Over the past year, global economic and geopolitical uncertainty posed challenges for media and telecoms mergers and acquisitions (M&A) activity, but despite this, the sector continued to see strategic acquisitions and funding rounds driven by factors such as digitalization, innovation, consolidation and the pursuit of new market opportunities, reports by consultancies Deloitte and KPMG highlight.

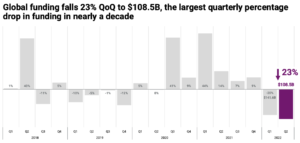

Deal activity in the technology, media and telecom continued their downtrend in Q2 2023, with deal value falling 32% from Q1 2023 to Q2 2023 on a 15% decline in deal volume. Tech transactions suffered a considerable pullback, with deal volume decreasing to 854 from 1,011 in Q1 2023 and deal value dropping to US$23.9 billion from US$47.4 billion. Telecom deal volume plunged from 74 to Q1 2023 to 44 in Q2 2023, though combined deal value remained steady at US$5.9 billion from US$5.8 billion.

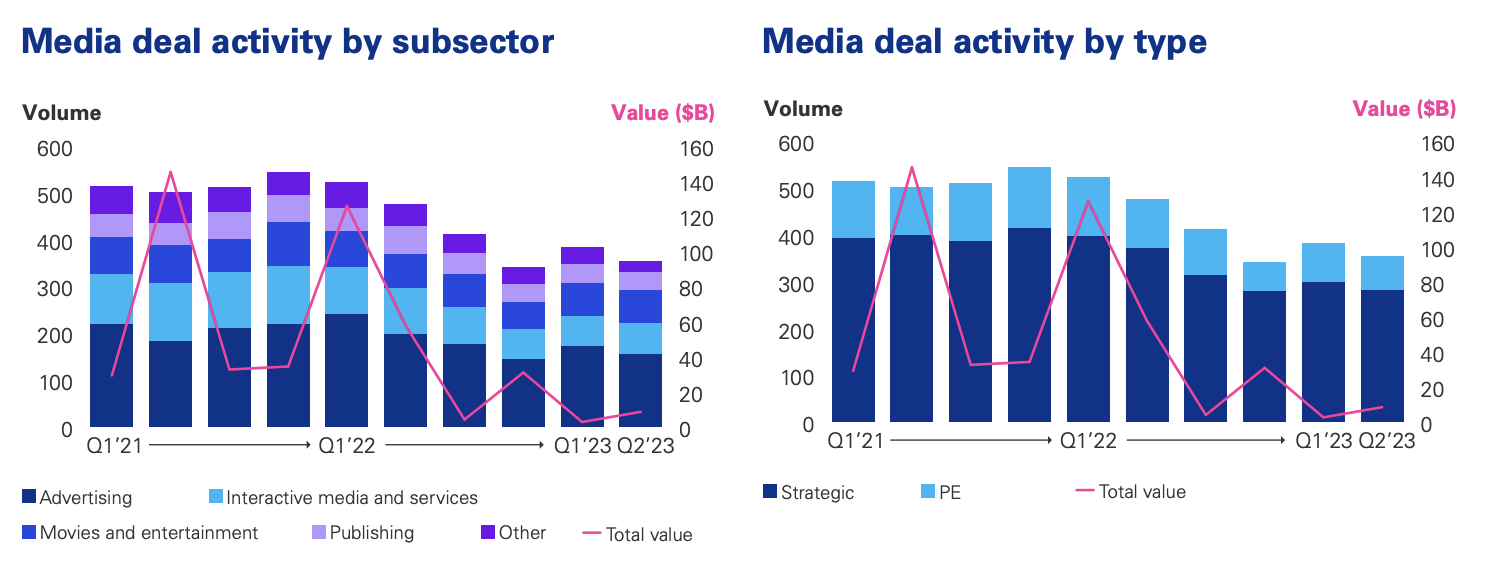

Media stood out in Q2 2023, emerging as the subsector of the bunch that defied the odds. Even though deal volume declined slightly to 354 in Q2 2023 from 382 in Q1 2023, deal value more than tripled to US$8.4 billion in Q2 2023 from US$2.6 billion in Q1 2023.

Strategic transactions accounted for the bulk of media deals in Q2 2023, with 281, down 5.7% from the previous quarter, compared to 73 private equity deals, down 13.1%. The picture was even more lopsided value-wise with strategic deals reaching a value of US$7.9 billion, up 491.3%, while private equity transactions collectively amounted to just US$400 million, down 64.5%.

Media deal activity by subsector, Source: Nearing the bottom?: M&A trends in technology, media and telecom, KPMG, Q2 2023

2023 has so far recorded a number of notable M&A deals in the media sector, focusing primarily on streaming, digital media, gaming, emerging economies, adtech, and social media, among other key themes. These deals were aimed at gaining access to a broader audience, connecting with new demographics and markets, and diversifying revenue streams.

Tech News and Crypto Media M&A acquisitions Accelerates in Asia

Notable media acquisition deals this year include SPH Media acquiring Tech in Asia to strengthen its tech and events business, Bullish acquiring CoinDesk to invest in global expansion, and TechCrunch acquiring StrictlyVC to refocus on its roots in venture investments.

Leading Singaporean media organization SPH Media announced in November its purchase of local digital news publication Tech in Asia. The deal aims to support SPH Media’s ambition to turn its publication, The Business Times, into a regional player and accelerate its goal of becoming a trusted source of business and tech news for investors, dealmakers, entrepreneurs and readers who have an interest in Southeast Asia.

The acquisition means both more startup coverage and perhaps more importantly picking up Tech in Asia’s events business, which specializes in tech shows in Singapore and Jakarta that attract thousands of attendees and top sponsors.

Tech in Asia is a Singaporean online news publication founded in 2010 that covers startup and venture capital (VC) news across Southeast Asia, India and North America. The company also operates a regional events network, an advertising agency unit called Studios, and a regional startup and tech jobs marketplace.

Financial details of the deal were not disclosed, but sources told DealStreetAsia that the agreed transaction pegged Tech in Asia’s valuation at US$30 million.

In the US, cryptocurrency exchange Bullish acquired this year crypto-focused media company CoinDesk in an all-cash deal with undisclosed financial terms, the Wall Street Journal reported in November. Bullish, which is run by New York Stock Exchange president Tom Farley, aims to invest in CoinDesk’s global expansion and the growth of the company’s media, events, and indexing businesses.

CoinDesk was previously owned by the Digital Currency Group (DCG), which acquired the media company back in 2016 for US$500,000. However, in the aftermath of the collapse of FTX, DCG found itself entangled in its own financial troubles. The firm’s lending subsidiary Genesis Global Capital filed for bankruptcy after rounds of layoffs, and its institutional trading platform TradeBlock and wealth management unit headquartered in were forced to closed shop.

CoinDesk, which generated US$50 million in revenue in 2022, has faced challenges this year, laying off 16% of its internal staff in August. The company had been exploring options, including a partial or full sale, and was earlier this year in the final stages of sealing an approximate US$125 million deal involving a syndicate of investors, the Wall Street Journal reported in July.

Founded in 2013, CoinDesk is a leading media, events, data, and indices company focusing on the crypto and blockchain industry. CoinDesk’s key businesses include CoinDesk Media, which delivers news stories on the crypto and blockchain industry; CoinDesk Events, which gathers the global crypto, blockchain and Web 3.0 communities at annual events such as Consensus, the world’s largest and longest-running crypto festival; and CoinDesk Indices, which offers expertise in digital asset indices, data and research to educate and empower investors.

Another noteworthy media M&A deal this year is the acquisition of media startup StrictlyVC by Yahoo. The deal, unveiled in August, will see StrictlyVC being incorporated into Yahoo-owned TechCrunch, operating as a sub-brand within the TechCrunch portfolio.

The acquisition showcases Yahoo’s commitment to TechCrunch under its new ownership, and signals a shift by TechCrunch back to its roots covering venture investments and startups in Silicon Valley. It’s part of a broader effort by Yahoo to invest in a few key pillars, often through acquisitions, including news, sports, finance, mail and search.

Launched in 2013, StrictlyVC is a popular daily newsletter focusing on the VC scene in Silicon Valley and beyond, and which claims 60,000 free email subscribers. The company also runs events and a podcast, and earns revenue from sponsorships.

