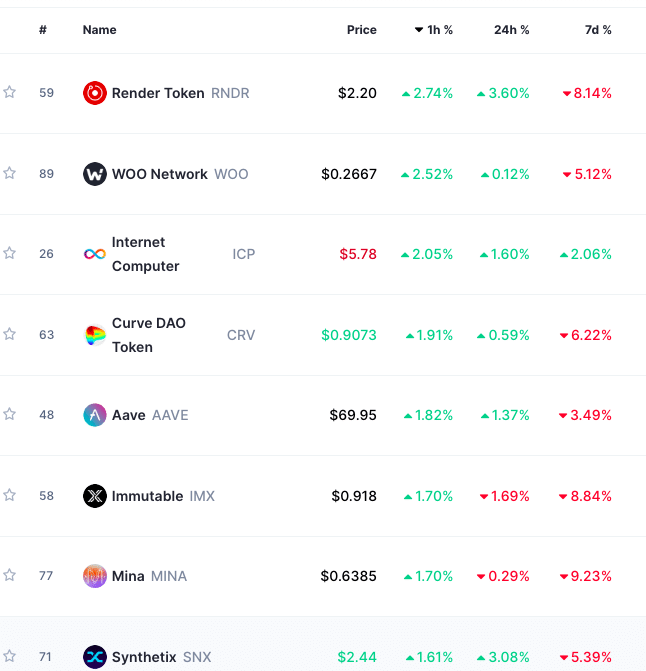

Both S&P 500 and crypto markets are steady following FED rate hike of 25 bps. Bitcoin price is hovering at $28,600 while S&P500 index is up by 20 basis points at the time of reporting. In crypto markets top gainers are Render Token, Woo Network and Curve Dao.

Share this update:

2023-05-03T23:41:00+5:30

Rate Cuts In September

In the wake of a 25 bps rate hike, traders are pricing in rate cut possibility in September 2023, as per US interest rate futures.

Share this update:

2023-05-03T23:35:00+5:30

Bitcoin Price Reaction

As an initial reaction, the Bitcoin price showed a 0.50 rise to the news of Fed rate hike on expected lines. However, the scenario could change after Jerome Powell’s speech.

Share this update:

2023-05-03T23:30:00+5:30

Fed Rate Hike

The FOMC hiked the Federal funds target rate by 25 bps, on expected lines. The hike effectively brings the current target rate to 500-525 bps range.

Share this update:

2023-05-03T23:15:00+5:30

US Dollar Index

The US Dollar Index (DXY) has been on a declining path in the lead up to the Fed rate hike decision announcement, with a 0.53% drop in the day.

Share this update:

2023-05-03T22:45:00+5:30

Peter Brandt Agrees

Peter Brandt, another veteran analyst, agreed with Tom’s analysis on Fed’s rate hike plans.

Share this update:

2023-05-03T22:30:00+5:30

More Rate Hikes Are A Mistake

Tom McClellan, a veteran analyst, commented that further hiking of interest rate would be fatal for the markets. They should instead cut to 4% immediately, he said.

Share this update:

Disclaimer

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Source: https://coingape.com/fomc-jerome-powell-fed-interest-rate/

- :has

- :is

- ][p

- $UP

- 1

- 20

- 2023

- 30

- 50

- 500

- a

- About

- Ads

- After

- Amid

- an

- analysis

- analyst

- and

- Announcement

- Announces

- Another

- any

- ARE

- AS

- At

- auto

- back

- background

- Bad

- Bank

- Banking

- banking crisis

- basis

- BE

- been

- Bitcoin

- Bitcoin Price

- blank

- Brings

- but

- by

- Center

- central

- Central Bank

- Chair

- change

- climb

- CME

- Coingape

- color

- come

- committee

- could

- crisis

- crypto

- Crypto Market

- Crypto Markets

- Current

- curve

- Curve DAO

- Cut

- cuts

- DAO

- day

- decision

- Declining

- desktop

- Display

- Dollar

- dollar index

- down

- Drop

- Dxy

- effectively

- Ether (ETH)

- expected

- expecting

- Fed

- Fed Chair

- Fed Chair Jerome Powell

- Federal

- Federal Open Market Committee

- feel

- Float

- following

- FOMC

- For

- from

- funds

- further

- Futures

- Gainers

- Go

- Green

- he

- height

- Hike

- Hikes

- hiking

- However

- HTTPS

- if

- immediately

- implements

- in

- index

- indicates

- indication

- initial

- instead

- interest

- INTEREST RATE

- jerome

- jerome powell

- judge

- Last

- lawsuit

- lead

- left

- likely

- lines

- live

- looking

- mainnet

- Margin

- Market

- Markets

- markets turn

- markets turn green

- May..

- Meanwhile

- meeting

- meetings

- Mobile

- Monetary

- Monetary Policy

- network

- news

- of

- on

- ongoing

- open

- path

- plans

- plato

- Plato Data Intelligence

- PlatoData

- points

- policy

- position

- possibility

- Powell

- Powell’s

- Precedent

- pressure

- price

- pricing

- raises

- range

- Rate

- Rate Hike

- rate hikes

- reaction

- Read

- recent

- regional

- Reporting

- respondents

- Rise

- S&P

- S&P 500

- S&P500

- Said

- scenario

- SEC

- September

- Series

- Share

- should

- Shows

- Signs

- Slowing

- some

- speech

- steady

- Take

- Target

- that

- The

- the Fed

- they

- this

- time

- times

- to

- token

- tool

- top

- Traders

- transparent

- TURN

- upcoming

- Update

- us

- US Dollar

- US Dollar Index

- us fed

- veteran

- Wake

- whether

- while

- with

- Woo

- woo network

- would

- xrp

- xrp lawsuit

- zephyrnet

✓ Share: