Despite a global pullback in fintech funding and regulatory headwinds, investments in India remained strong in 2022, driven by large deals in lending and fintech infrastructure-focused players as well as a dynamic early-stage funding landscape in emerging segments, including insurtech, embedded lending and wealthtech, a new report by management consulting firm Bain and Company says.

The India Venture Capital Report 2023, released on March 15, 2023, looks at the state of startup funding in the country, delving into trends observed in 2022 and key predictions for the year to come.

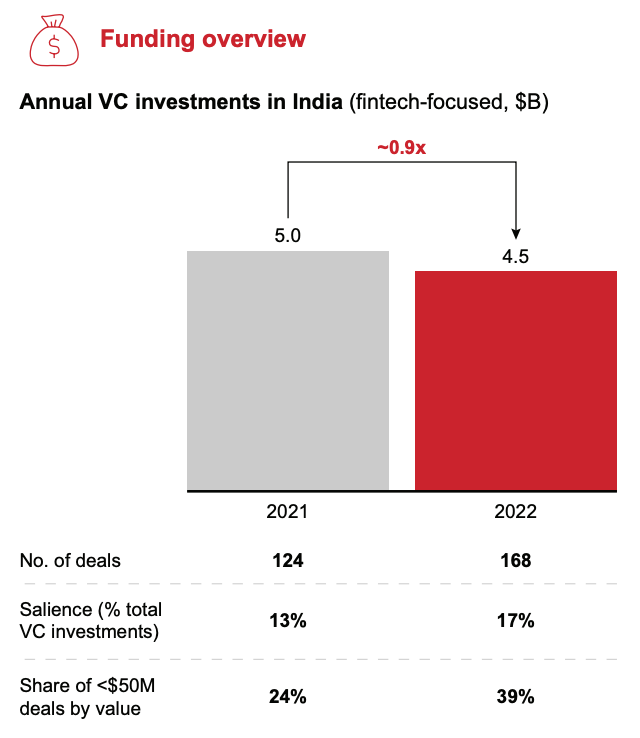

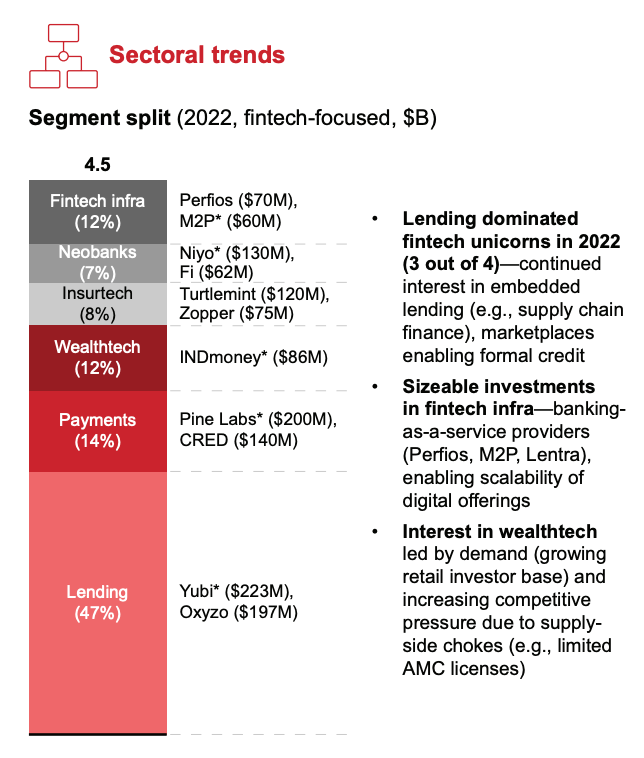

According to the report, fintech funding in India in 2022 remained at pace with the year prior, declining by a slight 10% last year to reach US$4.5 billion.

Annual VC investments in India (fintech-focused, US$B), Source: India Venture Capital Report 2023, Bain and Company, 2023

Fintech funding activity was led by large rounds closed by startups in lending and fintech infrastructure during the first half of 2022.

This trend emerged on the back of accelerated banking digitalization and financial infrastructure enhancement efforts which fueled demand for innovation in lending, payments and other core banking products, the report says.

Such rounds included Oxyzo, a tech-enabled smart financing solution provider that secured a US$197 million Series A to expand its digital financial services play; Perfios, a personal finance software solution provider that closed a US$70 million Series C to further grow its business, including financing acquisitions, capital expenditure and working capital requirements; and M2P, a fintech API specialist, which raised US$60 million to deepen its footprints in several international geographies and pursue acquisition opportunities.

The second half of 2022 saw consistent deal volume in early-stage fintech company deals across growing segments. In particular, rising customer demand and a growing retail investor base fueled interest in wealthtech, leading to deals like INDMoney’s US$86 million round.

INDMoney is an artificial intelligence (AI) and machine learning (ML)-based wealth management and advisory platform that allows users to track investments and expenses, set financial goals, and invest in mutual funds, bonds and stocks.

Besides wealthtech, insurtech is another emerging fintech segment that witnessed considerable interest in 2022, a trend that’s noticeable through rounds like Turtlemint’s US$120 million Series C, and Zopper’s US$75 million round. Turtlemint is an online insurance platform that aims to ease the process of buying and managing insurance policies, and Zopper works with insurance providers to create smaller and personalized insurance products that it supplies to distribution partners.

2022 fintech funding in India by segment (US$B), Source: India Venture Capital Report 2023, Bain and Company, 2023

Strengthened regulatory scrutiny

Sustained fintech funding activity in 2022 came despite intensified regulatory oversight.

In June, the Reserve Bank of India (RBI) prohibited all non-bank prepaid instrument issuers from loading prepaid instruments with credit lines. The move came amid a boom in credit instruments such as buy now, pay later (BNPL) arrangements and fintech-driven credit cards.

In December, new digital lending guidelines came into effect, focusing on establishing a more secure, inclusive, and accessible digital lending ecosystem and protecting consumers from unusually high-interest rates and unethical loan recovery practice.

2022 also saw the introduction of several tax rules on digital assets, including a 30% income tax on cryptocurrency gains and a 1% tax deducted at source. According to New Delhi-based technology think tank Esya Centre, the new regulation has significantly impacted trading volumes with some local platforms reporting a loss of up to 81% of their trading volume over just a three-and-a-half month period.

India has intensified its push for crypto regulation in the past year over concerns about monetary sovereignty. In parallel, the RBI has launched two central bank digital currency (CBDC) pilots, with hopes for full implementation by the end of 2023.

Bain and Company expects the regulatory landscape to remain challenging for the fintech sector in 2023, a trend which will ultimately help boost fintech innovation further, especially in segments including embedded finance, open APIs and wealthtech, the report says.

2023 should also see a number of notable mergers and acquisitions, carrying on a trend that was already observed in 2022 through deals like the purchase of EZEtap by Razorpay and the acquisition of Setu by Pine Labs. Consolidation in the fintech industry will come market leaders increase their focus on monetization, building full-stack solutions, and achieving profitable growth, the report says.

Featured image credit: Edited from Unsplash

- SEO Powered Content & PR Distribution. Get Amplified Today.

- Platoblockchain. Web3 Metaverse Intelligence. Knowledge Amplified. Access Here.

- Source: https://fintechnews.sg/71350/fintech-india/fintech-funding-remains-strong-in-india-despite-global-funding-pullback/

- :is

- $UP

- 2022

- 2023

- a

- About

- accelerated

- accessible

- According

- achieving

- acquisition

- acquisitions

- across

- activity

- advisory

- AI

- aims

- All

- allows

- already

- Amid

- and

- annual

- Another

- api

- APIs

- artificial

- artificial intelligence

- Artificial intelligence (AI)

- AS

- Assets

- At

- back

- Bain

- Bank

- Bank of India

- Banking

- base

- Billion

- BNPL

- Bonds

- boom

- boost

- Building

- business

- buy

- Buying

- by

- capital

- capital requirements

- caps

- Cards

- carrying

- CBDC

- central

- Central Bank

- central bank digital currency

- central bank digital currency (CBDC)

- centre

- challenging

- closed

- Coindesk

- come

- company

- Concerns

- considerable

- consistent

- consolidation

- consulting

- Consumers

- Core

- Core Banking

- country

- create

- credit

- Credit Cards

- crypto

- Crypto regulation

- cryptocurrency

- Currency

- customer

- deal

- Deals

- December

- Declining

- Deepen

- Demand

- Despite

- digital

- Digital Assets

- digital currency

- digital lending

- digitalization

- distribution

- driven

- during

- dynamic

- early stage

- ecosystem

- efforts

- embedded

- Embedded Finance

- emerged

- emerging

- enhancement

- especially

- establishing

- Ether (ETH)

- Expand

- expects

- expenses

- finance

- financial

- financial goals

- financial infrastructure

- financial services

- financing

- fintech

- FINTECH COMPANY

- Fintech Funding

- fintech infrastructure

- fintech innovation

- Firm

- First

- Focus

- focusing

- For

- friendly

- from

- funding

- funds

- further

- Gains

- geographies

- Global

- Goals

- Grow

- Growing

- Growth

- guidelines

- Half

- headwinds

- help

- hopes

- HTTPS

- image

- impacted

- implementation

- in

- included

- Including

- Inclusive

- Income

- income tax

- Increase

- india

- industry

- Infrastructure

- Innovation

- instrument

- instruments

- insurance

- Insurtech

- Intelligence

- interest

- International

- Introduction

- Invest

- Investments

- investor

- IT

- ITS

- Key

- Labs

- landscape

- large

- Last

- Last Year

- launched

- leaders

- leading

- learning

- Led

- lending

- like

- lines

- loading

- loan

- local

- LOOKS

- loss

- machine

- machine learning

- management

- managing

- March

- Market

- max-width

- Mergers and Acquisitions

- million

- ML

- Monetary

- monetization

- Month

- more

- move

- mutual

- mutual funds

- New

- notable

- number

- of

- on

- online

- open

- opportunities

- Other

- Oversight

- Oxyzo

- Pace

- Parallel

- particular

- partners

- past

- Pay

- payments

- period

- personal

- Personal Finance

- Personalized

- Pilots

- platform

- Platforms

- plato

- Plato Data Intelligence

- PlatoData

- Play

- players

- policies

- practice

- Predictions

- Prepaid

- Prior

- process

- Products

- profitable

- protecting

- provider

- providers

- pullback

- purchase

- pursue

- Push

- raised

- Rates

- razorpay

- RBI

- reach

- recovery

- Regulation

- regulatory

- regulatory landscape

- remain

- remained

- remains

- report

- Requirements

- Reserve

- reserve bank

- Reserve Bank of India

- retail

- return

- rising

- round

- rounds

- rules

- says

- Second

- sector

- secure

- Secured

- segment

- segments

- Series

- Series A

- Series C

- Services

- set

- several

- should

- significantly

- smaller

- smart

- Software

- software solution

- solution

- Solutions

- some

- Source

- sovereignty

- specialist

- startup

- startup funding

- Startups

- State

- Stocks

- strong

- such

- tank

- tax

- tax deducted at source

- tech-enabled

- Technology

- that

- The

- The Reserve Bank of India

- The State

- their

- think tank

- Through

- to

- track

- Trading

- trading volume

- trading volumes

- Trend

- Trends

- Ultimately

- users

- VC

- venture

- venture capital

- volume

- volumes

- Wealth

- wealth management

- wealthtech

- WELL

- which

- will

- with

- witnessed

- working

- works

- year

- zephyrnet