Besides these three noteworthy acquisition deals, the media sector also recorded a number of smaller transactions that are nevertheless worth mentioning.

In Austria, magazine publisher VGN Medien Holding joined in May Die Brutkasten Gruppe as a strategic investor, becoming the new majority shareholder of the Austrian tech news company. As part of the transaction, VGN Medien Holding said it will support the further growth of Die Brutkasten Gruppe and accompany the company in its expansion into new markets and segments.

Die Brutkasten Gruppe describes itself as a “multimedia platform for startups, the digital economy and innovation” and has witnessed considerable growth over the past years. According to Austrian national public broadcaster ORF, Die Brutkasten Gruppe grew its sales from EUR 600,000 to EUR 3.2 million between 2018 and 2022, and consists of a team of 35 people spread across Vienna, Munich and Berlin.

In Asia, Singapore-based Foresight Ventures completed in November the acquisition of the majority of the shares of crypto news and data provider The Block. The purchase was completed at a US$70 million valuation, and the company plans to “build out new exciting products” and expand into Asia and the Middle East, CEO Larry Cermak said in an X post on Monday.

Founded in 2018, The Block is a media outlet that delivers news, research, and data. The company makes most of its revenue from ads and subscription. It generates around US$20 million in revenue last year, told Axios last year.

In July 2022 the market already monitored the acquisition of Grvty Media (owner of Asian tech news page Vulcanpost) through Singpapore-based Towerhill by Kiat Lim.

But of course the whole media market was overshadowed in July 2022, by the sensational acquisition of Industry Dive by Informa, who bought the niche publication service for an estimated whopping 525m USD.

Media funding rounds and deals

In the fast-paced media and tech landscape, 2023 has also witnessed several strategic moves, with significant funding rounds shaping the industry.

In the Middle East, Saudi Arabia’s Events Investment Fund (EIF), a part of the National Development Fund, acquired in July a stake in Tahaluf. Tahaluf is a local large-scale live events company created through a strategic joint venture between the Saudi Federation for Cybersecurity, Programming and Drones (SAFCSP) and Informa, the international event organizer and digital services group behind the Finovate event series.

The investment in Tahaluf aligns with EIF’s strategy to develop a sustainable infrastructure for the culture, tourism, entertainment and sports sectors across Saudi Arabia, by building multiple world-class venues by 2030.

Tahaluf is the organizer of tech events LEAP and Black Hat Middle East, as well as the artificial intelligence (AI) event DeepFest in Saudi Arabia. In the span of just two years, Tahaluf, together with the Saudi Arabian Ministry of Communications and IT, managed to turn LEAP into one of the world’s most-attended tech events with attendance reaching 172,000 this year.

Tahaluf plans to launch further diverse original concept events, including the Saudi Maritime Congress, Global Health Exhibition and Inflavour, for the food industry. Tahaluf will also bring iconic Informa brands to Saudi Arabia including CityScape, CPHI and Cosmoprof, serving the global real estate, pharmaceutical and beauty industries respectively.

In Singapore, Bitsmedia, the creator of popular Muslim lifestyle application, Muslim Pro, secured in December a US$20 million Series A funding round from Asia-focused venture capital (VC) firm Gobi Partners, CMIA Capital Partners and Bintang Capital Partners.

Bitsmedia said it would use the proceeds to advance AI capabilities; enrich content offerings on Bitsmedia’s streaming platform, Qalbox; continuously develop educational features; and improve the Quran experience within Muslim Pro.

Muslim Pro is a highly-rated and comprehensive Muslim lifestyle app with more than 150 million downloads globally to date, and Qalbox is a global subscription video on demand entertainment streaming service aimed at the global Muslin community.

Finally in the US, crypto media outlet Blockworks raised in May a US$12 million funding round led by private equity firm 10T Holdings at a US$135 million post-money valuation. The company said it would use the proceeds to expand its research and data analytics offering, Blockworks Research.

