- Current slowdown in inflationary growth has led to lower odds of another Fed Funds rate hike after today’s FOMC.

- Inflationary expectations measured by US breakeven inflation rates have started to tick higher since the end of May, in line with the 19% rally seen in WTI crude oil futures.

- If rising inflationary expectations are left unchecked, it may spiral into the real economy with a potential upside reversal in the lagging CPI data in the coming months.

The US Federal Reserve FOMC meeting will conclude later today where the interest rates futures market based on the CME FedWatch tool has priced in almost a 100% chance of a 25 basis points (bps) hike to bring the Fed Funds rate to 5.25% to 5.50%, and a 20% chance of another 25 bps hike for the Fed Funds rate to hit the terminal rate of 5.50% to 5.75% on the next FOMC meeting in September before the expected first rate cut to materialize in either May or June next year.

Today’s FOMC meeting will not release any new economic data and Fed Funds rate (dot plot) projections. Thus, Fed Chair Powell’s press conference will be closely watched for clues on the Fed’s current thinking on growth and inflation and how long it will maintain its current “higher interest rates for a longer period” guidance.

There was some form of “rejoice” in the last two weeks when the US and other developed nations’ consumer inflation rates for June grew at the slowest pace in almost two years. In contrast from a supply-side, and financial markets point of view, inflation may start to creep back up in Q4.

Inflationary expectations via breakeven rates have ticked higher since late May

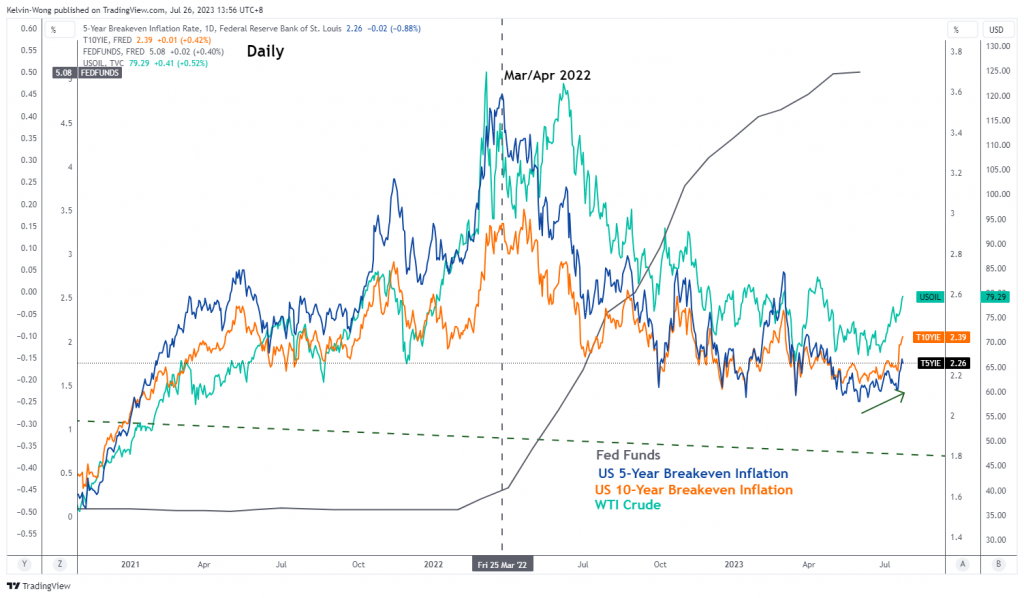

Fig 1: WTI crude oil correlation with US 5-year & 10-year breakeven inflation rates as of 25 Jul 2023 (Source: TradingView, click to enlarge chart)

Based on data in the past five years, oil prices have had a significant direct correlation with inflationary expectations as measured by the tradable 5-year and 10-year US breakeven inflation rates derived from Treasury Inflation-Protected securities.

Since its 28 June 2023 low of US$67.05 per barrel, WTI crude oil futures have rallied by 19% to print a recent high of US$79.90 per barrel on Tues, 25 Jul which in turn led to a similar directional up move in the 5-year and 10-year US breakeven rates. The 10-year US breakeven rate rose to 2.39% on Tuesday, 25 July, that’s close to a four-month high.

