First Republic Deal Won’t Resolve White House’s Banking Challenges

CNN | Stephen Collinson | May 1, 2023

A new joint effort by the government and the finance industry to prevent another teetering bank from triggering a wider crisis is underscoring US and international worries about the sector and producing another no-win political headache for the Biden administration.

- JPMorgan Chase is buying most assets of the troubled First Republic Bank and assuming all of its deposits in a deal announced Monday that was arranged by the US Federal Deposit Insurance Corporation.

- The announcement came after regulators rushed over the weekend to auction off the troubled regional bank, which was hit by massive withdrawals despite a previous industry cash injection to try to shore it up.

- The independent agency’s new forced intervention is likely to fuel concerns about the overall health of the US banking sector. The run of banking crises has been partly caused by damage to banks — which had profited from years of low interest rates — from the Federal Reserve’s quick rate hikes to fight high inflation.

- Yet the pain in the regional banking industry comes amid growing anxiety about a separate challenge to the sector posed by tens of billions of dollars in commercial real estate loans held on buildings whose values have tumbled following a slow return to offices in many cities and a reshaped work culture after the pandemic.

See: Credit Suisse: Statecraft and De-dollarization

- The political impact of a widespread banking crisis could be damaging to both Americans and the Biden administration, especially ahead of 2024.

- The administration faces challenges over concerns in the banking sector, with officials denying that their interventions amount to a bailout.

- The economic outlook is further darkened by the standoff between Biden and congressional Republicans over raising the government’s borrowing authority, with the risk of a US default if not resolved.

- Progressive Democrats criticize potential consolidation in the banking sector and attribute the increased likelihood of failures to deregulation efforts by the Trump administration.

Continue to the full article –> here

CBC News | Associated Press | May 1, 2023

JPMorgan Chase Acquires Struggling First Republic Bank in US Regulator-Mediated Agreement

- San Francisco-based First Republic is the third midsize bank to fail in two months. It is the second-biggest bank failure in U.S. history, behind only Washington Mutual, which collapsed at the height of the 2008 financial crisis and was also taken over by JPMorgan.

See: How Government Could Take Control of the Banking System

- The Federal Deposit Insurance Corporation (FDIC) said early Monday that First Republic Bank’s 84 branches in eight states will reopen as branches of JPMorgan Chase Bank and depositors will have full access to all of their deposits.

- As of April 13, First Republic had approximately $229 billion US in total assets and $104 billion in total deposits, the FDIC said. The FDIC estimated its deposit insurance fund would take a $13 billion hit

- Impact: Restructuring a balance sheet can be challenging when a firm must rapidly sell assets and has limited bankers to identify investment opportunities. Banks such as Citigroup and Bank of America took years to regain profitability after the global financial crisis 15 years ago, even with government support.

Continue to the full article –> here

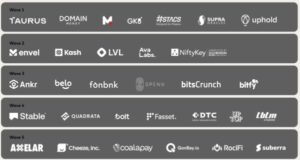

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada’s Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoAiStream. Web3 Data Intelligence. Knowledge Amplified. Access Here.

- Minting the Future w Adryenn Ashley. Access Here.

- Source: https://ncfacanada.org/first-republic-deal-wont-resolve-white-houses-banking-challenges/

- :has

- :is

- :not

- $UP

- 1

- 13

- 15 years

- 2008 Financial Crisis

- 2018

- 2024

- a

- About

- access

- Acquires

- administration

- affiliates

- After

- agency

- ago

- ahead

- All

- also

- alternative

- alternative finance

- america

- Americans

- Amid

- amount

- and

- announced

- Announcement

- Another

- Anxiety

- approximately

- April

- arranged

- article

- AS

- Assets

- associated

- At

- Auction

- authority

- Balance

- Balance Sheet

- Bank

- Bank of America

- bankers

- Banking

- banking crisis

- banking industry

- banking sector

- banking system

- Banks

- BE

- become

- been

- behind

- between

- biden

- Biden Administration

- Billion

- billions

- blockchain

- both

- branches

- Buying

- by

- cache

- came

- CAN

- Canada

- Cash

- Category

- caused

- challenge

- challenges

- challenging

- chase

- Cities

- Citigroup

- closely

- CNN

- collapsed

- comes

- community

- compliance

- Concerns

- Congressional

- consolidation

- control

- CORPORATION

- could

- create

- credit

- credit suisse

- crisis

- Crowdfunding

- cryptocurrency

- Culture

- damaging

- deal

- decentralized

- Democrats

- deposit

- DEPOSIT INSURANCE

- depositors

- deposits

- Despite

- digital

- Digital Assets

- distributed

- does

- dollars

- Early

- Economic

- ecosystem

- Education

- effort

- efforts

- end

- engaged

- entry

- especially

- estate

- estimated

- Ether (ETH)

- Even

- faces

- FAIL

- Failure

- fdic

- Federal

- Federal Deposit Insurance Corporation

- federal reserve

- fight

- finance

- financial

- financial crisis

- financial innovation

- fintech

- Firm

- First

- following

- For

- from

- Fuel

- full

- funding

- funding opportunities

- further

- get

- Global

- global financial

- Global Financial Crisis

- Government

- government support

- Growing

- had

- Have

- Health

- height

- Held

- helps

- High

- High inflation

- Hikes

- history

- House

- How

- HTML

- http

- HTTPS

- identify

- if

- Impact

- in

- increased

- independent

- industry

- inflation

- information

- Innovation

- innovative

- insurance

- Insurtech

- Intelligence

- interest

- Interest Rates

- International

- intervention

- investing

- investment

- investment opportunities

- IT

- ITS

- Jan

- joint

- jpg

- JPMorgan

- jpmorgan chase

- Limited

- Low

- many

- Market

- massive

- max-width

- May..

- member

- Members

- Monday

- more

- most

- mutual

- networking

- New

- of

- off

- offices

- on

- only

- opportunities

- or

- Outlook

- over

- overall

- Pain

- pandemic

- partners

- payments

- peer to peer

- perks

- plato

- Plato Data Intelligence

- PlatoData

- please

- political

- potential

- press

- prevent

- previous

- profitability

- projects

- provides

- Quick

- raising

- rapidly

- Rate

- rate hikes

- Rates

- real

- real estate

- regain

- regional

- Regtech

- Regulators

- Republic

- Republicans

- Reserve

- resolved

- restructuring

- return

- Run

- s

- Said

- sector

- Sectors

- sell

- separate

- Services

- slow

- stakeholders

- States

- Stephen

- Stewardship

- Struggling

- such

- Suisse

- support

- system

- TAG

- Take

- that

- The

- their

- Third

- thousands

- Title

- to

- today

- Tokens

- Total

- triggering

- trump

- two

- u.s.

- us

- US Federal

- Values

- vibrant

- Visit

- was

- washington

- weekend

- when

- which

- white

- White House

- wider

- widespread

- will

- with

- Won

- Work

- works

- would

- years

- zephyrnet