In 2023, Singapore actively pursued key initiatives across various domains in the financial sector.

Green finance and environmental, social and governance (ESG) data took center stage, with the Monetary Authority of Singapore (MAS) launching Gprnt, a digital platform simplifying ESG data collection and access, as well as the establishment of Project Savannah, an initiative that aims to develop digital ESG credentials for micro, small, and medium-sized enterprises (MSMEs) worldwide.

Singapore also made strides in payment innovation, focusing on enhancing electronic payments and expanding cross-border capabilities. Developments include cross-border quick response (QR) payment linkages, connectivity between real-time national payment schemes, and the ongoing Singapore Response Code Scheme (SGQR+) project focusing on furthering QR code payment interoperability.

Efforts were also made to advance digital assets, tokenization and central bank digital currency (CBDC) experimentation with initiatives such as Project Guardian and Project Orchid expanding to include more use cases and moving towards “live” pilots.

Finally, partnerships were inked to pursue artificial intelligence (AI) opportunities, increase financial access and address challenges faced by micro, small and medium-sized enterprises (SMEs).

Green finance takes center stage

In 2023, MAS accelerated its efforts to foster green finance, enable reliable ESG data collection and sharing, and encourage sustainability initiatives.

In November, the central bank launched Gprnt (pronounced “Greenprint”), an integrated digital platform that simplifies how large businesses and small and medium-sized enterprises (SMEs) collect, access and act upon ESG data to support their sustainability initiatives.

An outcome of MAS’ Project Greenprint, Gprnt is designed to automate the ESG reporting process and provide end users, including financial institutions, regulators and large corporates, with timely insights to support sustainability-related decision-making.

Gprnt is currently undergoing live testing with selected banks and SMEs and will be progressively rolled out from Q1 2024. Moving forward, MAS aims for Gprnt to expand its capabilities to serve the more sophisticated data needs of larger multi-national entities and other regional economies. A new entity named Greenprint Technologies Pte Ltd and supported by MAS, HSBC, KPMG, Microsoft, and MUFG Bank, will be established to further these ambitions.

Separately, MAS is collaborating with the United Nations Development Programme (UNDP) and the Global Legal Entity Identifier Foundation (GLEIF) on Project Savannah, an initiative that aims to develop digital ESG credentials for MSMEs worldwide.

Announced in June, Project Savannah seeks to lower barriers to access to financing and supply chain opportunities by establishing a common framework of ESG metrics for MSMEs to generate their basic sustainability credentials.

Lastly, MAS announced earlier this year a new collaboration with the Climate Data Steering Committee (CDSC) and the Singapore Exchange (SGX) to strengthen access by stakeholders around the world to key climate transition-related data.

The collaboration, which will commence in the first quarter of 2024, will aim to synergize MAS’ Project Greenprint’s ESGenome disclosure portal with the CDSC’s Net-Zero Data Public Utility (NZDPU) global repository of climate transition-related data. It will allow companies that report into ESGenome to transmit to the NZDPU their data on Scope 1, 2 and 3 greenhouse gas emissions, helping enhance the tracking of their climate commitments.

Singapore furthers payment innovation aspirations

2023 also saw Singapore advance its payment innovation ambitions, particularly in the realms of electronic payments and cross-border payment capabilities.

Singapore’s journey in e-payments journey, which started out in domestic transfers with systems including PayNow and FAST, is now evolving into bilateral and multilateral networks, with several developments announced this year to advance cross-border payment capabilities.

These developments include the launch of cross-border QR payment linkage between Singapore and Indonesia, and between Singapore and Malaysia, as well as establishment of connectivity between Singapore’s PayNow and Malaysia’s DuitNow, two national real-time payment systems. These developments build on previous linkages of PayNow with Thailand’s PromptPay and India’s Unified Payments Interface (UPI), as well as QR payment connection with China and Thailand.

To strengthen its payment infrastructure, MAS is working on an interoperable SGQR+ scheme designed to enhance QR code payment interoperability. A proof-of-concept (POC) of the system ran in November, exploring the feasibility of enabling merchants in Singapore to accept QR payments from a variety of payment schemes through a single financial institution.

SGQR+ aims to increase the number of payment methods that merchants can accept. With the system, merchants would only be required to sign up with a single financial institution to unlock a diverse range of local and cross-border payment schemes. They would no longer need to maintain commercial relationships with several financial institutions to accept different payment schemes.