Already in June 2021 Lloyds Capital invested GBP13 million into Hybrid Media, a UK and Malaysia based media agency which owns also the the tech news page Techwireasia,

Read also: Fintech and Finance Firms Snap Up Media Companies to Gain Audience

Fintech and Finance Firms Snap Up Media Companies to Gain Audience

This article first appeared on fintechnews.ch

Featured image credit: edited from freepik

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://fintechnews.sg/82832/funding/fintech-tech-and-crypto-media-sector-shows-resilience-with-notable-strategic-acquisitions-and-funding-rounds-in-2023/

- :has

- :is

- :not

- $UP

- 000

- 1

- 13

- 15%

- 150

- 2010

- 2013

- 2016

- 2018

- 2021

- 2022

- 2023

- 2030

- 35%

- 500

- 60

- 600

- 7

- 73

- 8

- 9

- a

- accelerate

- accelerates

- access

- accompany

- accounted

- acquired

- acquiring

- acquisition

- acquisitions

- across

- activity

- Ads

- advance

- Advertising

- After

- aftermath

- agency

- agreed

- AI

- aimed

- aims

- Aligns

- already

- also

- ambition

- america

- among

- amp

- an

- analytics

- and

- annual

- app

- appeared

- Application

- approximate

- Arabian

- ARE

- around

- article

- artificial

- artificial intelligence

- Artificial intelligence (AI)

- AS

- asia

- Asia’s

- asian

- asset

- At

- attendance

- attendees

- attract

- audience

- AUGUST

- Austria

- austrian

- author

- Axios

- back

- Bankruptcy

- based

- Beauty

- becoming

- been

- begin

- behind

- being

- berlin

- between

- Beyond

- Billion

- Black

- Black Hat

- Block

- blockchain

- blockchain industry

- Blockworks

- both

- Bottom

- bought

- brands

- bring

- broader

- Building

- Bullish

- Bunch

- business

- businesses

- but

- by

- called

- capabilities

- capital

- caps

- ceo

- challenges

- cityscape

- claims

- closed

- CO

- Coindesk

- Collapse

- collectively

- COM

- combined

- commitment

- Communications

- Communities

- community

- Companies

- company

- Company’s

- compared

- Completed

- comprehensive

- concept

- Congress

- Connecting

- Consensus

- considerable

- consists

- consolidation

- content

- continued

- continuously

- course

- coverage

- covering

- covers

- created

- creator

- credit

- crypto

- Crypto Media

- Crypto News

- cryptocurrency

- Cryptocurrency Exchange

- Culture

- Currency

- Cybersecurity

- daily

- data

- Data Analytics

- Date

- DCG

- deal

- dealmakers

- Deals

- December

- Decline

- decreasing

- defied

- delivers

- deloitte

- Demand

- Demographics

- describes

- Despite

- details

- develop

- Development

- Die

- digital

- Digital Asset

- digital currency

- digital currency group

- Digital Currency Group (DCG)

