The digital world is evolving at a breathtaking pace. New technologies like generative AI, blockchain, embedded finance and the metaverse promise to fundamentally change the user experience, and those who do not adapt will be left behind. But, how ready are financial companies to implement these innovations in their products? It depends on their design maturity.

Let’s say we have a handful of the highest-quality breeding seeds. We throw them into the ground, water them and sit back, waiting for large and tasty fruits. But, for some reason, they don’t thrive. For everyone who has grown at least one plant, it is obvious that the result depends on what kind of soil we use, whether we prepare the grains for planting, what fertilizers we use and in what month we plant. All these conditions play a critical role in obtaining a good harvest.

We see a similar story happening with financial innovation. Some digital financial services grow, while others disappear even before launching in the market. This is because everything everywhere depends on the right growth conditions.

Investing in new technology and throwing it to the development team is not sufficient. Every company needs to provide fertile ground for better integration. And it’s not about the willingness to integrate innovation but, rather, about the company’s ability to design, implement and improve digital solutions through customer-centricity. This is where an organization’s design maturity comes into play.

What is Design Maturity in Financial Organizations?

Design maturity refers to the evolution of an organization’s design capabilities and how well efficient design principles are integrated into its processes, decision-making and strategy.

High-maturity design focuses on solving business and customer problems, aiming for long-term competitive advantages rather than just improving visual appearances. Product design is at the core of the business, involving all departments and executives, not just designers. As a result, more innovations are being explored and developed to improve user experience and customer satisfaction.

In contrast, the entry level of design maturity is characterized by a lack of strategic focus, ad hoc decision-making and a siloed approach to product design and innovation implementation. This results in low competitiveness, inefficient product development, poor customer experience, brand dilution, talent gap, reactive decision-making, wasted resources and lack of collaboration.