Digital money, digital assets and tokenization

MAS is envisioning a future financial ecosystem that’s characterized by a network of interoperable systems, facilitating instantaneous and seamless payment, clearing and settlement. To realize this vision, the central bank is actively exploring digital assets, tokenization and digital money.

Project Guardian, led by MAS and industry partners, focuses on testing the feasibility of applications in asset tokenization and decentralized finance (DeFi) while managing risks to financial stability and integrity. The project, inaugurated in 2022, expanded its scope of experimentation this year by adding five new industry trials to test promising asset tokenization use cases involving foreign exchange, funds and bonds.

On digital money, MAS is investigating wholesale central bank digital currencies (CBDCs), tokenized bank liabilities, and regulated stablecoins. These initiatives include a blueprint for the infrastructure needed for a digital Singapore dollar which MAS released on November 16, the expansion of digital money trials, and a plan to issue a “live” CBDC for wholesale settlement.

MAS announced this year the addition of four new trials under Project Orchid, the central bank’s digital Singapore dollar initiative. These trials focus on examining tokenized bank liabilities, wallet interoperability, supplied financing and institutional payment controls.

To complement the digital money trials, MAS said that it will commence the development of CBDC for wholesale interbank settlement in 2024. The first pilot will involve the use of “live” wholesale CBDC to settle retail payments between commercial banks. Future pilots could include the use of the “live” wholesale CBDC for the settlement of cross-border securities trade, MAS said.

Finally, the last piece of MAS’ envisioned new financial landscape is the underlying digital infrastructure. On this topic, MAS is collaborating with policymakers and financial institutions to explore the design of an open digital infrastructure that would host tokenized financial assets and applications.

This new initiative, called Global Layer One (GL1), focuses on building a system that facilitates seamless cross-border transactions and which enables tokenized assets to be traded across global liquidity pools, while meeting relevant regulatory requirements and guidelines.

SME finance and financial access

Across every economy, MSMEs are playing a crucial role by contributing significantly to economic output and employment. Recognizing their importance, efforts are underway in Singapore to address the challenges faced by these small businesses, including lack of scale, connectivity, and financing.

These efforts focus on building foundational digital infrastructures accessible to all participants in the digital economy, from large multinational firms to MSMEs and individuals, to foster digital, financial, and green inclusion for businesses, both domestically and globally.

With the National Bank of Cambodia (NBC), MAS is working on the Financial Transparency Corridor (FTC) initiative, a project that aims to establish supporting digital infrastructures to facilitate trade and cross-border related financial services between SMEs in Singapore and Cambodia.

The supporting digital infrastructures under the FTC initiatives will seek to establish a consent-based digital infrastructure to facilitate information exchange between participating financial institutions in Singapore and Cambodia, and support financial institutions’ loan assessments for trade financing and an SME’s compliance with anti-money laundering rules.

Separately, MAS is collaborating with the International Finance Corporation (IFC) and the World Economic Forum on initiatives to advance digital inclusion through financial services, with the aim of reducing inequalities for people and smaller businesses in emerging and developing economies.

The partnership, announced in November, focuses on finding ways to better mobilize financing to make digital services more affordable and accessible for underserved individuals and communities, and MSMEs, with the support of financial institutions and fintech companies.

These efforts follow the launch of the Rwanda Imbaraga SME Ecosystem (RISE) program in June. The program, developed by MAS, the National Bank of Rwanda (NBR), in partnership with the Business Development Fund of Rwanda (BDF) and Proxtera, seeks to strengthen connections between financial institutions and SMEs in Rwanda and Singapore.

RISE aims to equip SMEs in Rwanda with better capabilities to participate in domestic and cross-border trade opportunities, as well as enhanced access to trade financing. The program components include financial literacy and capacity building, access to financing, and expanded trade opportunities.

AI in finance

Finally, MAS actively promoted the use of AI in the financial services sector this year, recognizing the technology’s potential to enhance various aspects of the industry.

The 2023 Singapore Fintech Festival (SFF), which took place from November 15 to 17, put a focus on AI applications in the financial services sector, delving into some of the fintech industry’s hottest topics such as generative AI, responsible tokenization, ESG, Web 3.0, and advancing talent.

