Innovation | Jan 30, 2024

Image: Unsplash/Max Harlynking

Image: Unsplash/Max HarlynkingFintech for Boomers

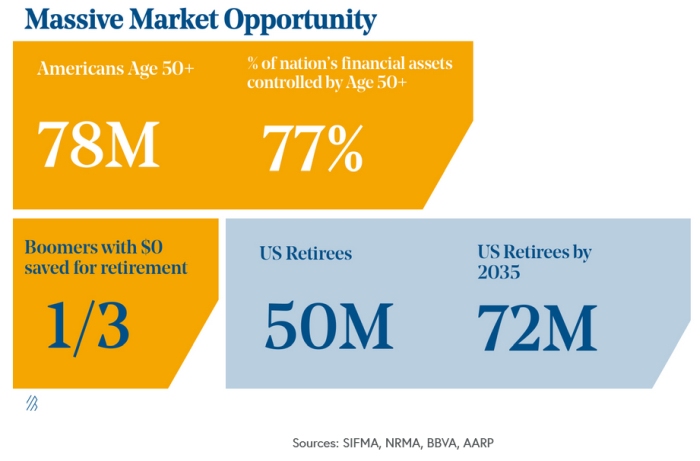

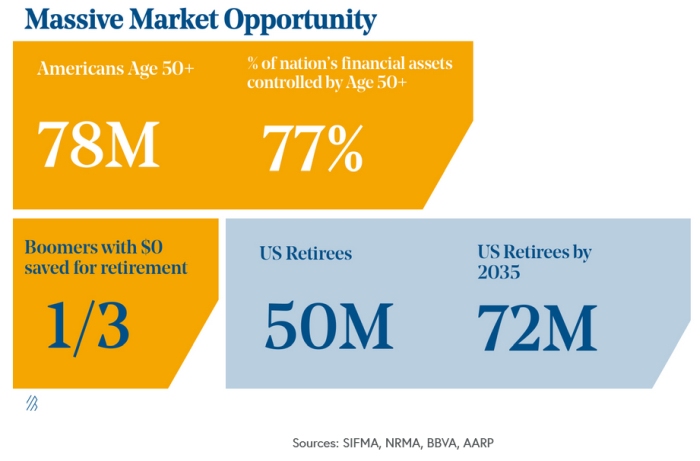

While the fintech industry has long catered to the millennial demographic, it is now recognizing the untapped potential in addressing the unique financial needs of baby boomers. This shift is crucial as boomers represent a substantial portion of the population, with significant economic impact. In the United States alone, boomers make up a large segment of retirees, with numbers expected to reach 72 million by 2035. They control a considerable portion of the country's wealth, with estimates suggesting they own 83 percent of all investable assets, nearly $35 trillion.

- They are the first generation to largely transition from defined benefit to defined contribution pension plans mid-career, confronting them with the complexities of managing their retirement savings independently.

- Healthcare costs are escalating, and Social Security income is becoming increasingly unsustainable, posing significant risks to their financial security.

- Many boomers are still burdened with student loan debt, further complicating their financial situation.

See: Evolving Banking Landscape: Asset Shift, Interest Rates, Distribution

Fintech solutions for boomers need to be tailored to their specific life stages and financial challenges. This includes offering support for managing healthcare costs, pensions, and retirement savings, as well as providing avenues for supplemental income. Home equity, which for many boomers is a significant asset, presents opportunities for financial planning and security in retirement.

Given the skepticism and loyalty characteristic of this demographic, fintechs may prefer to collaborate with trusted incumbents rather than positioning themselves as market disruptors.

Image: Bessemer Venture Partners

Image: Bessemer Venture PartnersSome Key Areas of Boomer Fintech Opportunity

- Boomers are facing retirement or are already retired, and many are navigating this phase with significant wealth. Fintech opportunities include digital platforms for retirement planning, wealth management tools, and investment advice tailored to the needs of retirees.

- With healthcare costs in the U.S. increasing at a rate 2-3 times faster than inflation, and boomers living longer (thanks to modern science), managing healthcare expenses is a critical concern. Fintech solutions can include tools for estimating and managing healthcare costs, integrating health savings accounts, and exploring insurance options.

- Many boomers need to supplement their income due to inadequate retirement savings. Fintech platforms can offer ways to monetize hobbies, find part-time work, or connect with gig economy opportunities. This is important considering the low balances in retirement accounts and the need for many to work longer.

See: Three Big Things: The Most Important Forces Shaping the World

- An often-overlooked issue is the burden of debt, including student loans, among boomers. With around 7 million Americans over 50 having student loan debt, fintech solutions can provide debt management and consolidation services, helping them manage repayments and reduce financial stress.

- With the transition from defined benefit to defined contribution pensions, boomers need help managing this shift. Fintech can offer digital estate planning tools, including will creation, trust management, and digital legacy services.

- For many boomers, home equity is a significant asset. Fintech opportunities exist in creating products that help manage this asset, such as reverse mortgages or home equity loans, tailored for the aging population.