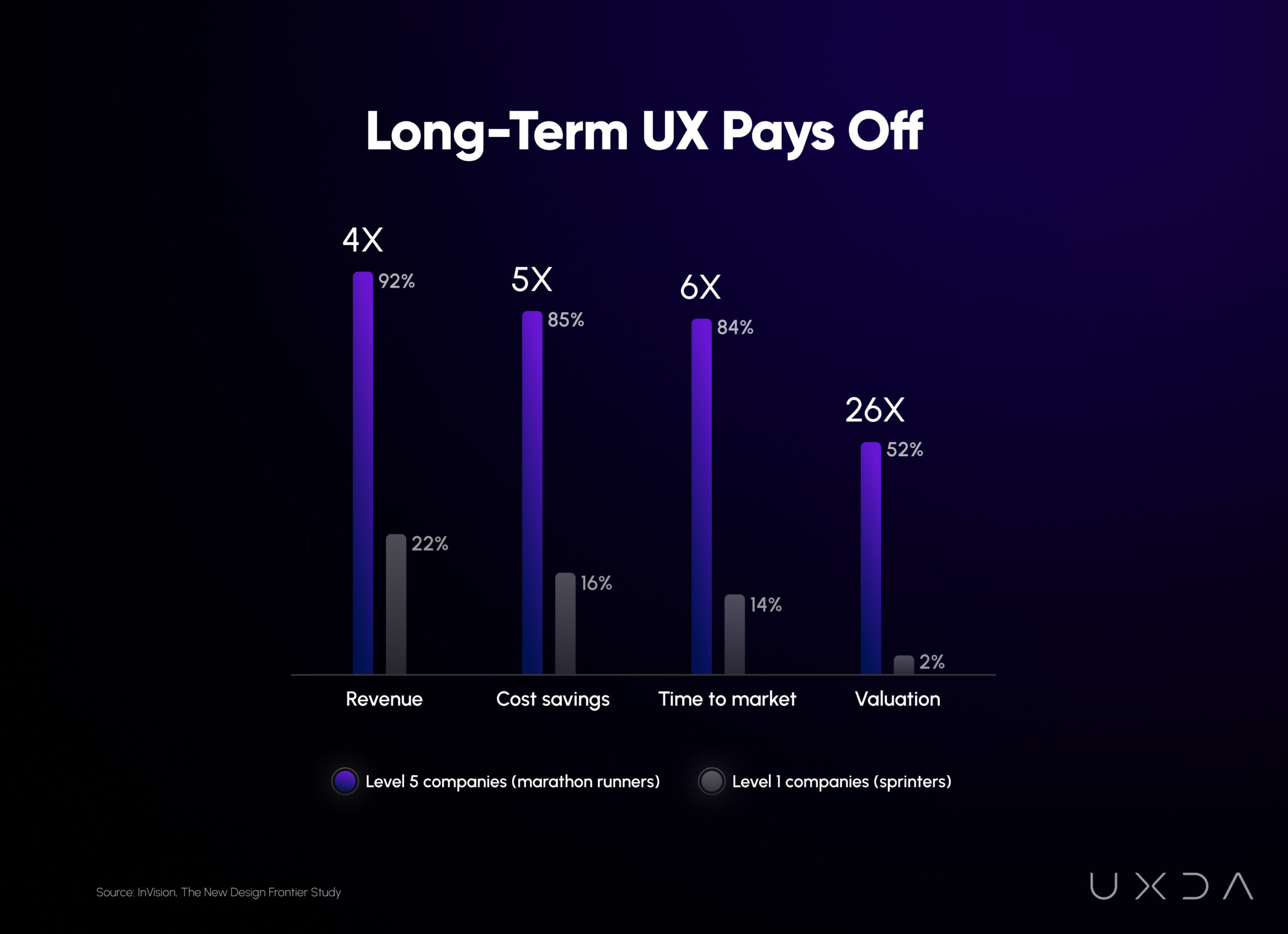

According to the largest study of 2,200 companies on design maturity by InVision, the number of companies that note a noticeable impact of designers on revenue, cost savings and time to market is five times higher with advanced design maturity─87% versus 17%. And, in the case of the design team’s impact on company valuation, the difference is even larger─26x, or 52% versus 2%.

Three Steps to Becoming a Design-Mature Financial Organization

Design-mature organizations use design research and processes to gain a deeper understanding of user needs and identify opportunities for product improvements and business growth. They create a culture of innovation, fueled by design-driven strategies and customer-centric approach.

To implement design mature practices into your financial organization, follow these three steps:

1. Unite the team with design

Integrate research and collaboration to bridge the silos between designers and other departments.

-

Collaborate

Organize design training sessions and workshops for cross-functional teams to solve real business challenges using design thinking. Align departments with a common design language and approach, creating a seamless user experience.

-

Engage the team

Advocate for design at the strategic level, showcasing its impact on customer experience, brand perception and business outcomes. Align design ideas with business goals, highlighting benefits like customer satisfaction, revenue growth and brand strengthening.

-

Buy-in from executives

Secure buy-in from top executives by engaging and educating them about the design’s value and alignment with the organization’s business goals. Foster a design-driven culture, rewarding employees for embracing design thinking. Seek external expertise for breakthroughs to accelerate design maturity.

2. Enhance design processes

Establish a design system and emphasize design with daily standups, clear roles, design briefs and formalized design operations.

Drive innovation by prioritizing major accomplishments over minor ones. Set long-term design goals aligned with the company’s vision, focusing on digital ecosystem development, user experience enhancements and design process improvements. Track progress and report design achievements on a regular basis.

-

Consistency

Elevate design to the strategy level to ensure consistent user experiences across all touchpoints, channels and products. Such consistency builds customer satisfaction, eliminating friction and enhancing the customer experience with the organization’s offerings.

-

Measure impact

Measure the impact of design on company success through customer satisfaction, engagement, retention, usability and brand perception. Use a design performance dashboard to visually communicate the design impact to stakeholders.

3. Drive growth through design

Drive business growth with data-driven approaches across the organization, integrating ideation, experiments and analytics.

-

Explore context

Designers should align with the company’s business strategy, understanding target market, competition and long-term goals. Conduct user research and involve stakeholders to present insights and pain points. Explore competitors and best practices in the industry from a design perspective.

-

Find opportunities

Understand user needs for product improvements and collaborate with other departments to uncover innovative solutions that drive growth. Test and validate concepts prior to implementation. Use analytics for data-driven decision-making. Embrace continuous learning and stay updated on design trends.

-

Inspire with outcomes

Celebrate design success stories to increase visibility and importance. Create periodic design impact reports to demonstrate tangible outcomes and contributions to business growth, customer satisfaction and team efficiencies.

Empower Financial Innovation with Design

To get the most out of financial innovation, you need to take design to the level of a core strategy. Use design tools to explore user needs, trends and market fit for a unified cross-platform digital strategy that delivers long-term impact through user-centric innovation.

Digital innovation empowers organizations to thrive in a rapidly changing world and uncover the next big business opportunity, impacting everything from boardroom decisions to product discovery and customer experiences. Implement design thinking, research and customer-centricity across your organization to ensure fertile soil to achieve financial innovation and significant growth opportunities.

- SEO Powered Content & PR Distribution. Get Amplified Today.

- PlatoData.Network Vertical Generative Ai. Empower Yourself. Access Here.

- PlatoAiStream. Web3 Intelligence. Knowledge Amplified. Access Here.

- PlatoESG. Automotive / EVs, Carbon, CleanTech, Energy, Environment, Solar, Waste Management. Access Here.

- BlockOffsets. Modernizing Environmental Offset Ownership. Access Here.