This year’s event drew a record of 66,000 participants from 150 countries and regions and attracted a line-up of over 970 speakers. More than 2,400 government and regulatory attendees across 530 central banks, regulatory institutions and other government organizations participated, and 56 sessions showcased advancements in AI and quantum technologies, as well as their practical applications in e-commerce and payments.

MAS managing director Ravi Menon told the press during SFF 2023 that the central bank was “most keen” to explore how AI can be used in the fight against money laundering.

MAS is currently utilizing AI for advanced data analytics to detect fraud and suspicious activities, he said, but the central bank intends to expand its approach by leveraging AI to connect dots across different financial institutions, acknowledging the need to address money laundering operations that span multiple entities.

Specifically, AI can be applied to COSMIC, a forthcoming digital platform enabling financial institutions to share information on suspicious customers or transactions, to gain “additional insights” and form “a more holistic picture of the risks facing us,” Menon said.

Earlier this year, MAS inked a partnership with Google Cloud to collaborate on generative AI solutions. The partnership seeks to explore technology opportunities to advance the development and use of responsible generative AI applications within MAS, as well as cultivate technologists with deep AI skillsets.

Singapore continues to lead Southeast Asia fintech innovation

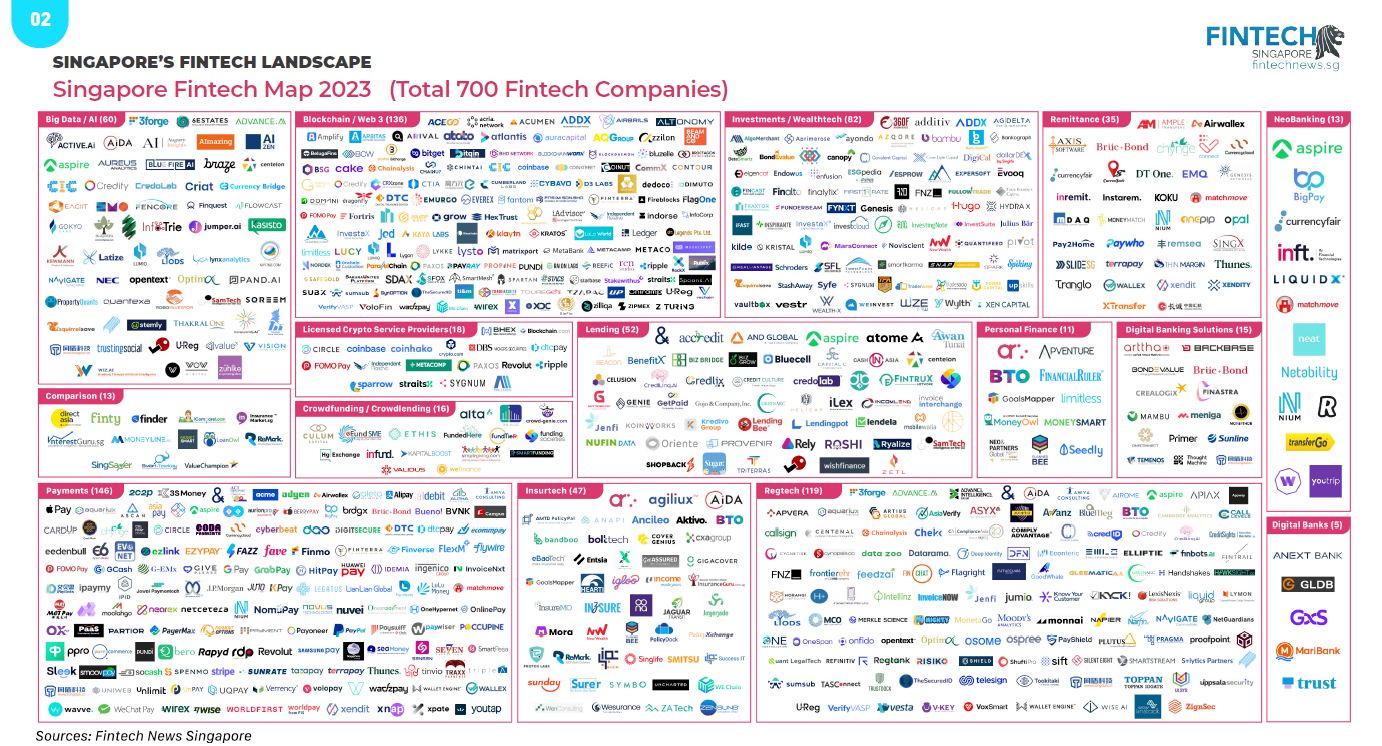

In 2023, Singapore continued to dominate the Southeast Asian fintech landscape, hosting the highest number of fintech companies across the region at 700, data from the Singapore Fintech Report 2023, a new report produced by Fintech News Singapore, show. Payments remained the largest fintech verticals with 146 companies, followed by blockchain and Web 3.0 (136), regtech (119) and investments and wealthtech (82).