- Digital economy

- Digital media

- digital services

- digitalization

- dive

- diverse

- down

- downloads

- driven

- Drones

- Dropping

- Earlier

- East

- Economic

- economies

- economy

- educate

- educational

- effort

- eif

- emerging

- empower

- end

- enrich

- Entertainment

- entrepreneurs

- equity

- estate

- estimated

- EUR

- Even

- Event

- events

- exchange

- exciting

- exhibition

- Expand

- expansion

- experience

- expertise

- Exploring

- factors

- Falling

- far

- fast-paced

- Features

- Federation

- FESTIVAL

- few

- filed

- final

- final stages

- finance

- Finance firms

- financial

- Financial Troubles

- Finovate

- fintech

- Fintech News

- Firm

- firms

- First

- focusing

- food

- For

- For Investors

- For Startups

- forced

- foresight

- Foresight Ventures

- form

- found

- Founded

- Free

- from

- FTX

- full

- fund

- funding

- Funding Round

- funding rounds

- further

- Gain

- gaining

- gaming

- generated

- generates

- Genesis

- Genesis Global

- geopolitical

- Global

- Global Crypto

- Global Economic

- global expansion

- Global health

- Globally

- goal

- Gobi Partners

- grew

- Group

- Growth

- had

- hat

- Have

- headquartered

- Health

- High

- Highlight

- holding

- Holdings

- hottest

- However

- HTML

- HTTPS

- Hybrid

- iconic

- image

- importantly

- improve

- in

- include

- Including

- Incorporated

- india

- Indices

- industries

- industry

- Infrastructure

- Innovation

- Institutional

- Intelligence

- interest

- internal

- International

- into

- Invest

- investment

- investment fund

- Investments

- investor

- Investors

- involving

- IT

- ITS

- itself

- Jobs

- joint

- joint venture

- journal

- jpg

- July

- june

- just

- Key

- KPMG

- landscape

- large-scale

- largest

- Larry Cermak

- Last

- Last Year

- launch

- laying

- layoffs

- leading

- Leap

- Led

- lending

- lifestyle

- live

- Live Events

- Lloyds

- local

- M&A

- magazine

- mailchimp

- Majority

- MAKES

- Malaysia

- managed

- management

- Maritime

- Market

- market opportunities

- marketplace

- Markets

- May..

- Media

- media acquisition

- mergers

- Mergers and Acquisitions

- Middle

- Middle East

- million

- ministry

- Monday

- monitored

- Month

- more

- most

- moves

- multiple

- Munich

- National

- nearing

- network

- Nevertheless

- New

- New Market

- New York

- New York Stock Exchange

- news

- Newsletter

- niche

- North

- north america

- notable

- noteworthy

- November

- number

- Odds

- of

- off

- offering

- Offerings

- Offers

- often

- on

- once

- ONE

- online

- operates

- operating

- opportunities

- Options

- or

- organization

- original

- Other

- out

- outlet

- over

- own

- owned

- owner

- ownership

- owns

- page

- part

- partners

- past

- pegged

- People

- perhaps

- Pharmaceutical

- picking

- picture

- pillars

- plans

- platform

- plato

- Plato Data Intelligence

- PlatoData

- player

- podcast

- Popular

- portfolio

- posed

- Post

- Posts

- president

- previous

- previously

- primarily

- private

- Private Equity

- Pro

- proceeds

- Programming

- provider

- public

- Publication

- publisher

- pullback

- purchase

- pursuit

- Q1

- Q2

- Quarter

- QURAN

- reaching

- readers

- real

- real estate

- recorded

- regional

- remained

- Reports

- research

- resilience

- respectively

- revenue

- roots

- round

- rounds

- Run

- runs

- Said

- sale

- sales

- Saudi

- Saudi Arabia

- scene

- Search

- sector

- Sectors

- see

- segments

- Series

- Series A

- Series A funding

- Series A funding round

- service

- Services

- serving

- several

- shaping

- shareholder

- Shares

- shift

- Shop

- Shows

- signals

- significant

- Silicon

- Silicon Valley

- Singapore

- Singaporean

- smaller

- Snap

- So

- so Far

- Social

- social media

- Source

- Sources

- southeast

- Southeast Asia

- span

- specializes

- Sponsors

- Sports

- spread

- Staff

- stages

- stake

- startup

- Startups

- steady

- stock

- Stock Exchange

- stood

- Stories

- Strategic

- Strategy

- streaming

- streaming service

- streams

- street

- Strengthen

- studios

- subscribers

- subscription

- subsidiary

- such

- support

- sustainable

- syndicate

- team

- tech

- tech news

- TechCrunch

- Technology

- telecom

- telecoms

- terms

- than

- that

- The

- The Block

- The Wall Street Journal

- their

- themes

- These

- this

- this year

- though?

- thousands

- three

- Through

- times

- to

- together

- tom

- top

- Tourism

- Tradeblock

- Trading

- Trading Platform

- transaction

- Transactions

- Trends

- trusted

- TURN

- two

- Uk

- Uncertainty

- under

- unit

- us

- US$125

- USD

- use

- Valley

- Valuation

- value

- VC

- venture

- venture capital

- venture capital (VC)

- Ventures

- venues

- Video

- video on demand

- volume

- Wall

- Wall Street

- Wall Street Journal

- was

- Wealth

- wealth management

- web

- Web 3

- Web 3.0

- WELL

- were

- which

- while

- WHO

- whole

- will

- with

- within

- witnessed

- world-class

- world’s

- worth

- would

- WSJ

- X

- Yahoo

- year

- years

- york

- Your

- zephyrnet