- Source: https://www.finextra.com/blogposting/24720/financial-innovation-flourishes-only-in-design-mature-organizations?utm_medium=rssfinextra&utm_source=finextrablogs

- :has

- :is

- :not

- :where

- 2%

- 200

- a

- ability

- About

- accelerate

- accomplishments

- Achieve

- achievements

- across

- Ad

- adapt

- advanced

- advantages

- AI

- Aiming

- align

- aligned

- All

- an

- analytics

- and

- appearances

- approach

- approaches

- ARE

- AS

- At

- back

- basis

- BE

- because

- becoming

- before

- behind

- being

- benefits

- BEST

- best practices

- Better

- between

- Big

- blockchain

- brand

- breakthroughs

- breathtaking

- BRIDGE

- builds

- business

- business strategy

- but

- by

- capabilities

- case

- challenges

- change

- changing

- channels

- characterized

- clear

- collaborate

- collaboration

- comes

- Common

- communicate

- Companies

- company

- competition

- competitive

- competitiveness

- competitors

- concepts

- conditions

- Conduct

- consistent

- continuous

- contrast

- contributions

- Core

- Cost

- cost savings

- create

- Creating

- critical

- cross-functional teams

- cross-platform

- Culture

- customer

- customer experience

- Customer satisfaction

- daily

- dashboard

- data-driven

- Decision Making

- decisions

- deeper

- delivers

- demonstrate

- departments

- depends

- Design

- design principles

- design process

- design thinking

- designers

- developed

- Development

- development team

- difference

- digital

- digital ecosystem

- digital strategy

- digital world

- dilution

- disappear

- discovery

- do

- Dont

- drive

- ecosystem

- educating

- efficiencies

- efficient

- eliminating

- embedded

- Embedded Finance

- embrace

- embracing

- emphasize

- employees

- empowers

- engagement

- engaging

- enhance

- enhancements

- enhancing

- ensure

- entry

- Even

- Every

- everyone

- everything

- evolution

- evolving

- executives

- experience

- Experiences

- experiments

- expertise

- explore

- Explored

- external

- finance

- financial

- financial innovation

- financial services

- fit

- five

- Focus

- focuses

- focusing

- follow

- For

- Foster

- friction

- from

- Fruits

- fueled

- fundamentally

- Gain

- gap

- generative

- Generative AI

- get

- Goals

- good

- Ground

- Grow

- grown

- Growth

- handful

- Happening

- harvest

- Have

- higher

- highlighting

- How

- HTTPS

- ideas

- identify

- Impact

- impacting

- implement

- implementation

- importance

- improve

- improvements

- improving

- in

- Increase

- industry

- inefficient

- Innovation

- innovations

- innovative

- insights

- integrate

- integrated

- Integrating

- integration

- into

- InVision

- involve

- involving

- IT

- ITS

- jpg

- just

- Kind

- Lack

- language

- large

- largest

- launching

- learning

- least

- left

- Level

- like

- long-term

- Low

- major

- Market

- mature

- maturity

- Metaverse

- minor

- Month

- more

- most

- Need

- needs

- New

- New technologies

- next

- number

- obtaining

- obvious

- of

- Offerings

- on

- ONE

- ones

- only

- Operations

- opportunities

- Opportunity

- or

- organization

- organizations

- Other

- Others

- out

- outcomes

- over

- Pace

- Pain

- Pain points

- perception

- performance

- periodic

- perspective

- Planting

- plato

- Plato Data Intelligence

- PlatoData

- Play

- points

- poor

- practices

- Prepare

- present

- principles

- Prior

- prioritizing

- problems

- process

- processes

- Product

- product design

- product development

- Products

- Progress

- promise

- provide

- rapidly

- rather

- ready

- real

- reason

- refers

- regular

- report

- Reports

- research

- Resources

- result

- Results

- retention

- revenue

- revenue growth

- rewarding

- right

- Role

- roles

- s

- satisfaction

- Savings

- say

- seamless

- see

- seeds

- Seek

- Services

- sessions

- set

- should

- showcasing

- significant

- silos

- similar

- sit

- soil

- Solutions

- SOLVE

- Solving

- some

- stakeholders

- stay

- Steps

- Stories

- Story

- Strategic

- strategies

- Strategy

- strengthening

- Study

- success

- Success Stories

- such

- sufficient

- system

- Take

- Talent

- Target

- team

- teams

- Technologies

- Technology

- test

- than

- that

- The

- The Metaverse

- their

- Them

- These

- they

- Thinking

- this

- those

- three

- Thrive

- Through

- Throwing

- time

- times

- to

- tools

- top

- track

- Training

- Trends

- uncover

- understanding

- unified

- unite

- updated

- usability

- use

- User

- User Experience

- user-centric

- using

- VALIDATE

- Valuation

- value

- Versus

- visibility

- vision

- Waiting

- Water

- we

- WELL

- What

- whether

- while

- WHO

- will

- Willingness

- with

- Workshops

- world

- you

- Your

- zephyrnet