Singapore Fintech Map 2023, Source: Singapore Fintech Report 2023, Fintech News Network, Dec 2023

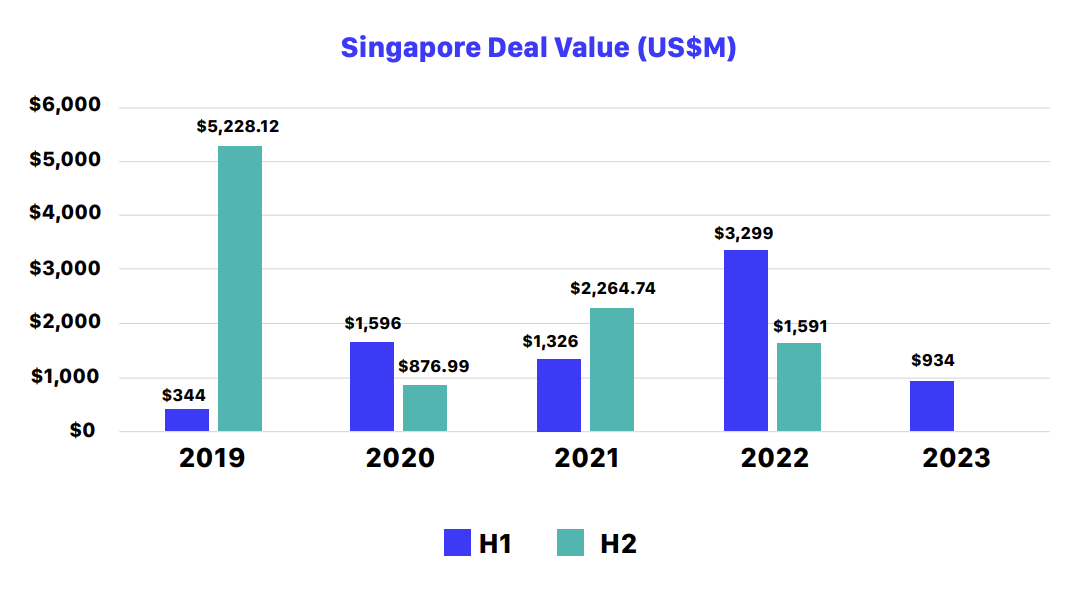

In the first half of 2023, fintech companies in the country secured a total of US$934 million in funding across 84 deals, a far cry from the US$3.3 billion raised during the same period the prior year, the data show.

The slump followed trends observed across the broader global venture capital (VC) landscape where fundraising activity plunged significantly in 2022 and 2023 as investors pumped the brakes on aggressive funding, spooked by an uncertain economic picture, plunging tech stock prices and recession fears.

Nevertheless, Singaporean fintech companies managed to secure some of the largest rounds of funding across the whole ASEAN region in 2023. These deals includes Bolttech’s US$246 million Series B, Aspire’s US$100 million Series C, Advance Intelligence Group’s US$80 million Series E, Thunes’ US$72 million Series C and Endowus’ US$35 million Series B.

Singapore fintech funding activity, Source: Singapore Fintech Report 2023, Fintech News Network, Dec 2023

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- PlatoHealth. Biotech and Clinical Trials Intelligence. Access Here.