Medium-term bullish breakout in WTI crude oil

Fig 2: WTI crude oil futures medium-term trend as of 26 Jul 2023 (Source: TradingView, click to enlarge chart)

From a technical analysis standpoint, the medium-term momentum of WTI crude oil futures has turned bullish with the clearance of the US$77.30 per barrel key intermediate resistance level and 200-day moving average. The next resistances stand at US$83.35 and US$92.70 per barrel which implies that inflationary expectations measured by the breakeven inflation rates in the US may tick higher in the coming months. Hence, if left unchecked, these reflexivity feedback loops inherent in financial markets may spiral into the real economy where lagging CPI data faces the risk of an upside reversal.

Therefore, watch Fed Chair Powell’s lips later on any mention of inflationary expectations.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.marketpulse.com/news-events/central-banks/fomc-day-look-out-for-fed-chair-powells-view-on-inflationary-expectations/kwong

- :has

- :is

- :not

- :where

- $UP

- 1

- 15 years

- 15%

- 2023

- 25

- 26

- 28

- 30

- 70

- 90

- a

- About

- above

- access

- addition

- advice

- affiliates

- After

- an

- analysis

- and

- Another

- any

- ARE

- around

- AS

- At

- author

- authors

- avatar

- average

- award

- back

- based

- basis

- BE

- before

- below

- Box

- Breakeven

- breakout

- bring

- Bullish

- business

- buy

- by

- Chair

- Chance

- Chart

- click

- Close

- closely

- CME

- COM

- combination

- coming

- Commodities

- conclude

- conducted

- Conference

- Connecting

- consumer

- contact

- content

- contrast

- Correlation

- courses

- CPI

- CPI data

- crude

- Crude oil

- Current

- Cut

- data

- day

- Derived

- developed

- direct

- Directors

- DOT

- Economic

- economy

- either

- Elliott

- end

- enlarge

- Ether (ETH)

- exchange

- expectations

- expected

- experience

- expert

- faces

- Fed

- Fed Chair

- fed funds rate

- Federal

- federal reserve

- feedback

- financial

- Find

- First

- five

- flow

- FOMC

- For

- foreign

- foreign exchange

- forex

- form

- found

- from

- fund

- fundamental

- funds

- Futures

- General

- Global

- global markets

- Growth

- guidance

- had

- Have

- hence

- High

- higher

- Hike

- Hit

- How

- HTTPS

- if

- in

- Inc.

- Indices

- inflation

- Inflation Rates

- Inflationary

- information

- inherent

- interest

- Interest Rates

- Intermediate

- into

- investment

- IT

- ITS

- July

- june

- Kelvin

- Key

- lagging

- Last

- Late

- later

- Led

- left

- Level

- levels

- like

- Line

- Long

- longer

- Look

- Low

- lower

- Macro

- maintain

- Market

- market outlook

- market research

- MarketPulse

- Markets

- max-width

- May..

- measured

- meeting

- Momentum

- months

- more

- move

- moving

- moving average

- necessarily

- New

- news

- next

- numerous

- Odds

- of

- officers

- Oil

- on

- only

- Opinions

- or

- Other

- out

- Outlook

- over

- Pace

- passionate

- past

- per

- perspectives

- photo

- plato

- Plato Data Intelligence

- PlatoData

- please

- Point

- Point of View

- points

- positioning

- Posts

- potential

- Powell’s

- press

- Prices

- Produced

- projections

- providing

- purposes

- rally

- Rate

- Rate Hike

- Rates

- real

- recent

- release

- research

- Reserve

- Resistance

- retail

- Reversal

- rising

- Risk

- ROSE

- rss

- Securities

- seen

- sell

- senior

- September

- service

- Services

- sharing

- significant

- similar

- since

- Singapore

- site

- Slowdown

- solution

- some

- Source

- specializing

- stand

- standpoint

- start

- started

- stock

- Stock markets

- Strategist

- supply-side

- Technical

- Technical Analysis

- ten

- Terminal

- that

- The

- the Fed

- These

- Thinking

- thousands

- Thus

- to

- today

- today’s

- tool

- Traders

- Trading

- TradingView

- Training

- treasury

- Trend

- Tuesday

- TURN

- Turned

- two

- unique

- Upside

- us

- US Federal

- us federal reserve

- using

- v1

- via

- View

- Visit

- was

- Watch

- Wave

- Weeks

- WELL

- when

- which

- will

- winning

- with

- wong

- would

- WTI

- WTI Crude

- year

- years

- you

- zephyrnet