Outlook

Fintech for the aging boomer market is about creating user-friendly, efficient, and secure financial solutions that address the unique challenges faced by this demographic. With their substantial wealth and specific needs, boomers represent a significant opportunity for fintech innovation. Note however there is significant competition from incumbent banks and near bank institutions all chasing after this demographic so consider yourself forewarned.

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org

The National Crowdfunding & Fintech Association (NCFA Canada) is a financial innovation ecosystem that provides education, market intelligence, industry stewardship, networking and funding opportunities and services to thousands of community members and works closely with industry, government, partners and affiliates to create a vibrant and innovative fintech and funding industry in Canada. Decentralized and distributed, NCFA is engaged with global stakeholders and helps incubate projects and investment in fintech, alternative finance, crowdfunding, peer-to-peer finance, payments, digital assets and tokens, artificial intelligence, blockchain, cryptocurrency, regtech, and insurtech sectors. Join Canada's Fintech & Funding Community today FREE! Or become a contributing member and get perks. For more information, please visit: www.ncfacanada.org Related Posts

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://ncfacanada.org/fintech-opportunities-in-wealthy-retired-boomer-markets/

- :has

- :is

- $UP

- 150

- 2018

- 30

- 300

- 32

- 50

- 500

- a

- About

- Accounts

- address

- addressing

- advice

- affiliates

- After

- Aging

- All

- alone

- already

- alternative

- alternative finance

- Americans

- among

- and

- ARE

- areas

- around

- artificial

- artificial intelligence

- AS

- asset

- Assets

- At

- avenues

- Baby

- balances

- Bank

- Banking

- Banks

- BE

- become

- becoming

- benefit

- bessemer

- Big

- blockchain

- burden

- by

- cache

- CAN

- Canada

- challenges

- characteristic

- closely

- collaborate

- community

- competition

- complexities

- Concern

- Connect

- Consider

- considerable

- considering

- consolidation

- contribution

- control

- Costs

- country

- create

- Creating

- creation

- critical

- Crowdfunding

- crucial

- cryptocurrency

- Debt

- decentralized

- defined

- demographic

- digital

- Digital Assets

- digital platforms

- Disruptors

- distributed

- distribution

- due

- Economic

- Economic Impact

- economy

- ecosystem

- Education

- efficient

- engaged

- equity

- estate

- estimates

- Ether (ETH)

- evolving

- exist

- expected

- Exploring

- faced

- facing

- faster

- finance

- financial

- financial innovation

- financial planning

- financial security

- Find

- fintech

- fintech innovation

- Fintech Opportunities

- fintechs

- First

- First Generation

- For

- Forces

- from

- funding

- funding opportunities

- further

- generation

- get

- gig economy

- Global

- Government

- having

- Health

- healthcare

- help

- helping

- helps

- High

- Hobbies

- Home

- However

- http

- HTTPS

- image

- Impact

- important

- in

- include

- includes

- Including

- Income

- increasing

- increasingly

- Incumbent

- independently

- industry

- information

- Innovation

- innovative

- institutions

- insurance

- Insurtech

- Integrating

- Intelligence

- interest

- Interest Rates

- investment

- Investopedia

- issue

- IT

- Jan

- jpg

- Key

- Key Areas

- lake

- landscape

- large

- largely

- Legacy

- Life

- loan

- Loans

- Long

- longer

- Low

- Loyalty

- make

- manage

- management

- managing

- many

- Market

- Markets

- max

- max-width

- May..

- member

- Members

- Millennial

- million

- Modern

- monetize

- more

- Mortgages

- most

- navigating

- Near

- nearly

- Need

- needs

- networking

- note

- numbers

- of

- offer

- offering

- opportunities

- Opportunity

- Options

- or

- over

- own

- partners

- payments

- peer to peer

- pension

- Pensions

- percent

- perks

- phase

- planning

- plans

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- please

- population

- portion

- positioning

- potential

- prefer

- presents

- Products

- projects

- provide

- provides

- providing

- Rate

- Rates

- rather

- reach

- recognizing

- reduce

- Regtech

- repayments

- represent

- retirees

- retirement

- retirement accounts

- risks

- s

- Savings

- Science

- Sectors

- secure

- security

- segment

- Services

- shaping

- shift

- significant

- situation

- Skepticism

- So

- Solutions

- specific

- stages

- stakeholders

- States

- Stewardship

- stress

- Student

- substantial

- such

- supplement

- support

- tailored

- than

- thanks

- that

- The

- the world

- their

- Them

- themselves

- There.

- they

- things

- this

- thousands

- three

- times

- to

- today

- Tokens

- tools

- transition

- Trust

- trusted

- u.s.

- unique

- United

- United States

- Unsplash

- untapped

- venture

- vibrant

- Visit

- ways

- Wealth

- wealth management

- wealthy

- WELL

- which

- with

- Work

- works

- world

- yourself

- zephyrnet