- Source: https://fintechnews.sg/82374/fintech/fintech-in-singapore-2023-in-review/

- :is

- :where

- $UP

- 000

- 1

- 10

- 15%

- 150

- 16

- 17

- 2022

- 2023

- 2024

- 36

- 400

- 500

- 600

- 66

- 7

- 700

- 84

- 970

- a

- accelerated

- Accept

- access

- accessible

- across

- Act

- actively

- activities

- activity

- addition

- address

- advance

- advanced

- advancements

- advancing

- affordable

- against

- aggressive

- AI

- aim

- aims

- All

- allow

- also

- ambitions

- an

- analytics

- and

- announced

- anti-money laundering

- applications

- applied

- approach

- ARE

- around

- artificial

- artificial intelligence

- Artificial intelligence (AI)

- AS

- Asean

- asia

- asian

- aspects

- assessments

- asset

- Asset Tokenization

- Assets

- At

- attendees

- attracted

- author

- authority

- automate

- b

- Bank

- Banks

- barriers

- basic

- BE

- begin

- Better

- between

- Billion

- blockchain

- blueprint

- Bonds

- both

- broader

- build

- Building

- business

- business development

- businesses

- but

- by

- Cambodia

- CAN

- capabilities

- Capacity

- capital

- caps

- cases

- CBDC

- CBDCs

- Center

- center stage

- central

- Central Bank

- central bank digital currencies

- CENTRAL BANK DIGITAL CURRENCIES (CBDCS)

- central bank digital currency

- central bank digital currency (CBDC)

- Central Banks

- chain

- challenges

- characterized

- China

- Clearing

- Climate

- Cloud

- code

- collaborate

- collaborating

- collaboration

- collect

- collection

- commercial

- commitments

- committee

- Common

- Communities

- Companies

- Complement

- compliance

- components

- Connect

- connection

- Connections

- Connectivity

- content

- continued

- continues

- contributing

- controls

- corporates

- CORPORATION

- corridor

- could

- countries

- country

- Credentials

- cross-border

- crucial

- Cultivate

- currencies

- Currency

- Currently

- Customers

- data

- Data Analytics

- Deals

- dec

- decentralized

- Decentralized Finance

- decentralized finance (DeFi)

- Decision Making

- deep

- DeFi

- Design

- designed

- detect

- develop

- developed

- developing

- Development

- developments

- different

- digital

- Digital Assets

- digital currencies

- digital currency

- Digital economy

- Digital Money

- digital services

- Director

- disclosure

- diverse

- Dollar

- domains

- Domestic

- domestically

- dominate

- during

- e

- e-commerce

- Earlier

- Economic

- Economic Forum

- economies

- economy

- ecosystem

- efforts

- Electronic

- emerging

- Emissions

- employment

- enable

- enables

- enabling

- encourage

- end

- enhance

- enhanced

- enhancing

- enterprises

- entities

- entity

- environmental

- envisioned

- ESG

- establish

- established

- establishing

- establishment

- Ether (ETH)

- Event

- Every

- evolving

- Examining

- exchange

- Expand

- expanded

- expanding

- expansion

- explore

- Exploring

- faced

- facilitate

- facilitates

- facilitating

- facing

- far

- Far Cry

- FAST

- fears

- feasibility

- FESTIVAL

- fight

- finance

- financial

- financial institution

- Financial institutions

- Financial Literacy

- Financial sector

- financial services

- financial stability

- financial transparency

- financing

- finding

- fintech

- Fintech Companies

- Fintech Funding

- Fintech News

- Fintech News Network

- firms

- First

- five

- Focus

- focuses

- focusing

- follow

- followed

- For

- foreign

- foreign exchange

- form

- forthcoming

- Forum

- Forward

- Foster

- Foundation

- Foundational

- four

- Framework

- fraud

- from

- FTC

- fund

- funding

- Fundraising

- funds

- further

- furthering

- future

- Gain

- GAS

- generate

- generative

- Generative AI

- Global

- Globally

- Google Cloud

- governance

- Government

- Green

- Green Finance

- greenhouse gas

- Greenhouse gas emissions

- Group’s

- guardian

- guidelines

- Half

- he

- helping

- High

- highest

- holistic

- host

- hosting

- hottest

- How

- HSBC

- HTTPS

- identifier

- importance

- in

- include

- includes

- Including

- inclusion

- Increase

- individuals

- industry

- industry partners

- industry’s

- inequalities

- information

- Infrastructure

- infrastructures

- Initiative

- initiatives

- inked

- Innovation

- insights

- Institution

- Institutional

- institutions

- integrated

- integrity

- Intelligence

- intends

- Interface

- International

- Interoperability

- interoperable

- into

- Investments

- Investors

- involve

- involving

- issue

- IT

- ITS

- journey

- jpg

- june

- Key

- KPMG

- Lack

- landscape

- large

- larger

- largest

- Last

- launch

- launching

- Laundering

- layer

- layer one

- lead

- Led

- Legal

- legal entity

- leveraging

- liabilities

- Liquidity

- liquidity pools

- literacy

- live

- loan

- local

- longer

- lower

- Ltd

- made

- mailchimp

- maintain

- make

- managed

- managing

- Managing Director

- map

- MAS

- max-width

- meeting

- Merchants

- methods

- Metrics

- micro

- Microsoft

- million

- mobilize

- Monetary

- monetary authority

- Monetary Authority of Singapore

- Monetary Authority of Singapore (MAS)

- money

- Money Laundering

- Month

- more

- moving

- MUFG

- MUFG Bank

- multi-national

- multilateral

- multinational

- multiple

- Named

- National

- National Bank

- Nations

- NBC

- Need

- needed

- needs

- net-zero

- network

- networks

- New

- news

- no

- nov

- November

- now

- number

- observed

- of

- on

- once

- ONE

- ongoing

- only

- open

- Operations

- opportunities

- or

- Orchid

- organizations

- Other

- out

- Outcome

- output

- over

- participants

- participate

- participated

- participating

- particularly

- partners

- Partnership

- partnerships

- payment

- payment methods

- Payment Systems

- payments

- PayNow

- People

- period

- picture

- piece

- pilot

- Pilots

- Place

- plan

- platform

- plato

- Plato Data Intelligence

- PlatoData

- playing

- plunging

- PoC

- policymakers

- Pools

- Portal

- Posts

- potential

- Practical

- Practical Applications

- press

- previous

- Prices

- Prior

- process

- Produced

- Program

- programme

- progressively

- project

- Project Orchid

- promising

- Promoted

- Promptpay

- pronounced

- provide

- pte

- public

- pursue

- put

- Q1

- QR code

- qr payments

- Quantum

- Quarter

- Quick

- raised

- range

- RAVI MENON

- real-time

- realize

- realms

- recession

- recognizing

- record

- reducing

- region

- regional

- regions

- Regtech

- regulated

- Regulators

- regulatory

- related

- Relationships

- released

- relevant

- reliable

- remained

- report

- Report 2023

- Reporting

- repository

- required

- Requirements

- response

- responsible

- retail

- review

- Rise

- risks

- Role

- Rolled

- rounds

- rules

- Said

- same

- saw

- Scale

- scheme

- schemes

- scope

- seamless

- sector

- secure

- Secured

- Securities

- Seek

- Seeks

- selected

- Series

- Series B

- Series C

- serve

- Services

- sessions

- settle

- settlement

- several

- SGX

- Share

- share information

- sharing

- show

- showcased

- sign

- significantly

- simplifies

- simplifying

- Singapore

- singapore dollar

- Singapore Exchange

- Singapore Exchange (SGX)

- Singapore Fintech Festival

- Singapore FinTech Festival (SFF)

- Singaporean

- single

- Slump

- small

- small businesses

- smaller

- SME

- SMEs

- Social

- Solutions

- some

- sophisticated

- Source

- southeast

- Southeast Asia

- span

- speakers

- Stability

- Stablecoins

- Stage

- stakeholders

- started

- steering

- stock

- Strengthen

- strides

- such

- supplied

- supply

- supply chain

- support

- Supported

- Supporting

- suspicious

- Sustainability

- system

- Systems

- takes

- Talent

- tech

- Technologies

- technologists

- Technology

- test

- Testing

- Thailand

- Thailand’s

- than

- that

- The

- the world

- their

- These

- they

- this

- this year

- Through

- timely

- to

- Tokenization

- tokenized

- tokenized assets

- took

- topic

- Topics

- Total

- towards

- Tracking

- trade

- traded

- Transactions

- transfers

- transmit

- Transparency

- Trends

- trials

- two

- Uncertain

- under

- undergoing

- underlying

- underserved

- Underway

- unified

- United

- united nations

- unlock

- UPI

- upon

- us

- US$100 million

- use

- used

- users

- utility

- Utilizing

- variety

- various

- VC

- venture

- venture capital

- venture capital (VC)

- verticals

- vision

- Wallet

- was

- ways

- wealthtech

- web

- Web 3

- Web 3.0

- WELL

- were

- which

- while

- whole

- wholesale

- wholesale CBDC

- will

- with

- within

- working

- world

- World Economic Forum

- worldwide

- would

- year

- Your

- zephyrnet